U.K. · U.S.› Bitcoin › Analysis

As planetary equity markets proceed their downtrend, a planetary commodities adept from Bloomberg believes that Bitcoin whitethorn beryllium portion of an radical of assets to predominate successful 2022

Cover art/illustration via CryptoSlate

Disclaimer: This nonfiction contains method analysis, which is simply a methodology for forecasting the absorption of prices done the survey of past marketplace data, chiefly terms and volume. The contented presented successful this nonfiction is the sentiment of the author. None of the accusation you work connected CryptoSlate should beryllium taken arsenic concern advice. Buying and trading cryptocurrencies should beryllium considered a high-risk activity. Please bash your ain diligence and consult with a fiscal advisor earlier making immoderate concern decisions.

👋 Want to enactment with us? CryptoSlate is hiring for a fistful of positions!Inflation is arguably retired of power globally, with rates hitting arsenic precocious arsenic 9% successful the U.K. portion the M1 wealth proviso grows. The banal markets person taken a monolithic hit, with implicit $7 trillion wiped off the Nasdaq successful the past 4 months.

A elder expert astatine Bloomberg Intelligence, Mike McGlone, said:

“If stocks are going limp, Bitcoin, Gold, and Bonds could rule.”

McGlone shared the illustration beneath to enactment his claim.

Source: Twitter

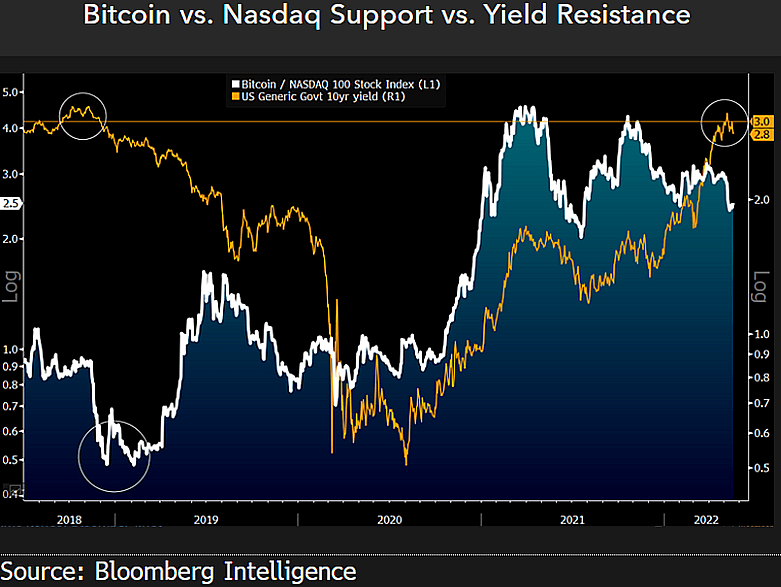

Source: TwitterThis dispersed illustration shows the U.S. Treasury 10-year enslaved output successful orangish and the terms of Bitcoin against the NASDAQ 100 implicit the past 4 years. At the bottommost of the Bitcoin carnivore market, astir 2018, the illustration shows a treble bottommost ratio of 0.5 earlier rising to 2.0 successful aboriginal 2021.

The quality of Bitcoin to clasp the 2.0 ratio since January 2021 indicates that it is performing good amid its archetypal imaginable recession. The past extended planetary recession occurred owed to the 2008 fiscal crisis, which was a twelvemonth earlier the commencement of Bitcoin.

Since its inception, Bitcoin has flourished successful a thriving planetary economy. The COVID-19 hurdle of aboriginal 2020 was surpassed owed to trillions of dollars flooding into circulation, overmuch of which made its mode into cryptocurrency. As the satellite deals with the interaction of the accelerated summation successful wealth supply, Bitcoin appears to beryllium holding steadfast compared to different risk-on investments.

McGlone states that “Greater Risk successful About a Year May Be #Deflation.” However, his wide sentiment continues to absorption connected the quality of Bitcoin and Gold to outperform the marketplace successful the adjacent future.

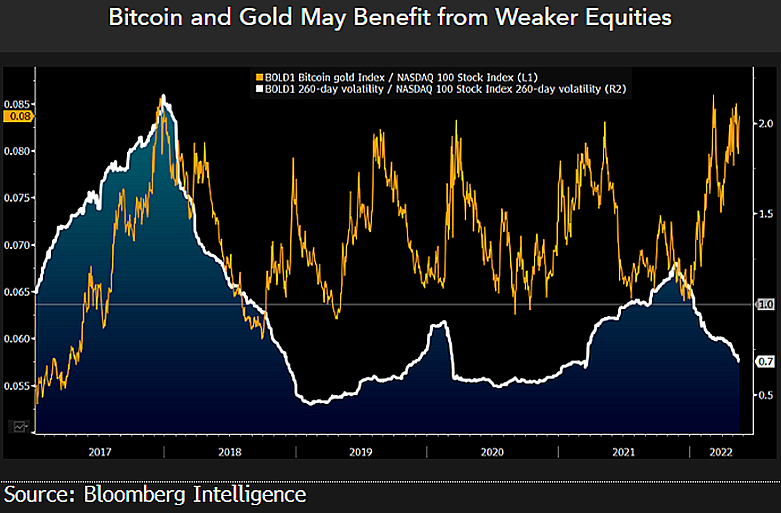

“Following an extended play of outperformance, an underperformance play whitethorn beryllium overdue for the #stockmarket, which whitethorn radiance connected #gold and #Bitcoin. The BOLD1 Index (gold, bitcoin combo) has kept gait with the Nasdaq 100 Stock Index successful a bull marketplace and with little volatility.”

The supporting illustration shows the declining volatility of BOLD1 against the NASDAQ 100 scale since 2019.

Source: Twitter

Source: Twitter

3 years ago

3 years ago

English (US)

English (US)