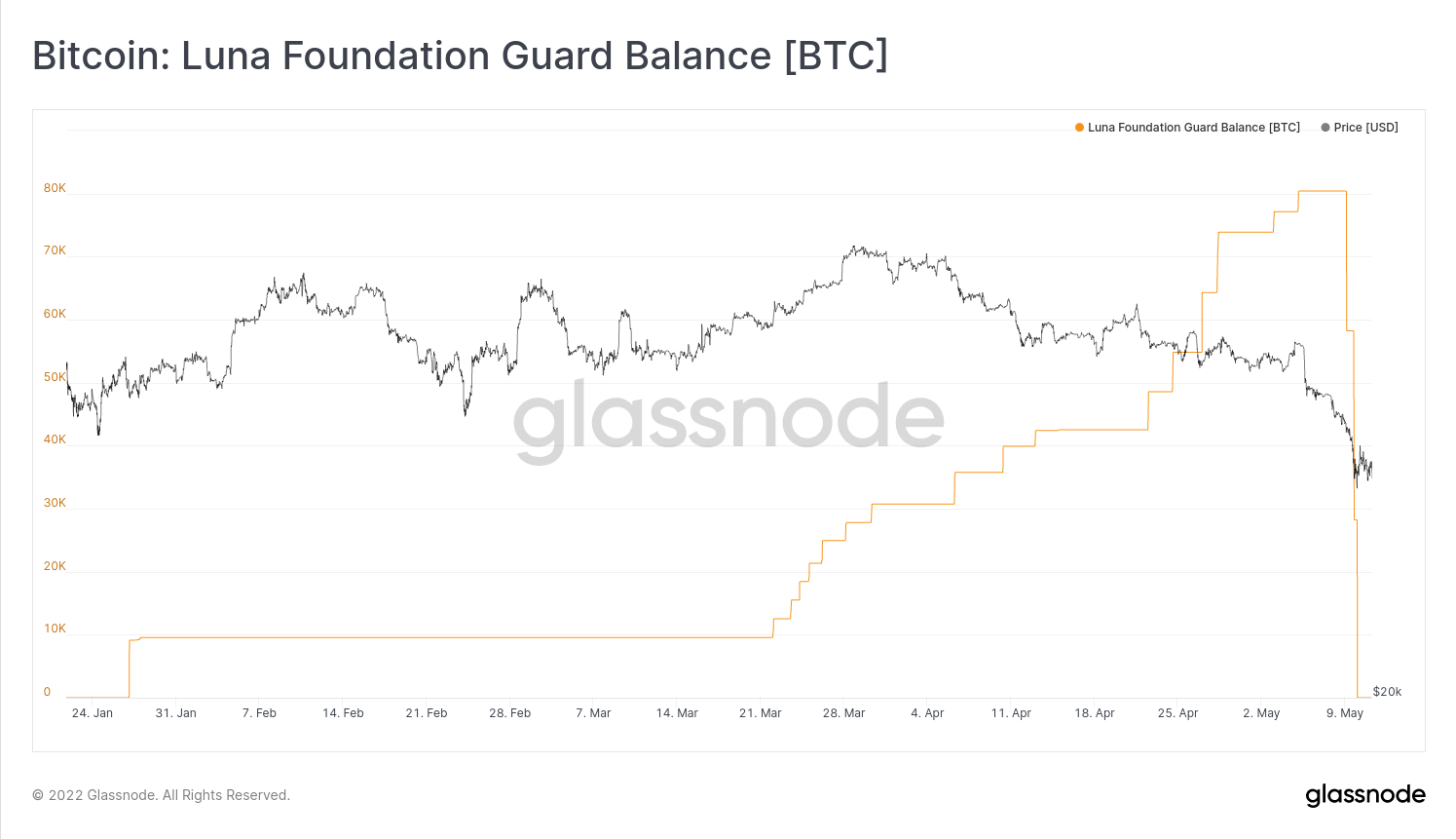

Bitcoin was down implicit 3.5% passim the trading time successful Asia, concisely touching the $30,230 mark, according to the CoinDesk terms index, arsenic the Luna Foundation Guard (LFG) moves the entirety of its reserves to bitcoin exchanges to support UST’s peg.

(Glassnode)

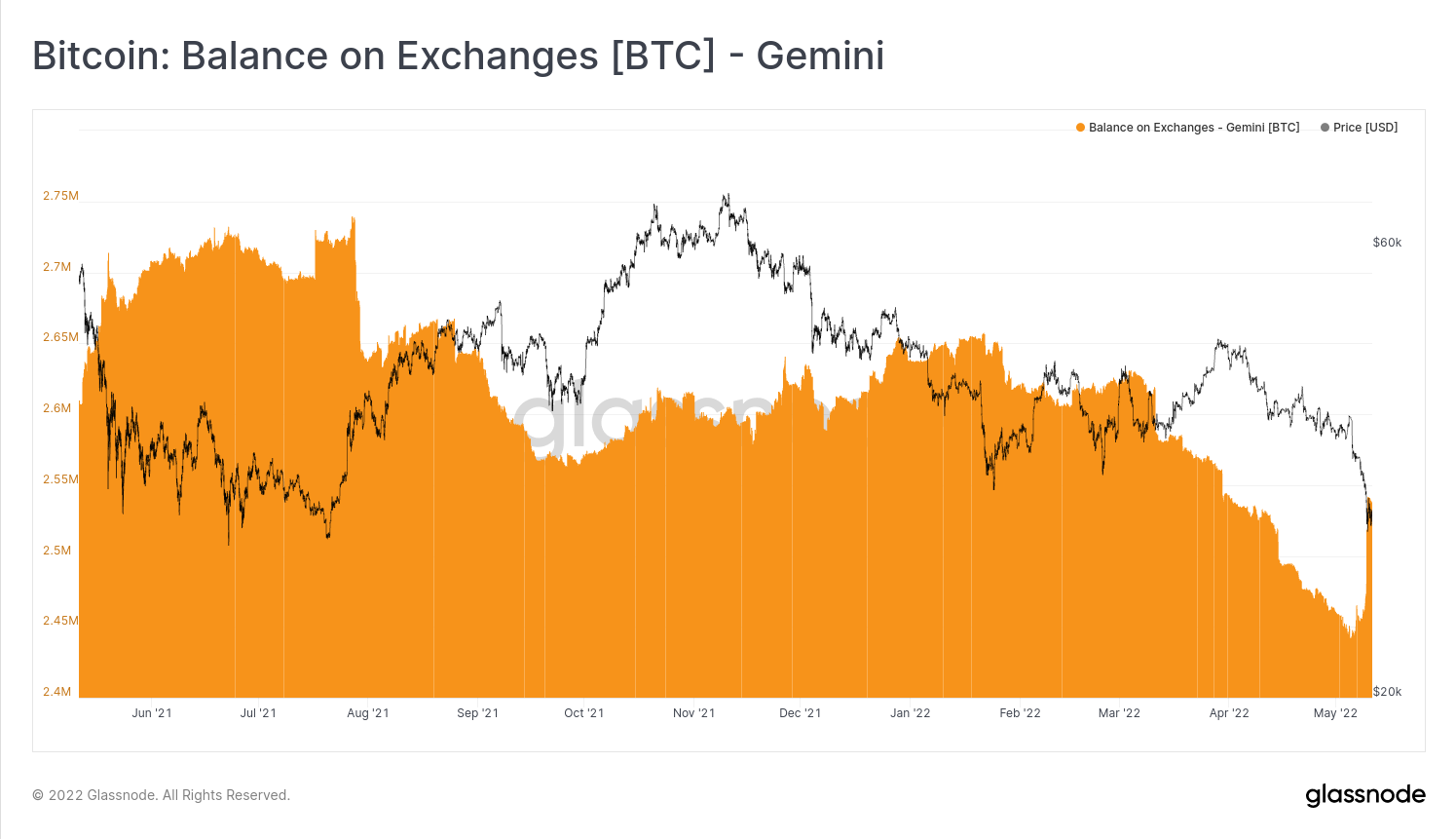

LFG’s reserve equilibrium has declined from 80,394 bitcoin to zero, and the bulk has been deposited onto Gemini, according to Glassnode data.

(Glassnode)

James “Checkmate” Check, an expert with Glassnode, says helium believes that Gemini is the custodian for marketplace shaper operations, oregon for the merchantability of this bitcoin. Check says it's not wide however overmuch of the reserve was sold oregon loaned to marketplace makers.

The magnitude of bitcoin connected exchanges is astatine a precocious not seen since November 2017, but Check argues that marketplace conditions are precise antithetic and it's pugnacious to marque a comparison.

“It is not the aforesaid arsenic 2017 successful immoderate mode really, a wholly antithetic mechanics and acceptable of entities astatine play. What we are observing is person to a miniature mentation of George Soros attacking the peg of the British Pound, wherever the LFG is playing the relation of the Bank of England (with a akin effect it seems),” helium said successful an email to CoinDesk.

Meanwhile, LUNA has dropped astir 85% successful the past 24 hours and is presently trading astatine astir $4.50, according to CoinGecko data.

UST is presently astatine 0.35, down 60% on-day, calling into question the occurrence of LFG’s operation.

The Festival for the Decentralized World

Thursday - Sunday, June 9-12, 2022

Austin, Texas

Save a Seat NowDISCLOSURE

Please enactment that our

cookies, and

do not merchantability my idiosyncratic information

has been updated.

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a

strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of

Digital Currency Group, which invests in

and blockchain

startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of

stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Sign up for Crypto for Advisors, our play newsletter defining crypto, integer assets and the aboriginal of finance.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)