The ascendant crypto communicative for 2024 has been organization adoption. From the U.S. support of spot bitcoin (BTC) exchange-traded funds to the burgeoning fig of companies pledging to bargain the largest cryptocurrency for their treasuries, crypto has entered, much than ever before, the mainstream conversation.

Bitcoin has accrued astir 130% this year, breaking grounds highs connected respective occasions. It is presently hovering adjacent the intelligence threshold of $100,000. The ETFs approved successful January person seen nett inflows of $36 cardinal and amassed implicit 1 cardinal BTC.

In addition, the fig of publically traded companies saying they're adding bitcoin to their firm treasury is accelerating. The trend, which started with MicroStrategy (MSTR) successful 2020, precocious attracted KULR Technology (KULR), a shaper of vigor retention products for the abstraction and defence industries. The Houston, Texas-based institution said it bought 217.18 BTC for $21 million and is allocating up to 90% of the surplus to currency to BTC.

Now Bitwise Asset Management, which already has spot bitcoin and ether ETFs, has applied for an exchange-traded money to way the shares of companies that clasp astatine slightest 1,000 BTC successful treasury. Other requirements for the fund, dubbed Bitwise Bitcoin Standard Corporations ETF, are a marketplace capitalization of astatine slightest $100 million, a minimum mean regular liquidity of astatine slightest $1 cardinal and a nationalist escaped interval of little than 10%, according to the Dec. 26 filing.

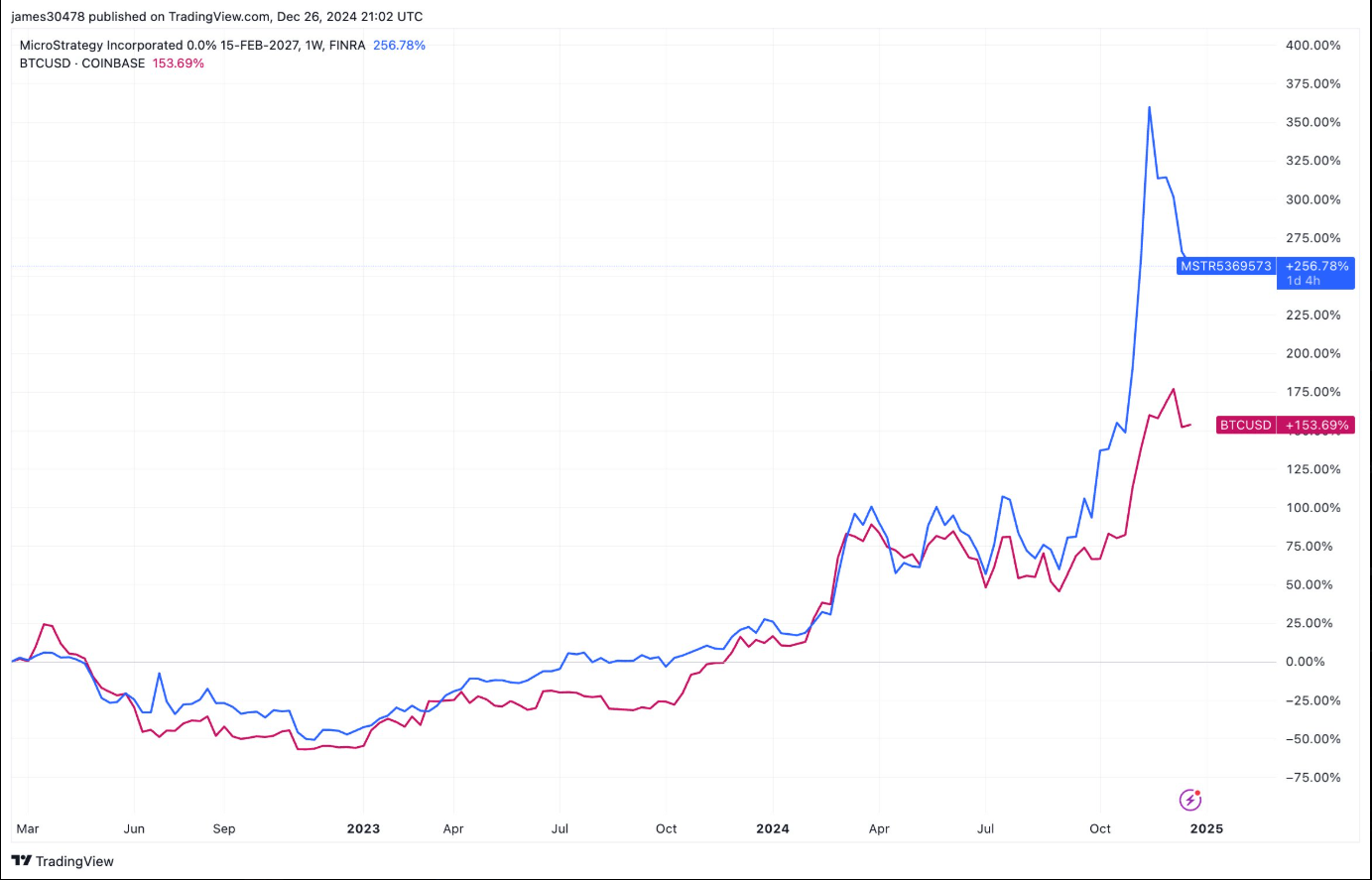

A 2nd Thursday filing was made by Strive Asset Management, co-founded by Vivek Ramaswamy, a person successful the medication of U.S. President-elect Donald Trump. The Bitcoin Bond ETF seeks vulnerability done derivative instruments specified arsenic MicroStrategy's convertible securities successful an actively managed ETF. The bonds person been a monolithic success. The 0% coupon enslaved maturing successful 2027 is priced astatine 150% supra par and has outperformed bitcoin since inception.

"Since our inception, Strive has called retired the semipermanent concern risks caused by the planetary fiat indebtedness crisis, inflation, and geopolitical tensions," Strive CEO Matt Cole told CoinDesk. "We powerfully judge determination is nary amended semipermanent concern to hedge against these risks than thoughtful vulnerability to bitcoin."

"Strive's archetypal of galore planned bitcoin solutions volition democratize entree to bitcoin bonds, which are bonds issued by corporations to acquisition bitcoin. We judge these bonds supply charismatic risk-return vulnerability to bitcoin, yet they are not disposable to beryllium purchased by astir investors," helium added.

9 months ago

9 months ago

English (US)

English (US)