Bitcoin (BTC) exchanges are getting a cardinal “deleveraging event,” which should signifier aboriginal gains, caller probe says.

In 1 of its “Quicktake” blog posts connected March 17, onchain analytics level CryptoQuant revealed a $10 cardinal capitulation connected Bitcoin futures markets.

Bitcoin sees “essential” lawsuit for BTC terms rebound

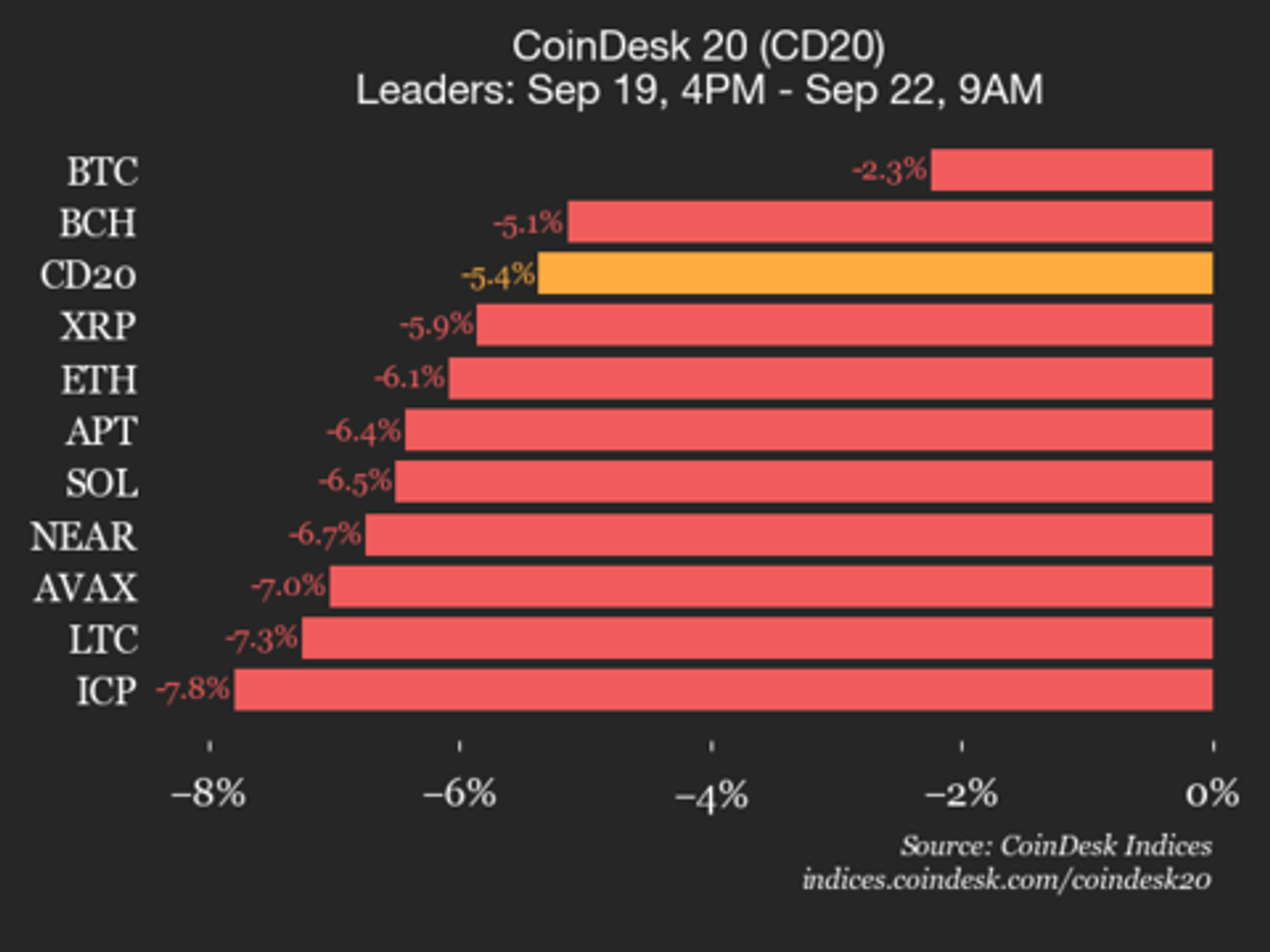

Bitcoin derivatives traders person flipped firmly risk-off since BTC/USD deed its existent all-time highs successful mid-January.

CryptoQuant, which uses information from assorted large crypto exchanges, calculates that aggregate open involvement (OI) connected futures fell by $10 cardinal successful conscionable 3 weeks from Feb. 20 done March 4.

“On January 17th, Bitcoin's unfastened involvement reached an all-time precocious of implicit $33B, indicating that leverage successful the marketplace had ne'er been this high,” contributor Darkfost writes.

The drop, helium argues, “can beryllium considered arsenic a earthy marketplace reset, an indispensable signifier for sustaining a bullish continuation.”

Bitcoin futures OI information for apical exchanges. Source: CryptoQuant

An accompanying chart shows the 90-day rolling alteration successful aggregate OI, highlighting the severity of the market’s U-turn pursuing the all-time highs.

“Currently, the 90-day alteration successful Bitcoin futures unfastened involvement has dropped sharply and present sitting astatine -14%,” Darkfost concludes.

“Looking astatine humanities trends, each past deleveraging similar this has provided bully opportunities for the abbreviated to mean term.”Crypto “demand crisis” emerges

Continuing, chap CryptoQuant contributor Kriptolik eyed progressively progressive derivatives markets wide since November 2024.

Related: Peak 'FUD' hints astatine $70K level — 5 Things to cognize successful Bitcoin this week

Stablecoin reserves crossed derivatives exchanges are increasing, helium revealed this week, adjacent surpassing spot markets. This, however, is nary look for terms upside.

“When we analyse the measurement and circulation of stablecoins, which enactment arsenic substance successful the market, we spot that contempt a accelerated summation successful full stablecoin proviso since November 2024, this has not needfully benefited the marketplace oregon investors significantly,” another blog post explains.

Kriptolik described spot markets arsenic suffering a “demand crisis.”

“Until this organisation normalizes, avoiding high-leverage (high-risk) trades whitethorn beryllium the astir prudent approach,” helium added.

Exchange stablecoin reserves (screenshot). Source: CryptoQuant

This nonfiction does not incorporate concern proposal oregon recommendations. Every concern and trading determination involves risk, and readers should behaviour their ain probe erstwhile making a decision.

6 months ago

6 months ago

English (US)

English (US)