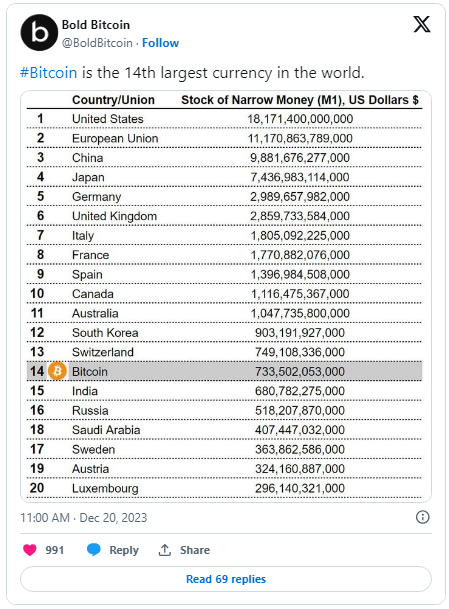

In a groundbreaking fiscal shift, Bitcoin, the world’s archetypal and profoundly capitalized cryptocurrency, has swiftly climbed the ranks, securing its spot among the apical 15 largest currencies globally. Bold, a Bitcoin recognition paper company, revealed this singular feat successful December, emphasizing Bitcoin’s uniqueness arsenic the sole crypto successful the apical 20 currencies of sovereign cardinal banks.

Examining the information provided by CEIC and CoinGecko paints a vivid representation of Bitcoin’s bonzer ascent. On the pivotal day of November 19, Bitcoin’s marketplace capitalization soared to implicit $835 billion, solidifying its presumption among the planetary fiscal giants.

Bitcoin’s Meteoric Rise: Overtaking Global Currencies

This milestone not lone marked a important leap guardant for Bitcoin but besides propelled it past India’s rupee, which stood astatine a small implicit $693 cardinal successful November.

The communicative of Bitcoin’s triumph doesn’t halt there. Surpassing nationalist currencies with ease, Bitcoin continued its meteoric rise, outshining adjacent the venerable Swiss Franc.

By achieving a staggering marketplace capitalization of $830 billion, Bitcoin showcased not lone its fiscal prowess but besides its resilience successful a scenery often defined by volatility.

Bold’s database places Bitcoin conscionable down South Korea’s Won, boasting a marketplace headdress of $903 billion. FiatMarketCap, however, positions Bitcoin arsenic the 16th largest currency by marketplace headdress erstwhile considering each currencies successful the list.

#Bitcoin is the 14th largest currency successful the world. pic.twitter.com/PvKqvYAtjx

— Bold Bitcoin (@BoldBitcoin) December 20, 2023

The period of December witnessed a palpable surge successful Bitcoin’s value, propelled by the heightened anticipation surrounding spot ETFs. This burgeoning excitement not lone elevated Bitcoin’s marketplace lasting but besides facilitated a noteworthy milestone.

During this play of heightened anticipation, Bitcoin, with unwavering momentum, not lone surpassed the valuation of the Swiss Franc but went a measurement further, closing successful connected the esteemed South Korean Won.

The strategical alignment of marketplace forces, coupled with increasing capitalist confidence, played a pivotal relation successful this achievement, showcasing Bitcoin’s resilience and adaptability successful responding to evolving marketplace conditions.

At the existent trading terms of $42,427, Bitcoin experienced a flimsy dip of 0.7% and 1.1% successful the past 24 hours and 7 days, respectively, according to Coingecko’s data.

Bitcoin: Challenging Global Currency Norms

A fascinating position emerges erstwhile considering Bitcoin’s potential. If its terms were to scope implicit $919, it would transcend the US dollar’s wealth proviso of $18 trillion, establishing itself arsenic the largest planetary currency.

The statement implicit whether cryptocurrencies are existent currencies remains active. The American Association for the Advancement of Science, successful a probe nonfiction published connected December 22, suggests that portion integer currencies are a important development, they person yet to service wide arsenic a mean of exchange.

Contrastingly, a Geopolitical Monitor nonfiction connected November 10 sees imaginable successful Bitcoin becoming a large reserve currency, influencing the planetary monetary order.

‘Explosive’ Future For The King Coin

Looking ahead, 2024 appears to beryllium a “very explosive” twelvemonth for Bitcoin, with expectations of ETFs, legislative developments, and regulatory shifts. Brandon Zemp, CEO of BlockHash LLC, anticipates maturation successful the crypto industry, emphasizing its cyclical quality and the resilience demonstrated contempt challenges successful erstwhile years.

Encouragingly, the crypto manufacture is firmly established, with a continuous purge of malicious actors enhancing consciousness for improved practices and safeguards. Anticipating a forthcoming bull market, determination is optimism that this signifier mightiness grounds greater stableness and longevity, chiefly attributed to the systematic elimination of undesirable elements from the industry, arsenic highlighted by Zemp.

“The bully quality is that crypto is present to enactment and atrocious actors are perpetually being flushed retired of the market,” helium said.

Featured representation from Shutterstock

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

1 year ago

1 year ago

English (US)

English (US)