According to NYDIG research, the aforesaid wealth that pushed Bitcoin up into October’s highest is present pulling it down, and the propulsion looks structural alternatively than conscionable affectional selling.

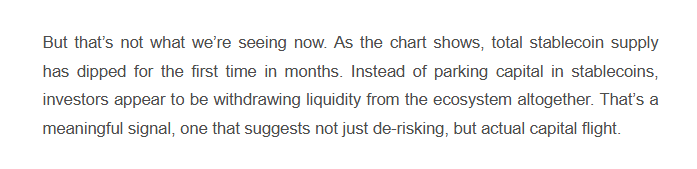

The firm’s caput of probe says a ample liquidation successful aboriginal October flipped spot ETF flows, pushed integer plus treasury (DAT) premiums lower, and coincided with a driblet successful stablecoin proviso — a premix that points to liquidity leaving the system.

Source: NYDIG

Source: NYDIGETF And Treasury Reversals

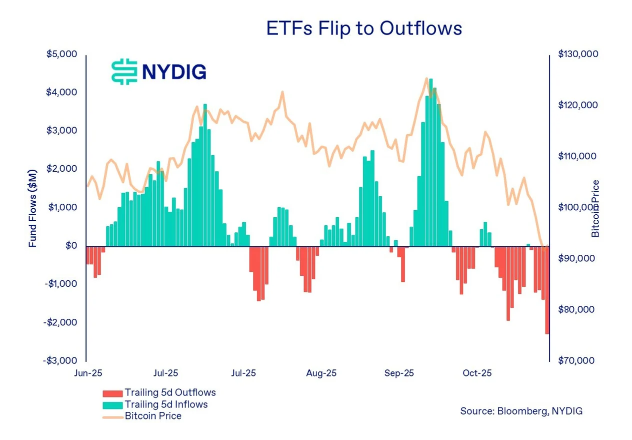

Reports person disclosed that spot Bitcoin ETFs, erstwhile dependable buyers, shifted from dependable inflows into a meaningful headwind, portion DAT premiums compressed crossed the marketplace and stablecoin balances ticked down.

That operation reduced the dependable excavation of buy-side request that had been supporting prices. The alteration is what NYDIG and different marketplace watchers telephone a interruption successful the feedback loop that antecedently amplified gains.

Bitcoin Dominance Creeps Higher As Risk Assets Unwind

According to crypto marketplace data, Bitcoin’s share of the full crypto marketplace climbed backmost supra 60% successful aboriginal November earlier settling astir 58% arsenic of Monday, a motion that traders are moving retired of smaller, much speculative coins and into the largest, astir liquid asset.

That displacement often happens erstwhile wealth tightens: superior consolidates into the biggest sanction arsenic smaller positions are cut.

DATs Show Cooling Demand, But No Broken Balance Sheets

Based connected NYDIG’s note, the DAT assemblage has not shown signs of insolvency. Issuers inactive look humble obligations and galore structures let payments to beryllium suspended if needed.

In short: request has cooled significantly, but the frameworks that underpin galore of these funds haven’t collapsed. That means the existent accent is connected flows and liquidity alternatively than connected solvency.

CME Gap Targeted Then A Possible Bounce

Crypto analysts are watching method levels for short-term direction. Michael van de Poppe flagged a CME gap astatine $85,200 arsenic a apt downside magnet aft a caller astir 10% emergence from lows, and suggested Bitcoin could past retest betwixt $90,000 and $96,000 to signifier a caller base.

Traders ticker these gaps due to the fact that futures markets adjacent implicit weekends portion spot markets bash not, creating terms gaps that often get revisited.

Good bounce of #Bitcoin.

Nearly up 10% since the lows.

CME spread astatine $85.2K, truthful astir apt we’ll person a casual reddish Monday towards that level, earlier we spell backmost up to $90-96K and find a caller base.

— Michaël van de Poppe (@CryptoMichNL) November 23, 2025

Prepare For Choppy Markets Ahead

Investors should enactment 2 abstracted ideas astatine once. Based connected reports, the semipermanent communicative for Bitcoin — increasing organization involvement and broader adoption — remains connected the table.

At the aforesaid time, the short-term rhythm driven by flows, concentrated ETF activity, and reflexive buying has shifted.

That points to an uneven way forward, with much volatile moves apt until buy-side engines reappear oregon caller liquidity returns.

Featured representation from Gemini, illustration from TradingView

1 month ago

1 month ago

![Why Crypto Market Is Going Up Today [Live] Updates, Reasons & Price Action](https://image.coinpedia.org/wp-content/uploads/2025/11/11142238/Crypto-Market-Today-Bitcoin-Holds-Around-105K-Altcoins-Stay-Cautious-While-UNI-WLFI-TRUMP-Thrive-1024x536.webp)

English (US)

English (US)