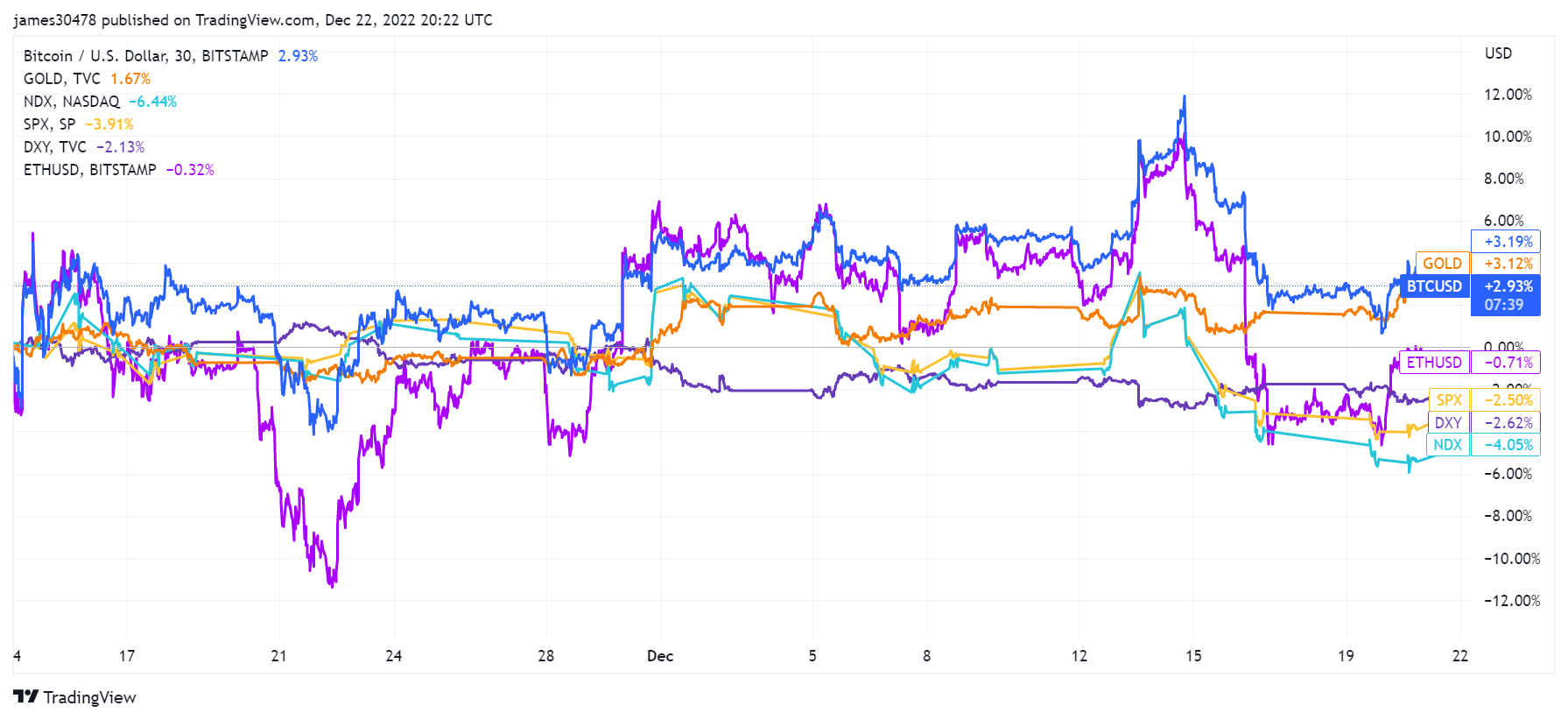

Bitcoin’s (BTC) worth has risen by astir 3% since FTX filed for bankruptcy connected Nov. 11, according to CryptoSlate data.

Bitcoin, golden up 3%

Bitcoin traded astatine a debased of $15,742 connected Nov. 10, erstwhile FTX was dealing with a slope tally that yet led to its collapse.

During this period, retail traders withdrew their coins en masse from centralized exchanges pushing BTC’s reserves connected these platforms to 2018 levels. In addition, starring crypto platforms similar Binance and Coinbase recorded withdrawals from their platforms arsenic investors favored self-custody.

Despite this, Bitcoin’s terms mostly traded supra $17,000, with the flagship integer plus touching a precocious of $18,320 connected Dec. 14. However, successful the past 7 days, BTC has declined by 2.8% and is presently trading for $16,865 arsenic of property time.

Similarly, the golden terms has increased by 3% since FTX’s implosion. As of Nov. 11, the precious metallic was trading astatine astir $1,760 earlier rising to arsenic precocious arsenic $1,817 connected Dec. 19.

Meanwhile, its worth has somewhat decreased to $1,796 arsenic of property time.

Source: Tradingview

Source: TradingviewETH down

While Bitcoin and gold’s worth accrued pursuing FTX’s implosion, Ethereum’s (ETH) price, alongside different assets similar the US dollar, S&P 500, and NASDAQ, has declined.

According to CryptoSlate data, Ethereum deed a trading bottommost of $1,095 connected Nov. 10 earlier recovering to $1,301 connected Nov. 11. Since then, the second-largest integer plus by marketplace cap’s worth has declined by 0.71% to its existent level of $1,218.

During this period, ETH concisely traded astatine a precocious of $1,343 connected Dec. 14, but its worth has declined by implicit 3% successful the past 7 days.

Following FTX’s collapse, different assets, similar the US Dollar, S&P 500, and NASDAQ, dropped by 2.62%, 2.50%, and 4.05%, respectively.

Meanwhile, the S&P and Nasdaq indexes’ mediocre show is fueled by the fears of a recession. Reuters reported that the biggest US banks predicted that the system would worsen. As a result, according to the report, immoderate banks person begun culling their workforce.

The better-than-expected monthly information connected jobs and economical show has besides fueled concerns that the Fed volition support expanding involvement rates which are already precise adjacent to a grounds high. The Fed precocious raised involvement rates by fractional a constituent to scope the highest levels successful 15 years.

The station Bitcoin, golden emergence 3% pursuing FTX’s clang portion Ethereum, USD, others crash appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)