Even though Bitcoin (BTC) was rejected astatine $45,500, anticipation for different important beforehand successful the cryptocurrency marketplace has reappeared. Bulls are present aiming to beef up their defence astatine the $43,000 enactment level.

According to TradingView data, aft reaching a play precocious of $45,500 aboriginal connected Feb. 8, bears were capable to little the terms of Bitcoin to $42,900 during day trading arsenic investors realized profits and prepared to spot bids astatine $38,000. At the clip of writing, the pioneer token is worthy $44,091.

Bitcoin Steadies At $44k

Bitcoin (BTC) bulls person successfully returned the main integer currency’s terms to the $44K enactment level, boosted by encouraging occurrences. Most notably, the Canadian subsidiary of accounting large KPMG precocious announced that it has integrated BTC and ETH to its firm treasury. In addition, Tesla Inc reported successful a precocious filed 10-K that it possessed astir $2 cardinal successful BTC astatine the extremity of past year.

The speedy emergence caught galore traders disconnected surprise, arsenic headlines crossed the crypto assemblage predicted the commencement of a lengthy carnivore market, but specified grim predictions whitethorn person been premature, according to information from a caller Glassnode research. According to the blockchain probe company, “prices person bounced disconnected a fig of cardinal levels that person historically signaled undervaluation oregon a “fair value” price.”

The laminitis and CEO of multi-strategy steadfast Banz Capital, John Iadeluca, commented connected this trend, saying:

“Tesla’s 10K SEC filing update was released yesterday, reaffirming notions that Tesla held onto their BTC holdings amidst declines successful Bitcoin’s terms to the little 30 thousands. Combined with the quality of KPMG Canada adding Bitcoin onto its equilibrium sheet, encouraged a crisp emergence successful affirmative Bitcoin terms sentiment.”

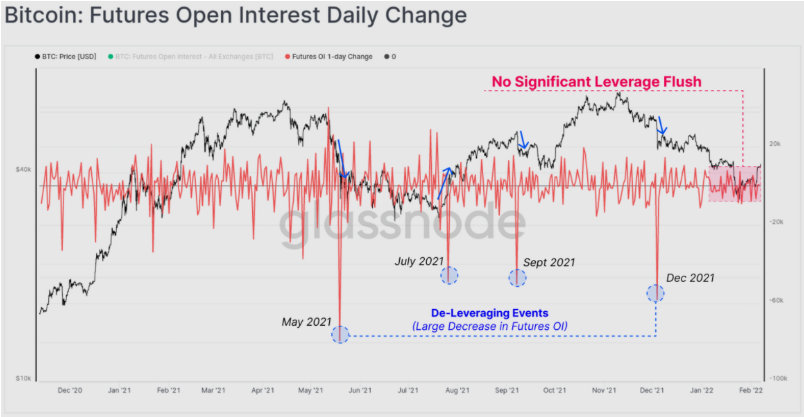

Glassnode observed that during earlier instances of terrible terms losses, futures unfastened involvement (OI) experienced immense drawdowns oregon “de-leveraging events,” arsenic evidenced by the ample downward reddish spikes connected the graph above, a diagnostic that is strikingly absent from this caller terms decline. The steadfast said:

“This whitethorn bespeak the probability of a abbreviated compression is little than archetypal estimated, oregon that specified an lawsuit remains imaginable should the marketplace proceed higher, reaching clusters of abbreviated seller stop-loss/liquidation levels.”

Related nonfiction | Valkyrie Bitcoin Mining ETF “WGMI” Approved For Nasdaq Listing

Bitcoin In Longest Rally

Bitcoin caller rally is BTC longest streak since past September. After the caller dip, investing successful respective of these risky plus groups has go considerably much comfortable.

While the marketplace isn’t retired of the woods yet, determination is inactive overmuch uncertainty connected a fig of fronts, including however swiftly the Federal Reserve tin enactment to combat expanding inflation.

Meanwhile, seasoned traders, notably the pseudonymous Twitter idiosyncratic Pentoshi, are seizing the opportunity. This includes collecting immoderate net and repositioning yourself for what the aboriginal holds. Pentoshi enactment it this way:

“Taking the past highs now. Looking for 1 past spike up but $44,000–$46,300. In my opinion, bully spot to adjacent longs retired and re-evaluate.”

Despite BTC’s accrued consciousness of optimism successful presumption of pricing, immoderate traders stay gloomy connected the apical cryptocurrency. Allen Au, a Bitcoin adept and Twitter user, shared a graph depicting the past terms action’s interaction connected futures markets. Following a driblet successful unfastened interest, determination was a $71 cardinal liquidation of Bitcoin shorts. Au described this arsenic a “short squeeze” that volition astir surely proceed to beforehand terms increases. In addition, helium stated:

“Perpetual futures backing rates are antagonistic contempt BTC breaking supra $44K. Traders are inactive bearish astir BTC.”

Related nonfiction | As Bitcoin Price Jumps Above $40k, Tesla Reveals Holdings Tapped $2 Billion

Featured representation from iStockPhoto, Charts from TradingView.com

3 years ago

3 years ago

English (US)

English (US)