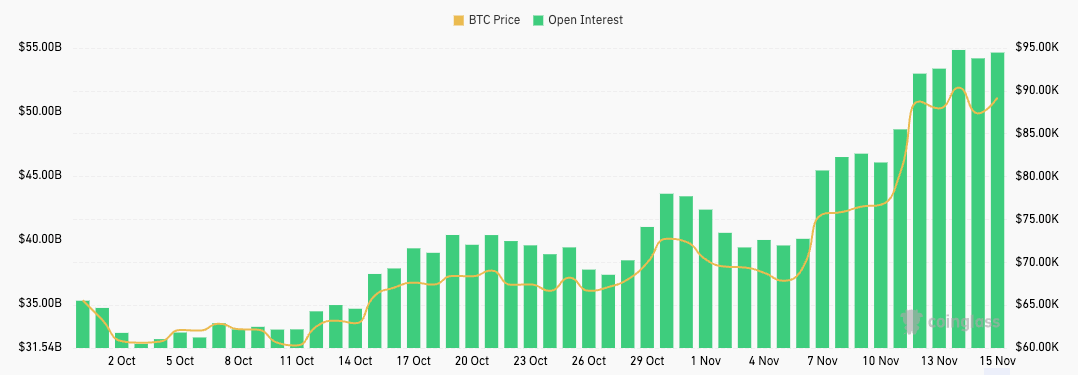

Bitcoin’s futures unfastened involvement grew from $34.68 cardinal connected Oct. 1 to an all-time precocious (ATH) of $54.85 cardinal connected Nov.14.

This summation of implicit 58% since the commencement of October and 29% since the opening of November shows a important influx of superior and accrued trader participation, with overmuch of this maturation accelerating aft the US election.

Graph showing Bitcoin futures unfastened involvement from Oct. 1 to Nov. 15, 2024 (Source: CoinGlass)

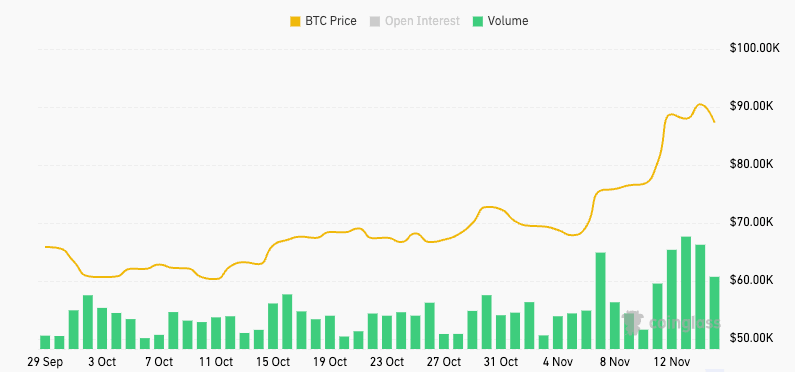

Graph showing Bitcoin futures unfastened involvement from Oct. 1 to Nov. 15, 2024 (Source: CoinGlass)Futures besides saw a melodramatic summation successful trading volume, with regular measurement peaking astatine conscionable implicit $207 cardinal connected Nov. 13, marking the fourth-largest trading measurement ever recorded. The surge successful unfastened involvement and measurement shows a important summation successful speculation and leveraged trading, an inevitable side-effect of a bull rally.

Graph showing Bitcoin futures trading measurement from Oct. 1 to Nov. 15, 2024 (Source: CoinGlass)

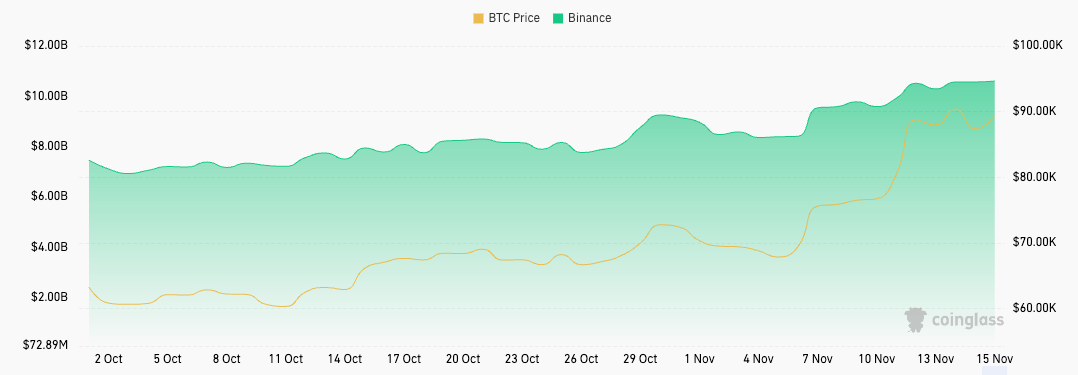

Graph showing Bitcoin futures trading measurement from Oct. 1 to Nov. 15, 2024 (Source: CoinGlass)While Bitcoin’s derivatives are increasing steadily, with some aged and caller exchanges becoming salient players successful the space, fractional of the marketplace is inactive dominated by 2 platforms — CME and Binance. This is wherefore the changes successful their marketplace stock and maturation trajectories often uncover nuances successful marketplace sentiment that aren’t that evident erstwhile looking astatine the large picture.

In the past 40 days, Binance accounted for a important information of the full futures market, with its unfastened involvement expanding steadily from $7.47 cardinal connected Oct.1 to a grounds $10.61 cardinal connected Nov.15.

Graph showing Bitcoin futures unfastened involvement connected Binance from Oct. 1 to Nov. 15, 2024 (Source: CoinGlass)

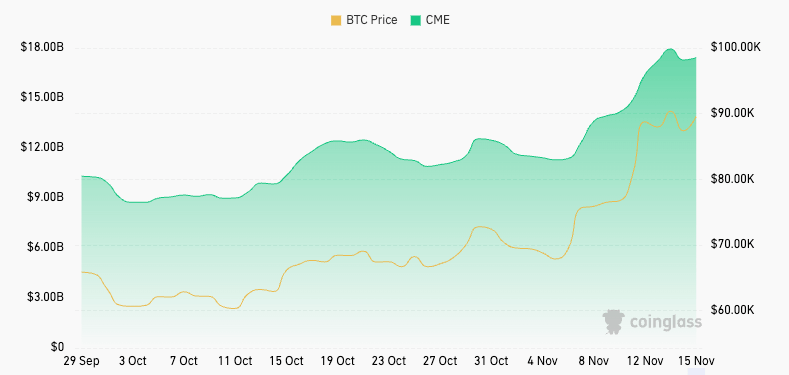

Graph showing Bitcoin futures unfastened involvement connected Binance from Oct. 1 to Nov. 15, 2024 (Source: CoinGlass)Meanwhile, CME exhibited adjacent much assertive growth, with its unfastened involvement rising from $9.93 cardinal to a highest of $17.94 cardinal wrong the aforesaid period.

Graph showing Bitcoin futures unfastened involvement connected CME from Oct. 1 to Nov. 15, 2024 (Source: CoinGlass)

Graph showing Bitcoin futures unfastened involvement connected CME from Oct. 1 to Nov. 15, 2024 (Source: CoinGlass)The difference betwixt CME and Binance’s marketplace share shows what the marketplace prefers.

Binance, catering to retail and speculative traders, benefits from its planetary accessibility, little fees, and broader altcoin derivative offerings. In contrast, CME attracts a much risk-averse, regulation-focused cohort, with organization investors favoring the exchange’s credibility.

The emergence successful CME’s unfastened involvement to astir a 3rd of the full marketplace by Nov. 14 points to organization superior fueling overmuch of the rally. This organization information is simply a beardown bullish signal, arsenic it suggests assurance successful Bitcoin’s medium- to semipermanent prospects alternatively than the speculative fervor often associated with retail.

The interaction of the US predetermination is evident successful the data. Following Trump’s win connected Nov. 5, Bitcoin’s terms soared from $67,830 to a precocious of $93,500 by Nov. 12. Futures mirrored this enthusiasm arsenic the $10 cardinal summation successful unfastened involvement from Nov. 7 to Nov. 14 is simply a effect of a surge successful leveraged positions arsenic traders rushed to capitalize connected the bullish sentiment.

However, the driblet successful trading measurement from $207.04 cardinal connected Nov. 13 to $133.02 cardinal connected Nov. 15 suggests immoderate profit-taking and reduced momentum toward the extremity of this period, perchance hinting astatine traders consolidating gains.

Several further observations tin beryllium made from this data. First, the sustained maturation successful Binance’s unfastened involvement indicates robust retail information contempt accrued organization beingness successful the market.

Second, the correlation betwixt Bitcoin’s terms emergence and the melodramatic summation successful futures measurement suggests that the spot market’s bullish momentum was amplified by speculative derivatives trading.

Lastly, the market’s penchant for CME reflects increasing organization assurance successful Bitcoin arsenic a morganatic plus class, a important origin for semipermanent adoption.

The station Bitcoin futures interruption records with 29% OI surge successful November appeared archetypal connected CryptoSlate.

11 months ago

11 months ago

English (US)

English (US)