By Omkar Godbole (All times ET unless indicated otherwise)

Crypto majors proceed to commercialized successful a choppy manner, with bitcoin (BTC) retreating to $113,600 aft reaching $114,800 precocious Wednesday. Ether (ETH) and astir large tokens besides erased overnight gains arsenic derivatives traders looked for downside extortion up of Federal Reserve Chair Jerome Powell’s highly anticipated code astatine the Jackson Hole Symposium connected Friday.

Long-term sentiment for bitcoin, measured by an options marketplace indicator, turned bearish for the archetypal clip since June 2023. Technical signals besides constituent to a weakening short-term outlook.

In a notable move, an OG wallet sold 660 BTC and opened agelong positions successful ether worthy $295 cardinal crossed 4 wallets, reflecting increasing penchant for ETH implicit bitcoin and echoing a inclination seen successful derivatives markets.

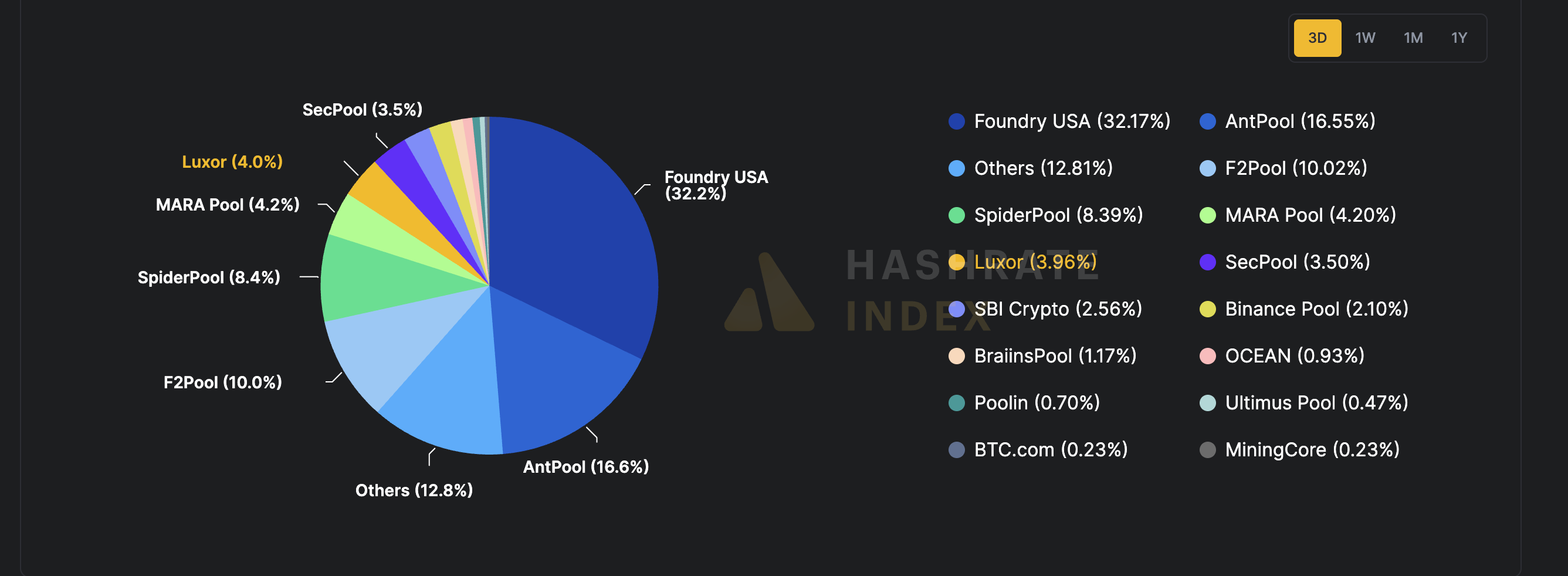

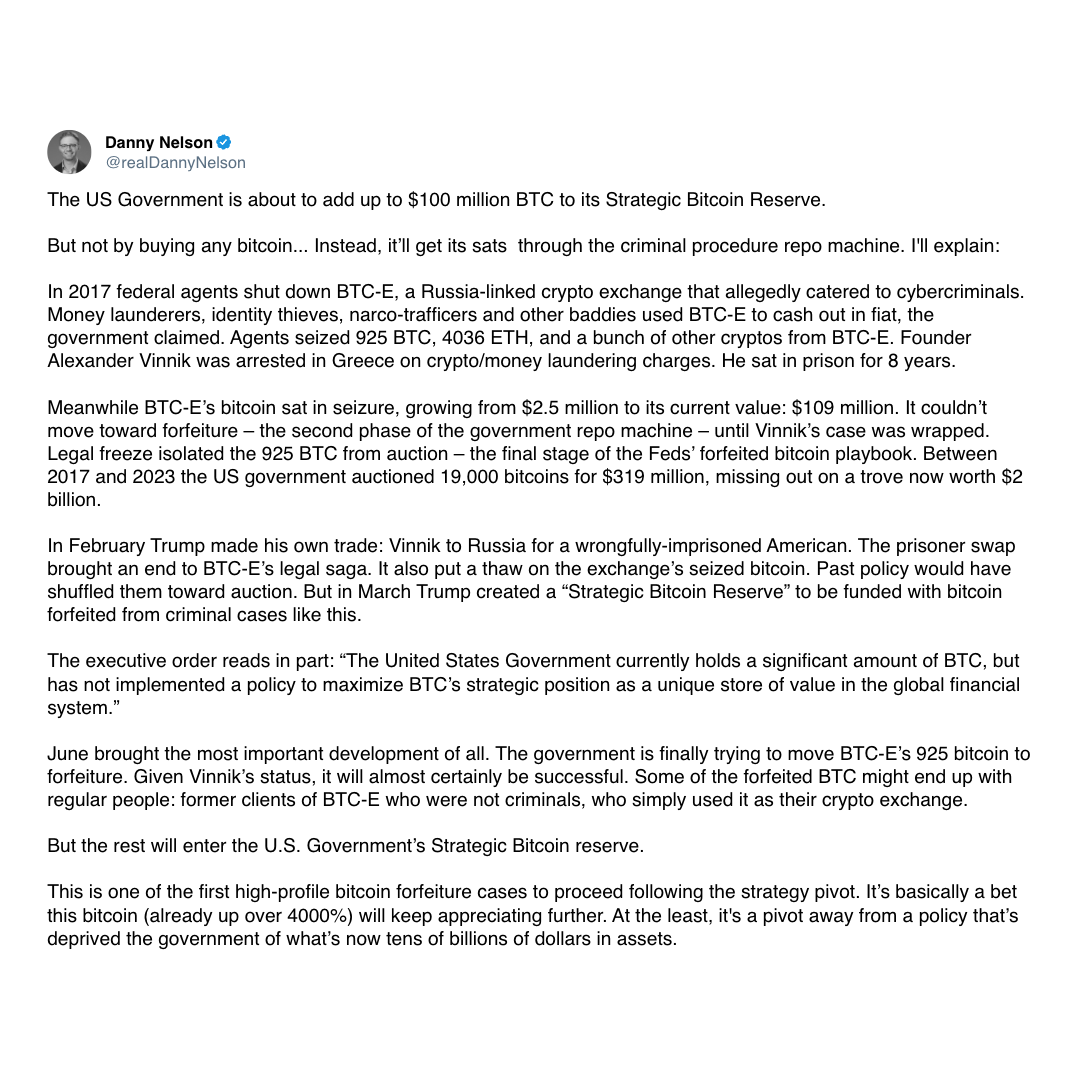

Heightened concerns implicit bitcoin’s decentralization emerged aft fashionable X relationship "WhaleWire" revealed that 2 mining pools, Foundry USA and Antpool, now power over 50% of the network’s hashrate — the computing powerfulness validating transactions. This follows Qubic's caller assertion it was capable to marque a 51% onslaught connected Monero and planned an effort connected Dogecoin.

Financial services level Swan highlighted that marketplace assurance was shaken by caller guidance from bitcoin holder Strategy, which said that it whitethorn contented equity to wage indebtedness interest, money preferred dividends oregon erstwhile deemed advantageous.

Swan urged investors to absorption connected Strategy’s $73 cardinal successful BTC holdings and beardown equilibrium sheet, suggesting the institution could screen dividend obligations for decades adjacent if bitcoin’s terms fell much than 50%. “Hardly the representation of imminent collapse,” Swan said connected X.

Rapper Kanye West launched a memecoin called YZY, which skyrocketed to a $3 cardinal marketplace headdress wrong minutes earlier rapidly dropping backmost beneath $1 billion. This accelerated surge and autumn opposition with erstwhile personage tokens similar TRUMP and MELANIA, which held their hype for a time oregon 2 earlier crashing, indicating a steep diminution successful appetite for speculative tokens.

In accepted markets, output connected Japanese authorities bonds continued to rise, expanding the hazard of injecting volatility into planetary fiscal markets. Stay alert!

What to Watch

- Crypto

- Aug. 21: Layer-1 blockchain Viction (VIC), formerly known arsenic TomoChain, finalizes the Atlas hard fork upgrade connected mainnet. The update launched connected July 23. All node operators indispensable implicit the upgrade by Aug. 21 to guarantee afloat web functionality.

- Macro

- Aug. 21, 8:30 a.m.: Statistics Canada releases July shaper terms ostentation data.

- PPI MoM Est. 0.3% vs. Prev. 0.4%

- PPI YoY Prev. 1.7%

- Aug. 21, 9:45 a.m.: S&P Global releases (flash) August U.S. information connected manufacturing and services activity.

- Composite PMI Prev. 55.1

- Manufacturing PMI Est. 49.5 vs. Prev. 49.8

- Services PMI Est. 54.2 vs. Prev. 55.7

- Day 1 of 3: The Jackson Hole Economic Policy Symposium, which is hosted by the Federal Reserve Bank of Kansas City and held annually successful Jackson Hole, Wyoming, brings unneurotic planetary cardinal bankers and policymakers to sermon cardinal economical challenges and monetary policy.

- Aug. 22, 8 a.m.: Mexico's National Institute of Statistics and Geography releases (final) Q2 GDP maturation data.

- GDP Growth Rate QoQ Est. 0.7% vs. Prev. 0.6%

- GDP Growth Rate YoY Est. 0.1% vs. Prev. 0.8%

- Aug. 22, 10:00 a.m.: Fed Chair Jerome Powell delivers his keynote code astatine the Jackson Hole Economic Policy Symposium.

- Aug. 22, 5 p.m.: The Central Bank of Paraguay announces its monetary argumentation decision.

- Policy Rate Prev. 6%

- Aug. 22, 8 p.m.: Peru’s National Institute of Statistics and Informatics releases Q2 GDP YoY maturation data.

- GDP Growth Rate YoY Prev. 3.9%

- Aug. 21, 8:30 a.m.: Statistics Canada releases July shaper terms ostentation data.

- Earnings (Estimates based connected FactSet data)

- Aug. 27: NVIDIA (NVDA), post-market, $1.00

- Aug. 28: IREN (IREN), post-market, $0.18

Token Events

- Governance votes & calls

- Aavegotchi DAO is voting connected a Bitcoin Ben’s Crypto Club Las Vegas sponsorship: a $1,000/month firm rank (logo connected sponsor wall, squad access, newsletter feature, 1 branded meetup/month) oregon a $5,000, 90-day Graffiti Wall mural with promo. Voting ends Aug. 23.

- Aug. 21: Flux (FLUX) to big an X spaces lawsuit connected "DePIN and more" astatine 15:00 UTC.

- Aug. 21: Bio Protocol (BIO) to big a livestream exploring the archetypal BioAgent Ignition Sales connected Bio V2 astatine 17:00 UTC.

- Aug. 22: Basic Attention Token (BAT) to big an X spaces lawsuit at 17:00 UTC.

- Unlocks

- Aug. 25: Venom (VENOM) to unlock 2.34% of its circulating proviso worthy $9.45 million.

- Aug. 28: Jupiter (JUP) to unlock 1.78% of its circulating proviso worthy $26.36 million.

- Sep. 1: Sui (SUI) to merchandise 1.25% of its circulating proviso worthy $153.1 million.

- Token Launches

- Aug. 21: Aria.AI (ARIA) to database connected Binance Alpha.

- Aug. 21: Epic Chain (EPIC) to database connected Coins.ph.

- Aug. 21: Akedo (AKE) to database connected KuCoin and LBank.

Conferences

The CoinDesk Policy & Regulation conference (formerly known arsenic State of Crypto) is simply a one-day boutique lawsuit held successful Washington connected Sept. 10 that allows wide counsels, compliance officers and regulatory executives to conscionable with nationalist officials liable for crypto authorities and regulatory oversight. Space is limited. Use codification CDB10 for 10% disconnected your registration done Aug. 31.

- Day 5 of 5: Crypto 2025 (Santa Barbara, California)

- Day 4 of 4: Wyoming Blockchain Symposium 2025 (Jackson Hole)

- Day 1 of 2: Coinfest Asia 2025 (Bali, Indonesia)

- Aug. 25-26: WebX 2025 (Tokyo)

- Aug. 27: Blockchain Leaders Summit 2025 (Tokyo)

- Aug. 28-29: Bitcoin Asia 2025 (Hong Kong)

Token Talk

By Shaurya Malwa

- YZY Money, a Solana memecoin tied to Ye (formerly Kanye West), debuted Thursday with a 6,800% surge successful terms earlier slipping nether $1, indicative of the speculative churn astir personage tokens.

- The token announcement connected Ye's X relationship sparked speculation of a hack earlier posting a video it which helium appeared to corroborate the launch. Questions stay whether the clip was AI-generated.

- The token operation mirrors the TRUMP coin: 70% proviso allocated to Ye, 10% to liquidity, 20% for sale. Insiders said Ye initially demanded 80% earlier agreeing to 70%.

- Wallet information shows wide beforehand access. Wallet 6MNWV8 spent 450,611 USDC astatine $0.35, aboriginal selling immoderate of its holding for $1.39 cardinal to reap a $1.5 cardinal nett erstwhile terms gains connected the remainder are included. Another whale bought $2.28 cardinal worthy and sits connected $6 cardinal successful gains.

- Liquidity was seeded single-sided with lone YZY, allowing developers oregon ample holders to retreat worth astatine volition — a plan critics liken to the arguable LIBRA token successful Argentina.

- Retail buyers absorbed the losses: One wallet mislaid astir $500,000 wrong 2 hours aft buying astatine $1.56 and exiting astatine $1.06.The occurrence highlights however insider-heavy allocations and liquidity gimmicks exposure fans and traders, adjacent arsenic hype concisely drove the token's marketplace headdress toward $3 billion.

- Wormhole challenged LayerZero’s $110 cardinal bid for Stargate with plans for a higher counteroffer, asking the assemblage to hold its governance ballot for 5 days to implicit owed diligence and guarantee token holders measure some proposals connected just terms.

- Stargate’s entreaty lies successful scale: $4 cardinal processed successful July, $345 cardinal locked, and a treasury with $92 cardinal successful stablecoins and ether positive $55 cardinal successful STG and different assets.

- LayerZero’s connection would transportation treasury and aboriginal gross to itself, which critics accidental undervalues Stargate and shortchanges token holders.

- Wormhole argues STG holders “deserve a much competitory process” and positions its bid arsenic delivering greater semipermanent value.

- A merger would fuse Stargate’s unified liquidity pools with Wormhole’s integrations crossed dozens of blockchains, creating 1 of the largest cross-chain hubs.

- The Wormhole Foundation claims specified a operation would “unlock unrealized value” and thrust some contiguous and lasting benefits for STG and Wormhole token holders.

Derivatives Positioning

- The maturation successful BTC and ETH futures unfastened involvement stalled astatine levels supra 700K BTC and 14.2 cardinal ETH, which is accordant with the directionless trading successful spot prices earlier the commencement of the cardinal bankers' confab astatine Jackson Hole.

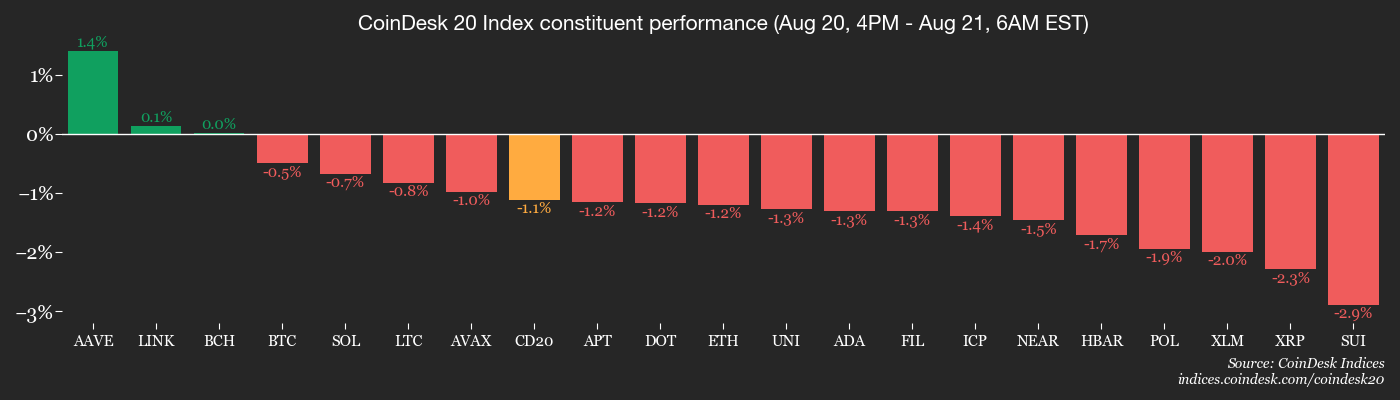

- Open involvement successful LINK futures remains adjacent grounds highs, with the token terms rising to astir $27 connected Wednesday, the astir since January. Other apical 10 tokens, excluding BNB, saw unfastened involvement autumn successful the past 24 hours.

- HYPE leads crypto majors with annualized backing rates exceeding 25%. That shows traders are progressively seeking bullish vulnerability successful the token.

- On CME, the betterment successful the BTC futures noted connected Wednesday has stalled, with the three-month premium receding to astir 7%. Meanwhile, ether futures OI continues to turn and is nearing the 2 cardinal ETH mark. These diverging trends constituent to a increasing organization penchant for ether implicit bitcoin.

- On Deribit, the 180-day bitcoin options skew dipped to -0.42, indicating the strongest request for enactment options, oregon downside insurance, since June 2023. Longer-dated ETH options continued to amusement a bias for calls.

- Flows implicit the OTC web Paradigm featured request for BTC puts financed by selling calls and mixed enactment successful the ether options market.

- Volmex's seven-day implied volatility indices for bitcoin and ether person remained dependable astatine astir 36% and 70%, respectively, indicating that the marketplace does not expect a important volatility spike from the Jackson Hole event.

Market Movements

- BTC is down 0.84% from 4 p.m. ET Wednesday astatine $113,434.22 (24hrs: -0.4%)

- ETH is down 1.68% astatine $4,283.19 (24hrs: +1.23%)

- CoinDesk 20 is down 1.44% astatine 4,019.84 (24hrs: +0.69%)

- Ether CESR Composite Staking Rate is down 1 bp astatine 2.93%

- BTC backing complaint is astatine 0.0074% (8.0548% annualized) connected Binance

- DXY is unchanged astatine 98.22

- Gold futures are down 0.20% astatine $3,381.60

- Silver futures are down 0.13% astatine $37.72

- Nikkei 225 closed down 0.65% astatine 42,610.17

- Hang Seng closed down 0.24% astatine 25,104.61

- FTSE is unchanged astatine 9,280.80

- Euro Stoxx 50 is down 0.3% astatine 5,455.71

- DJIA closed connected Wednesday unchanged astatine 44,938.31

- S&P 500 closed down 0.24% astatine 6,395.78

- Nasdaq Composite closed down 0.67% astatine 21,172.86

- S&P/TSX Composite closed up 0.2% astatine 27,878.76

- S&P 40 Latin America closed up 0.41% astatine 2,648.47

- U.S. 10-Year Treasury complaint is up 1.4 bps astatine 4.31%

- E-mini S&P 500 futures are down 0.11% astatine 6,406.50

- E-mini Nasdaq-100 futures are unchanged astatine 23,315.75

- E-mini Dow Jones Industrial Average Index are down 0.26% astatine 44,880.00

Bitcoin Stats

- BTC Dominance: 59.5% (+0.2%)

- Ether-bitcoin ratio: 0.03772 (-0.58%)

- Hashrate (seven-day moving average): 946 EH/s

- Hashprice (spot): $55.47

- Total fees: 3.41 BTC / $388,249

- CME Futures Open Interest: 143,050 BTC

- BTC priced successful gold: 34.0 oz.

- BTC vs golden marketplace cap: 9.62%

Technical Analysis

- The regular illustration for e-mini futures tied to the Nasdaq 100 amusement that the longer duration MACD (50,100,9) has turned antagonistic for the archetypal clip since April. The antagonistic crossover indicates a bullish-to-bearish displacement successful momentum.

- The RSI precocious diverged bearishly arsenic it produced a little precocious past week, contradicting the caller highest successful prices. The indicator is connected the verge of falling beneath 50 to suggest strengthening of the downside momentum.

- Together, the 2 indicators suggest much losses up for exertion stocks.

- Cryptocurrencies are known to intimately way movements successful Nasdaq.

Crypto Equities

- Strategy (MSTR): closed connected Wednesday astatine $344.37 (+2.32%), -0.69% astatine $342 successful pre-market

- Coinbase Global (COIN): closed astatine $304.39 (+0.77%), -0.55% astatine $302.73

- Circle (CRCL): closed astatine $137.81 (+1.91%), unchanged successful pre-market

- Galaxy Digital (GLXY): closed astatine $24.51 (+1.72%), -1.51% astatine $24.14

- Bullish (BLSH): closed astatine $62.89 (+5.68%), -1.57% astatine $61.90

- MARA Holdings (MARA): closed astatine $15.45 (+1.85%), -1.49% astatine $15.22

- Riot Platforms (RIOT): closed astatine $12.52 (+4.68%), -1.28% astatine $12.36

- Core Scientific (CORZ): closed astatine $14.08 (-1.88%), -1.99% astatine $13.80

- CleanSpark (CLSK): closed astatine $9.49 (+1.39%), -1.05% astatine $9.39

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $27.27 (+2.52%)

- Semler Scientific (SMLR): closed astatine $31.21 (-2.12%), unchanged successful pre-market

- Exodus Movement (EXOD): closed astatine $25.45 (-6.09%)

- SharpLink Gaming (SBET): closed astatine $19.47 (+5.93%), -1.95% astatine $19.09

ETF Flows

Spot BTC ETFs

- Daily nett flows: -$315.9 million

- Cumulative nett flows: $53.99 billion

- Total BTC holdings ~1.29 million

Spot ETH ETFs

- Daily nett flows: -$240.2 million

- Cumulative nett flows: $11.82 billion

- Total ETH holdings ~6.25 million

Source: Farside Investors

Chart of the Day

- The illustration shows 2 mining pools, Foundry USA and Antpool, relationship for astir 50% of the computing powerfulness dedicated to the Bitcoin blockchain.

- The attraction of hashrate has raised concerns astir centralization connected societal media.

While You Were Sleeping

- Talk of Boots connected the Ground successful Ukraine Sparks Unease successful Germany (Reuters): German Chancellor Merz kept the enactment of sending troops to Ukraine open, but the country's history, past overseas setbacks, economical strain and fears of subject overextension marque it a politically fraught move.

- Key Bitcoin Indicators Hint astatine Bearish Regime Shift arsenic Jackson Hole Nears (CoinDesk): Options markets amusement stronger request for downside protection, portion bitcoin has slipped beneath cardinal inclination levels, pointing to weakening sentiment contempt lone a humble terms pullback.

- Canada Cultivates Nordic Connections to Offset Its Reliance connected U.S. Trade (Financial Times): Canada is boosting defence and commercialized ties with Finland and Sweden, including icebreakers and combatant jets, to lessen reliance connected the U.S. pursuing Trump’s annexation and tariff threats.

- DBS Launches Tokenized Structured Notes connected Ethereum, Expanding Investor Access (CoinDesk): The Singapore-based slope is breaking down $100,000 structured notes into $1,000 tokenized units connected Ethereum, making them tradable for accredited and organization investors via Singapore exchanges ADDX, DigiFT and HydraX.

- Windtree’s BNB Treasury Bet Collides With Nasdaq Delisting Order (CoinDesk): Windtree’s sub-$1 stock terms forced a Nasdaq delisting, leaving its $200 cardinal BNB treasury program successful limbo arsenic it scrambles to displacement trading to over-the-counter markets nether its existing "WINT" ticker.

- Trump Orders Pentagon to Deploy Three Warships Against Latin American Drug Cartels (The Wall Street Journal): The Navy’s guided-missile destroyers volition beryllium tasked with intercepting cause shipments disconnected South America’s coast, including adjacent Venezuela, marking a displacement from their accustomed supporting relation to the Coast Guard.

In the Ether

3 months ago

3 months ago

English (US)

English (US)