The beneath is from a caller variation of the Deep Dive, Bitcoin Magazine's premium markets newsletter. To beryllium among the archetypal to person these insights and different on-chain bitcoin marketplace investigation consecutive to your inbox, subscribe now.

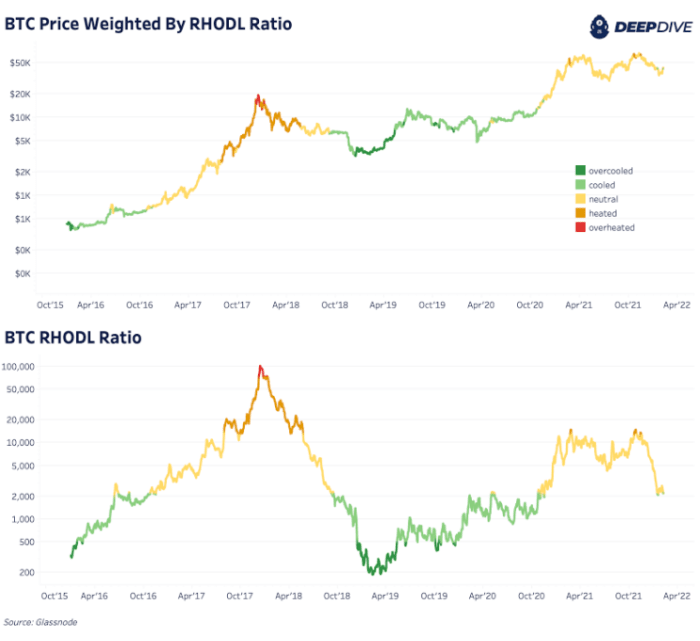

A cardinal on-chain metric that we’ve discussed before, and that we volition screen today, is the Realized HODL (RHODL) Ratio. The ratio uses realized headdress HODL waves, which takes the archetypal HODL Wave metric and weights the UTXOs successful each property set by their realized price. Specifically the Realized HODL Ratio uses the one-week and the one-to-two-years Realized Cap HODL Age bands.

For a much in-depth overview of this metric, cheque retired The Daily Dive: HODL Waves And Realized HODL Ratio.

By utilizing this metric, we tin amended recognize what’s happening with younger coins versus older coins. As younger coins go much ascendant and the ratio rises, semipermanent holders clasp little of the realized marketplace value. As the ratio falls, semipermanent holders clasp much market-realized worth compared to younger coins. An overheated marketplace would amusement overmuch higher younger coin dominance.

In the erstwhile bitcoin tops successful 2021, we didn’t spot the emergence of younger coins comparative to older coins similar erstwhile cycles. We saw the RHODL Ratio emergence passim the year, but it ne'er became heated oregon overheated similar the 2016 cycle. This tin beryllium owed to a changing cycle, a much maturing marketplace oregon the information that we didn’t spot the important question of caller demand, younger coin buying, seen successful past cycles.

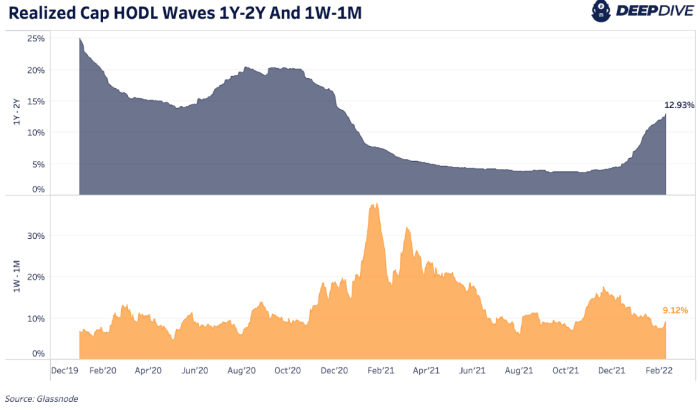

Over the past month, we’ve seen a important summation successful the HODL Waves and Realized Cap HODL Waves one-to-two-years property bands. More coins are aging into this set and are taking up much economical value successful the RHODL Ratio calculation arsenic much semipermanent held proviso comes into the market. As a result, the RHODL Ratio is close astir its 50th percentile inbetween a neutral and cooled state.

Historically, we’ve seen the one-to-two-years property set highest astir 50% of supply, portion it’s presently astatine 12.93%. We look to beryllium headed into a inclination of accrued holder accumulation station a section bitcoin terms top. As accumulation continues and older coins property in, the RHODL Ratio falls and makes bitcoin a much charismatic humanities buy.

3 years ago

3 years ago

English (US)

English (US)