Bitcoin has been steadily expanding since its January debased of $32,933.33. While seeing a 28 percent summation successful value. However, aft forming a ‘double top’ enactment adjacent the plaything highs of $45,500, the terms fell. Bitcoin begins the week connected a dependable diminution towards pivotal enactment astatine $40,000, wherever it has been for immoderate time.

Following a week of solemnisation for bulls, the contiguous situation appears to beryllium a harsh dose of world arsenic BTC confronts jittery banal markets, a rising US dollar, and different factors.

The bullish Bitcoin communicative was enactment to the trial this week arsenic geopolitical tensions betwixt Ukraine and Russia, arsenic good arsenic the likelihood of a 50 ground constituent Federal Reserve involvement complaint hike successful March, weighed connected the world’s largest cryptocurrency. However, Bitcoin fundamentals amusement that BTC is inactive successful upward momentum. Here are immoderate factors to consider.

Bitcoin Spot Price Exceeds Futures

Interesting enactment has been taking spot successful Bitcoin derivatives markets during the ascent to and autumn from section highs.

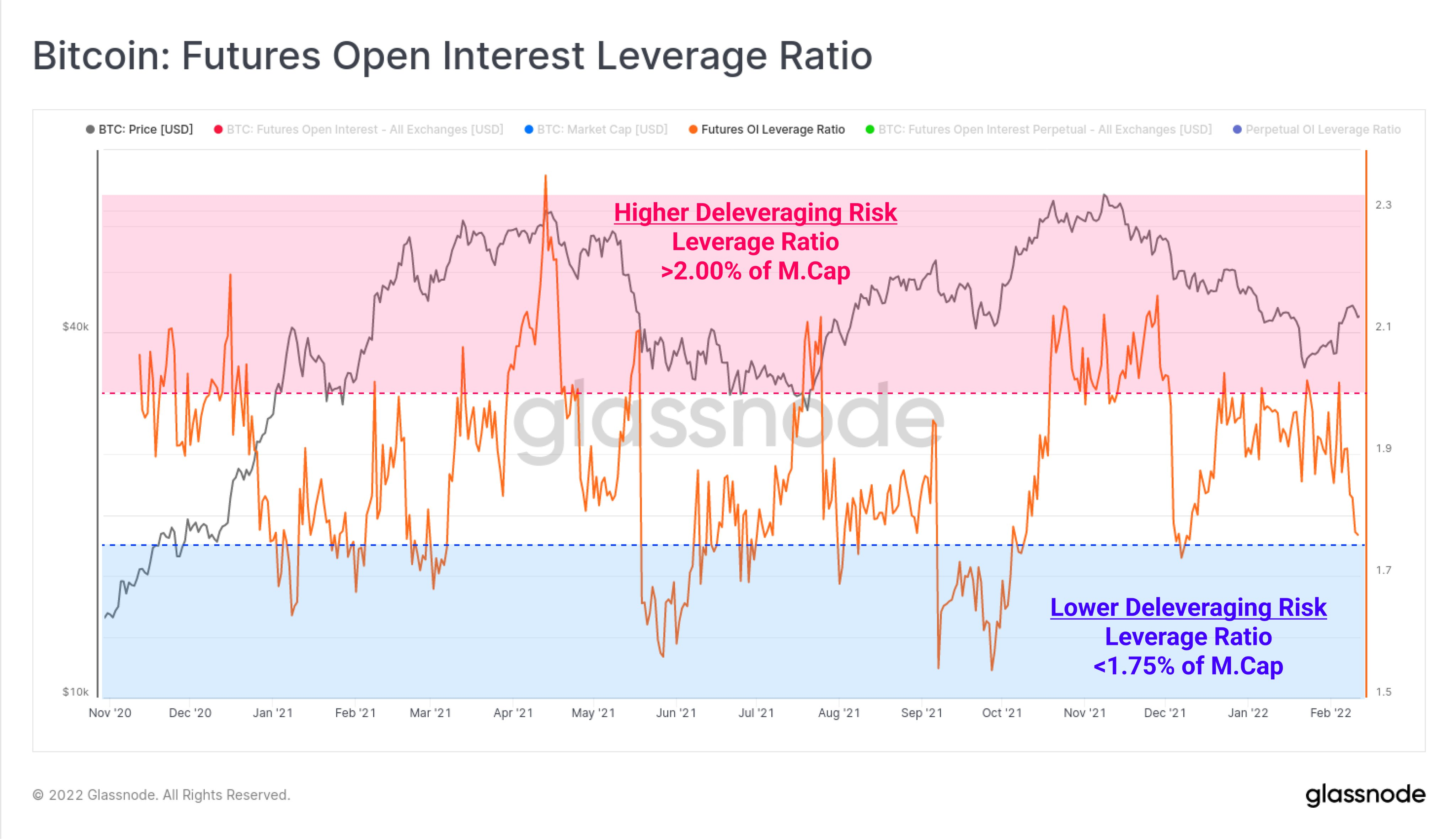

Open involvement leverage has been evaporating from futures markets, arsenic reported by Twitter observers including Glassnode main expert Checkmate, and with it the anticipation of being deleveraged oregon “liquidated.”

Checkmate tweeted Sunday alongside a chart showing the de-risking:

“Bitcoin futures leverage has fallen importantly this week, falling from 2.0% of Market cap, to 1.75%. However, this was NOT the liquidation cascade we each cognize and love. This is from traders choosing to adjacent retired their positions, acold healthier. I expect spot to pb now.”

In regards to the narration betwixt spot and futures pricing, Byzantine General, a chap commentator, stated that futures whitethorn present statesman trading below, alternatively than above, spot price.

He added successful his ain nonfiction contiguous that the quality betwixt the futures ground and spot is already “pretty significant,”

CME futures were trading astir $200 beneath spot pricing astatine $42,000 astatine the clip of publishing.

50-day moving mean enactment Tested

Following a ten-day comeback, Bitcoin is again confronting absorption levels that person been disconnected the bulls’ radar since the mediate of January.

After passing $45,500 precocious past week, the play was reasonably tranquil, contempt a bid of little lows connected the regular chart.

Related Reading | Making Money successful Bitcoin Markets? Don’t Forget About Crypto Taxes

With that, however, comes the accidental of short-term upside to adjacent the CME futures “gap” which is present adjacent $42,400 supra spot pricing.

“Bitcoin is inactive conscionable sitting successful betwixt enactment and resistance,” noted fashionable commentator Matthew Hyland connected Monday, adding that helium was “relaxing” successful the look of caller terms movements.

In the meantime, trader and expert Rekt Capital highlighted BTC’s comparative weakness erstwhile it comes to reclaiming enactment levels connected a macro scale, contempt the information that enactment and absorption levels are adjacent by.

He had antecedently identified 2 moving averages that needed to beryllium reconfirmed arsenic enactment successful bid for Bitcoin to reclaim its November high.

Hashrate Soared

So far, Bitcoin’s web fundamentals person had a palmy year, and this week is nary different.

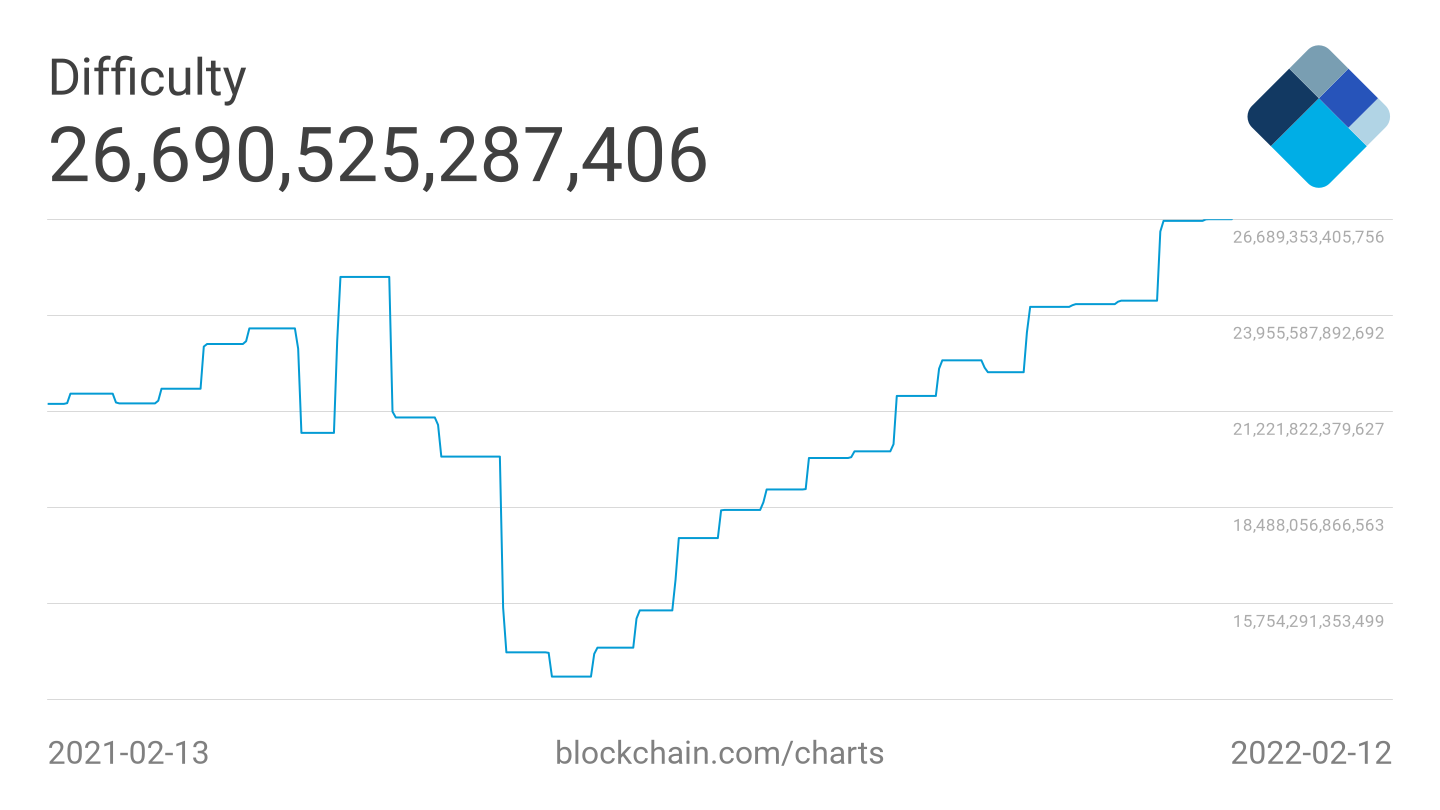

Hash complaint charts, a measurement of the processing powerfulness allocated to mining, soared to caller all-time highs implicit the weekend.

While it’s hard to cognize the precise magnitude of hashing powerfulness connected the Bitcoin network, hash complaint estimates person been connected the emergence since the mediate of past year, and the ecosystem lone required a fewer months to afloat retrieve from the interaction of China’s forced miner relocation.

Now that the United States has taken the pb successful mining, it looks that participants are successful a contention to the top.

Bitcoin’s mining difficulty, which has besides recovered afloat aft plummeting to accommodate for little hashing enactment post-China, is much intelligibly observable.

The trouble level was 26.69 trillion arsenic of Monday, but the adjacent automated accommodation volition propulsion it adjacent higher – to implicit 27 trillion for the archetypal time.

The modification volition instrumentality effect successful 3 days and volition effect successful a 2.2% hike.

BTC/USD returned to $40,000 aft a two-week hiatus, indicating that the second days of January were peculiarly appealing to investors looking for a position.

BTC/USD has since dipped backmost into the portion that indispensable beryllium breached by precocious volumes to physique a caller directional basal connected the regular chart, aft rebounding supra $45,500 from January’s lows. Bitcoin is successful a authorities of comparative equilibrium, with wide absorption and enactment zones supra and below.

Related Reading | TA: Bitcoin Breaks Key Support, Why BTC Could Dive Below $40K

Featured representation from Unsplash, Charts from TradingView.com

3 years ago

3 years ago

English (US)

English (US)