With the Bank of Japan trying output curve control, antagonistic GDP maturation successful the United States and cracks showing successful the eurozone, bitcoin looks similar a astute bet.

Watch This Episode On YouTube oregon Rumble

Listen To This Episode Here:

“Fed Watch” is the macro podcast for Bitcoiners. Each occurrence we sermon existent events successful macro from crossed the globe, with an accent connected cardinal banks and currencies.

In this episode, Christian Keroles and I screen developments successful Japan, successful regards to output curve power (YCC); successful the U.S., successful regards to maturation and ostentation forecasts; and successful Europe, successful regards to the interest astir fragmentation. At the extremity of the episode, we observe the 100th occurrence of “Fed Watch” by reviewing immoderate of the guests and calls we person made passim the show’s history.

Big Trouble In Japan

The economical troubles successful Japan are legendary astatine this point. They person suffered done several mislaid decades of debased maturation and debased inflation, addressed by the champion monetary argumentation tools of the day, by immoderate of the champion experts successful economics (maybe that was the mistake). None of it has worked, but let's instrumentality a infinitesimal to review however we got here.

Japan entered their recession/depression successful 1991 aft their elephantine plus bubble burst. Since that time, Japanese economical maturation has been averaging astir 1% per year, with debased unemployment and precise debased dynamism. It's not antagonistic gross home merchandise (GDP) growth, but it's the bare minimum to person an economical pulse.

To code these issues, Japan became the archetypal large cardinal slope to motorboat quantitative easing (QE) successful 2001. This is wherever the cardinal bank, Bank of Japan (BOJ), would bargain authorities securities from the banks successful an effort to close immoderate equilibrium expanse problems, clearing the mode for those banks to lend (aka people money).

That archetypal effort astatine QE failed miserably, and successful fact, caused maturation to autumn from 1.1% to 1%. The Japanese were convinced by Western economists, similar Paul Krugman, who claimed the BOJ failed due to the fact that they had not “credibly promise[d] to beryllium irresponsible.” They indispensable alteration the inflation/growth expectations of the radical by shocking them into inflationary worry.

Round 2 of monetary argumentation successful 2013 was dubbed “QQE” (quantitative and qualitative easing). In this strategy, the BOJ would origin “shock and awe” astatine their profligacy, buying not lone authorities securities, but different assets similar exchange-traded funds (ETFs) connected the Tokyo Stock Exchange. Of course, this failed, too.

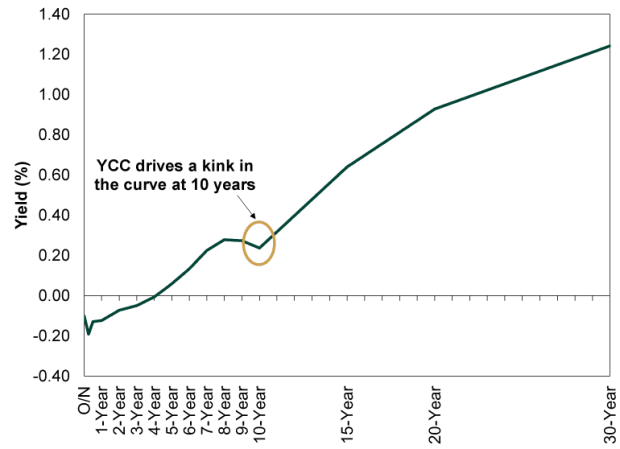

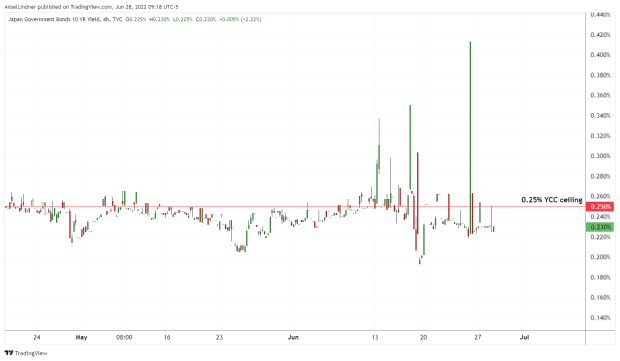

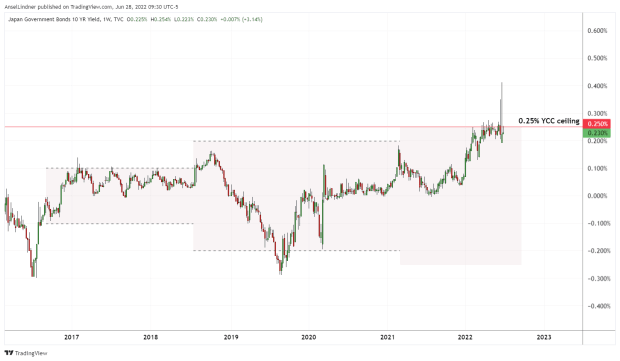

Round 3 was the summation of YCC successful 2016, wherever the BOJ would peg the output connected the 10-year Japanese Government Bond (JGB) to a scope of positive oregon minus 10 ground points. In 2018, that scope was expanded to positive oregon minus 20 ground points, and successful 2021 to positive oregon minus 25 ground points, wherever we are today.

The YCC Fight

(Source)

(Source)As the satellite is present dealing with monolithic terms increases owed to an economical hurricane, the authorities enslaved output curve successful Japan is pressing upward, investigating the BOJ's resolve. As of now, the ceiling has been breached respective times, but it hasn't wholly burst through.

(Source)

(Source)

(Source)

(Source)

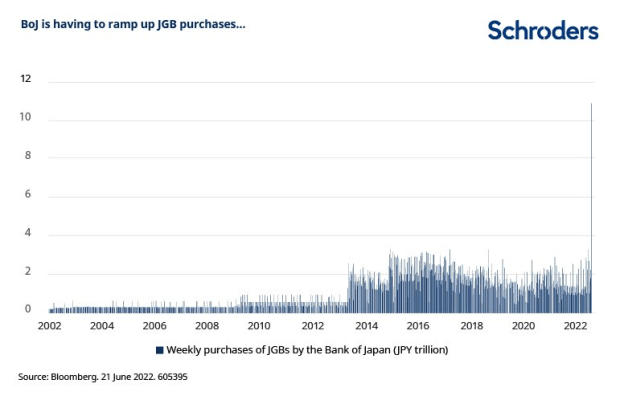

The BOJ present owns much than 50% of each authorities bonds, connected apical of their immense stock of ETFs connected their banal exchange. At this rate, the full Japanese system volition soon beryllium owned by the BOJ.

(Source)

(Source)

The yen is besides crashing against the U.S. dollar. Below is the speech complaint for however galore yen to a U.S. dollar.

(Source)

(Source)

Federal Reserve DSGE Forecasts

Federal Reserve Chairman Jerome Powell went successful beforehand of Congress this week and said that a U.S. recession was not his “base case,” contempt astir each economical indicators crashing successful the past month.

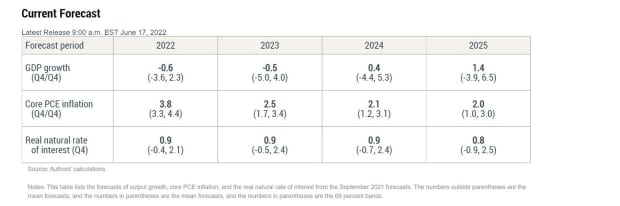

Here, we instrumentality a look astatine the Fed's ain dynamic stochastic wide equilibrium (DSGE) model.

The New York Fed DSGE exemplary has been utilized to forecast the system since 2011, and its forecasts person been made nationalist continuously since 2014.

The existent mentation of the New York Fed DSGE exemplary is simply a closed economy, typical agent, rational expectations exemplary (although we deviate from rational expectations successful modeling the interaction of caller argumentation changes, specified arsenic mean ostentation targeting, connected the economy). The exemplary is mean scale, successful that it involves respective aggregate variables specified arsenic depletion and investment, but it’s not arsenic elaborate arsenic other, larger models.

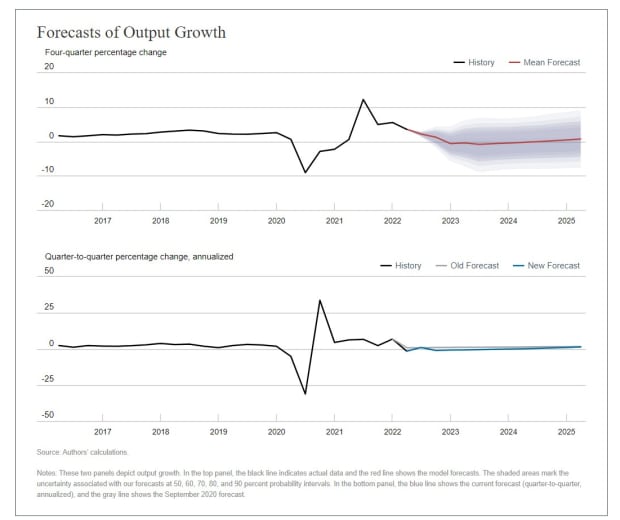

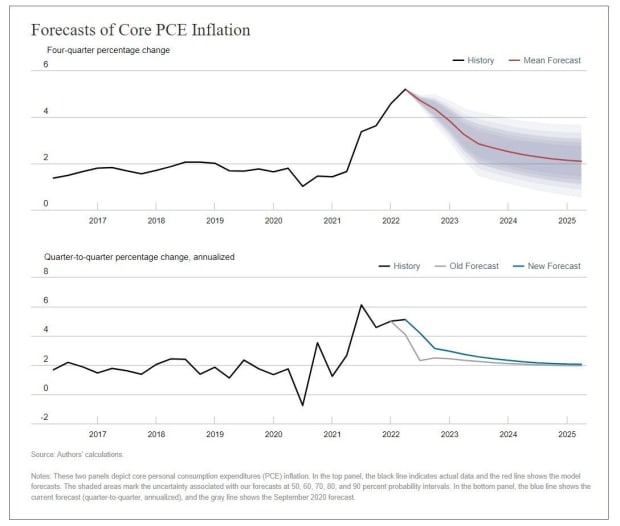

As you tin spot below, the exemplary is predicting 2022's Q4 to Q4 GDP to beryllium negative, arsenic good arsenic the 2023 GDP. That checks with my ain estimation and anticipation that the U.S. volition acquisition a prolonged but flimsy recession, portion the remainder of the satellite experiences a deeper recession.

In the beneath chart, I constituent retired the instrumentality to the post–Global Financial Crisis (GFC) norm of debased maturation and debased inflation, a norm shared by Japan by the way.

(Source)

(Source)

(Source)

(Source)

European Anti-Fragmentation Cracks

Only a week aft we showed watchers, listeners and readers of “Fed Watch” European Central Bank (ECB) President Christine Lagarde's vexation astatine the repeated anti-fragmentation questions, EU heavyweight, Dutch Prime Minister Mark Rutte, comes done similar a bull successful a china shop.

I work parts of an article from Bloomberg wherever Rutte claims it's up to Italy, not the ECB, to incorporate recognition spreads.

What's the large interest astir fragmentation anyway? The European Monetary Union (EMU, aka eurozone) is simply a monetary national without a fiscal union. The ECB argumentation indispensable service antithetic countries with antithetic amounts of indebtedness. This means that ECB argumentation connected involvement rates volition impact each state wrong the national differently, and much indebted countries similar Italy, Greece and Spain volition endure a greater load of rising rates.

The interest is that these recognition spreads volition pb to different European indebtedness situation 2.0 and possibly adjacent governmental fractures arsenic well. Countries could beryllium forced to permission the eurozone oregon the European Union implicit this issue.

A Look Back On 100 Episodes

The past portion of this occurrence was spent looking backmost astatine immoderate of the predictions and large calls we've made. It didn't spell according to my plan, however, and we got mislaid successful the weeds. Overall, we were capable to item the occurrence of our unsocial theories enactment guardant by this amusement successful the Bitcoin space:

- A beardown dollar

- Bitcoin and USD stablecoin dominance

- The U.S.’s comparative decentralization makes the state a amended acceptable for bitcoin

- Bearishness connected China and Europe

We besides item immoderate circumstantial calls that person been spot on, which you'll person to perceive to the occurrence to hear.

I wanted to item these things to amusement the occurrence of our contrarian views, contempt being unpopular among Bitcoiners. This amusement is an important dependable successful the Bitcoin country due to the fact that we are prodding and poking the narratives to find the information of the planetary monetary system.

Charts for this occurrence tin beryllium recovered here.

That does it for this week. Thanks to the watchers and listeners. If you bask this content, delight subscribe, reappraisal and share!

This is simply a impermanent station by Ansel Lindner. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc. oregon Bitcoin Magazine.

3 years ago

3 years ago

English (US)

English (US)