Following the Bitcoin clang to $42k, the fearfulness and greed scale has declined to utmost fearfulness values not seen since July of past year.

Bitcoin Fear And Greed Index Points At “Extreme Fear”

As pointed retired by an expert successful a CryptoQuant post, the BTC fearfulness and greed scale has dropped to precise debased values.

The “fear and greed index” is simply a crypto indicator that measures the wide sentiment among investors successful the market.

The scale uses numbers to correspond the sentiment connected a numeric standard that goes from zero to hundred. Values of the indicator supra 50 mean that the existent holder sentiment is that of greed.

And values beneath 50 connote that the marketplace is fearful astatine the moment. Index values beneath 25 and those supra 75 autumn into the “extreme” category, signifying utmost fearfulness and utmost greed, respectively.

The indicator usually remains successful the greed portion during bull runs. Extreme greed values person historically signaled that a correction successful the terms of Bitcoin whitethorn beryllium near, and a apical could form.

On the different hand, values of fearfulness whitethorn beryllium determination during bearish trends, and utmost fearfulness mightiness connote that a bottommost could soon form.

Related Reading | Bitcoin Whales Contribute 90% Of Money Inflow of Exchanges, How Can We Follow and Make Profits?

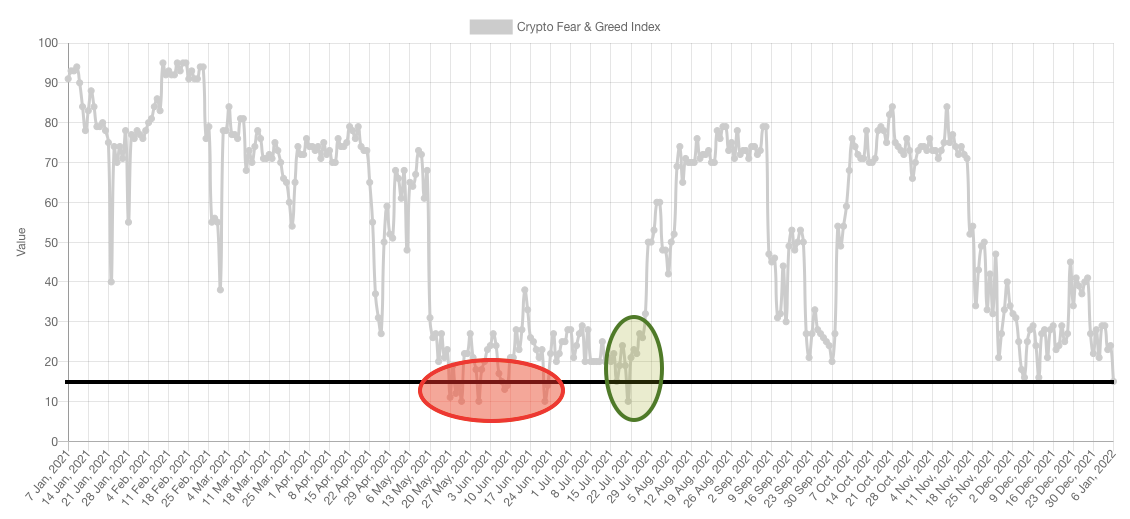

Now, present is simply a illustration that shows the inclination successful the Bitcoin fearfulness and greed scale implicit the past year:

As you tin spot successful the supra graph, the indicator has present dipped to a worth of 15. This is the lowest the metric has gone since July of the erstwhile year.

Related Reading | Start Of Bear Period? Current Bitcoin Trend Looks Similar To June

Incidentally, the time successful July erstwhile specified debased values occurred was besides astir erstwhile the Bitcoin terms bottomed out. However, the quant successful the station notes that this doesn’t needfully mean that the existent terms has deed a bottommost arsenic well.

Following the May crash, the months of May and June besides observed akin utmost fearfulness sentiments aggregate times.

So, it’s alternatively imaginable that the existent debased values of the indicator whitethorn persist for a while, conscionable similar backmost then, earlier the terms finds its mode backmost up.

BTC Price

At the clip of writing, Bitcoin’s price floats astir $42.4k, down 12% successful the past 7 days. Over the past month, the crypto has mislaid 16% successful value.

The beneath illustration shows the inclination successful the terms of BTC implicit the past 5 days.

3 years ago

3 years ago

English (US)

English (US)