Bitcoin's (BTC) 15% rally toward $30,300 betwixt June 19 and June 21 caught astir traders by surprise, triggering $125 cardinal successful liquidations of leveraged abbreviated futures contracts. Narrowing down the trigger for the rally is complicated, but immoderate analysts constituent to the imaginable inflow of organization investors if Blackrock’s exchange-traded money (ETF) application gets regulatory approval.

— Joe Consorti ⚡ (@JoeConsorti) June 15, 2023ARK Invest CEO and main concern serviceman Cathie Wood explained the rationale for the firm’s bullishness connected Bitcoin price, much specifically their $1 cardinal target. According to Wood, adjacent successful a deflationary environment, Bitcoin tin inactive outperform by offering a solution to the accepted fiscal system’s counterparty risk.

Furthermore, the antagonistic regulatory unit eased connected June 16 aft Binance speech was capable to onslaught a impermanent agreement with the U.S. Securities and Exchange Commission (SEC) to debar a imaginable plus freeze. The lawsuit further cemented Bitcoin bears’ accidental to nett connected the $715 cardinal play BTC options expiry.

Bears made a mistake erstwhile BTC terms dropped beneath $25,000

Bitcoin’s terms dropped beneath $26,300 connected June 10, fueling bearish bets by traders utilizing enactment contracts. Such a level was lone recouped connected June 16, which explains wherefore bears person concentrated their bets connected Bitcoin prices trading beneath $27,000.

Deribit Bitcoin options aggregate unfastened involvement for June 23. Source: Deribit

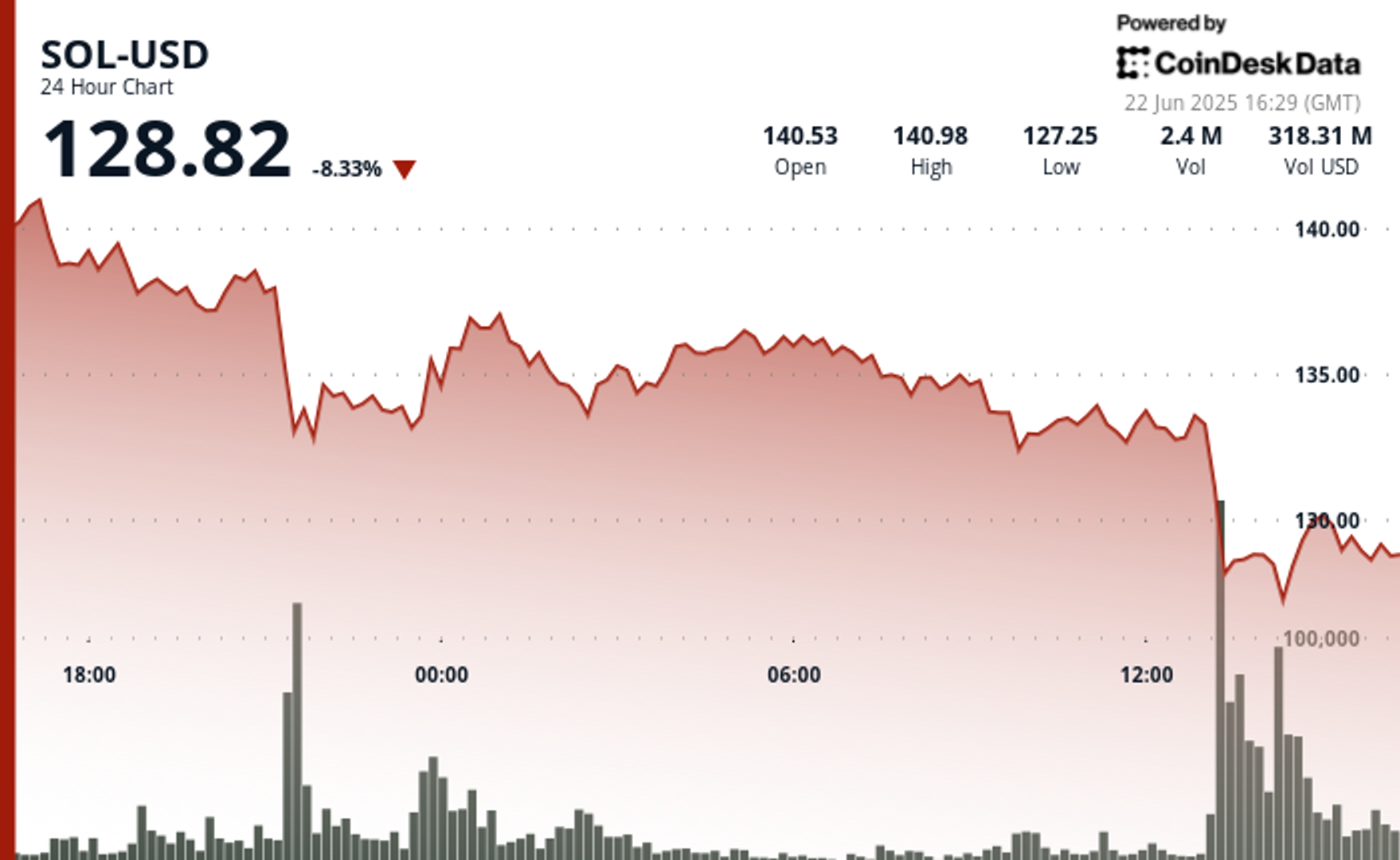

Deribit Bitcoin options aggregate unfastened involvement for June 23. Source: DeribitThe 0.82 put-to-call ratio reflects the quality successful unfastened involvement betwixt the $415 cardinal telephone (buy) options and the $300 cardinal enactment (sell) options. However, the result volition beryllium little arsenic bears were caught by astonishment arsenic Bitcoin gained 10% successful 2 days.

For instance, if Bitcoin's terms remains adjacent $29,800 astatine 8:00 a.m. UTC connected June 23, determination volition beryllium lone $5 cardinal successful enactment options. This favoritism arises since the close to merchantability Bitcoin astatine $28,000 oregon $29,000 is rendered void if BTC trades supra that connected the expiry.

Bulls are successful a bully presumption to seizure a $250 cardinal profit

Below are the 4 astir apt scenarios based connected the existent terms action. The fig of options contracts disposable connected June 23 for telephone (buy) and enactment (sell) instruments varies depending connected the expiration price. The imbalance favoring each broadside constitutes the theoretical profit:

- Between $27,000 and $28,000: 3,500 calls vs. 1,200 puts. The nett effect favors the telephone (buy) instruments by $60 million.

- Between $28,000 and $29,000: 7,300 calls vs. 500 puts. The nett effect favors the telephone instruments by $195 million.

- Between $29,000 and $30,000: 8,600 calls vs. 100 puts. The bulls' vantage increases to $250 million.

- Between $30,000 and $31,000: 10,400 calls vs. 0 puts. Bulls person full control, profiting $310 million.

This unsmooth estimation considers lone enactment options successful bearish bets and telephone options successful neutral-to-bullish trades. Nonetheless, this oversimplification excludes much analyzable concern strategies. A trader, for example, could person sold a telephone option, efficaciously gaining antagonistic vulnerability to Bitcoin supra a circumstantial price, but this effect is hard to estimate.

Related: Singapore MAS proposes integer wealth standards with large manufacture players

Bears volition apt effort to downplay the aggregate Bitcoin exchange-traded funds (ETF) applications, including Blackrock’s and WisdomTree’s. Meanwhile, bulls should intimately show the regulatory changes, including the ongoing Binance exchange’s probe successful France, arsenic the Paris Prosecutor’s Office reportedly cited “acts of amerciable workout of the relation of a work supplier connected integer assets (PSAN), and acts of aggravated wealth laundering.”

The captious level for the play expiration is $28,000, but it is intolerable to foretell the result owed to accrued cryptocurrency regulatory risks. If bulls are capable to nett $250 cardinal oregon higher, those funds volition astir apt beryllium utilized to further fortify the $28,000 support.

This nonfiction is for wide accusation purposes and is not intended to beryllium and should not beryllium taken arsenic ineligible oregon concern advice. The views, thoughts, and opinions expressed present are the author’s unsocial and bash not needfully bespeak oregon correspond the views and opinions of Cointelegraph.

2 years ago

2 years ago

English (US)

English (US)