Despite the macro and geopolitical risks presently heightened by Russia’s penetration of Ukraine, bitcoin (BTC) HODLers proceed to accumulate, according to blockchain information from Glassnode.

Bitcoin's terms is higher since the penetration started past week, gaining 15% successful the past 24 hours. The largest cryptocurrency by marketplace capitalization was trading astir $43,500 astatine property time.

On-chain information from Glassnode suggests it is simply a HODLer-dominated market, meaning investors are holding onto their cryptocurrency for aboriginal profits alternatively than selling.

HODLing is crypto slang, referring to a buy-and-hold strategy wherever traders enactment invested and refrain from selling erstwhile the plus terms decreases.

“Despite this precise uncertain macro and geopolitical backdrop, the behaviour of bitcoin HODLers support a remarkably bullish conviction,” said the Glassnode report, published Tuesday.

3 Charts Showing Strong Hands Stacking

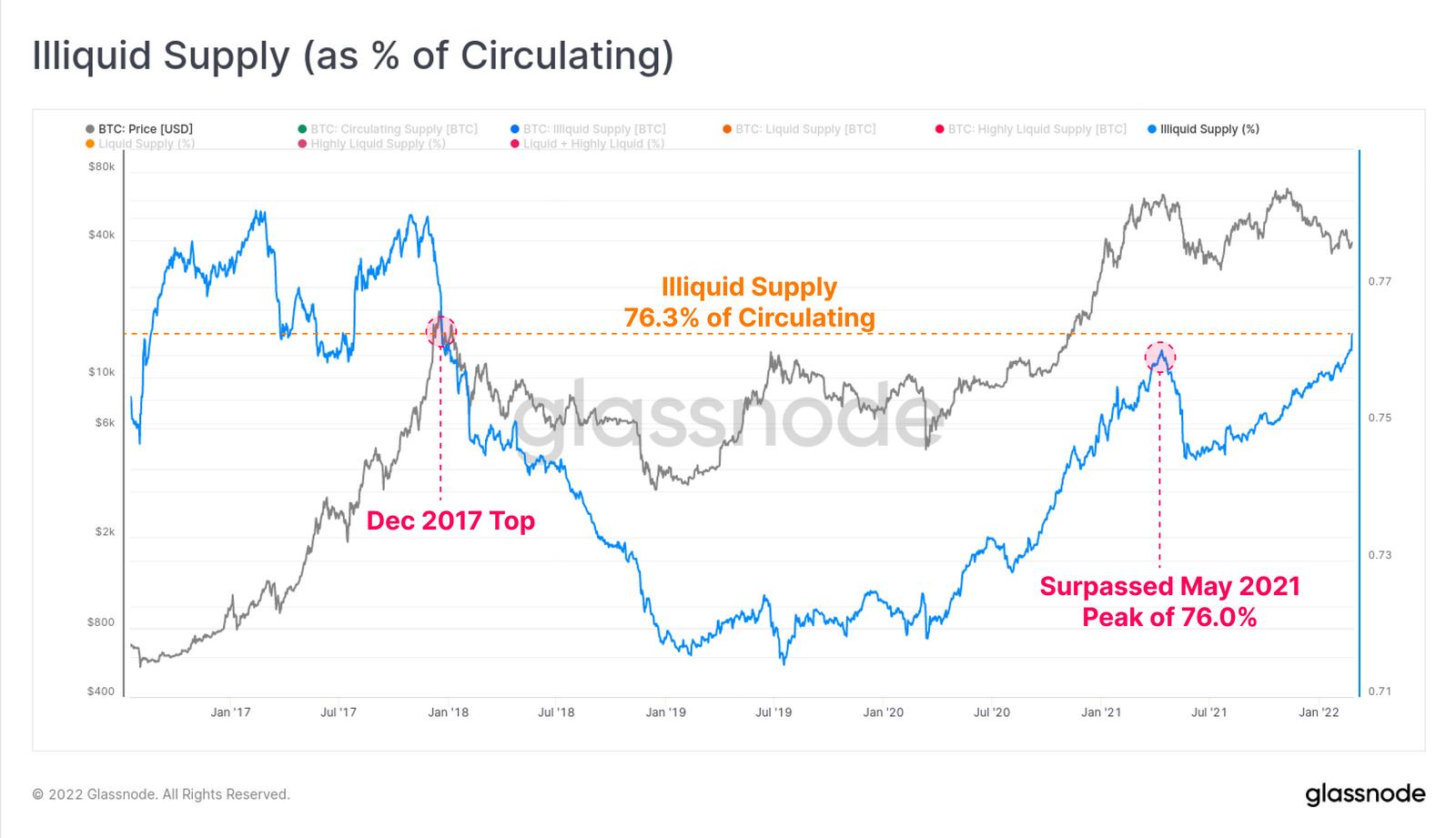

Illiquid Supply, which tracks the measurement of coins held successful wallets with small to nary past of spending, has surpassed the May 2021 peak, reaching 76%.

“We tin marque an estimation that this is likely, successful part, a motion of accumulation,” James Check, expert astatine Glassnode, said successful an email to CoinDesk.

These often correspond coins socked distant successful acold storage, oregon storing crypto offline, and the wallets of HODLers who undertake a dollar-cost averaging strategy, said Glassnode’s play report.

(Glassnode)

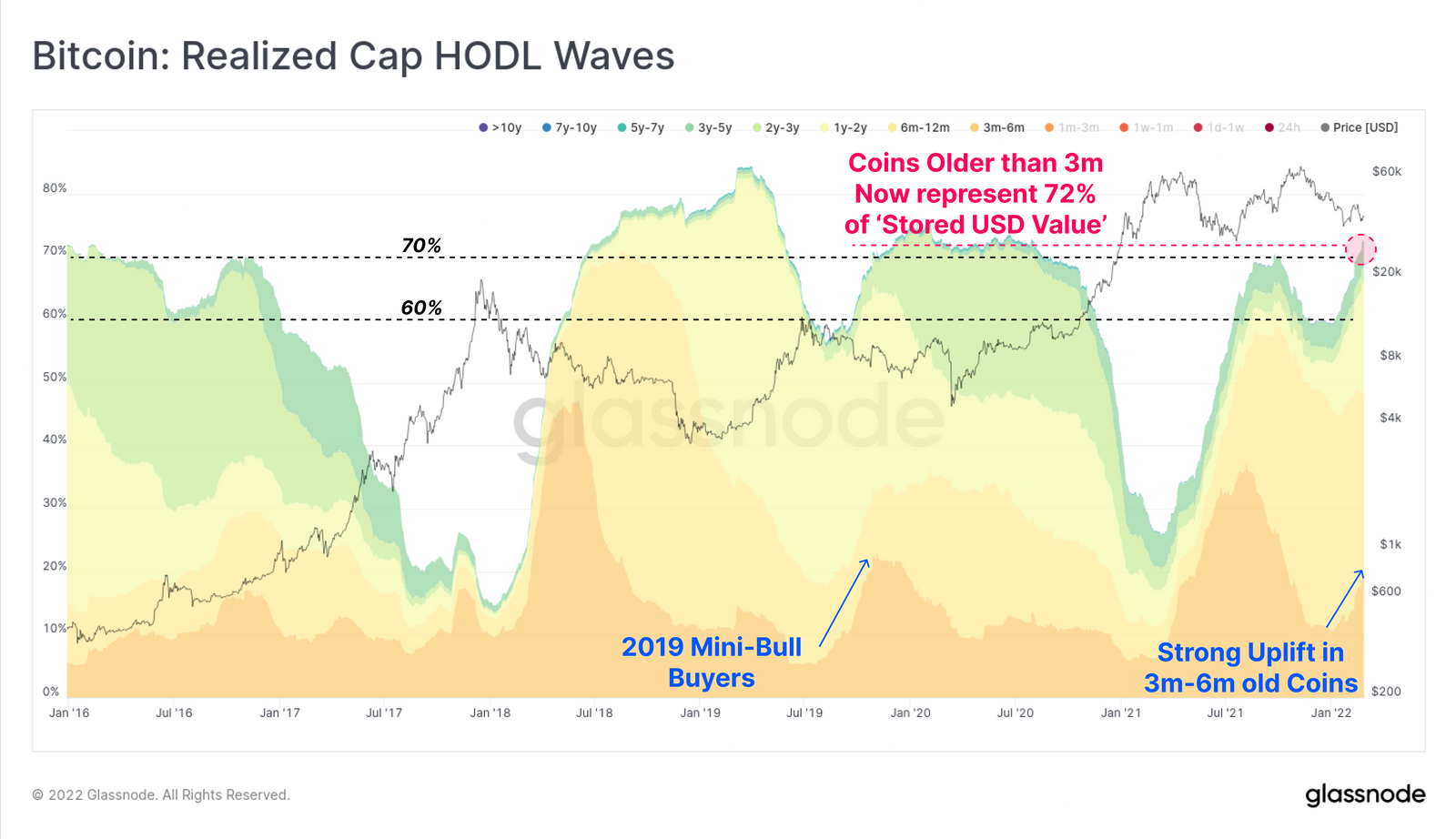

2. Realized Cap HODL Waves

The Realized Cap HODL question bands older than 3 months are pushing to caller highs of 72%. This means that 72% of the dollar worth stored successful bitcoin is held by coins 3 months and older.

“This is emblematic of carnivore markets wherever semipermanent investors spot worth and simultaneously dilatory their spending,” said the report. “Note that overmuch of this caller uplift is driven by the three-month- to six-month-old property band. These are coins that are approaching oregon successful the process of crossing the short-to-long-term holder bound of 155 days.”

(Glassnode)

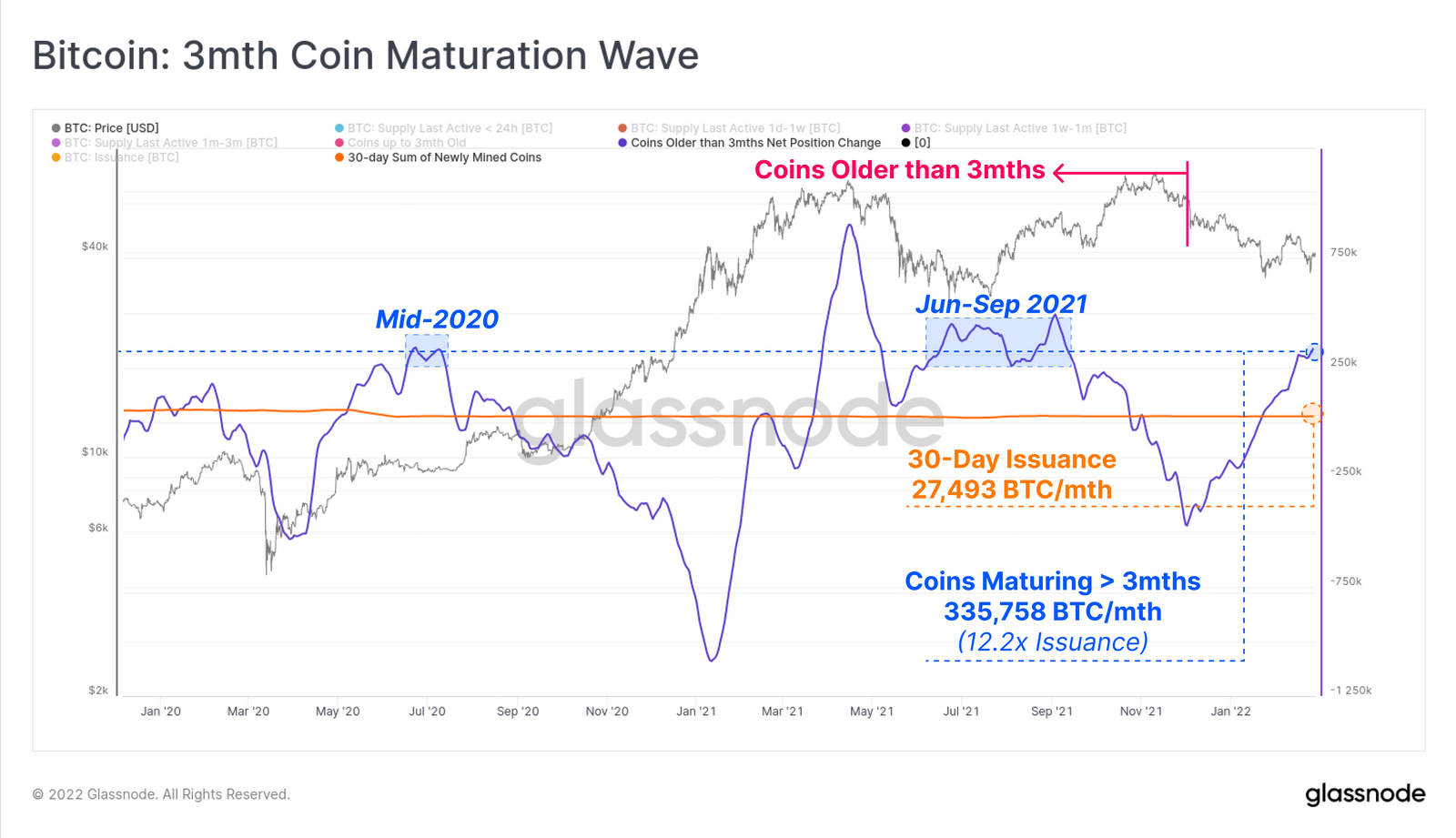

3. Three-Month Coin Maturation Wave

Glassnode information besides tracks the coin measurement crossing the three-month property threshold implicit the past 30 days.

“Statistically, the older a coin is, the much apt it is held by a 'strong hand' HODLer and little apt to beryllium spent and sold,” said Check.

A akin magnitude of HODLing behaviour was seen successful mid-2020 and June-September 2021, some of which preceded upside moves.

(Glassnode)

The study noted that though uncertainty from macroeconomic events prevails, coins proceed to beryllium withdrawn from exchanges, are moving into progressively illiquid wallets and are maturing into progressively elder property bands astatine a precocious rate.

These look similar semipermanent holder coins (wallet addresses holding bitcoin greater than a 155-day period) successful the making and truthful little apt to beryllium spent and sold, according to Glassnode.

“It is present cardinal to ticker successful lawsuit these coherent trends statesman to reverse, which whitethorn awesome broad-scale nonaccomplishment of confidence,” said the report.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Lyllah Ledesma is simply a CoinDesk Markets newsman presently based successful Europe. She holds a Masters grade from New York University successful Business and Economics and an undergraduate grade successful Political Science from the University of East Anglia. Lyllah holds bitcoin, ethereum, and tiny amounts of different crypto assets.

Subscribe to Crypto for Advisors, our play newsletter defining crypto, integer assets and the aboriginal of finance.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

2 years ago

2 years ago

English (US)

English (US)