Bitcoin has plunged during the past 24 hours and present finds itself astatine the $26,200 level. Here’s wherefore this level is important for the asset.

Bitcoin 200 WMA & 111 DMA Are Both At $26,200 Right Now

In a caller tweet, the analytics steadfast Glassnode has talked astir however the antithetic method pricing models for Bitcoin whitethorn beryllium interacting with the asset’s terms currently.

There are 4 applicable method pricing models here, and each of them is based connected antithetic moving averages (MAs) for the cryptocurrency.

An MA is simply a instrumentality that finds the mean of immoderate fixed quantity implicit a specified region, and arsenic its sanction implies, it moves with clip and changes its worth according to changes successful said quantity.

MAs, erstwhile taken implicit agelong ranges, tin creaseless retired the curve of the quantity and region short-term fluctuations from the data. This has made them utile analytical tools since they tin marque studying semipermanent trends easier.

In the discourse of the existent topic, the applicable MAs for Bitcoin are 111-day MA, 200-week MA, 365-day MA, and 200-day MA. The archetypal of these, the 111-day MA, is called the Pi Cycle indicator, and it mostly finds utile successful identifying abbreviated to mid-term momentum successful the asset’s value.

The 200-week MA is utilized for uncovering the baseline momentum of a BTC rhythm arsenic 200 weeks are adjacent to astir 4 years, which is astir what the magnitude of BTC cycles successful the fashionable consciousness is.

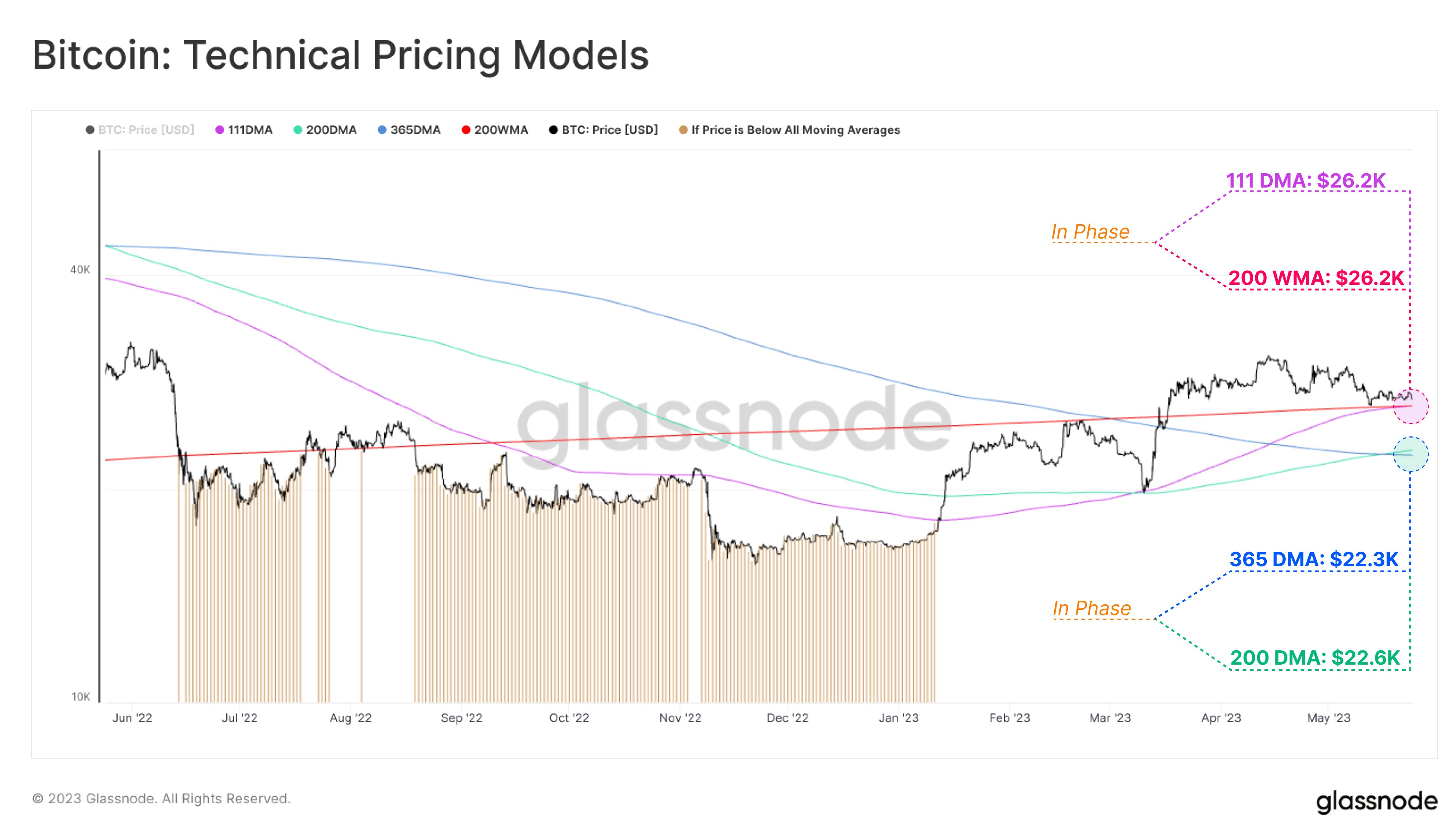

Here is simply a illustration that shows the inclination successful these antithetic Bitcoin method pricing models implicit the past year:

As shown successful the supra graph, these antithetic Bitcoin pricing models person taken turns successful providing enactment and absorption to the terms during antithetic periods of the cycle.

For example, the 111-day MA turned into enactment recently, arsenic the terms rebounded disconnected this level backmost during the plunge successful March of this year, arsenic tin beryllium seen successful the chart.

The 111-day and 200-week MAs person precocious travel into phase, arsenic some their values basal astatine $26,200 close now. This is the level that Bitcoin has been uncovering enactment astatine successful caller days, truthful it would look that the basal formed by these lines whitethorn beryllium helping the terms currently.

Glassnode notes that if a interruption beneath this portion of enactment takes place, the adjacent levels of involvement tin beryllium the 365-day and 200-day MAs. The erstwhile of these simply correspond the yearly mean price, portion the second metric is called the Mayer Multiple (MM).

The MM has historically been associated with the modulation constituent betwixt bullish and bearish trends for the cryptocurrency. When the 111-day MA provided enactment to the terms backmost successful March, the metric had been successful signifier with the MM.

From the graph, it’s disposable that the 365-day and 200-day MAs person besides interestingly recovered confluence recently, arsenic their existent values are $22,300 and $22,600, respectively. This would connote that betwixt $22,300 and $22,600 whitethorn beryllium the adjacent large enactment country for the asset.

BTC Price

At the clip of writing, Bitcoin is trading astir $26,200, down 4% successful the past week.

Featured representation from iStock.com, charts from TradingView.com, Glassnode.com

2 years ago

2 years ago

English (US)

English (US)