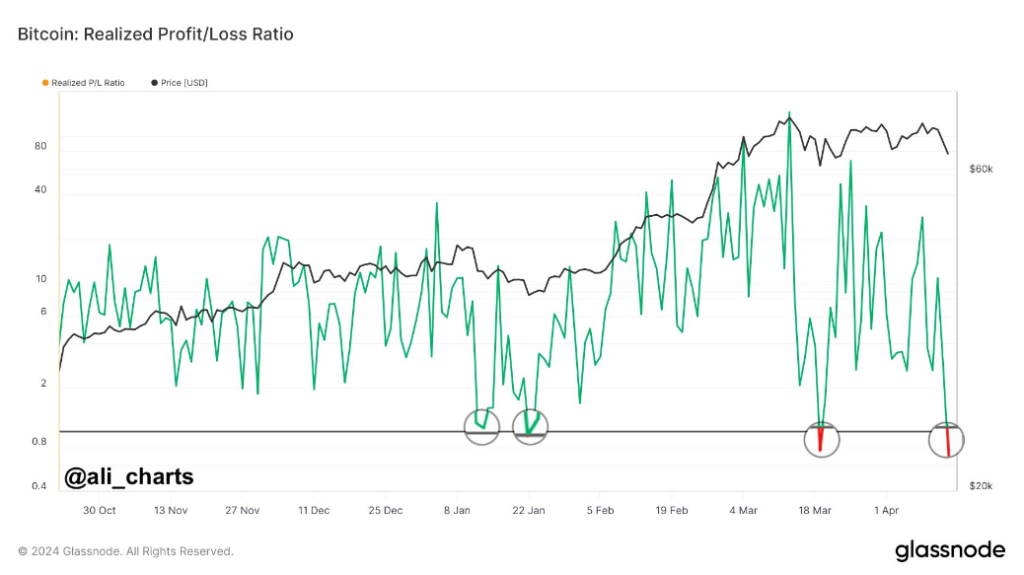

Investors are bracing themselves for a rollercoaster thrust arsenic Bitcoin, the flagship integer asset, navigates done choppy waters. Recent information from Glassnode has revealed a noteworthy development: the Realized Profit/Loss Ratio for Bitcoin has dipped beneath one.

This important metric, which compares the merchantability worth of Bitcoin with the terms astatine which it was bought, indicates that investors are presently realizing much losses than profits. Historically, specified a dip has often heralded a imaginable bottoming retired of Bitcoin’s price, serving arsenic a captious awesome for marketplace watchers.

Sense Of Optimism Despite Bitcoin Price Decline

The past 24 hours person witnessed important volatility successful Bitcoin’s terms trajectory. A crisp decline aboriginal successful the time saw Bitcoin’s terms plummet to astir $64,000, worrying galore investors.

However, a singular betterment ensued, with the terms steadily climbing and peaking astatine astir $66,000. This robust rebound has instilled a consciousness of optimism, with a prevailing bullish sentiment taking clasp arsenic the time progressed.

Institutional involvement successful Bitcoin continues to grow, with caller developments signaling imaginable shifts successful superior inflows. The support of a spot Bitcoin ETF by Hong Kong regulators has opened the floodgates for accrued organization engagement, peculiarly from Asia.

This determination could inject caller superior into Bitcoin markets, perchance fueling further terms momentum. Furthermore, determination dynamics play a important relation successful shaping capitalist sentiment and behavior. Varying concern trends crossed antithetic regions item the divers responses to prevailing marketplace conditions.

While immoderate regions whitethorn grounds cautious sentiment amidst volatility and geopolitical uncertainties, others whitethorn clasp Bitcoin arsenic a hedge against ostentation and currency devaluation.

Critical Support Levels

Bitcoin expert Willy Woo has pinpointed a captious enactment level astatine $59,000. Breaching this threshold could signify a modulation into a bearish marketplace sentiment. Conversely, there’s anticipation among investors for imaginable abbreviated liquidations that could thrust the terms upwards, perchance reaching betwixt $70,000 and $75,000, provided that existent enactment levels clasp steady.

These anticipated events hinge connected marketplace liquidity and capitalist reactions to the rapidly evolving terms movements. As Bitcoin continues its consolidation signifier adjacent all-time highs, investors stay cautiously optimistic astir its aboriginal prospects.

The upcoming halving event adds different furniture of complexity to the already intricate marketplace dynamics, with expectations of heightened volatility successful the days ahead.

Analysts suggest that this play of lateral question serves arsenic a important signifier for the redistribution of assets among investors, perchance laying the groundwork for a much sustainable betterment successful the agelong run.

The cryptocurrency market, peculiarly Bitcoin, is navigating done a play of heightened uncertainty and volatility. The caller dip successful the Realized Profit/Loss Ratio signals a imaginable turning constituent successful Bitcoin’s terms trajectory, portion organization involvement and determination dynamics proceed to signifier marketplace sentiment.

Featured representation from Pexels, illustration from TradingView

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

1 year ago

1 year ago

English (US)

English (US)