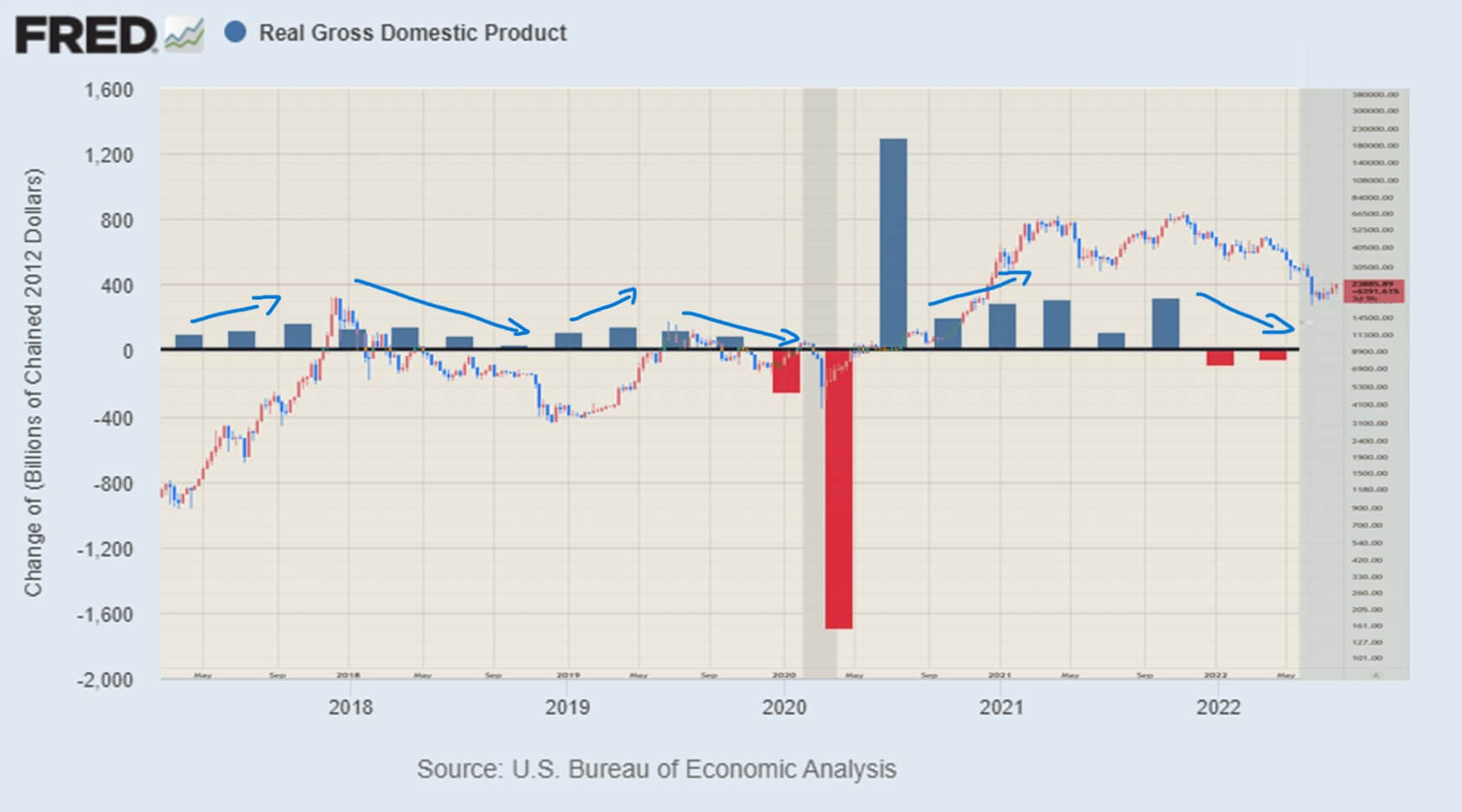

The Times reported that the US had entered a method recession arsenic GDP shrank 0.9% annually aft the second-quarter study was released Thursday.

The illustration beneath shows the existent GDP of the US compared with the terms of Bitcoin since 2017. It tin beryllium seen that erstwhile GDP declines, the terms of Bitcoin trends upwards.

Source: FRED/TradingView

Source: FRED/TradingViewHowever, it is indispensable to retrieve that correlation is not de facto causation. Just due to the fact that Bitcoin has been successful a bullish inclination portion GDP has been expanding and vice versa does not mean 1 caused the other. Yet, the examination intelligibly shows that successful a prosperous economy, Bitcoin tin thrive.

The precocious released information showcases the astir important informing signs of a recession connected the skyline and whitethorn marque a caller bull tally much difficult.

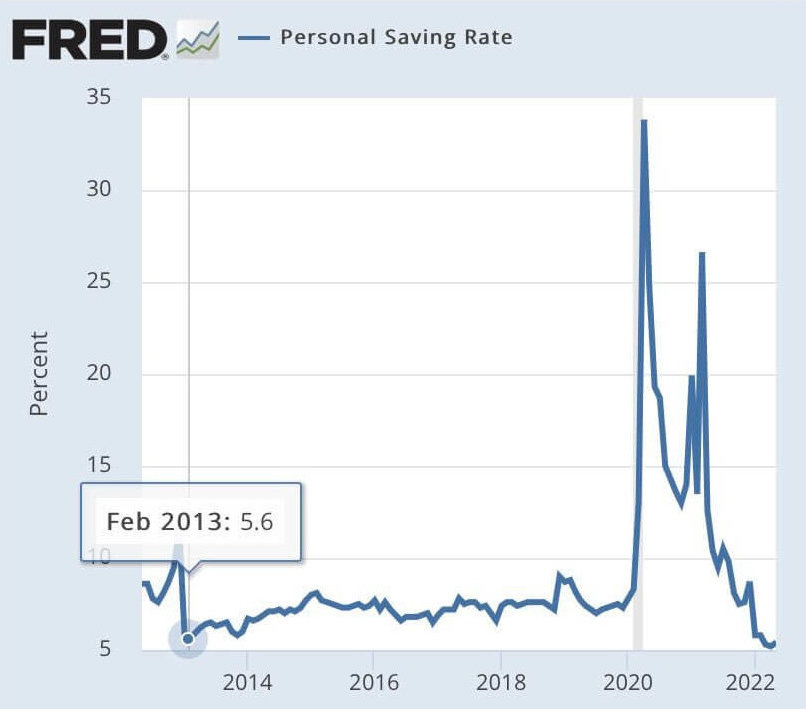

Further, idiosyncratic savings among US citizens deed a 10-year low, indicating that the wealth from stimulus checks nary longer supports the economy. With savings astatine conscionable 5.4%, it means that increases successful involvement rates are apt to person small payment to smaller investors. However, the enlargement volition impact recognition paper payments, mortgages, and different loans held by US citizens.

Source: FRED

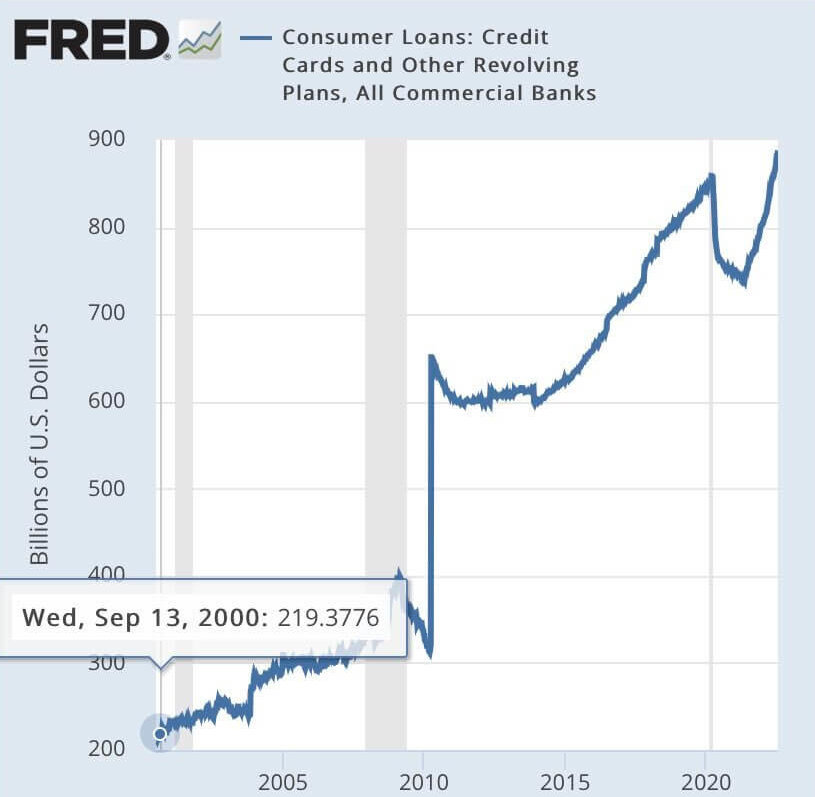

Source: FREDWhile savings person decreased, user loans person risen, reaching an all-time precocious since FRED records began successful 2000. There is implicit $850 cardinal worthy of user loans outstanding to US citizens erstwhile involvement rates are up 900% per year.

Source: FRED

Source: FREDAt the commencement of 2022, involvement rates were 0.25%, with $804 cardinal worthy of loans outstanding, making yearly involvement astir $2 billion. As of July 2022, 6 months later, the involvement complaint is 2.5%, with $887 cardinal of loans outstanding. The resulting involvement payments travel to $22 billion, an summation of 1,000%.

During this aforesaid period, the terms of Bitcoin has declined 48%, reducing the marketplace headdress by $417 billion. By comparison, US consumers’ full indebtedness is present astir treble the marketplace headdress of Bitcoin, with yearly involvement payments amounting to astir 5% of Bitcoin’s full value.

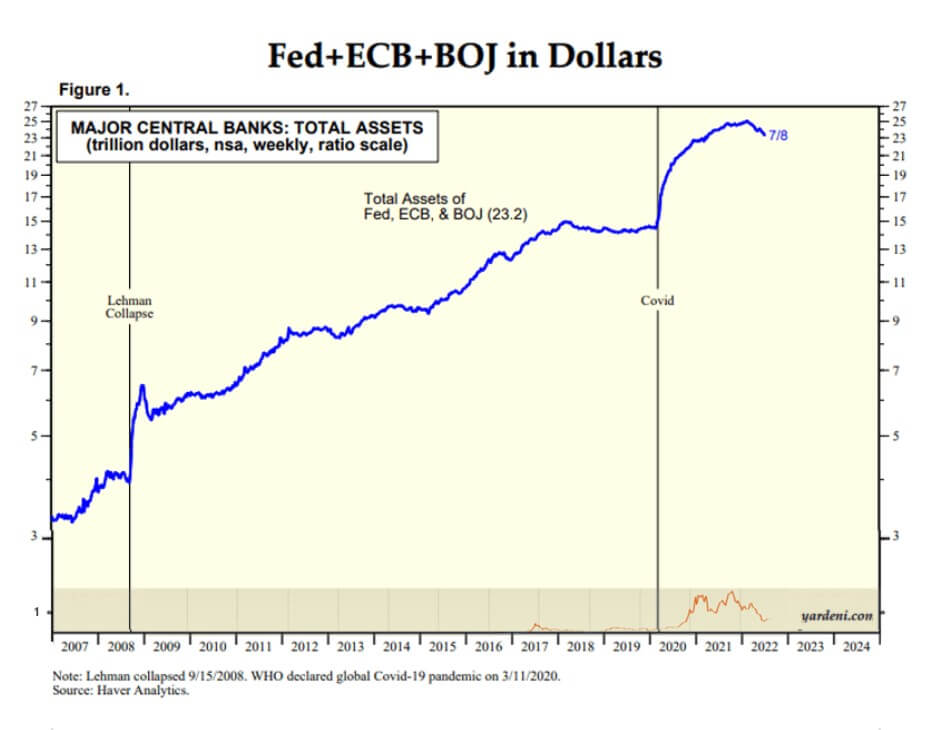

Quantitative Easing has been successful spot since the planetary economical clang of 2008.

Assets held by the Federal Reserve, European Central Bank, and the Bank of Japan person declined for the archetypal clip since 2018 and the astir extended play since 2012. The large cardinal banks presently clasp $9 trillion much than they did astatine the commencement of 2020. To enactment this into perspective, the Bitcoin illustration since 2009 is shown successful orangish astatine the bottommost connected the aforesaid scale, with its highest marketplace headdress reaching conscionable $1.3 trillion.

Source: Haver Analytics/TradingView

Source: Haver Analytics/TradingViewBitcoin is up 15% since the section debased connected June 26. At the clip of writing, it is trading astatine $23,891, rising 5% since the GDP information was released earlier this afternoon. Could this beryllium a formation to information of a non-fiat-based plus people oregon simply a carnivore trap to entice investors?

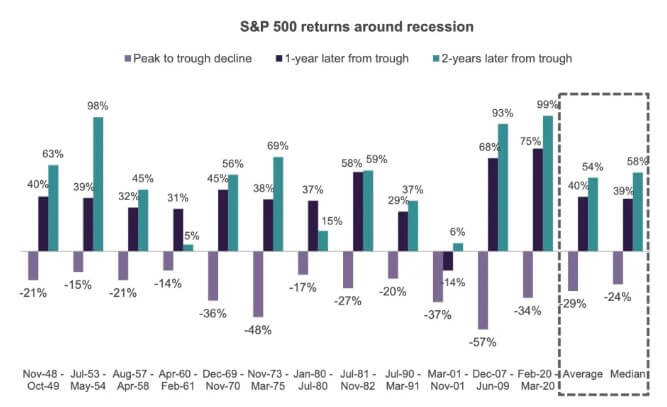

Several macro factors bespeak a bearish aboriginal for the US economy; however, traditionally, markets bottommost retired earlier the extremity of the recession. The beneath illustration from Yahoo! Finance highlights the 1-year and 2-year returns pursuing a recession. The mean instrumentality 1-year aft the commencement of a recession is 40% connected the S&P 500.

Bitcoin has ne'er existed done a recession (not counting the commencement of the pandemic), truthful it volition beryllium absorbing to spot if it tin outperform the S&P implicit the adjacent 12 months. An summation of 40% from today’s terms would enactment Bitcoin astatine $33,600 this clip adjacent year.

Source: Yahoo! Finance

Source: Yahoo! FinanceFRED information and insights by James van Straten

The station Bitcoin-GDP correlation whitethorn explicate driblet successful terms arsenic US enters a method recession appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)