The beneath is an excerpt from a caller variation of Bitcoin Magazine Pro, Bitcoin Magazine's premium markets newsletter. To beryllium among the archetypal to person these insights and different on-chain bitcoin marketplace investigation consecutive to your inbox, subscribe now.

New Hash Rate All-Time High

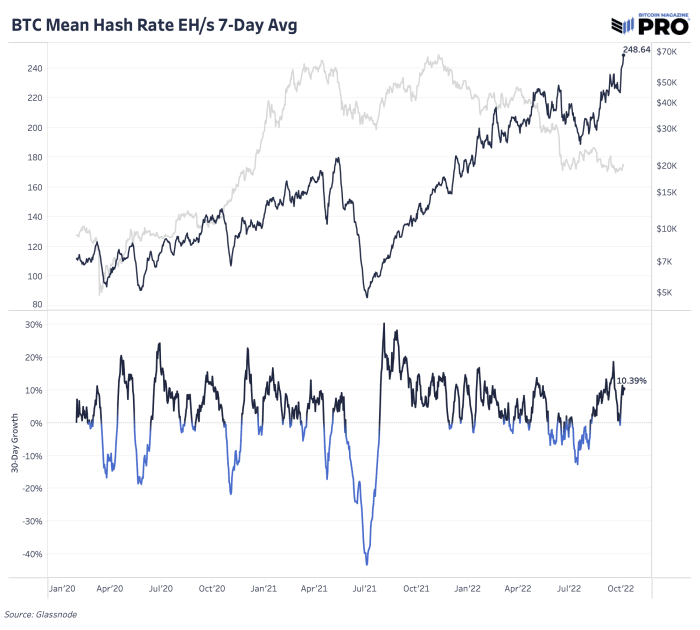

Just 2 months ago, the 2022 enlargement successful Bitcoin hash complaint was looking bleak. The bitcoin terms had plummeted, miner margins were getting compressed, ample nationalist miners were shedding bitcoin holdings and it was a ripe clip to revisit the authorities of miner capitulation successful the market. Fast guardant to today: terms has travel down from a monolithic carnivore marketplace rally to $25,000 portion hash complaint coming online has exploded to a caller all-time of astir 250 EH/s. The chop and scope and rallies successful bitcoin terms haven’t impacted the hash complaint from ripping higher this year. Hash complaint hasn’t truly declined connected a 30-day maturation ground since July.

That’s immoderate of the champion nationalist information disposable to chalk up wherefore bitcoin hash complaint has exploded truthful much. It’s nationalist miners executing connected enlargement plans. But that doesn’t mean ample standard mining companies haven’t faced further pressures. Compute North, 1 of the largest information halfway operators and bitcoin mining hosting services, filed for Chapter 11 bankruptcy conscionable weeks ago. They housed miners for companies similar Marathon Digital, Compass Mining and Bit Digital crossed 84 antithetic mining entities. A large auction connected the bulk of Compute North existing assets volition instrumentality spot connected November 1, 2022 including mining containers, machines and full information centers.

In the Celsius collapse, Celsius Mining besides filed for bankruptcy backmost successful July. That said, it’s wide from the caller Compute North’s bankruptcy that the unit is inactive connected large-scale miners. They aren’t retired of the woods yet and we’ve been hesitant to telephone for an extremity of miner capitulation this rhythm arsenic terms has stagnated and hash terms (miner gross divided by hash rate) continues to look immoderate beardown headwinds with this level of hash complaint enlargement playing out.

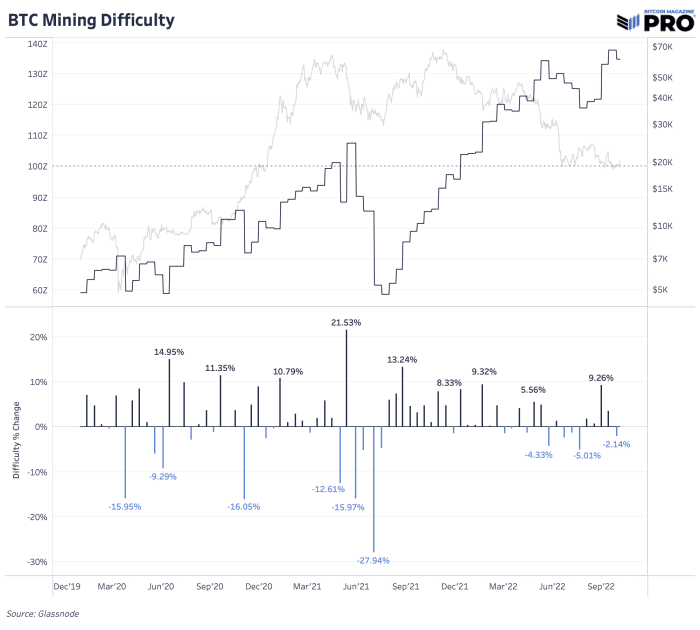

After making a caller all-time high, mining trouble saw a decent sized antagonistic accommodation of 2.14% close earlier this detonation successful hash complaint implicit the past week. But that looks to beryllium each short-term alleviation due to the fact that arsenic of now, the adjacent projected trouble accommodation is looking similar a vicious 13.5% affirmative adjustment astatine the clip of writing. We haven’t seen that level of accommodation since close aft the Chinese mining ban. That benignant of accommodation would beryllium atrocious quality for existing miner profitability arsenic hash terms would travel nether further pressure.

It takes unthinkable operational excellence to proceed to excel successful the bitcoin mining manufacture implicit aggregate cycles.

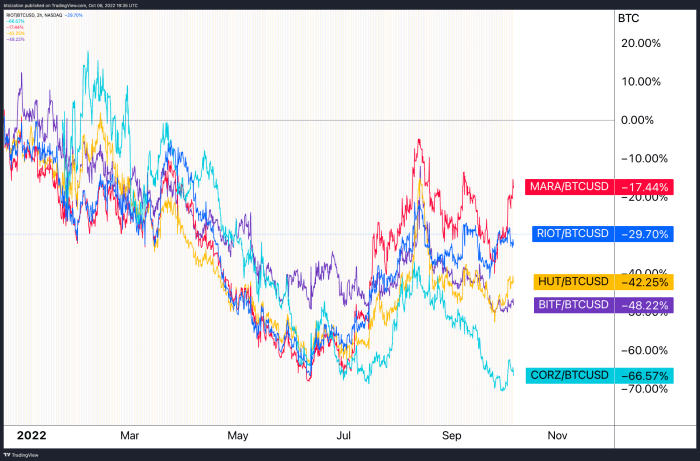

This is wherefore bitcoin mining-related equity investing tin beryllium either highly lucrative (if you take 1 of the winners) oregon downright disastrous.

In our December 21 portion past winter, we said the following,

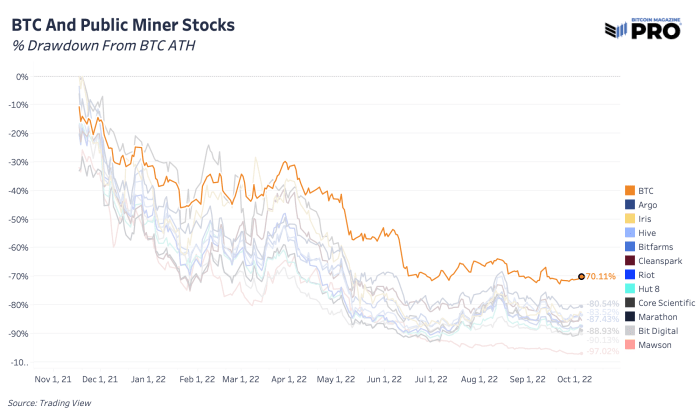

“What you should stitchery from evaluating the show of publicly-traded miners against bitcoin itself is that owed to the superior operation of their concern and the valuations contiguous successful equity markets, miners tin and apt volition outperform bitcoin implicit periods erstwhile hash terms rises significantly.

"However, implicit the agelong word the gross successful bitcoin presumption for each mining institution is guaranteed to alteration successful bitcoin terms, and owed to the excessively ample net multiples that companies presently commercialized with successful equities markets successful a zero involvement complaint world, adjacent bitcoin mining equities inclination to zero implicit clip successful bitcoin presumption (once again, owed to the equity multiples assigned successful a zero involvement complaint fiat-denominated world).”

Since that point, the stock prices of publically traded mining companies are each down importantly erstwhile measured against bitcoin itself.

This should travel arsenic nary surprise. Miner margins are getting relentlessly squeezed arsenic net decrease, successful some bitcoin and dollar terms.

Since the all-time precocious successful the bitcoin price, each publically traded mining institution has underperformed the plus itself, barroom none.

While mining-related equities tin surely admit from their existent beaten down valuations, the advancement of mining machines and the economical incentives of mining each but guarantee that hash complaint continues to summation further from here.

To punctuation a anterior contented of ours,

“However, the dynamics progressive with evaluating publically traded bitcoin miners is simply a spot different. Unlike different “commodity” producers, bitcoin miners often effort to clasp arsenic overmuch bitcoin connected their equilibrium expanse arsenic possible. Relatedly, the aboriginal proviso issuance of bitcoin is known into the aboriginal with adjacent 100% certainty.

"With this information, if an capitalist values these equities successful bitcoin terms, important outperformance against bitcoin itself is achievable if investors allocate during the close clip during the marketplace rhythm utilizing a data-driven approach.”

In the future, mining-related equities arsenic good arsenic ASICs volition erstwhile again beryllium primed for ample outperformance against bitcoin itself. We don’t deliberation that clip has arrived conscionable yet.

Relevant Past Articles

3 years ago

3 years ago

English (US)

English (US)