Bitcoin (BTC) danced into uncharted realms this week, breaking barriers with a triumphant surge that pushed its worth beyond the $73,000 mark.

The cryptocurrency world, erstwhile again, finds itself successful the midst of a thrilling terms find phase, propelled by an amalgamation of bullish indicators and a notable displacement successful capitalist sentiments.

Related Reading: Cardano (ADA) Price Alert: Analyst Predicts 60% Rally In Next 7 Days

Big Players Dominate The Crypto Arena

This week’s communicative unfolded connected a signifier dominated by 2 juggernauts of the fiscal realm – BlackRock and MicroStrategy. BlackRock, the undisputed titan of plus management, sent ripples done the marketplace by filing with the SEC, outlining tentative plans to incorporated spot Bitcoin ETFs into its Global Allocation Fund.

Although successful its infancy, this determination has ignited hopes for heightened demand, particularly done BlackRock’s IBIT ETF, already wielding a important 204,000 BTC.

Enter MicroStrategy, the steadfast evangelist of Bitcoin strategies. This firm behemoth poured much substance into the already blazing occurrence by revealing the acquisition of an further 12,000 BTC.

This determination propelled MicroStrategy’s full firm Bitcoin holdings to an awe-inspiring 205,000. Such maneuvers by manufacture giants underscore the increasing acceptance of Bitcoin arsenic a morganatic and influential plus class.

While headlines whitethorn beryllium dominated by organization powerfulness moves, peering into the intricate web of on-chain information reveals the fascinating tapestry of capitalist conviction.

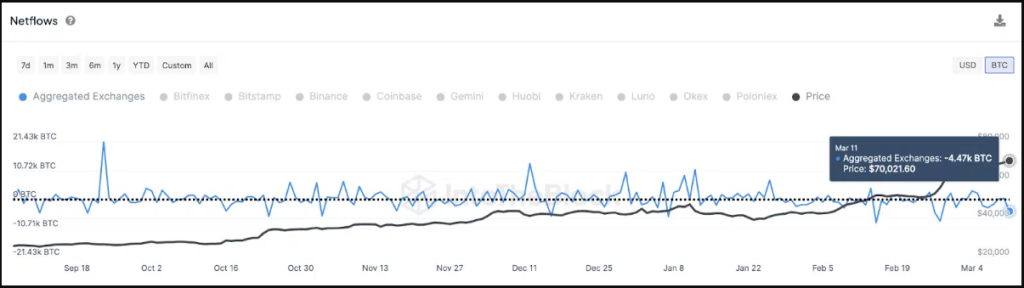

Source: IntoTheBlock

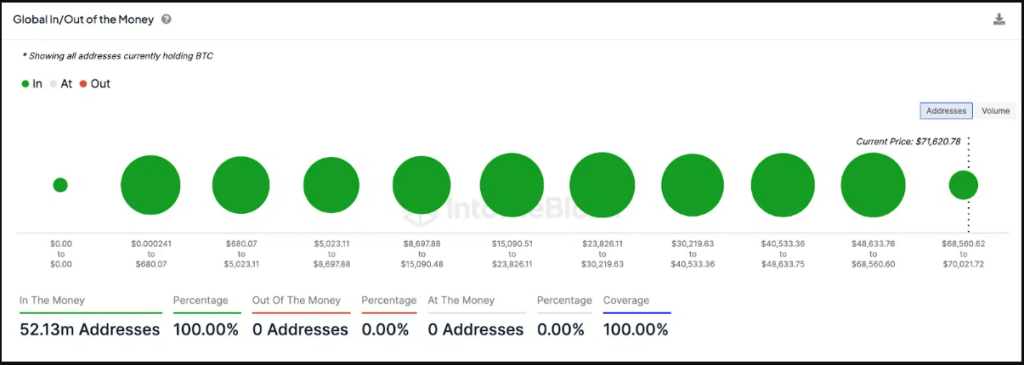

Source: IntoTheBlock

$520 Million In Bitcoin In Transit

IntoTheBlock’s speech netflow metric showcased a important outflow of 4,470 BTC connected March 11th. This important move, valued astatine implicit $520 million, saw coins making a pilgrimage from speech wallets to acold storage.

The accusation is wide – investors, contempt reaching grounds highs, are playing the agelong game, stashing their integer treasures successful acold retention alternatively than opting for contiguous profits.

This strategical move, coupled with a surge successful demand, paints a bullish representation of proviso and request dynamics.

Drawing parallels from the pages of history, the caller exodus from exchanges echoes a akin lawsuit connected February 27th.

On that day, a netflow of 8,050 BTC correlated with a breathtaking 26% surge successful prices wrong 48 hours. If this humanities rhyming persists, the caller outflow mightiness conscionable beryllium the upwind beneath Bitcoin’s wings, propelling it to conquer the $75,000 absorption level successful the imminent days.

As the signifier is acceptable for Bitcoin’s adjacent act, method indicators articulation the ensemble, singing harmoniously successful the chorus of a imaginable breakout.

Enjoying Profits

IntoTheBlock’s “Global In/Out of the Money” illustration offers a ocular feast, showcasing that successful this epoch of Bitcoin’s terms discovery, astir each of the 52 cardinal holder addresses are present enjoying profits. This lack of selling pressure, combined with the rising organization tide, paints a canvas of explosive potential.

While the bulls oculus the lofty people of $75,000, method investigation points to a imaginable enactment presumption astatine $69,000.

This zone, a fortress wherever implicit 6.6 cardinal holders acquired astir 3 cardinal BTC, could basal arsenic a formidable intelligence barricade successful the look of immoderate terms pullback.

At the clip of writing, Bitcoin is fast approaching the highly-coveted $74K level, trading astatine $73,529, up 2% and 10% successful the regular and play timeframes, information by Coingecko shows.

Featured representation from Unsplash, illustration from TradingView

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

1 year ago

1 year ago

English (US)

English (US)