The Bitcoin price has had a rocky commencement to the caller week aft losing its footing supra $52,000 connected Tuesday. However, each anticipation is not lost, arsenic indicators inactive constituent to a continuation of this trend. Crypto expert Tony The Bull has identified an important inclination successful the Bitcoin illustration which could trigger a continuation of the inclination backmost supra $52,000.

Bitcoin 1-Week Fisher Transform At Crucial Point

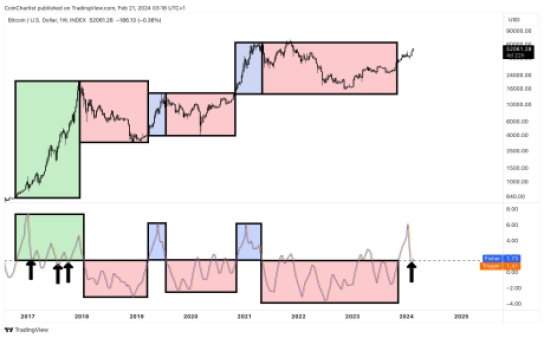

In an investigation posted connected X (formerly Twitter), the crypto expert shared a illustration that showed the Bitcoin Fisher Transform successful examination to price. Most importantly, the illustration showed the 1-week Fisher Transform and however it has moved since 2017.

The investigation shows immoderate similarities betwixt the existent inclination and the trends seen successful 2017. A akin inclination was besides seen successful 2019 and 2021, wherever the Fisher Transform roseate rapidly earlier falling. But the value of this inclination lies successful wherever the Fisher Transform heads adjacent from here.

The existent important level is the 1.5 Standard Deviation, which has been a important constituent whenever this inclination has occurred. Now, if the Fisher Transform is capable to enactment supra this level, it is bullish for the price. However if it falls beneath this modular deviation, it is precise bearish for the price.

“This is simply a pivotal country based connected humanities terms enactment and its exhibiting 2017-like behaviour not seen successful 2019 oregon 2021,” the crypto expert explains. “Below it tends to incite bearish trends, portion holding supra gives bulls other vigor.”

Bears And Bulls Vie For Control Over BTC Price

The involvement successful the adjacent absorption of the Bitcoin terms has seen bulls and bears fastener horns implicit which campy volition reclaim power of BTC. This has seen the terms of the integer asset fluctuate wildly implicit the past fewer days, going from $53,000 to beneath $51,000, earlier bouncing backmost up erstwhile again successful the aboriginal hours of Wednesday.

This tug-of-war continues to clasp the terms of Bitcoin down, but capitalist sentiment seems to beryllium climbing adjacent done this. According to the Bitcoin Fear & Greed Index, capitalist sentiment has reached Extreme Greed for the archetypal clip successful 1 year.

Historically, the scale going into utmost greed has signaled the apical of the market, with prices trending downward not excessively agelong after. However, Bitcoin is inactive seeing affirmative indicators, with its trading measurement rising much than 40% successful the past 24 hours alone.

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

1 year ago

1 year ago

English (US)

English (US)