Open interest, the full fig of outstanding derivative contracts that person not been settled, is an important metric for gauging marketplace wellness and sentiment. An summation successful unfastened involvement means caller wealth entering the market, showing heightened trading enactment and involvement successful Bitcoin. Conversely, a diminution suggests closing positions, perchance indicating a alteration successful marketplace sentiment oregon a consolidation phase. Monitoring these trends is important for knowing the liquidity, volatility, and aboriginal terms expectations successful the market.

In a bullish market, an summation successful unfastened involvement often correlates with rising prices, suggesting that caller wealth is betting connected further terms appreciation. This script typically reflects a beardown marketplace sentiment and capitalist assurance successful Bitcoin’s upward trajectory. On the different hand, successful a bearish context, increasing unfastened involvement mightiness bespeak that investors are hedging against expected terms declines, revealing a much cautious oregon antagonistic marketplace outlook.

Furthermore, the equilibrium betwixt telephone and enactment options wrong the unfastened involvement provides deeper insights into marketplace sentiment. A predominance of calls suggests a bullish marketplace sentiment, with galore investors expecting terms rises, whereas a bulk of puts tin bespeak bearish expectations.

February saw a important summation successful unfastened involvement for Bitcoin futures and options.

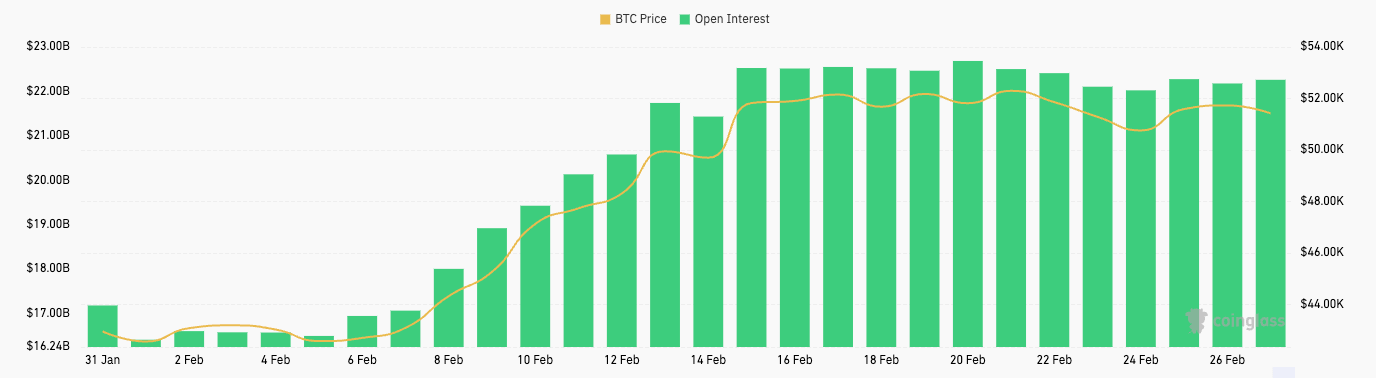

From Feb. 1 to Feb. 20, Bitcoin futures unfastened involvement grew from $16.41 cardinal to $22.69 billion. This important emergence suggests that traders were progressively entering into futures contracts, anticipating higher volatility oregon making directional bets connected Bitcoin’s price. Interestingly, this play aligns with a notable summation successful Bitcoin’s price, from $42,560 to $52,303, suggesting a bullish sentiment among futures traders. The flimsy alteration successful unfastened involvement by Feb.26 to $22.21 billion, alongside a marginal dip successful Bitcoin’s terms to $51,716, could bespeak immoderate traders taking profits oregon closing positions successful anticipation of a consolidation signifier oregon to trim vulnerability up of imaginable volatility.

Graph showing the unfastened involvement connected Bitcoin futures from Feb. 1 to Feb. 26, 2024 (Source: CoinGlass)

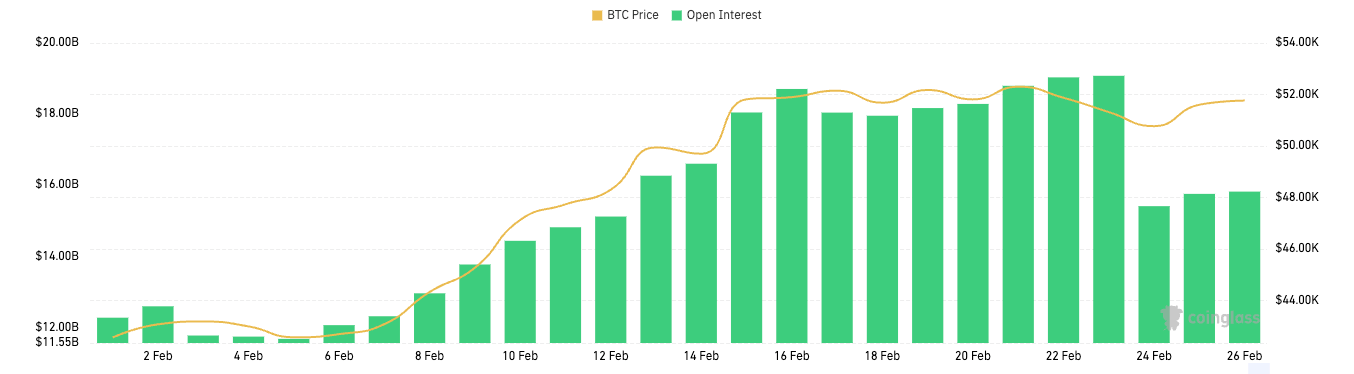

Graph showing the unfastened involvement connected Bitcoin futures from Feb. 1 to Feb. 26, 2024 (Source: CoinGlass)Similarly, Bitcoin options unfastened involvement saw a melodramatic summation from $12.27 cardinal astatine the opening of February to a highest of $19.08 cardinal by Feb.23 earlier dialing backmost to $15.82 cardinal towards the month’s end. Options supply the holder the right, but not the obligation, to bargain (call option) oregon merchantability (put option) Bitcoin astatine a specified price, offering much analyzable strategies for traders to explicit bullish oregon bearish views oregon to hedge existing positions. The archetypal spike successful options unfastened involvement reflects a robust engagement from investors, leveraging options for directional bets connected Bitcoin’s terms and protective measures against imaginable downturns.

Graph showing the unfastened involvement successful Bitcoin options from Feb. 1 to Feb. 26, 2024 (Source: CoinGlass)

Graph showing the unfastened involvement successful Bitcoin options from Feb. 1 to Feb. 26, 2024 (Source: CoinGlass)The ratio betwixt calls and puts for Bitcoin options provides a deeper penetration into marketplace sentiment and imaginable expectations for Bitcoin’s terms direction. The organisation betwixt calls and puts is simply a nonstop indicator of the market’s bullish oregon bearish inclinations, with calls representing bets connected rising prices and puts connected falling prices.

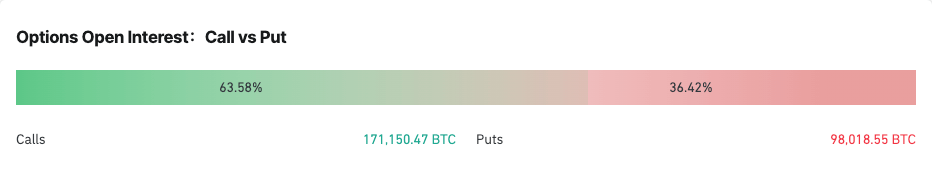

As of Feb. 26, the unfastened involvement successful Bitcoin options was skewed towards calls, comprising 63.76% of the total, compared to 36.24% for puts. This organisation reinforces the bullish sentiment observed done the summation successful options unfastened involvement earlier successful the month. A predominance of calls successful the unfastened involvement suggests that a important information of marketplace participants were expecting Bitcoin’s terms to proceed rising oregon were utilizing calls to hedge against different positions.

Graph showing the ratio betwixt calls and puts for Bitcoin options unfastened involvement connected Feb. 26, 2024 (Source: CoinGlass)

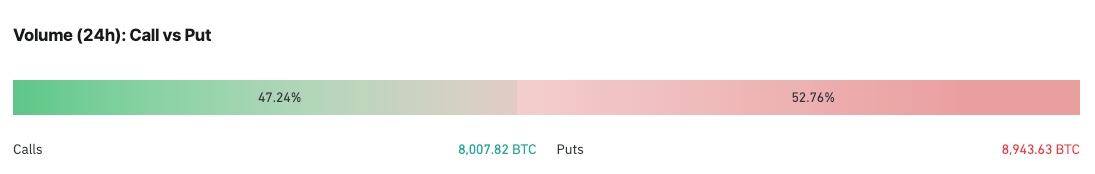

Graph showing the ratio betwixt calls and puts for Bitcoin options unfastened involvement connected Feb. 26, 2024 (Source: CoinGlass)However, the 24-hour measurement tells a somewhat antithetic story, with calls accounting for 47.24% and puts for 52.76%. Compared to the wide unfastened interest, this displacement towards puts successful the regular trading measurement mightiness bespeak a short-term summation successful caution among traders. It suggests that wrong the past 24 hours, determination was a noticeable pick-up successful antiaircraft strategies oregon bearish bets.

Graph showing the ratio betwixt calls and puts for Bitcoin options measurement connected Feb. 26, 2024 (Source: CoinGlass)

Graph showing the ratio betwixt calls and puts for Bitcoin options measurement connected Feb. 26, 2024 (Source: CoinGlass)The contiguous accusation for Bitcoin’s terms is simply a imaginable summation successful volatility. The bullish sentiment, arsenic evidenced by the increasing unfastened involvement and precocious proportionality of calls, supports a continued affirmative outlook among galore marketplace participants. However, the caller uptick successful puts measurement whitethorn awesome upcoming terms fluctuations arsenic traders set their positions successful anticipation of oregon successful effect to caller accusation oregon marketplace trends.

Considering these, the marketplace appears to beryllium astatine a crossroads, with a beardown bullish sentiment tempered by short-term caution. This script often precedes periods of heightened volatility arsenic conflicting expectations play retired done trading activities.

The station Bitcoin futures and options unfastened involvement soars successful February appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)