Bitcoin's ascent stalled adjacent the 200-day mean level arsenic Luna Foundation Guard (LFG), a non-profit enactment focused connected UST, slowed its complaint of buying the largest cryptocurrency.

LFG has purchased conscionable implicit 2,830 BTC, worthy $134 cardinal astatine the existent spot marketplace terms of $47,400, this week, the foundation's confirmed bitcoin code shows. Notably, each the purchases took spot connected Monday. Last week, it acquired astir $125 cardinal of BTC each week day.

"We haven't seen large purchases since March 28," Arcane Research's Vetle Lunde told CoinDesk successful a Twitter chat. "Last week, LFG sent $125 cardinal worthy of USDT crossed each weekdays and $160 cardinal connected Saturday to Jump Trading, who executed the BTC trades rapidly thereafter." USDT is the awesome for tether, the world's largest stablecoin by marketplace value.

LFG announced past period that it had raised $1 cardinal done an over-the-counter merchantability of LUNA, the autochthonal token of the Terra blockchain, to physique a bitcoin-denominated reserve arsenic an further furniture of information for Terra's decentralized dollar-pegged stablecoin UST, the fourth-largest stablecoin. The backing circular was led by Jump Crypto and Three Arrows Capital.

The instauration accrued the size of its bitcoin reserve to $3 cardinal aboriginal this period and has been utilizing tether to acquisition BTC. Tether helps users bypass marketplace volatility by maintaining a 1:1 peg with the U.S. dollar.

"The reserve volition assistance support a UST peg to the dollar during downward peg deviations," Lunde told CoinDesk successful a Telegram chat. The coin has been capable to retail the dollar peg by issuing and destroying LUNA tokens. For each UST created, $1 worthy of Luna is burned connected the Terra blockchain.

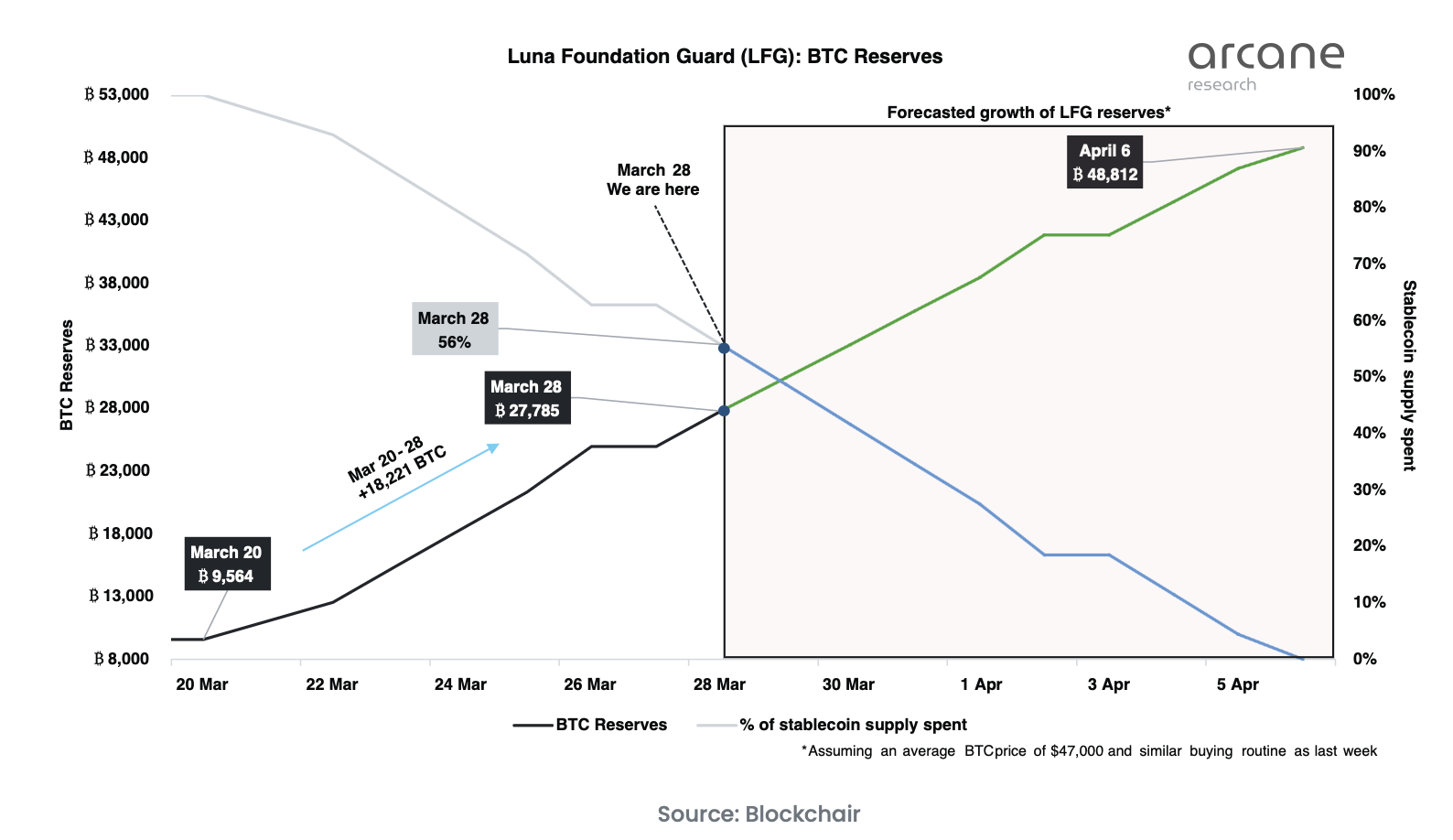

LFG has accumulated 27,785 BTC worthy $1.3 billion, topping the archetypal people of $1 billion. The foundation's ether code present has stablecoins worthy $988 million, which tin beryllium utilized to money further BTC purchases. It could get an further $800 cardinal by converting its UST holdings to tether.

While determination is nary look oregon frequence for executing purchases and nary deadline for gathering the reserve, the process would beryllium completed successful the adjacent 2 weeks if LFG reverted to it erstwhile buying pattern.

"If LFG continues to bargain astatine a akin complaint arsenic past week and the $800 cardinal is not converted, LFG volition finalize gathering the BTC reserve connected April 6. Assuming a unchangeable BTC terms of $47,000 until April 6, LFG volition person 48,800 BTC successful its reserve erstwhile finished," Lunde said successful Tuesday's blog post.

"If LFG besides spends its $800m UST reserves connected BTC, this process volition beryllium finalized astir April 14, with a further *~17,000 BTC being added to the reserve, starring the reserves to scope 65,000 BTC," Lunde added.

The accusation is that, astatine slightest for the short-term, the way of slightest absorption for bitcoin appears to beryllium connected the higher side. Terraform Labs laminitis and CEO Do Kwon recently tweeted that LFG could yet summation the size of the reserve to $10 billion.

Bitcoin was past trading adjacent $47,500, small changed connected the day. The cryptocurrency roseate astir 13.5% past week, the biggest single-week percent emergence since April 2021, information provided by charting level TradingView show. According to Arcane Research, LFG's purchases astir apt contributed to lifting the marketplace and the foundation's enactment indispensable beryllium intimately tracked successful coming days.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Sign up for Market Wrap, our regular newsletter explaining what happened contiguous successful crypto markets – and why.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)