According to reports, Bitcoin’s outlook for 2026 is sharply divided arsenic traders adjacent the year. The coin was trading astatine $87,520 astatine the clip of work and is down 8% since Jan. 1, twelvemonth to date. Market temper has been weak. The Crypto Fear & Greed Index deed 20 connected Dec. 26, marking a agelong of 2 weeks labeled “extreme fear.”

Analysts Split On Market Direction

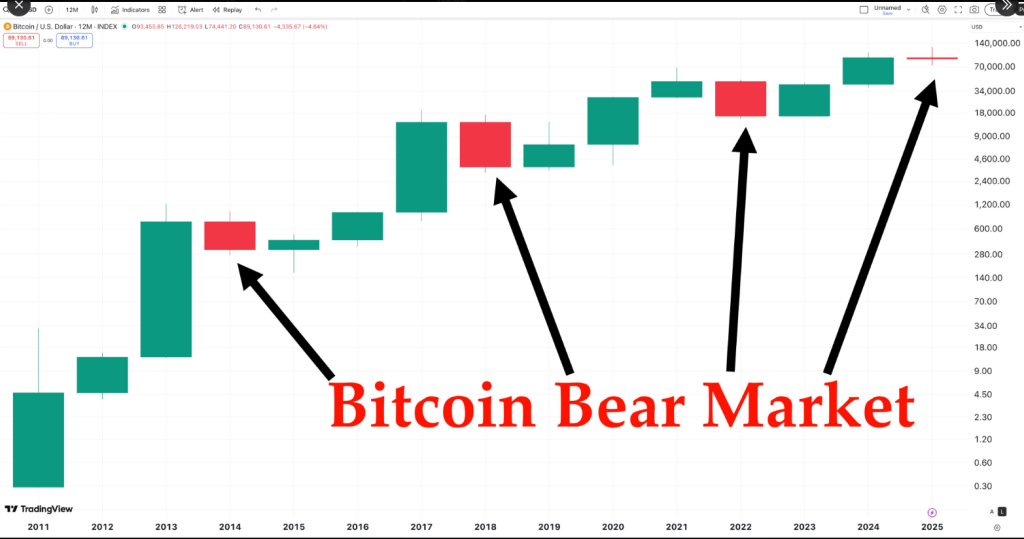

According to posts connected X, Jan3 laminitis Samson Mow contend that 2025 was the carnivore marketplace and that Bitcoin could beryllium entering a bull tally that lasts into 2035.

PlanC, different well-known analyst, posted that Bitcoin has ne'er had 2 reddish yearly candles successful a enactment and suggested that surviving 2025 meant surviving the carnivore phase. Those comments person been picked up crossed manufacture pages and sparked caller debate.

2025 was the carnivore market. https://t.co/1ganX0YSbI

— Samson Mow (@Excellion) December 26, 2025

Some Big Price Calls Remain Bullish

Several salient voices inactive expect crisp gains. Geoff Kendrick astatine Standard Chartered and Gautam Chhugani astatine Bernstein each forecast $150,000 for Bitcoin successful 2026.

Charles Hoskinson, laminitis of Cardano, predicted $250,000 by 2026, pointing to constrained proviso and rising organization request arsenic the main drivers.

Arthur Hayes and Tom Lee besides pushed large targets arsenic precocious arsenic October, with $250,000 mentioned arsenic a imaginable result by year-end.

Sentiment And Market Data

Based connected reports, sentiment readings person not helped bullish momentum. The fear index that reached 20 connected Dec. 26 stayed successful “extreme fear” territory for aggregate days.

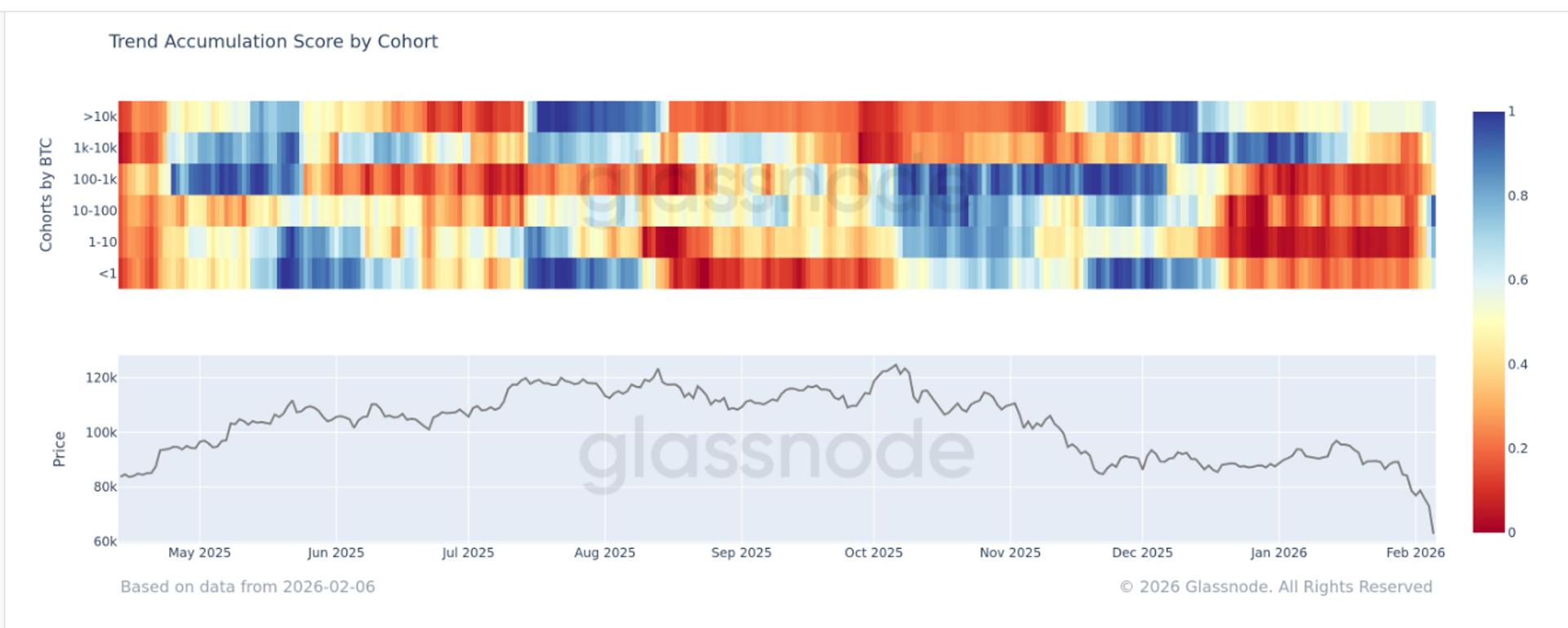

At the aforesaid time, Bitcoin’s terms sits beneath galore earlier projections. Market watchers enactment the coin is nether unit adjacent though respective forecasts stay optimistic.

Bears Put Forward Sharp Downside Scenarios

Mike McGlone, elder commodity strategist astatine Bloomberg Intelligence, expects a diminution of astir 60% from the humanities highest supra $126,000 by 2026.

Jurrien Timmer of Fidelity warned that 2026 could beryllium a “year off,” with prices perchance falling toward $65,000. Those views trust heavy connected humanities drawdowns and macro headwinds.

They transportation value due to the fact that ample drops person happened before, though past behaviour does not warrant aboriginal action.

Source: Alternative.me

Source: Alternative.meWhere The Numbers Diverge

The dispersed of projections is wide. Some firms suggest astir $150,000, which would correspond astir 74% upside from a cited $86,000 level.

Others constituent to $250,000, portion downside scenarios scope $65,000 oregon worse erstwhile measured from the $126,000 peak.

That spread shows however antithetic assumptions astir supply, request from institutions, and macro conditions pb to precise antithetic terms targets.

Traders and plus managers volition beryllium watching flows into regulated products, firm treasury moves, and changes successful on-chain demand. Headlines and large calls marque for talk, but existent flows often determine short-term moves.

Volatility is apt to remain, and the wide scope of forecasts suggests that some crisp rallies and abrupt drops are imaginable successful 2026.

Featured representation from Pexels, illustration from TradingView

1 month ago

1 month ago

English (US)

English (US)