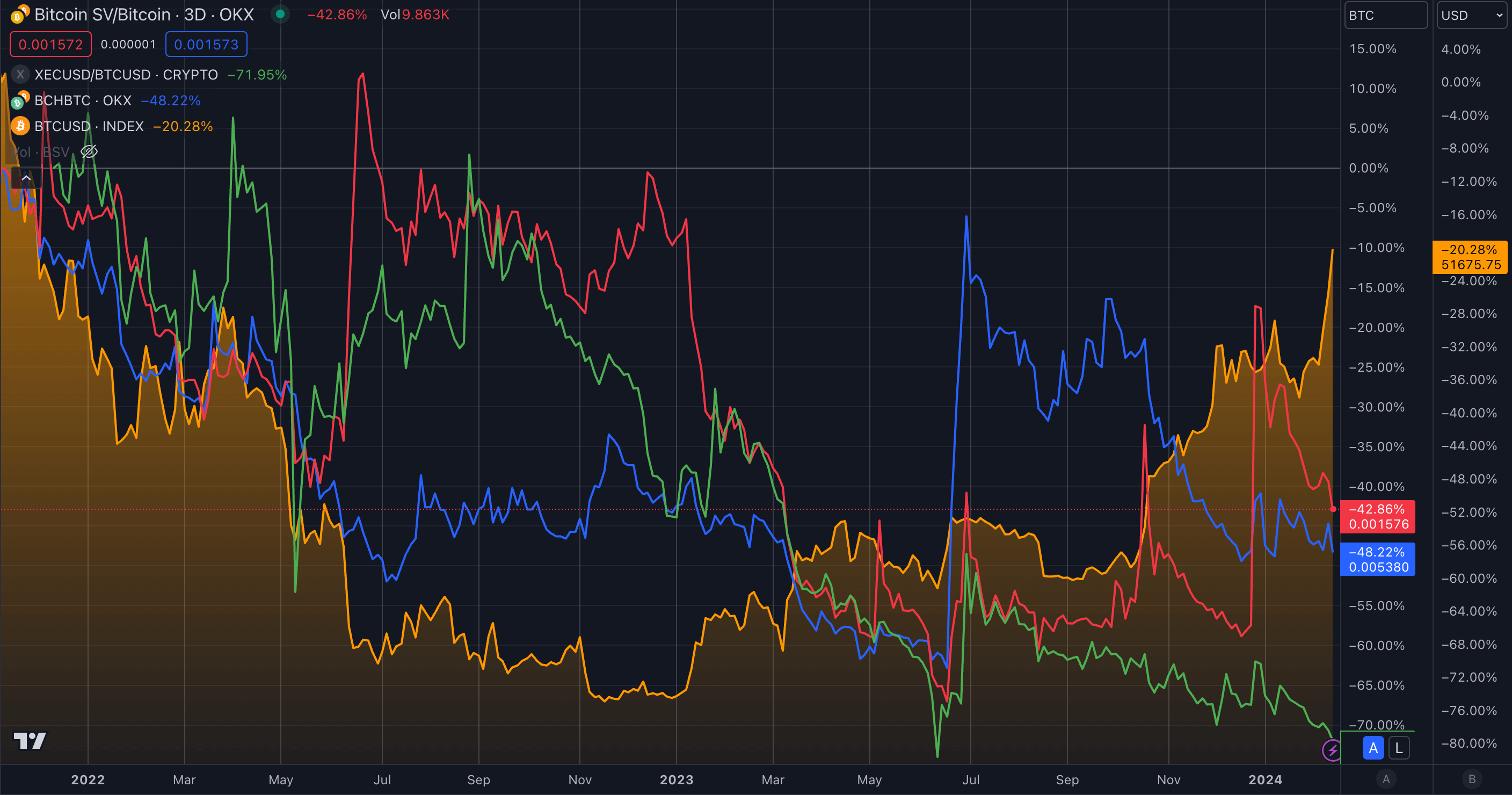

Major Bitcoin forks, including Bitcoin Cash (BCH), Bitcoin SV (BSV), and eCash (XEC, formerly Bitcoin Cash ABC), person experienced important terms depreciation against Bitcoin (BTC) since its all-time precocious successful November 2021. BCH declined by 48%, BSV by 42%, and XEC suffered a important 71% nonaccomplishment against BTC during this timeframe.

Bitcoin Forks (Source: TradingView)

Bitcoin Forks (Source: TradingView)This bearish show contrasts with Bitcoin’s trajectory, which has displayed comparative resilience, down lone 20% successful dollar presumption aft it rallied alongside the Newborn Nine’s archetypal exertion and eventual support of spot Bitcoin ETFs.

The 3 main Bitcoin forks person a comparatively debased beta to BTC, showcasing a antagonistic correlation successful terms action. While Bitcoin declined from November 2021 until January 2023, the forks saw immoderate affirmative show successful the second fractional of 2022. However, arsenic Bitcoin began to retrieve from January 2023, the forks past started to retreat.

This inclination continued until June 2023, erstwhile each 3 forks roseate importantly against Bitcoin, with BCH recovering astir 65%. BSV and XEC besides regained astir 30% and 20%, respectively, portion Bitcoin accrued astir 8% against the dollar successful that play arsenic BlackRock entered to spot Bitcoin ETF race.

BSV’s terms surge of 65% tin beryllium linked to a important summation successful trading measurement connected Upbit, South Korea’s largest crypto exchange, wherever 66.89% of BSV’s trading measurement was concentrated. BCH’s terms leap to a one-year precocious was fueled by a operation of factors, including the motorboat of EDX Markets, rising trading volumes, and a spike successful societal media interest. XEC had several updates passim 2023, aligning with its terms performance.

However, likely, BlackRock throwing its chapeau successful the ringing for a spot Bitcoin ETF connected June 15 was a applicable origin successful the forks’ surge. Social media speculation that Bitcoin becoming an organization concern merchandise could person a affirmative effect connected forks whitethorn person fueled archetypal momentum trading activity. Yet, ETF sponsors similar BlackRock, Fidelity, Ark Invest, and others released prospectus updates, identifying that they would not enactment immoderate aboriginal oregon past forks successful their offerings. Thus, aft the archetypal surge against Bitcoin, each 3 forks retraced astir of their gains.

BSV had a momentary rally successful November up of the COPA vs. Wright proceedings connected the individuality of Satoshi Nakamoto, gaining astir 40% against BTC. The rally was short-lived arsenic it past continued connected its downward trajectory.

While broader marketplace forces interaction the full crypto sector, Bitcoin’s strengthening communicative and institutional interest look to person further amplified losses for BCH, BSV, and XEC. Additionally, controversies surrounding figures specified arsenic Craig Wright, who claims to beryllium the pseudonymous Bitcoin creator Satoshi Nakamoto, whitethorn lend to BSV’s declining terms performance.

The disparity highlights the perchance waning marketplace dominance of large Bitcoin forks arsenic investors re-evaluate these projects amid a competitory scenery wherever Bitcoin continues to solidify its communicative arsenic the premier integer asset.

The station Bitcoin forks down up to 70% against BTC successful since all-time high appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)