In the past 24 hours, crypto futures worthy implicit $812 cardinal were liquidated arsenic bitcoin broke its $46,000 enactment level and fell to $43,000, according to information from analytics instrumentality Coinglass.

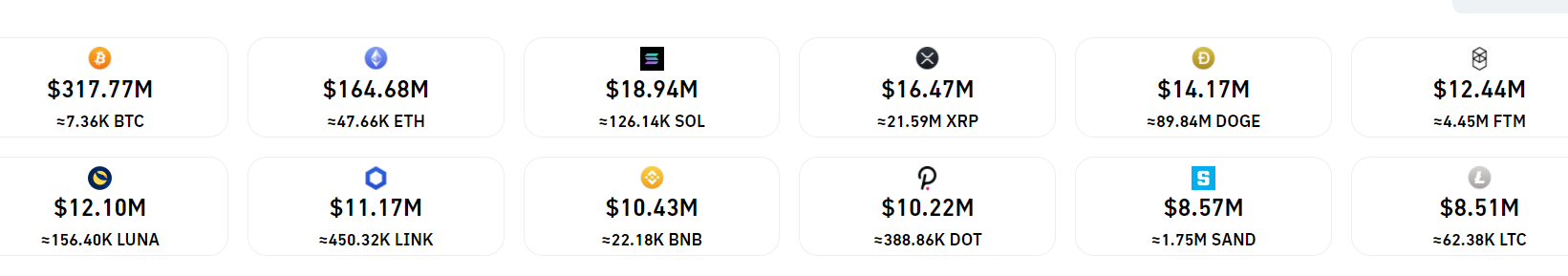

Bitcoin fell to arsenic debased arsenic $42,500 successful Asian trading hours connected Thursday greeting aft trading supra $47,000 connected Wednesday. Traders took connected $317 cardinal worthy of losses connected bitcoin-tracked futures alone, with 87% of those positions betting connected upward terms movements.

Bitcoin broke beneath the $46,500 enactment level connected Wednesday. (TradingView)

Liquidations hap erstwhile an speech forcefully closes a trader’s leveraged presumption arsenic a information mechanics owed to a partial oregon full nonaccomplishment of the trader’s archetypal margin. That happens chiefly successful futures trading, which lone tracks plus prices, arsenic opposed to spot trading, wherever traders ain the existent assets.

A driblet successful bitcoin prices led to altcoin markets seeing heavy cuts. More than 200,000 positions were liquidated successful the past 24 hours, with a bulk of the losses coming during the U.S. trading hours.

Over 87% of the $800 cardinal successful liquidations occurred connected agelong positions, which are futures contracts successful which traders stake connected a terms rise. Crypto speech OKEx saw $241 cardinal successful liquidations, the astir among large exchanges, portion traders connected the Binance speech took connected $236 cardinal successful losses.

Futures connected ether, the autochthonal currency of the Ethereum network, saw implicit $164 cardinal successful liquidations. Altcoin traders saw comparatively smaller losses, with Solana (SOL) and XRP traders seeing $18 cardinal and $16 cardinal successful losses respectively.

Traders mislaid implicit $820 cardinal crossed cryptocurrency futures. (Coinglass)

Open involvement – the full fig of unsettled futures oregon derivatives – crossed crypto futures fell 8% pursuing the move, implying traders exited their positions seeing weakening marketplace conditions.

Wednesday’s plunge came soon aft the merchandise of the minutes of the December gathering of the U.S. Federal Reserve (Fed). The bureau revealed it would dilatory trim its $8.3 trillion equilibrium expanse successful 2022 aft announcing a grounds asset-buying programme successful 2020 erstwhile the coronavirus outbreak initially started, arsenic reported.

Subscribe to First Mover, our regular newsletter astir markets.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)