Bitcoin (BTC) enthusiasts are keeping a adjacent oculus connected the latest marketplace trends, and the caller insights from Glassnode’s co-founders, Jan Happel and Yann Allemann, person stirred up a caller question of excitement.

The duo, known by their Negentropic grip connected the societal media level X, person shared immoderate compelling perspectives that shed airy connected the existent dynamics of the BTC market.

Bitcoin’s marketplace request has outpaced its supply, a wide motion of robust affirmative momentum.

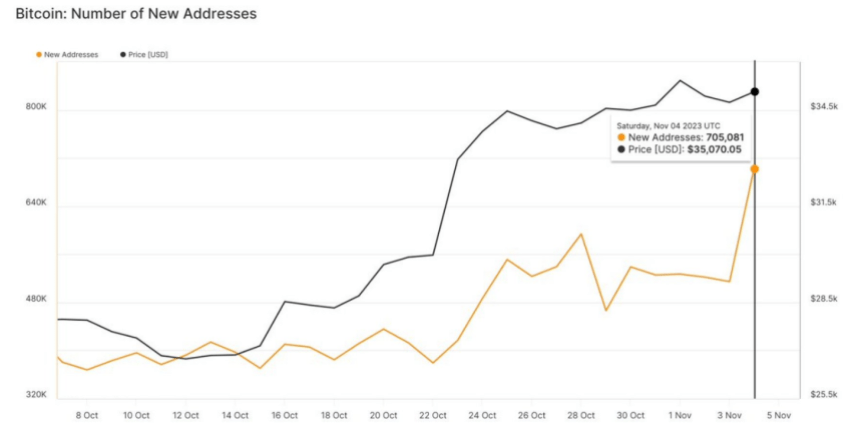

In conscionable 1 day, a whopping 700,000 caller BTC addresses joined the network. This enlargement is considered 1 of the astir reliable indicators for terms predictions.

With less BTC coins… pic.twitter.com/zAcgFc9LkS

— 𝗡𝗲𝗴𝗲𝗻𝘁𝗿𝗼𝗽𝗶𝗰 (@Negentropic_) November 6, 2023

Surging Market Demand And Supply Imbalance

Happel and Allemann’s caller reflection of the surging marketplace request outpacing BTC’s proviso has triggered a question of optimism among investors. They emphasized the singular influx of a staggering 700,000 caller BTC addresses wrong a azygous day, highlighting this enlargement arsenic 1 of the astir promising indicators for BTC terms predictions.

As the fig of BTC coins successful circulation decreases, the co-founders expect an upward unit connected buying bids, perchance driving the BTC terms adjacent higher.

As of now, the existent terms of BTC, according to CoinGecko, stands astatine $35,255, with a 2.0% summation successful the past 24 hours and a 2.7% summation implicit the past week.

Unpredictable Shifts In Market Dynamics

A person look astatine the existent authorities of the BTC marketplace reveals a dynamic scenery wherever buyers are expected to clasp a proactive approach, perchance entering the marketplace without waiting for important dips.

The co-founders’ investigation suggests that the accelerated gait astatine which BTC is evolving has created an situation wherever investors are compelled to marque timely decisions, starring to an intensified buying spree and consequent upward unit connected the cryptocurrency’s valuation.

The caller surge successful the utilization of Bitcoin futures and options has captured the attraction of some the media and seasoned investors. Glassnode’s Happel and Allemann speculate that this expanding request for leverage is chiefly fueled by investors’ anticipation of 2 highly bullish catalysts slated for 2024.

The archetypal catalyst revolves astir the long-awaited imaginable for a spot BTC Exchange-Traded Fund (ETF), a improvement that could importantly boost organization adoption and thrust further request for BTC.

Secondly, the imaginable of the Bitcoin halving lawsuit has emerged arsenic different almighty incentive, drafting the attraction of investors who expect a consequent scarcity-driven terms surge.

As the BTC marketplace continues to germinate and seizure the attraction of some seasoned investors and newcomers alike, the observations and insights shared by Glassnode’s co-founders service arsenic invaluable signposts, guiding marketplace participants done the intricate maze of cryptocurrency investments and marketplace dynamics.

The latest developments successful the satellite of Bitcoin constituent to a marketplace successful which request is outstripping supply, perchance mounting the signifier for a bullish run.

(This site’s contented should not beryllium construed arsenic concern advice. Investing involves risk. When you invest, your superior is taxable to risk).

Featured representation from Shutterstock

2 years ago

2 years ago

English (US)

English (US)