On Monday, immoderate radical (like me) were struck by a little enactment published by Zoltan Pozsar, Credit Suisse’s short-term involvement complaint strategist, astir a caller satellite monetary order. At archetypal blush, the afloat enactment (available here) seems to beryllium unrelated to Bitcoin (but much connected that later).

Pozsar sees the “birth of Bretton Woods III – a caller satellite (monetary) bid centered astir commodity-based currencies successful the East that volition apt weaken the eurodollar strategy and besides lend to inflationary forces successful the West.” Here’s what it mightiness mean for america if his appraisal of the satellite is close and however it’s related to Bitcoin.

Entire books person been written astir Bretton Woods, and truthful I won’t unreal this portion is an exhaustive past of however things happened, but it helps to callback (as painlessly arsenic we can) however we got from Bretton Woods I to III.

First, we request to explicate 1 important concept. The word “countries’ reserves” is thrown astir a batch with small explanation. It simply means that governments clasp antithetic types of currencies, securities oregon commodities (i.e. “stuff”) to respond to things that are happening successful the economy. For example, if your currency looks weak, you merchantability overseas currency and bargain your own. Without “stuff” successful reserve, governments and cardinal banks can’t react. Countries are escaped to clasp immoderate “stuff” they privation successful reserve.

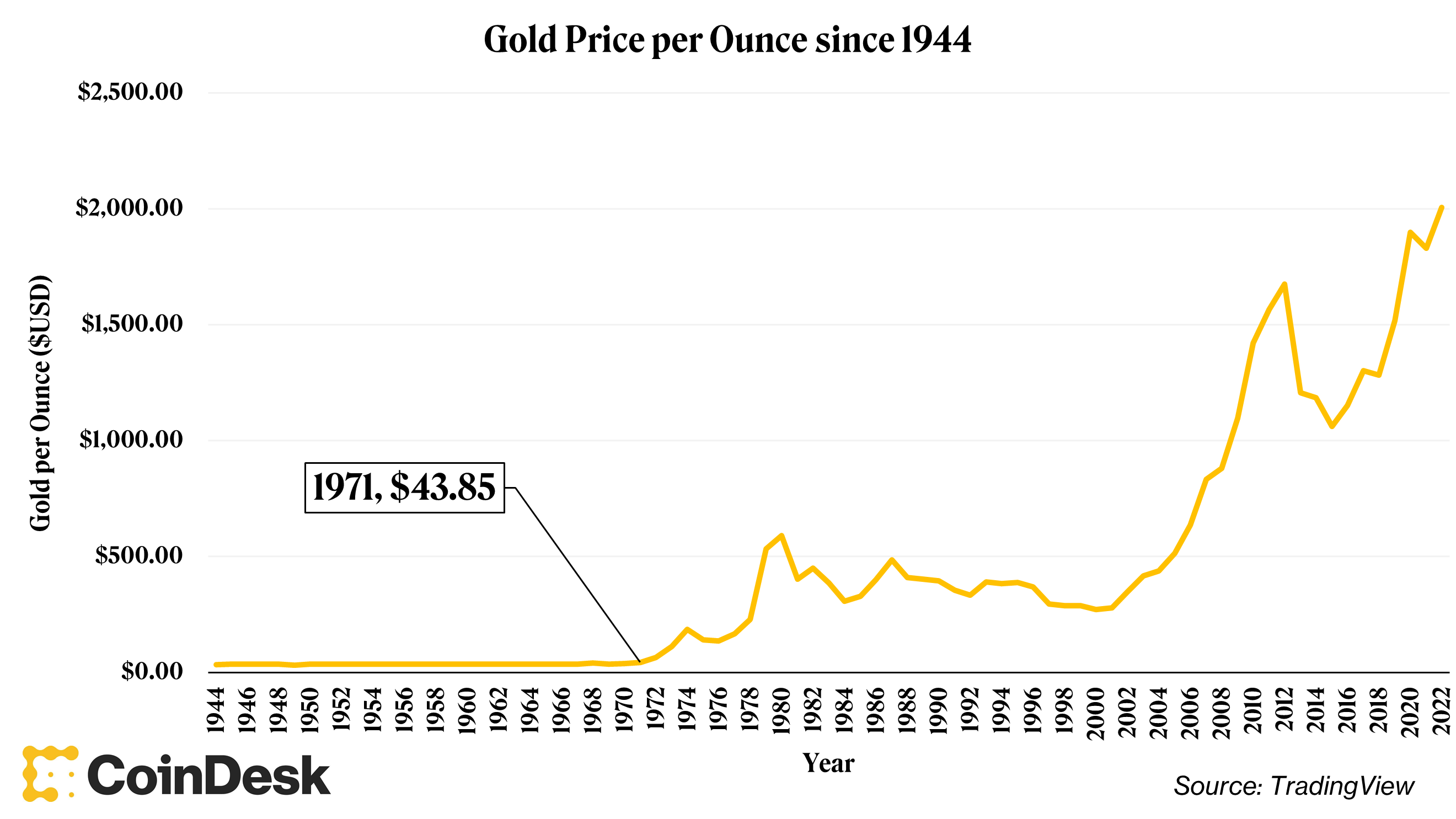

The archetypal iteration of Bretton Woods, present called Bretton Woods I, was a gold-based strategy wherever the U.S. dollar dominated and was freely convertible into golden astatine $35 per ounce (about 5,600% beneath its existent price). This is wherever “the U.S. dollar is backed by gold” misappropriation comes from. In 1971, a confluence of factors led to the U.S. changing its currency truthful that the dollar was free-floating and backed by the afloat religion and recognition of the government, not to notation by a massive military and oil.

Gold since 1944 (TradingView)

From there, Bretton Woods II was born, wherever the dollar inactive dominates, but successful a strategy that mostly uses “inside money.” Inside wealth is made up of claims that are idiosyncratic else’s liability, portion extracurricular wealth is the benignant of wealth that is the liability of nary one. In different words, the wealth strategy became mostly debt-based. So erstwhile China holds U.S. Treasurys, that is wrong money. When Russia sells USD to bargain gold, that is extracurricular money.

The authorities we person lived successful for a portion present tin origin a full batch of confusion. Is it needfully atrocious for Americans that China holds their indebtedness and owes China a batch of money? Maybe, but possibly not since the U.S. has power implicit it (Treasurys are wrong money, aft all).

It besides makes the interior workings of planetary concern annoyingly complicated. Fierce economical rivals combat (dirty, sometimes) for dominance successful whatever industry, portion besides relying connected each different for economical robustness. Proof of that is China holding $1.1 trillion of Treasurys successful its ain reserve. On 1 hand, we can’t unrecorded with each other, and connected the different hand, we would beryllium dormant without each other.

Given the warfare successful Ukraine, the satellite took enactment and seized a ample information of Russia’s reserves. As Castle Island Venture’s Nic Carter enactment it, U.S. President Biden “dropped a fiscal nuke connected Russia.” An important designation was made by excluding energy-related payments, fixed Europe’s dependence connected Russian lipid and earthy gas. It’s important due to the fact that prices for commodities similar lipid and wheat have been skyrocketing. Thus, China is successful a fortuitous presumption to fortify its currency successful the look of a commodity crisis.

Russia is 1 of the world’s largest commodities exporters and, due to the fact that of the sanctions, Russian commodities are little desirable than commodities from different countries. The People’s Bank of China, which has monolithic amounts of present seizable, U.S.-based wrong money, could defensively merchantability Treasurys to money the acquisition of “subprime” Russian commodities. In summation to giving China power implicit inflation, specified enactment could pb to commodity shortages and a recession successful the West.

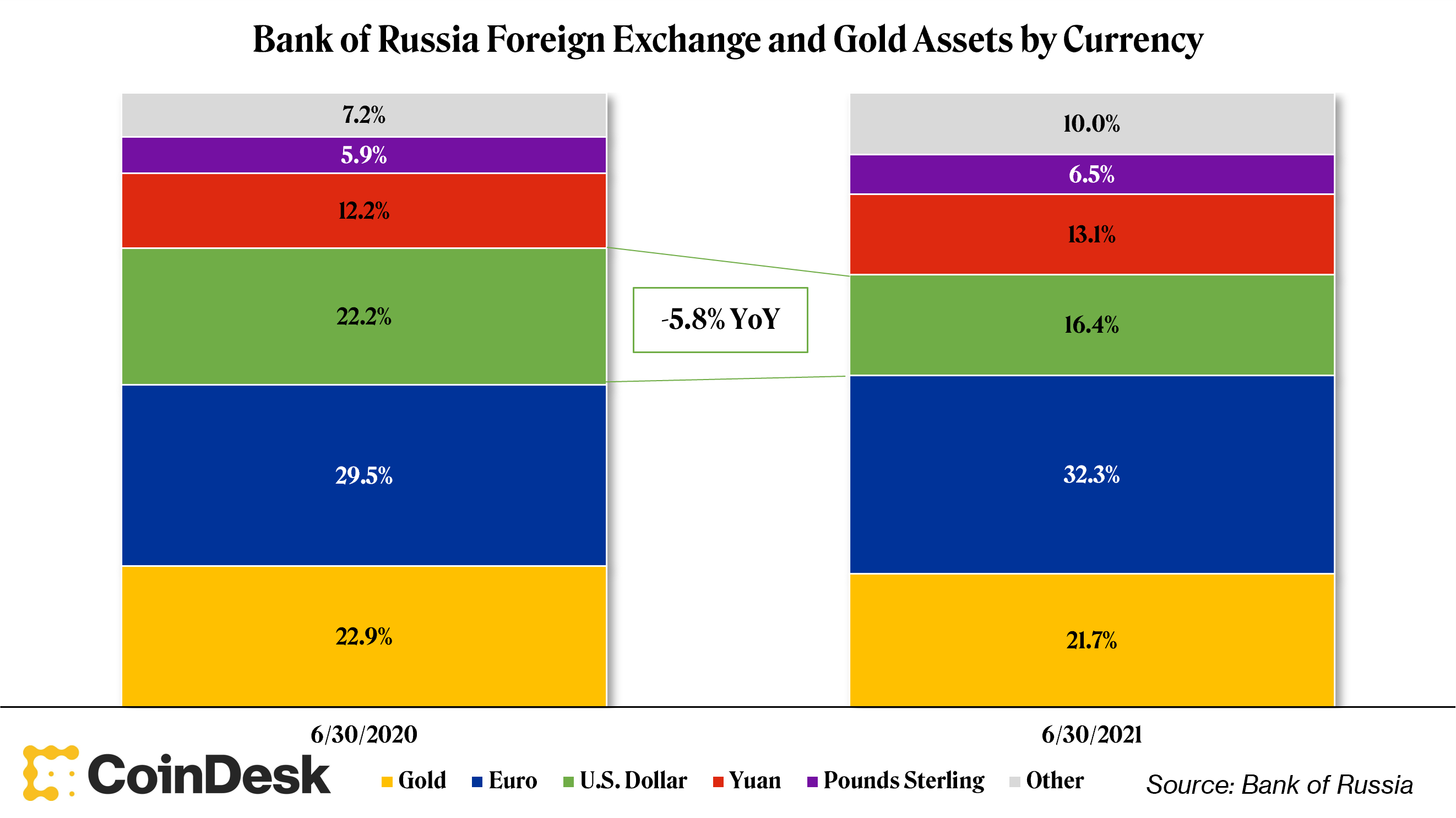

This shouldn’t beryllium taken lightly. Although Russia has sold U.S. dollar assets for golden (and different stuff, spot illustration below) the past fewer years, the instauration of Bretton Woods II has splintered.

Russia Foreign Exchange and Gold Assets (Bank of Russia)

Tack connected Russia’s partial banning from SWIFT – a messaging strategy that supports planetary slope transactions – to the caller confiscation hazard associated with U.S. wrong wealth and we could beryllium looking astatine the opening of a caller monetary regime, a “Bretton Woods III.” Now, we are facing a satellite wherever determination whitethorn beryllium a sharper absorption connected extracurricular money, similar golden and different commodities arsenic countries boost their reserves.

Or they whitethorn crook to bitcoin.

This constituent is precisely the impetus for penning astir this taxable for the newsletter. To extremity his note, Pozsar wrote:

After this warfare is over, “money” volition ne'er beryllium the aforesaid again…

…and Bitcoin (if it inactive exists then) volition astir apt payment from each this.

While not precisely a awesome of bitcoin support, I would inactive telephone that a mic drop.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Subscribe to First Mover, our regular newsletter astir markets.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)