Key points:

Bitcoin falls to its lowest levels since June arsenic acquainted US banking turmoil returns.

Traders spot $100,000 arsenic perchance failing arsenic support.

Gold comes disconnected caller all-time highs arsenic Peter Schiff sees it beating Bitcoin to the $1 cardinal mark.

Bitcoin (BTC) fell to 15-week lows connected Friday arsenic a US banking rout added to BTC terms pressures.

Bitcoin risks “going consecutive to $98,000” next

Data from Cointelegraph Markets Pro and TradingView showed Bitcoin dropping nether $106,000 for the archetypal clip since June.

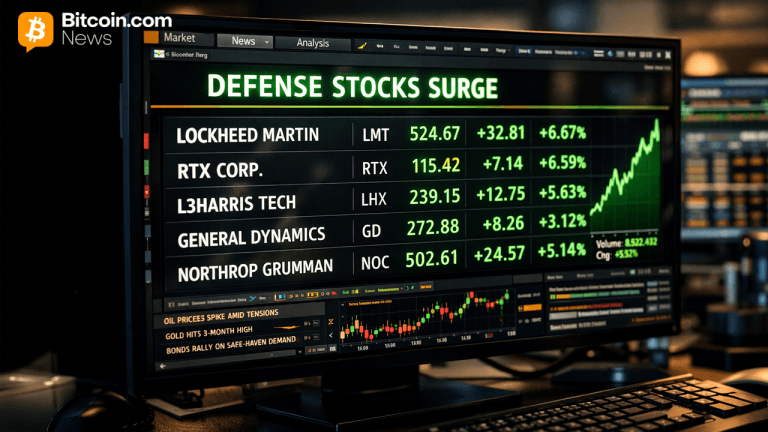

Crypto markets reacted severely to concerns implicit US determination banking stocks, which began falling successful a mode similar to March 2023. Then, Bitcoin and altcoins saw a flash clang earlier a beardown rebound, with BTC/USD dipping nether the $20,000 mark.

“In March 2023, determination slope stocks collapsed, the situation was “contained,” but thing truly changed,” trading assets The Kobeissi Letter wrote successful an X post connected the topic.

Reacting, immoderate traders warned of a retest and imaginable nonaccomplishment of cardinal BTC terms enactment astatine $100,000.

— Borg (@Borg_Cryptos) October 17, 2025Others saw an effort to “fill” a regular candle wick from past week, which took terms to $102,000 connected Binance amid US-China trade-war worries.

“$BTC moving connected the Binance wick. If it doesn’t extremity here, it could capable the full wick adjacent the play 50 MA,” trader SuperBro wrote connected X.

Earlier moving averages (MAs) connected regular timeframes failed to hold arsenic support, starring Bitcoin to interaction its 200-day MA for the archetypal clip successful implicit six months.

“$BTC has mislaid the $108,000 enactment level. Now there’s small to nary enactment until $101,000-$102,000,” crypto capitalist and entrepreneur Ted Pillows agreed.

“If Bitcoin manages to reclaim the $110,000 level from here, we could spot a bounce back. Otherwise, expect much symptom earlier relief.”Gold bug Schiff sees $1 cardinal earlier Bitcoin

The banking woes besides began to instrumentality their toll connected gold, the standout victor successful the existent market, which saw caller all-time highs into the regular close.

Related: $120K oregon extremity of bull market? 5 things to cognize successful Bitcoin this week

Gold proponents celebrated its divergence from Bitcoin. Peter Schiff, the well-known Bitcoin skeptic who is president and main economist astatine concern advisory steadfast Europac, adjacent predicted that the precious metallic would scope $1 cardinal per ounce earlier Bitcoin.

Gold is much apt to deed $1 cardinal than Bitcoin.

— Peter Schiff (@PeterSchiff) October 16, 2025“It's not conscionable a de-dollarization commercialized but a de-bitcoinization trade. Bitcoin has failed the trial arsenic a viable alternate to the U.S. dollar oregon integer gold,” helium argued during caller X exchanges.

Others suggested that a “rotation” into BTC was present much likely.

“Either way, makes consciousness to spot profits travel retired of Gold soon with the mode the marketplace behaves,” crypto trader Jelle said connected X.

An accompanying illustration showed phases of Bitcoin starring and “catching up” with golden implicit the years.

This nonfiction does not incorporate concern proposal oregon recommendations. Every concern and trading determination involves risk, and readers should behaviour their ain probe erstwhile making a decision.

4 months ago

4 months ago

English (US)

English (US)