By Francisco Rodrigues (All times ET unless indicated otherwise)

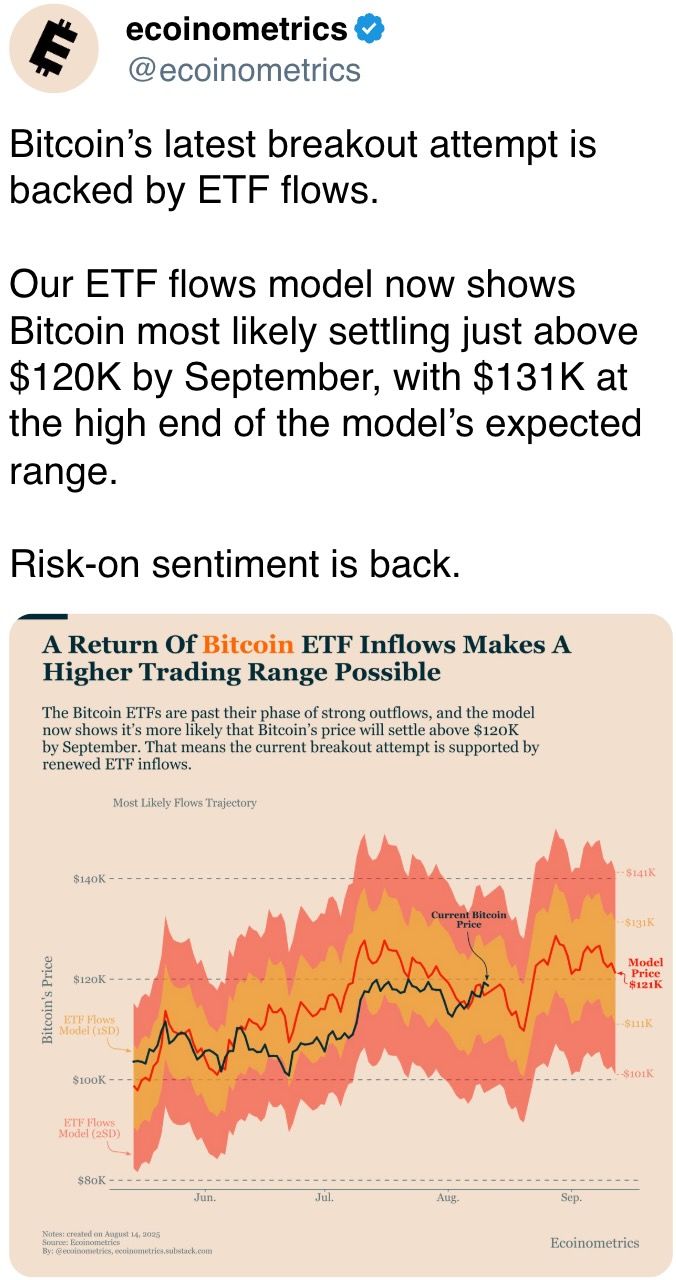

The cryptocurrency marketplace is inactive enjoying a rally connected the backmost of Tuesday's higher-than-expected halfway ostentation speechmaking that boosted chances of a Federal Reserve interest-rate chopped adjacent month. Some traders are adjacent calling for a 50 bps cut.

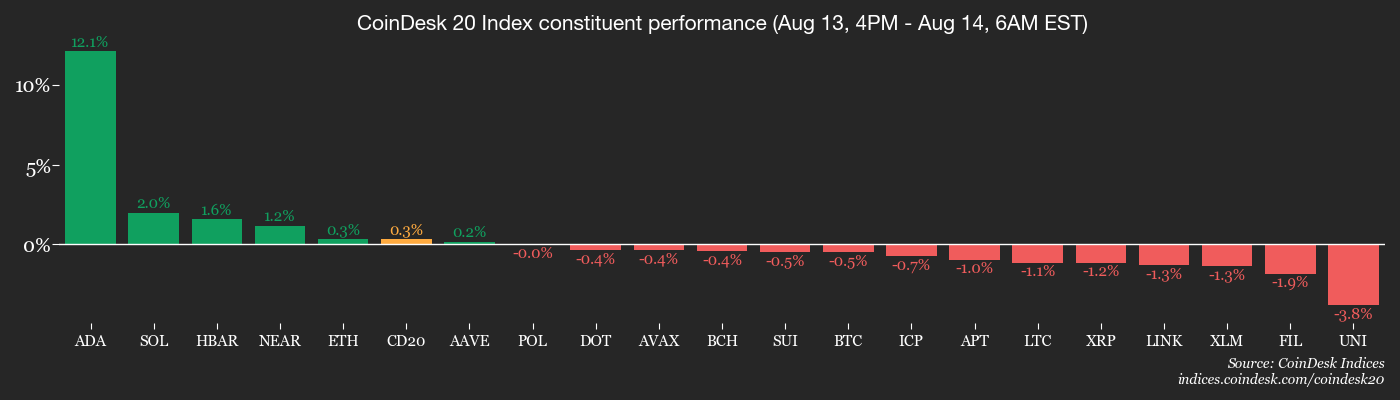

The euphoria has lifted the CoinDesk 20 (CD20) scale of largest cryptocurrencies much than 1% successful the past 24 hours, and sent bitcoin (BTC) to a grounds precocious implicit $124,000 and ether (ETH) 2.2% higher to $4,750, conscionable beneath its record.

Headline ostentation data for July came successful cooler than expected, but rising halfway ostentation fed into rate-cut expectations. On Polymarket, traders present measurement an 80% accidental of a 25 basis-point chopped successful September, portion chances of a 50 bps chopped roseate to 8.3%. The CME FedWatch instrumentality shows a 97.8% accidental of a 25 bps cut, and a 2.2% accidental of a 50 bps cut.

In the geopolitical front, President Donald Trump is expected to conscionable Russian President Vladimir Putin this Friday successful Alaska. The gathering comes arsenic the U.S. president ramps up unit for a ceasefire successful Ukraine. A follow-up gathering with Ukraine’s President Volodymyr Zelenskyy whitethorn besides beryllium connected the cards. Deescalation measures, including a imaginable aerial truce, are presently connected the table.

Institutional request has made this the champion week for spot ether ETFs nett inflows, with $2.27 cardinal coming successful according to SoSoValue data. Meanwhile, firm accumulation led by BitMine has seen ETH treasures accumulate implicit 3.5 cardinal ETH.

“Bitmine’s superior rise to physique its ETH treasury has drawn attention, with the marketplace noting that immoderate allocation to ETH has an outsized interaction compared with BTC, fixed ETH’s smaller marketplace headdress and marginally thinner liquidity,” analysts astatine QCP Capital wrote. ”We expect the existent momentum successful ETH to persist arsenic agelong arsenic caller flows proceed into ETH DATs.”

Bitcoin treasuries, including ETFs, person grown their holdings by astir 3.36% successful the past 30 days to 3.64 cardinal BTC. That’s much than 17% of the cryptocurrency’s full supply.

Put together, the cryptocurrency marketplace is benefiting from 4 cardinal tailwinds. These are the anticipated complaint cuts, a friendlier regulatory climate, easing geopolitical tensions and rising organization and firm interest.

Looking ahead, investors volition beryllium intimately monitoring today’s Producer Price Index (PPI) information for further clues connected what the Fed mightiness bash successful September. Stay alert!

What to Watch

- Crypto

- Aug. 15: Record day for the next FTX distribution to holders of allowed Class 5 Customer Entitlement, Class 6 General Unsecured and Convenience Claims who conscionable pre-distribution requirements.

- Aug. 18: Coinbase Derivatives volition launch nano SOL and nano XRP U.S. perpetual-style futures.

- Aug. 20: Qubic (QUBIC), the fastest blockchain ever recorded, volition acquisition its archetypal yearly halving event arsenic portion of a controlled emanation model. Although gross emissions stay fixed astatine 1 trillion QUBIC tokens per week, the adaptive pain complaint volition summation substantially — burning immoderate 28.75 trillion tokens and reducing nett effectual emissions to astir 21.25 trillion tokens.

- Macro

- Aug. 14, 8:30 a.m.: The U.S. Bureau of Labor Statistics releases July shaper terms ostentation data.

- Core PPI MoM Est. 0.2% vs. Prev. 0.0%

- Core PPI YoY Est. 2.9% vs. Prev. 2.6%

- PPI MoM Est. 0.2% vs. Prev. 0%

- PPI YoY Est. 2.5% vs. Prev. 2.3%

- Aug. 14, 7 p.m.: Peru's cardinal slope announces its monetary argumentation decision.

- Reference Interest Rate Est. 4.5% vs. Prev. 4.5%

- Aug. 14, 10 p.m.: El Salvador's Statistics and Census Office, which is portion of the Central Reserve Bank of El Salvador, releases July user terms ostentation data.

- Inflation Rate MoM Prev. 0.32%

- Inflation Rate YoY Prev. -0.17%

- Aug. 15: U.S. President Donald Trump and Russian President Vladimir Putin volition meet successful Alaska to sermon imaginable bid presumption for the warfare successful Ukraine.

- Aug. 15, 12 p.m.: Colombia's National Administrative Department of Statistics (DANE) releases Q2 GDP maturation data.

- GDP Growth Rate QoQ Prev. 0.8%

- GDP Growth Rate YoY Est. 2.6% vs. Prev. 2.7%

- Aug. 15, 4 p.m.: Peru’s National Institute of Statistics and Informatics releases June GDP YoY maturation data.

- GDP Growth Rate YoY Est. 4.7 vs. Prev. 2.67%

- Aug. 18, 6 p.m.: The Central Reserve Bank of El Salvador releases July shaper terms ostentation data.

- PPI YoY Prev. 1.29%

- Aug. 14, 8:30 a.m.: The U.S. Bureau of Labor Statistics releases July shaper terms ostentation data.

- Earnings (Estimates based connected FactSet data)

Token Events

- Governance votes & calls

- SoSoValue DAO is voting to allocate 5,000,000 SOSO tokens for a Researcher Ecosystem Fund, aimed astatine boosting top-tier crypto probe done competitions and incentives, improving contented quality, transparency and SOSO’s utility. Voting ends Aug. 18.

- Uniswap DAO is voting to allocate $540K successful UNI over six months to arsenic galore arsenic 15 apical delegates, with up to $6K/month based connected voting activity, assemblage engagement, connection authorship and holding 1,000+ UNI. Votings ends Aug. 18

- Aavegotchi DAO is voting connected a Bitcoin Ben’s Crypto Club Las Vegas sponsorship: a $1,000/month firm rank (logo connected sponsor wall, squad access, newsletter feature, 1 branded meetup/month) oregon a $5,000, 90-day Graffiti Wall mural with promo. Voting ends Aug. 23.

- Aug. 14, 10 a.m.: Lido to big a tokenholder update call.

- Aug. 14, 10 a.m.: Stacks to big a townhall meeting.

- Unlocks

- Aug. 15: Avalanche (AVAX) to unlock 0.33% of its circulating proviso worthy $41.84 million.

- Aug. 15: Starknet (STRK) to unlock 3.53% of its circulating proviso worthy $18.12 million.

- Aug. 15: Sei (SEI) to unlock 0.96% of its circulating proviso worthy $18.94 million.

- Aug. 16: Arbitrum (ARB) to unlock 1.8% of its circulating proviso worthy $49.95 million.

- Aug. 18: Fasttoken (FTN) to unlock 4.64% of its circulating proviso worthy $91.6 million.

- Aug. 20: LayerZero (ZRO) to unlock 8.53% of its circulating proviso worthy $57.59 million.

- Aug. 20: Kaito (KAITO) to unlock 8.82% of its circulating proviso worthy $27.55 million.

- Token Launches

- Aug. 14: Useless Coin (Useless) to beryllium listed connected Binance.US.

- Aug. 14: Cherry AI (AIBOT) to beryllium listed connected Binance Alpha, MEXC, and others.

Conferences

The CoinDesk Policy & Regulation conference (formerly known arsenic State of Crypto) is simply a one-day boutique lawsuit held successful Washington connected Sept. 10 that allows wide counsels, compliance officers and regulatory executives to conscionable with nationalist officials liable for crypto authorities and regulatory oversight. Space is limited. Use codification CDB10 for 10% disconnected your registration done Aug. 31.

- Day 3 of 3: AIBB 2025 (Istanbul)

- Day 3 of 7: Ethereum NYC (New York)

- Day 1 of 2: CryptoWinter ‘25 (Queenstown, New Zealand)

- Aug. 15: Bitcoin Educators Unconference (Vancouver)

- Aug. 17-21: Crypto 2025 (Santa Barbara, California)

- Aug. 18-21: Wyoming Blockchain Symposium 2025 (Jackson Hole)

- Aug. 21-22: Coinfest Asia 2025 (Bali, Indonesia)

Token Talk

By Shaurya Malwa

- SHIB’s pain complaint exploded 48,244% successful the past 24 hours, with astir 88 cardinal tokens permanently removed from supply.

- “Burning” means sending coins to a wallet nary 1 tin access, taking them retired of circulation forever.

- The biggest azygous pain was 69,420 tokens successful 1 hour, portion of a bid of transactions tracked by Shibburn, a community-run monitoring site.

- Prices are holding steadfast supra the $0.000010 enactment level, which traders spot arsenic a cardinal level for keeping bullish momentum intact.

- If buying unit continues, analysts accidental SHIB could effort a determination toward $0.000020, treble the existent price.

- Activity connected Shibarium, SHIB’s layer-2 blockchain, remains robust, clocking 1.51 cardinal full transactions and astir 4.69 cardinal daily.

- Burn-driven proviso cuts can, successful theory, marque each remaining token much valuable, but sustained terms gains beryllium connected request matching oregon outpacing the shrinking supply.

Derivatives Positioning

- ADA and SOL person seen the largest increases successful futures unfastened involvement among the apical 10 tokens successful the past 24 hours.

- Even though BTC roseate to grounds highs supra $124K, positioning successful futures remains comparatively light. Open involvement is presently astatine 687K BTC, good beneath the July highest of 742K BTC.

- Meanwhile, connected the CME, the three-month annualized premium successful BTC futures remains beneath 10%.

- The 24-hour unfastened interest-adjusted cumulative measurement delta for astir tokens but TRX is negative, implying seller dominance. This raises a question implicit the sustainability of terms gains.

- The markets for FART and FLR look overheated, with annualized perpetual backing rates exceeding 100%, a motion of overcrowding successful bullish agelong bets. Such a script tin pb to a agelong squeeze, resulting successful a crisp terms slide.

- On Deribit, August and September expiry BTC options are exhibiting lone a flimsy telephone bias. That's apt owed to persistent OTM telephone selling by semipermanent holders and indicates that the rally has yet to trigger a speculative frenzy. Meanwhile, telephone bias is much pronounced successful ether options crossed each clip frames.

- Flows implicit the OTC web Paradigm featured request for BTC calls and abbreviated telephone spreads successful ETH December expiry options.

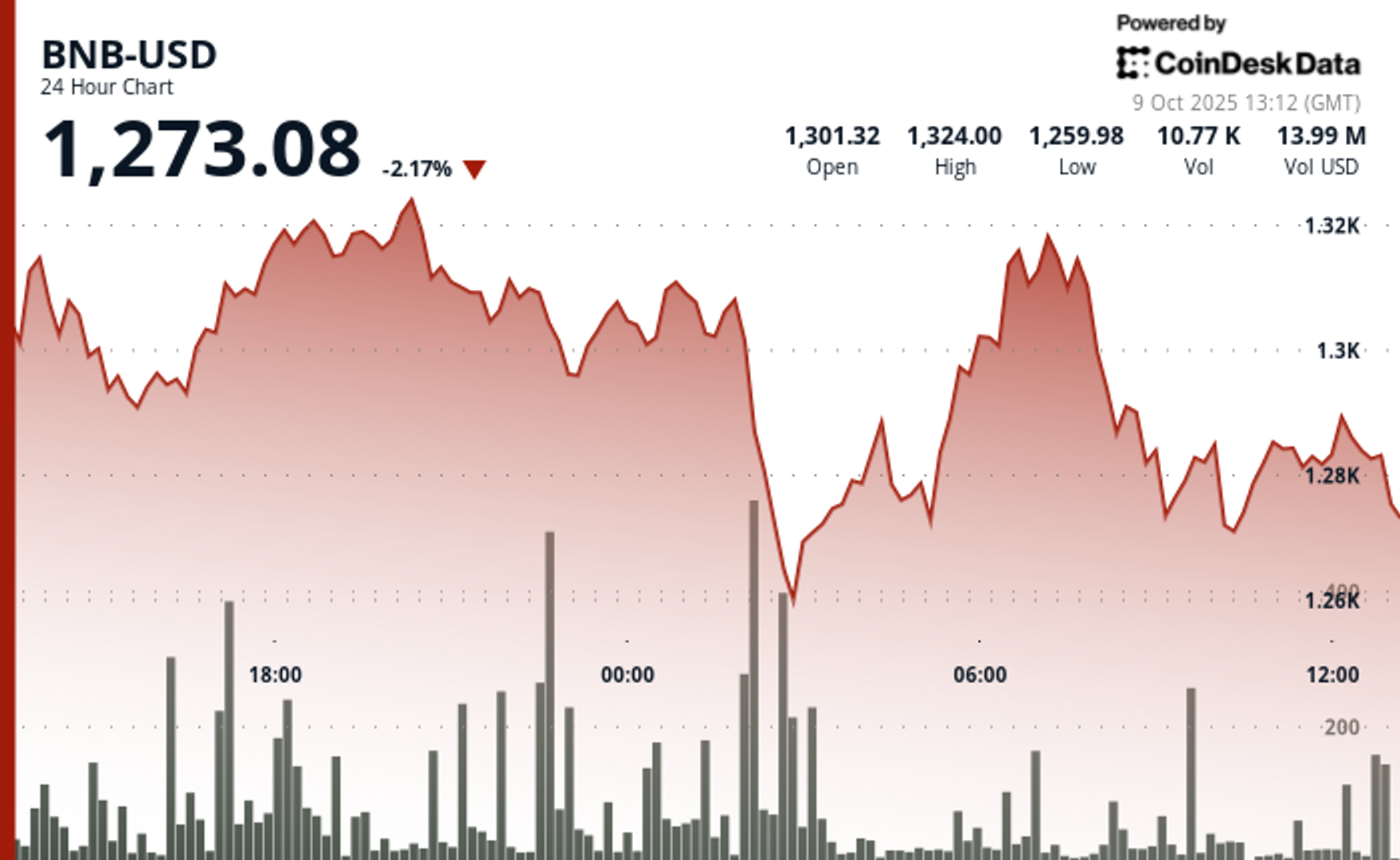

Market Movements

- BTC is down 0.98% from 4 p.m. ET Wednesday astatine $121,693.52 (24hrs: +0.88%)

- ETH is up 0.92% astatine $4,760.09 (24hrs: +1.2%)

- CoinDesk 20 is up 0.53% astatine 4,417.7 (24hrs: +0.86%)

- Ether CESR Composite Staking Rate is up 7 bps astatine 3.04%

- BTC backing complaint is astatine 0.0127% (13.9065% annualized) connected Binance

- DXY is unchanged astatine 97.84

- Gold futures are down 0.11% astatine $3,404.50

- Silver futures are down 0.55% astatine $38.39

- Nikkei 225 closed down 1.45% astatine 42,649.26

- Hang Seng closed down 0.37% astatine 25,519.32

- FTSE is unchanged astatine 9,165.62

- Euro Stoxx 50 is up 0.28% astatine 5,403.07

- DJIA closed connected Wednesday up 1.04% astatine 44,922.27

- S&P 500 closed up 0.32% astatine 6,466.58

- Nasdaq Composite closed up 0.14% astatine 21,713.14

- S&P/TSX Composite closed up 0.26% astatine 27,993.43

- S&P 40 Latin America closed down 0.45% astatine 2,684.56

- U.S. 10-Year Treasury complaint is down 3.1 bps astatine 4.209%

- E-mini S&P 500 futures are unchanged astatine 6,488.25

- E-mini Nasdaq-100 futures are unchanged astatine 23,932.75

- E-mini Dow Jones Industrial Average Index are unchanged astatine 45,057.00

Bitcoin Stats

- BTC Dominance: 59.32 (-0.57%)

- Ether to bitcoin ratio: 0.03906 (1.4%)

- Hashrate (seven-day moving average): 906 EH/s

- Hashprice (spot): $59.75

- Total Fees: 4.39 BTC / $532,696

- CME Futures Open Interest: 142,140 BTC

- BTC priced successful gold: 36.3 oz

- BTC vs golden marketplace cap: 10.26%

Technical Analysis

- The cardano-bitcoin (ADA/BTC) ratio has risen 11% today, confirming an inverse head-and-shoulders breakout connected the regular chart.

- The signifier indicates a bullish inclination change, indicating ADA outperformance ahead.

Crypto Equities

- Strategy (MSTR): closed connected Wednesday astatine $389.90 (-1.14%), -0.58% astatine $387.65 successful pre-market

- Coinbase Global (COIN): closed astatine $327.01 (+1.36%), +0.71% astatine $329.32

- Circle (CRCL): closed astatine $153.16 (-6.16%), -0.48% astatine $152.43

- Galaxy Digital (GLXY): closed astatine $28.34 (+1.58%), +1.09% astatine $28.65

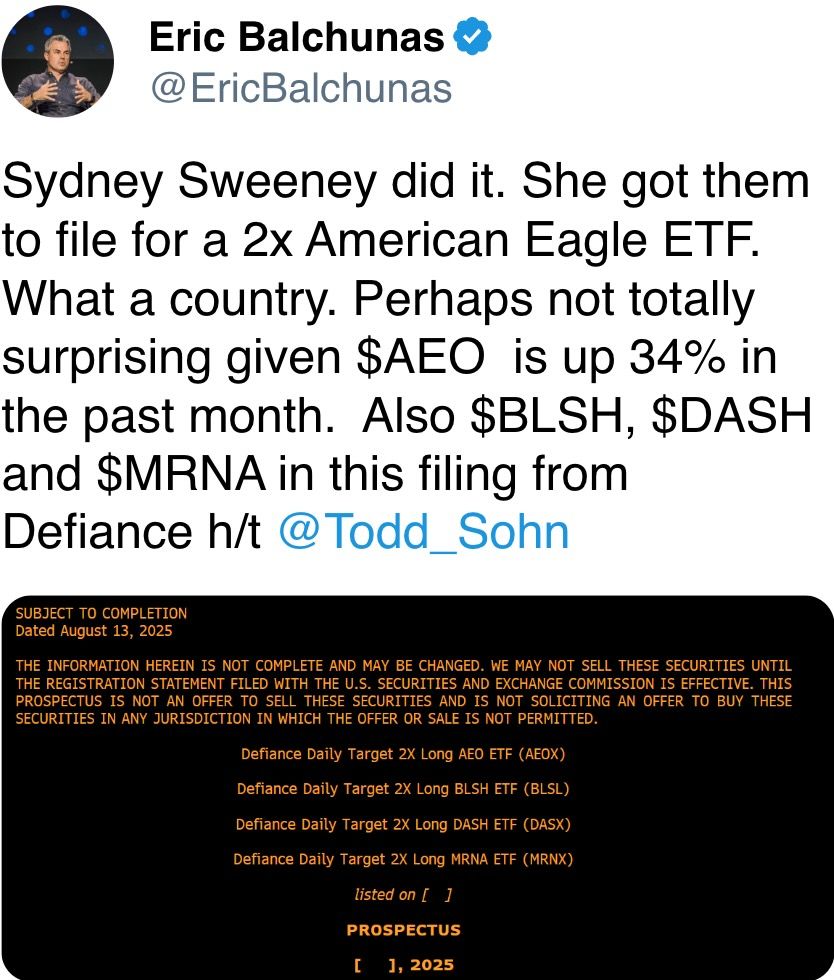

- Bullish (BLSH): closed astatine $68.00 (+83.8%), +15.7% astatine $78.70

- MARA Holdings (MARA): closed astatine $15.86 (+0.89%), -0.63% astatine $15.76

- Riot Platforms (RIOT): closed astatine $11.59 (+1.31%), -0.52% astatine $11.53

- Core Scientific (CORZ): closed astatine $13.85 (-8.34%)

- CleanSpark (CLSK): closed astatine $9.97 (+0.5%), -0.5% astatine $9.92

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $25.50 (+0.35%)

- Semler Scientific (SMLR): closed astatine $35.57 (+2.98%), -0.34% astatine $35.45

- Exodus Movement (EXOD): closed astatine $27.34 (-1.87%), +3.04% astatine $28.17

- SharpLink Gaming (SBET): closed astatine $23.52 (+4.67%), -0.13% astatine $23.49

ETF Flows

Spot BTC ETFs

- Daily nett flows: $86.9 million

- Cumulative nett flows: $54.74 billion

- Total BTC holdings ~1.3 million

Spot ETH ETFs

- Daily nett flows: $729.1 million

- Cumulative nett flows: $12.11 billion

- Total ETH holdings ~6.12 million

Source: Farside Investors

Chart of the Day

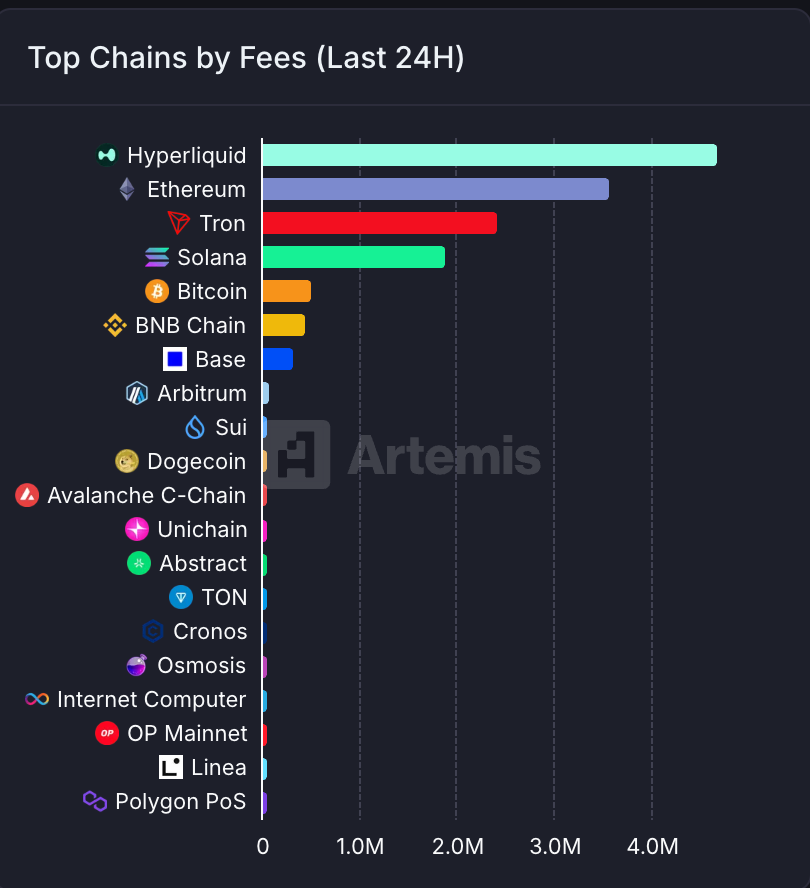

- Hyperliquid, the furniture 1 blockchain and decentralized speech (DEX) focused connected perpetual futures trading, has earned much than $4 cardinal successful fees successful the past 24 hours, outpacing Ethereum, the world's largest smart-contract blockchain.

- Hyperliquid has consistently generated much interest gross than Ethereum since aboriginal July, a motion that single-purpose blockchains are gaining traction by offering specialized, businesslike solutions that pull precocious idiosyncratic engagement and liquidity.

While You Were Sleeping

- Bitcoin Hits Fresh Record arsenic Fed Easing Bets Add to Tailwinds (Reuters): Bitcoin roseate supra $124,000, driven by expectations of U.S. complaint cuts, beardown organization request and regulatory momentum. IG’s Tony Sycamore says a sustained interruption implicit $125,000 could pave the mode to $150,000.

- Bitcoin Crosses Google to Become Fifth-Largest Asset arsenic Fed Rate-Cut Bets Rise (CoinDesk): The milestone caps a twelvemonth of increasing optimism for crypto, driven by a much supportive regulatory clime successful the U.S. and surging firm involvement successful the bitcoin treasury strategy.

- Scott Bessent Says Japan Is ‘Behind the Curve’ connected Interest Rates (Financial Times): The U.S. Treasury Secretary said the Bank of Japan should assistance its benchmark complaint to curb inflation. Mizuho strategist Shoki Omori sees markets pricing successful narrower U.S.-Japan short-term complaint gaps.

- Bitcoin Realized Price Breaks Above 200WMA, Signaling More Room to Run (CoinDesk): Bitcoin’s terms has moved supra a cardinal semipermanent method indicator, a milestone that successful erstwhile cycles has preceded extended rallies, according to humanities on-chain information from Glassnode.

- Chinese Imports Fell During Trump’s First Term. It’s Happening Again. (The Wall Street Journal): China present makes up astir 12% of U.S. goods imports, compared with 22% successful 2018, according to Census data. The goods commercialized shortage with China is astir $280 billion.

- Pound Extends Recent Winning Streak arsenic UK Growth Beats Estimates (Bloomberg): Sterling has outperformed G10 rivals implicit the past week and is heading for a six-day beforehand against the euro. Money markets expect 15 ground points of BOE complaint cuts this year.

In the Ether

1 month ago

1 month ago

English (US)

English (US)