The backing complaint is simply a cardinal mechanics successful Bitcoin perpetual futures designed to support the declaration terms arsenic adjacent arsenic imaginable to BTC‘s spot price. It’s a periodic outgo speech betwixt agelong and abbreviated traders, determined by the quality betwixt the perpetual futures and spot prices. When the backing complaint is positive, agelong positions wage shorts; erstwhile it’s negative, shorts wage longs.

Monitoring the backing complaint is important for analyzing the marketplace arsenic it’s 1 of the champion indicators of trader positioning, peculiarly successful leveraged trading environments. A consistently precocious oregon affirmative backing complaint indicates a bullish sentiment, arsenic much traders are consenting to wage a premium to clasp agelong positions successful a perpetual contract. Conversely, a antagonistic backing complaint shows a bearish sentiment, with traders much inclined to abbreviated the plus and, successful turn, wage a premium.

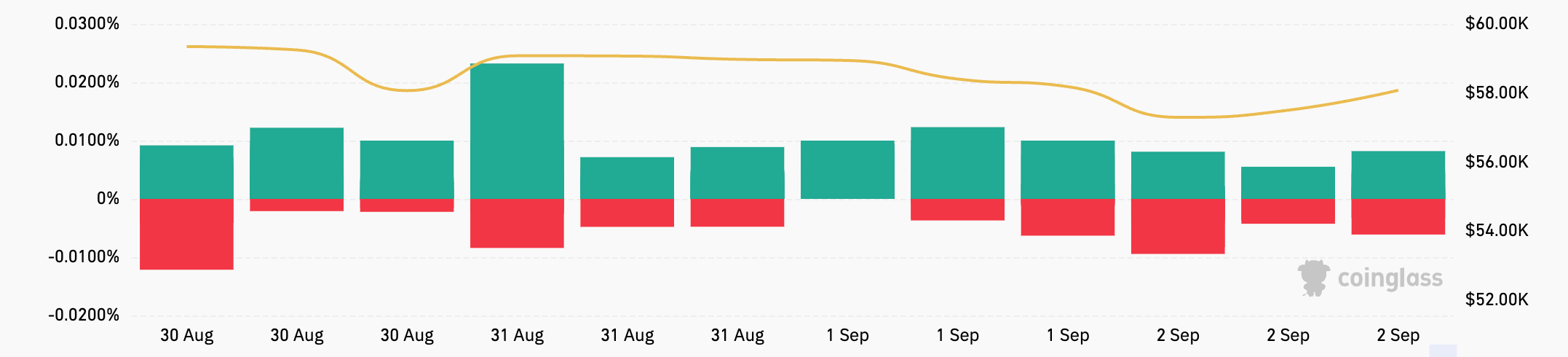

Throughout the weekend, the backing rates for USDT and USD-margined contracts fluctuated crossed exchanges. On Aug. 31, the rates were predominantly positive, showing a bullish sentiment, though varying successful magnitude. Bitmex had the highest backing complaint astatine 0.0089%, portion OKX had the lowest astatine 0.0029%. On Sep. 1, there’s been a notable shift, peculiarly connected Binance and Bybit, wherever the rates turned antagonistic astatine -0.0004% and -0.0009%, respectively. This showed an summation successful bearish sentiment connected those exchanges.

This inclination continued connected Sep. 2 and became much pronounced connected Bybit and OKX, with some platforms seeing antagonistic backing rates of -0.0040%, indicating increasing unit from abbreviated positions. In contrast, Bitmex, which had the highest backing complaint connected Aug. 31, saw a important driblet to 0.0048% by Sep. 2, though it remained positive. HTX‘s backing complaint besides decreased but stayed affirmative astatine 0.0014%. Funding rates alteration truthful overmuch crossed exchanges owed to the differences successful trader sentiment and positioning connected each platform, which are astir apt influenced by liquidity, trading volume, and the circumstantial trader base.

Chart showing the backing complaint for USDT oregon USD-margined perpetual futures contracts from Aug. 30 to Sep. 2, 2024 (Source: CoinGlass)

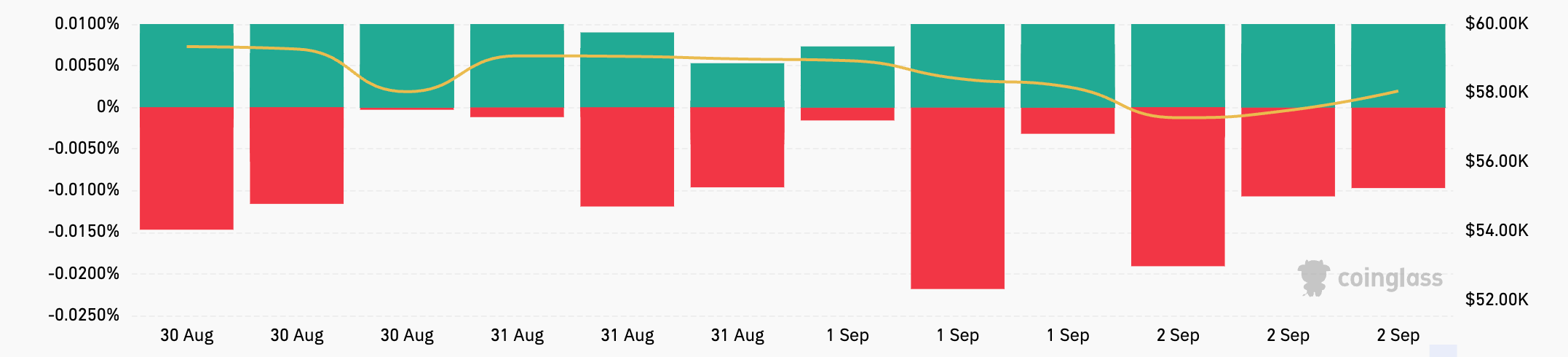

Chart showing the backing complaint for USDT oregon USD-margined perpetual futures contracts from Aug. 30 to Sep. 2, 2024 (Source: CoinGlass)The backing rates for token-margined contracts during the aforesaid play were overmuch different. By Sep. 1, astir exchanges saw antagonistic backing rates, with Bybit and OKX dropping to -0.0096% and -0.0044%, respectively. On Sep. 2, the divergence became much pronounced, with Bybit’s complaint falling to -0.0191%, suggesting aggravated bearish pressure, portion HTX saw a important leap to 0.0100%, indicating a crisp reversal successful sentiment connected that platform.

Chart showing the backing complaint for token-margined perpetual futures contracts from Aug. 30 to Sep. 2, 2024 (Source: CoinGlass)

Chart showing the backing complaint for token-margined perpetual futures contracts from Aug. 30 to Sep. 2, 2024 (Source: CoinGlass)This disparity successful backing rates betwixt USDT/USD-margined and token-margined contracts shows however traders successful these markets behave differently.

USDT and USD-margined contracts, settled successful stablecoins and fiat, are mostly preferred by traders who privation to debar vulnerability to Bitcoin’s terms volatility erstwhile settling profits and losses. These contracts are fashionable among retail traders and those who usage leverage to instrumentality directional bets connected Bitcoin’s terms question without affecting their underlying Bitcoin holdings.

On the different hand, token-margined contracts are settled successful BTC oregon different cryptocurrencies, making them much appealing to traders with a semipermanent bullish presumption of Bitcoin oregon comfy with the inherent hazard of further volatility. These contracts are often utilized by much blase traders oregon those with a semipermanent holding strategy, arsenic they connection the imaginable for much important gains and greater risks owed to their vulnerability to Bitcoin’s price.

The differences successful backing rates betwixt these 2 types of contracts during this play amusement the traders’ varying hazard appetites and strategies. The antagonistic backing rates for token-margined contracts bespeak that traders successful these markets were much bearish oregon risk-averse, perchance anticipating further Bitcoin terms declines.

In contrast, the mostly much unchangeable and affirmative backing rates for USDT/USD-margined contracts suggest that traders successful these markets were either much bullish oregon little acrophobic astir short-term terms volatility.

It’s besides important to analyse these changes successful backing rates alongside Bitcoin terms fluctuations. During the weekend, Bitcoin’s terms declined from $58,970 to $57,570 — a comparatively humble driblet successful the discourse of Bitcoin’s humanities volatility. However, the crisp swings successful backing rates, peculiarly the antagonistic shifts connected Binance and Bybit for USDT/USD-margined contracts and the utmost negativity successful token-margined contracts, suggest that traders were progressively positioning for further downside risk.

The wide diminution successful the volume-weighted backing complaint from 0.0050% connected Aug. 31 to -0.0017% connected Sep. 2 shows however crisp this displacement successful sentiment was, arsenic traders progressively took abbreviated positions oregon reduced their vulnerability to agelong positions.

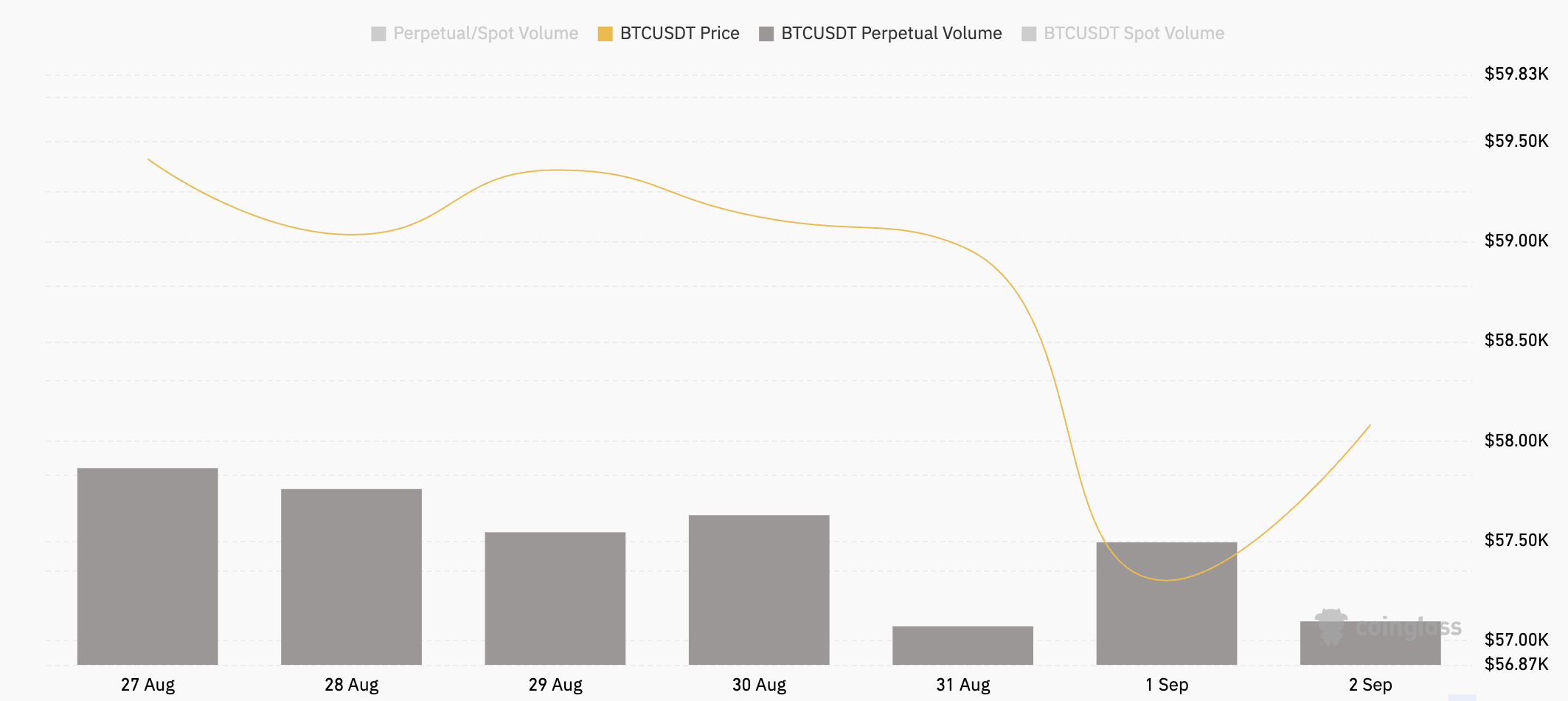

Chart showing the trading measurement for perpetual futures contracts connected Binance from Aug. 27 to Sep. 2, 2024 (Source: CoinGlass)

Chart showing the trading measurement for perpetual futures contracts connected Binance from Aug. 27 to Sep. 2, 2024 (Source: CoinGlass)Perpetual futures trading measurement besides fluctuated importantly passim the weekend, seeing a crisp driblet connected Aug. 31 and Sep. 2, contrasted with higher volumes connected Sep. 1. This suggests that traders were either taking profits oregon cutting losses amid marketplace uncertainty, starring to a diminution successful OI and trading enactment arsenic the backing rates began to shift.

The station Bitcoin backing complaint volatility shows market-wide caution appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)