Bitcoin held captious enactment adjacent arsenic accepted hazard assets dipped amid greater prospects of an aboriginal complaint hike by the U.S. Federal Reserve (Fed).

The apical cryptocurrency by marketplace headdress roseate 1% to $46,300, ensuring a continued compression successful a four-week trading scope of $45,400-$52,100. On Tuesday, the little extremity of the trading scope came into play, but sellers failed to propulsion done the long-held support.

Asian stocks dipped on with the S&P 500 futures and tech-heavy Nasdaq futures. Gold posted marginal gains portion copper and different growth-sensitive concern metals faced losses. The anti-risk currencies similar the U.S. dollar, Swiss franc and Japanese yen traded level to positive, according to Investing.com.

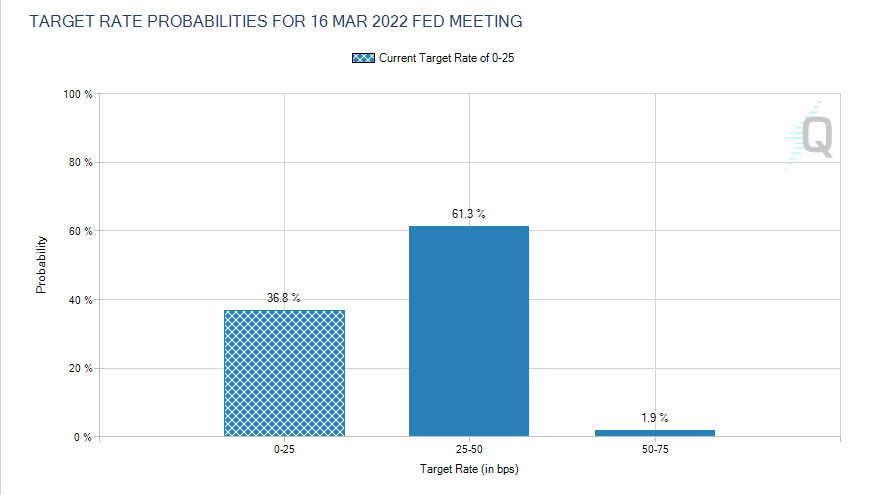

According to the CME Group’s FedWatch Tool, investors were pricing a 61% probability of a 25 ground constituent complaint hike successful March. That’s a important summation from the 25.9% probability a period ago. While past period the cardinal slope signaled 3 complaint hikes for 2022 and an extremity of liquidity-boosting plus acquisition programme successful March, it assured markets of a gradual gait of argumentation tightening.

However, a continued emergence successful the March complaint hike probability mightiness mean faster tightening - 4 complaint hikes, each delivered astatine quarterly meetings.

“If the Fed goes to 4 hikes adjacent year, that is simply a large statement. That means either 2 things. First, they are hiking successful March, which would beryllium nary spread betwixt the extremity of QE (quantitative easing) and the archetypal hike. Not impossible, but that is simply a large connection astir intent,” John Turek, the writer of the Cheap Convexity blog, said successful a blog post published connected Dec. 29. “If they don’t spell successful March and privation to spell 4 times adjacent year, that means they volition beryllium hiking astatine a complaint faster than quarterly, which is not thing they person done successful implicit a decade.”

Bitcoin and plus prices, successful general, whitethorn travel nether unit if the Fed’s December gathering minutes, owed astatine 19:00 UTC connected Wednesday, uncover an interior statement connected raising rates and starting the equilibrium expanse contraction on with the extremity of plus purchases successful March. That mightiness bolster the probability of a Fed complaint hike successful 2 months and possibly unit markets to see the anticipation of 4 complaint rises this year.

Target complaint probabilities for Fed gathering successful March (CME)

“Balance-sheet simplification could beryllium started concurrently with the archetypal complaint hike,” Andrew Hollenhorst, main U.S. economist astatine Citigroup, said successful a report, according to Bloomberg. “If the archetypal hike occurred successful March, it is imaginable that the committee would simply proceed to taper purchases resulting successful a simplification successful the size of the equilibrium expanse concurrent with the archetypal complaint hike.”

The Fed’s equilibrium expanse has much than doubled to $8.75 trillion since the commencement of the coronavirus situation successful March 2020, starring to plus terms inflation. The equilibrium expanse enlargement is acceptable to extremity with the termination of the plus acquisition programme successful March.

While bitcoin is wide touted arsenic a harmless haven by the crypto community, it is besides an emerging exertion and delicate to monetary argumentation tightening.

Tech rhythm arsenic represented by Nasdaq to S&P 500 ratio (TradingView)

The absorption would besides beryllium connected policymakers’ presumption of employment and ostentation up of Friday’s U.S. nonfarm payrolls report, which is expected to amusement the system added 424,000 jobs and the unemployment complaint slipped to 4.1% successful December.

Bitcoin could prime up a bid if the minutes amusement that astir policymakers were against the thought of controlling ostentation astatine the disbursal of the labour marketplace strength, implying slower complaint hikes. (Policy tightening tin bring down inflation, but it hurts businesses.)

Last month, Fed Chairman Jerome Powell said that the cardinal slope needed to displacement its absorption from maximum employment to preventing ostentation from becoming entrenched. So portion the minutes and Friday’s payrolls study whitethorn inject immoderate volatility into the crypto market, a wide directional bias whitethorn look adjacent week aft the merchandise of the U.S. ostentation data.

Subscribe to Crypto for Advisors, our play newsletter defining crypto, integer assets and the aboriginal of finance.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

4 years ago

4 years ago

English (US)

English (US)