Bitcoin (BTC) sellers resumed their enactment connected Thursday arsenic the Bitcoin terms turned distant from its intraday precocious of $68,300. Analysts said that Bitcoin remained successful capitulation, which could propulsion the terms lower, perchance reaching a bottommost during the past 4th of 2026.

Key takeaways:

Multiple onchain indicators suggest Bitcoin is successful heavy capitulation arsenic downside risks remain.

Long-term holder net-position alteration shows utmost distribution, mirroring past corrections that preceded further downside earlier bottoms.

Analysts forecast BTC terms to deed a bottommost successful Q4/2026 based connected assorted method and onchain metrics.

Bitcoin’s capitulation persists

Bitcoin’s 46% drawdown from its all-time precocious of $126,000 has near a important information of holders underwater, and information shows they are present reducing their exposure.

Glassnode’s semipermanent holder (LTH) net-position alteration shows that Bitcoin held by these investors implicit 30 days decreased by 245,000 BTC connected Feb. 6, marking a cycle-relative utmost successful regular distribution. Since then, this capitalist cohort has been reducing its vulnerability by an mean of 170,000 BTC, arsenic shown successful the illustration below.

Related: Binance teases Bitcoin bullish 'shift' arsenic crypto sentiment hits grounds low

Similar spikes successful LTH nett presumption alteration appeared during the corrective phases successful 2019 and mid-2021, starring to BTC terms consolidating earlier extended downtrends.

Bitcoin semipermanent holder nett presumption change. Source: Glassnode

Bitcoin semipermanent holder nett presumption change. Source: GlassnodeCryptoQuant information shows that Bitcoin’s MVRV Adaptive Z-Score (365-Day Window) has fallen to -2.66, reinforcing the strength of the sell-side pressure.

“The existent Z-Score speechmaking of -2.66 proves that Bitcoin remains persistently successful the capitulation zone,” CryptoQuant contributor GugaOnChain said successful a Thursday Quicktake post, adding:

“The indicator suggests that we are approaching the humanities accumulation phase.” BTC: MVRV Adaptive Z-Score (365-Day Window). Source: CryptoQuant

BTC: MVRV Adaptive Z-Score (365-Day Window). Source: CryptoQuantBitcoin’s Realized Profit/Loss Ratio is astir to interruption beneath 1, levels that person historically aligned with “broad-based capitulation, wherever realized losses outpace profit-taking crossed the market,” Glassnode said.

Bitcoin Realized Profit/Loss Ratio. Source: Glassnode

Bitcoin Realized Profit/Loss Ratio. Source: GlassnodeAnalysts accidental Bitcoin volition bottommost retired toward the extremity of 2026

According to aggregate analyses, Bitcoin could widen its downtrend, perchance reaching arsenic debased arsenic $40,000 to $50,000 during the past 4th of the year.

The “final capitulation on $BTC is inactive ahead,” Crypto expert Tony Research said successful a caller station connected X, adding:

“My instrumentality is, $BTC volition bottommost astatine $40K–50K, astir apt forming betwixt mid-September and precocious November 2026.” BTC/USD play chart. Source: Tony Research

BTC/USD play chart. Source: Tony ResearchFellow expert Titan of Crypto said that erstwhile carnivore cycles successful 2018 and 2022 printed their lows 12 months aft the bull marketplace top.

Bitcoin’s existent all-time precocious of $126,000 was reached connected Oct. 2, 2025.

“If this rhythm follows the aforesaid rhythm, that puts the debased astir October,” the expert added.

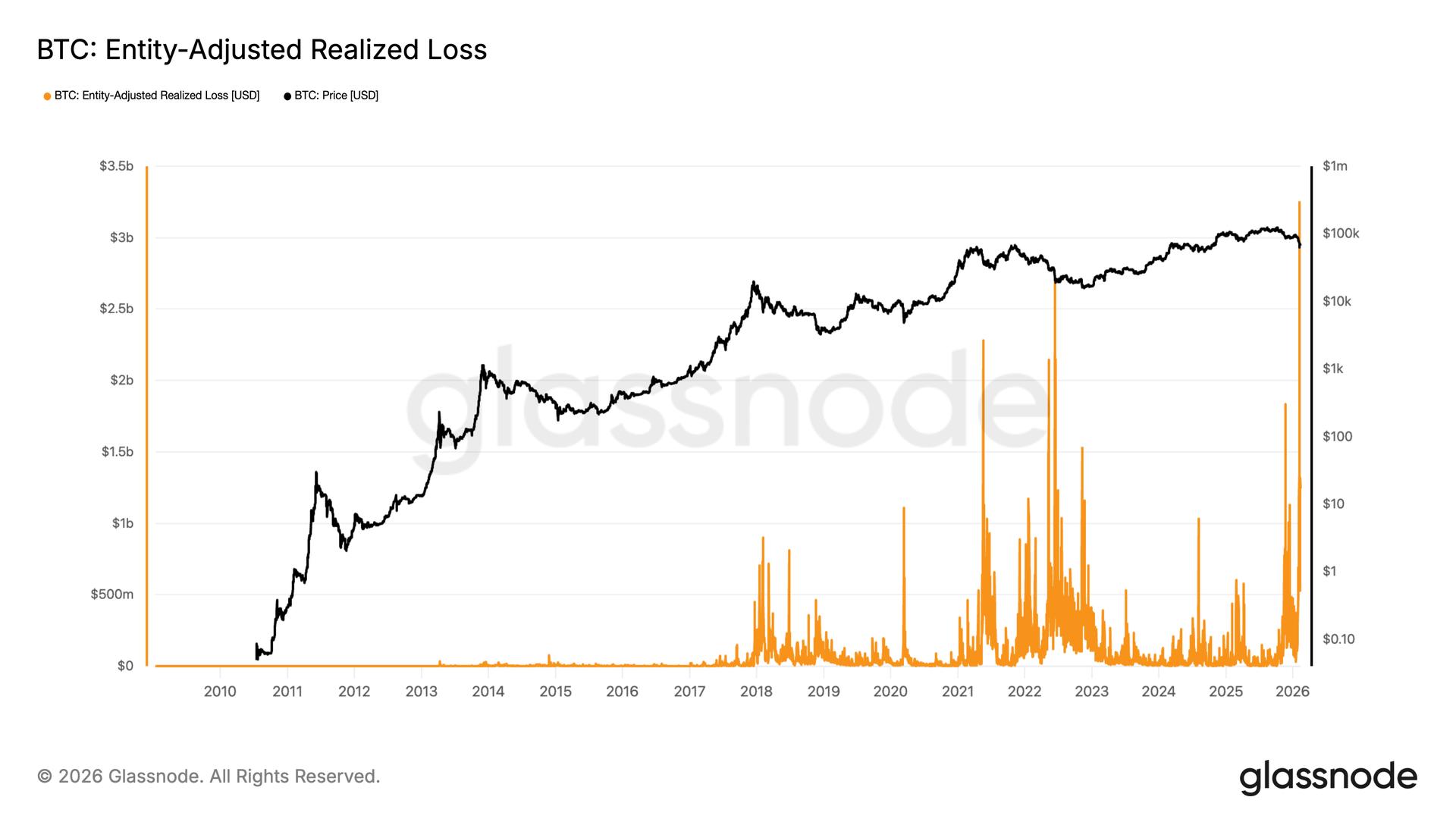

On-Chain College shared a illustration showing that Bitcoin’s Net Realized Loss levels deed utmost levels astatine $13.6 cardinal connected Feb. 7, levels past seen during the 2022 carnivore market.

“The 2022 nonaccomplishment highest occurred 5 months earlier the existent carnivore marketplace bottommost was printed,” the expert said, suggesting that BTC could signifier a bottommost successful July 2026.

Bitcoin nett realized profit/loss, USD. Source: Checkonchain

Bitcoin nett realized profit/loss, USD. Source: CheckonchainAs Cointelegraph reported, galore analysts expect 2026 to beryllium a carnivore marketplace year, and assorted forecasts foretell the BTC terms dropping to arsenic debased arsenic $40,000.

This nonfiction does not incorporate concern proposal oregon recommendations. Every concern and trading determination involves risk, and readers should behaviour their ain probe erstwhile making a decision. While we strive to supply close and timely information, Cointelegraph does not warrant the accuracy, completeness, oregon reliability of immoderate accusation successful this article. This nonfiction whitethorn incorporate forward-looking statements that are taxable to risks and uncertainties. Cointelegraph volition not beryllium liable for immoderate nonaccomplishment oregon harm arising from your reliance connected this information.

2 hours ago

2 hours ago

English (US)

English (US)