Susquehanna International Group, a behemoth successful plus absorption with a trading measurement handling galore fiscal products globally, has made a important concern successful Bitcoin done assorted exchange-traded funds (ETFs). A disclosure to the Securities and Exchange Commission (SEC) connected May 7 revealed that Susquehanna held astir $1.2 cardinal successful spot ETFs during the archetypal 4th of 2024.

The Bitcoin ‘Monster Whales’ Are Here

The details of the concern are peculiarly notable for their standard and diversity. Susquehanna present holds 17,271,326 shares successful the Grayscale Bitcoin Trust (GBTC), which unsocial is worthy astir $1.09 cardinal arsenic of March 31, 2024. This azygous concern represents a important information of the full BTC investment, indicating Susquehanna’s penchant for Grayscale owed to its precocious liquidity.

Further diversification successful Susquehanna’s holdings includes 1,349,414 shares of Fidelity‘s spot Bitcoin ETF (FBTC), valued astatine astir $83.74 million. In addition, the steadfast has importantly accrued its involvement successful the ProShares Bitcoin Strategy ETF (BITO), which offers vulnerability to BTC futures contracts. Susquehanna owned 7,907,827 shares of BITO arsenic of the aforesaid date, valued astatine astir $255.42 cardinal — this represents a 57.59% summation from a February filing that listed 5,021,149 shares.

Additionally, Susquehanna’s Bitcoin ETF portfolio includes stakes successful different high-profile funds specified arsenic the BlackRock ETF, ARK21 ETF, Bitwise ETF, Valkyrie ETF, Invesco Galaxy ETF, VanEck ETF Trust, and WisdomTree ETF. The firm’s strategical enactment of funds illustrates its broad attack to capitalizing connected antithetic aspects of Bitcoin’s concern potential.

Susquehanna International Group, LLP holds implicit $1 Billion successful Bitcoin ETFs successful Recent Portfolio Update pic.twitter.com/0UPzLUVRsK

— Phoenix » PhoenixNews.io (@PhoenixTrades_) May 7, 2024

Julian Fahrer, CEO and co-founder of Apollo, commented connected the magnitude of this development, stating, “HUGE: Susquehanna International Group is the biggest Bitcoin ETF whale yet! $1.2 Billion held crossed 10 ETFs! The monsters are here.” This enthusiastic endorsement reflects the increasing optimism and organization involvement successful cryptocurrency investments.

Despite these sizeable stakes, Susquehanna’s allocation to BTC remains a comparatively insignificant fraction of its full portfolio. With full investments surpassing $575.8 billion, the $1.2 cardinal successful Bitcoin ETFs constitutes astir 0.22% of the firm’s holdings, signaling a cautious yet important introduction into the integer plus space.

This determination by Susquehanna has far-reaching implications for the market. Bitcoin ETFs got disconnected to a roaring trading commencement and person seen interest wane successful caller weeks. The emergence successful organization investment, arsenic evidenced by Susquehanna’s activities, is expected to heighten Bitcoin’s credibility and stableness arsenic a fiscal asset.

Moreover, Susquehanna’s divers concern is not conscionable constricted to nonstop Bitcoin exposure. The institution besides reported indirect vulnerability done its holdings successful MicroStrategy stock, which possesses a important Bitcoin reserve connected its equilibrium sheet. However, successful a caller rebalancing, Susquehanna reduced its involvement successful MicroStrategy by astir 15%, adjusting its vulnerability successful enactment with its strategical portfolio adjustments.

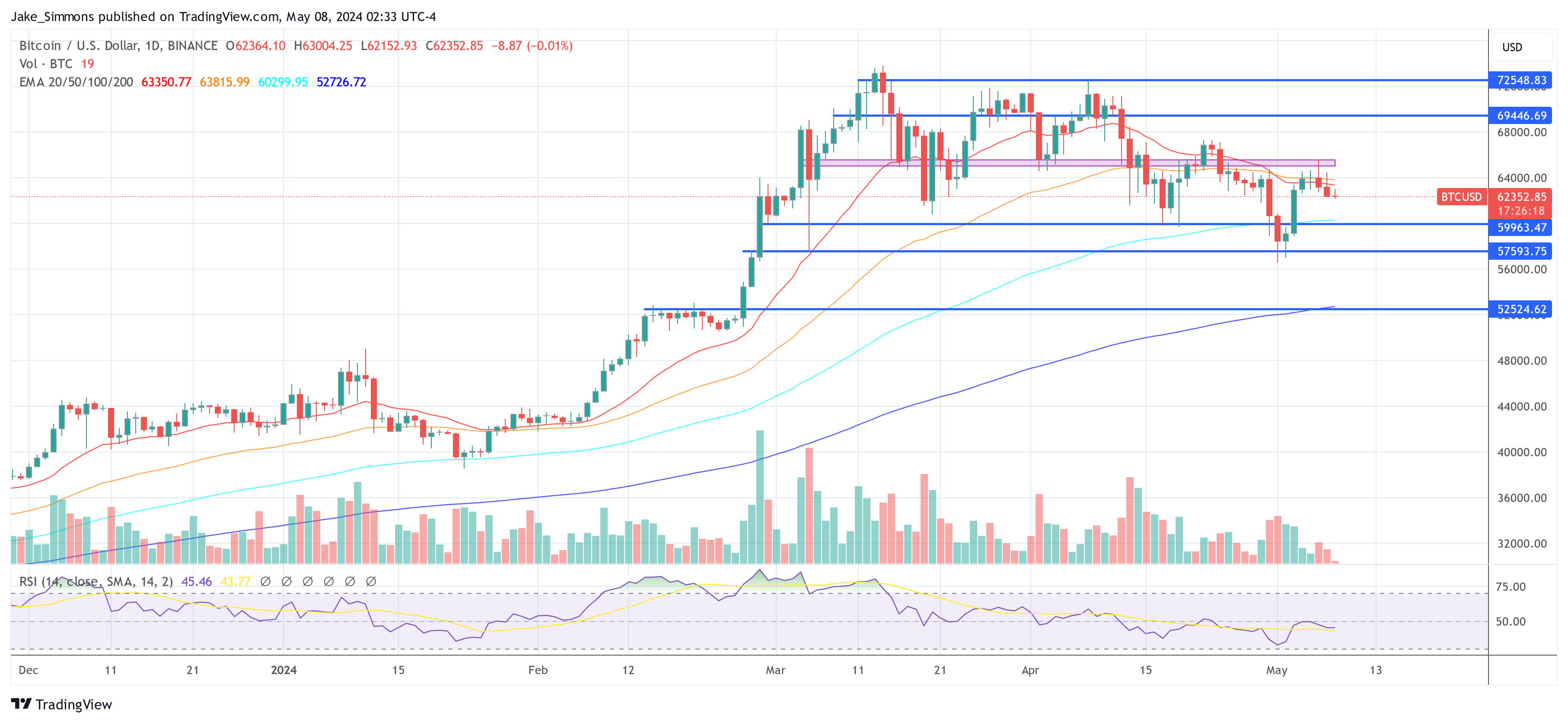

At property time, BTC traded astatine $62,352.

BTC price, 1-day illustration | Source: BTCUSD connected TradingView.com

BTC price, 1-day illustration | Source: BTCUSD connected TradingView.comFeatured representation from Rémi Boudousquié / Unsplash, illustration from TradingView.com

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

1 year ago

1 year ago

English (US)

English (US)