With today’s merchandise of the Personal Consumption Expenditure (PCE) terms scale by the Bureau of Economic Analysis, the Bitcoin marketplace conscionable experienced the astir important macro lawsuit of the week. Ahead of the Federal Open Market Committee (FOMC) of the US Federal Reserve (Fed) connected May 2-3, each eyes were connected the PCE today.

The second is known arsenic the Fed’s favourite ostentation gauge. (versus CPI). It measures prices paid by consumers for home purchases of goods and services and excludes nutrient and energy.

The baseline was arsenic follows: February’s halfway PCE scale was +0.3% connected a monthly basis, beneath the forecast of +0.4%. For March, analysts expected an summation of +0.3%. On an annualized (YoY) basis, an summation of 4.5% was expected, a flimsy driblet from the erstwhile month’s 4.6%.

Hitting expectations oregon immoderate “positive” surprises were expected to beryllium bullish for the Bitcoin market. Renowned expert Ted (@tedtalksmacro) stated up front: “Bulls privation to proceed seeing it inclination south!” and added the chances for a bullish astonishment were good: “CPI + PPI prints earlier successful the month, astatine slightest for now, suggests that the way of slightest absorption is for little ostentation numbers.”

PCE Slightly Impacts Bitcoin Price

These expectations were so met. As reported by the Bureau of Economic Analysis, halfway PCE came successful astatine 0.3% connected a monthly basis, arsenic expected. On an yearly basis, halfway PCE fell to 4.6%, besides delivering the expected number.

BREAKING: US PCE information is out!

Headline y/y 4.2% vs 4.1% expectation

Headline m/m 0.1% vs 0.1% expectation

Core y/y 4.6% vs 4.58% expectation

Core m/m 0.3% vs 0.3% expectation

— Markets & Mayhem (@Mayhem4Markets) April 28, 2023

Bitcoin terms reacted successful enactment with expectations. At the clip of writing, BTC was sticking to the terms level astir $29,300.

The large question, however, volition beryllium whether advancement successful warring ostentation is capable for Fed Chairman Jerome Powell. In a telephone prank with a fake Ukraine President Volodymyr Zelenskyy yesterday, Powell acknowledged that determination are astatine slightest 2 much complaint hikes coming, followed by a agelong play of precocious involvement rates with important antagonistic effects connected the US system and the US labour market.

Powell besides stated that a recession successful the United States is likely. “This is what it takes to get ostentation down. By cooling disconnected the system and cooling disconnected the labour marketplace ostentation comes down. We don’t cognize of immoderate painless mode for ostentation to travel down.”

In a prank telephone with a fake Zelenskyy Jerome Powell, Chairman of the Federal Reserve, admits astatine slightest 2 much upcoming involvement complaint hikes followed by a agelong play of precocious rates with important antagonistic effects connected the US system and the US labour market. https://t.co/vDb19Ed5ux

— Kim Dotcom (@KimDotcom) April 27, 2023

What Will The Fed Make Of The Data?

After the latest macro data, Fed Funds Futures traders expect a probability of much than 80% for a 25 ground points (bps) complaint hike adjacent Wednesday. The probability according to the CME FedWatch Tool was 88% earlier the merchandise of the PCE. After the release, the fig remained astatine this level.

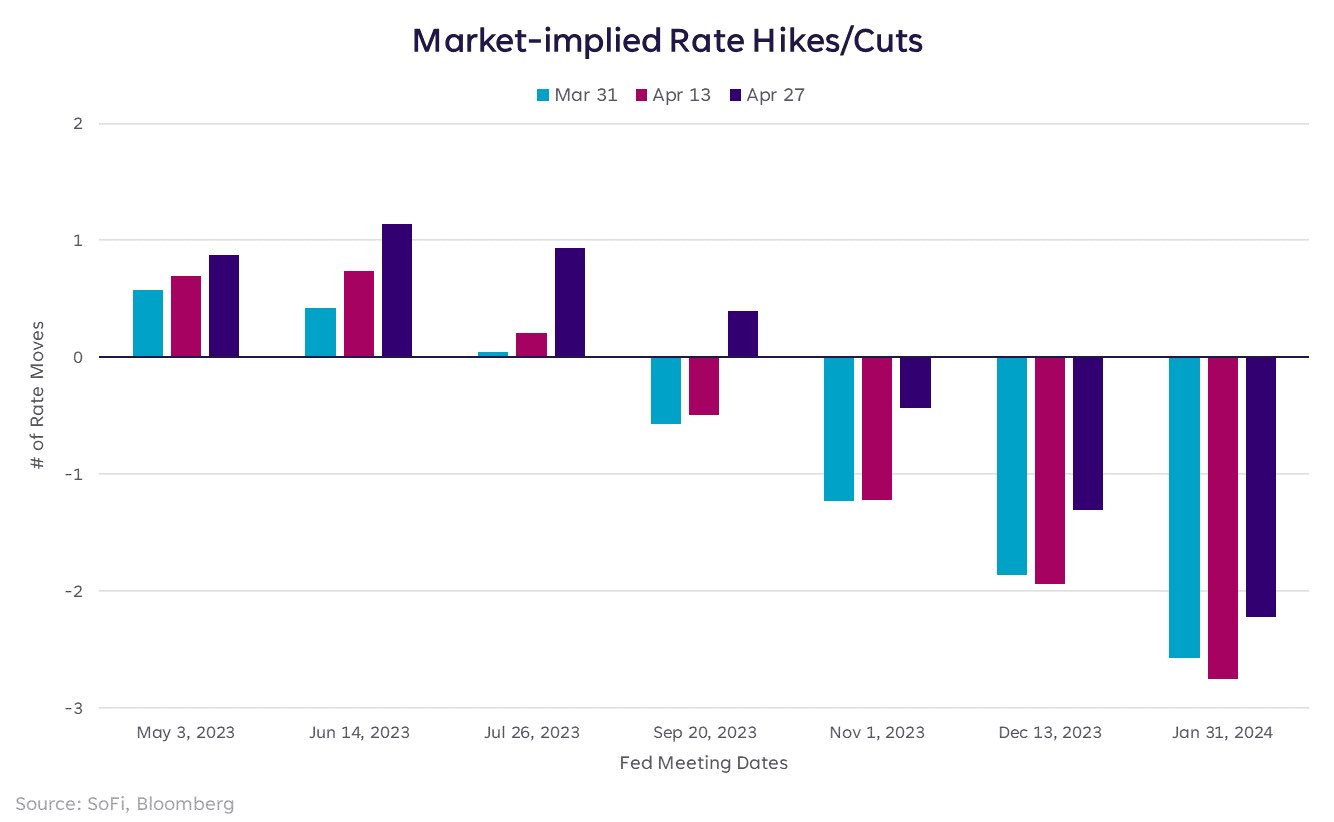

Still, the marketplace is calling Powell’s bluff. Liz Young, caput of concern strategy astatine SoFi shared the illustration beneath and stated anterior to the PCE release:

Market pricing implies 88% likelihood of a complaint hike adjacent week, up from earlier successful the month. Some traders are starting to stake connected a hike successful June arsenic well, but that’s little certain. Either way, markets inactive deliberation we’re going to get aggregate cuts aboriginal successful 2023 & aboriginal 2024.

Market-implied complaint hikes / cuts | Source: Twitter @LizYoungStrat

Market-implied complaint hikes / cuts | Source: Twitter @LizYoungStratToday’s merchandise is not expected to alteration this. On the different hand, a 2nd question of slope failures is presently brewing successful the US with First Republic Bank. Higher involvement rates are apt to propulsion much determination banks to their limit. Bitcoin could erstwhile again beryllium the beneficiary, arsenic the Fed can’t hike arsenic precocious arsenic they would privation to.

At property time, the Bitcoin terms stood astatine $29,314.

BTC price, 4-hour illustration | Source: BTCUSD connected TradingView.com

BTC price, 4-hour illustration | Source: BTCUSD connected TradingView.comFeatured representation from iStock, illustration from TradingView.com

2 years ago

2 years ago

English (US)

English (US)