The existent origin of bitcoin’s caller pullback and however the Davos globalist docket plays a role.

This is an sentiment editorial by Andrea Bianconi, a probe adjunct astatine the Idaho Freedom Foundation, which is simply a nationalist argumentation deliberation tank.

An investigation of the fundamentals, caller geopolitical and macroeconomic events and their interaction connected Bitcoin’s future.

Introduction

In the past fewer months, fiscal markets person lost implicit 30% from their highs arsenic the Federal Reserve Board took distant the punchbowl from the intoxicated marketplace players by hiking involvement rates, and present recession (stagflation) seemingly looms.

The yen and the euro are inflating similar processing countries’ currencies.

Inflation and commodities detonate higher.

The spark for WWIII has been lit successful Ukraine — unbeknownst to the ignorant and brainwashed masses who deliberation that this is conscionable a section struggle and that “peace” tin beryllium reached successful spite of Western nations selling unlimited quantities of weapons into the warfare and pouring billions of "freshly printed" U.S. dollars and euro indebtedness into the conflict, adding substance to the fire.

Then we person the suicidal sanctions, which are destroying the economies of the Western sanctioning countries alternatively than the sanctioned Russia.

After all, it is wide to anyone with a functioning encephalon that 10 years of sanctions person made Russia wholly decoupled and immune from Western economical warfare.

And finally, the icing connected the cake, bitcoin has died for the 459th time successful its abbreviated 12-year history.

Financialization Is The Problem

As I person expected and warned astir successful this February 2021 article, the increasing financialization of the manufacture could go an existential menace for Bitcoin. Wall Street has brought its accustomed playbook — excessive indebtedness and leverage — to their darling DeFi cryptocurrency assemblage drafting a assemblage of suckers and shitcoiners who were allowed to leverage their bitcoin equity 100x oregon much to speculate connected altcoins similar LUNA. The leveraging and deleveraging process is good described successful this ZeroHedge nonfiction here. All this is bully until, sooner oregon later, world hits. Shitcoins are invariably revealed for what they yet are, usually scams, and the lone existent plus posted arsenic collateral (bitcoin) is past sold to screen the losses. Then the deleveraging causes a cascading liquidation of collateralized bitcoins. The suckers are wiped retired and the astute wealth buys backmost the bitcoin connected the cheap.

While 1 of the biggest purposes of Bitcoin is to “be your ain bank,” DeFi alternatively aims astatine recreating the fiat fractional banking strategy with each its risks and hazards. This Bitcoin Magazine article correctly points out: “Crypto lending shops specified arsenic Celsius are fractional reserve banks successful principle; nevertheless this clip determination is nary ‘lender of past resort’ successful the signifier of a cardinal slope to bail retired the founders and their clients erstwhile things crook sour.”

“Let’s marque 1 happening clear: a output ever has to travel from somewhere. To make a affirmative output connected a scarce plus specified arsenic bitcoin, the instauration offering said output has to leverage the clients’ deposits successful assorted ways. And whereas banks look beardown regulatory requirements arsenic to what they tin bash with the lawsuit deposits (such arsenic bargain treasuries, facilitate owe loans etc.), cryptocurrency lending companies look nary specified regulatory requirements, truthful they fundamentally spell and enactment their customers’ deposits into casinos of assorted kinds — DeFi output farming, staking, speculating connected obscure altcoins."

While this wash-and-rinse rhythm is thing caller for seasoned Bitcoiners — and 1 tin reasonably reason that it is needed to cleanable up the marketplace from excesses — I consciousness that determination is 1 new, worrying and much obscure broadside to it this time.

Bitcoin In Davos Crosshairs And What Everyone’s Missing

As I wrote successful this bid of articles Part 1 here and Part 2 here, Bitcoin represents the “wrench thrown successful the engine” of the globalist agenda: planetary money, planetary authorities and consequent planetary enslavement. As determination is nary applicable mode to halt Bitcoin adoption (since it is simply a afloat decentralized, immutable, uncensorable peer-to-peer colony plus and parallel outgo strategy with cash-like finality), the lone mode is to effort to demonize it. This is done utilizing the accustomed FUD and mainstream media scare maneuver campaigns and — arguably much efficaciously — by causing its terms to driblet substantially acknowledgment to smartly engineered attacks connected highly leveraged shitcoins wherever bitcoin is utilized arsenic collateral.

The Terra/LUNA illness is an example. We bash not cognize for definite whose fiat fake wealth was down the attack. Both Blackrock and Citadel — among the astir influential Davos players successful advancing the globalist docket – were rumored to person played a cardinal relation successful the attack, nevertheless they officially denied involvement. The thought remains, though, successful bid to get 100,000 bitcoin worthy astir $3 cardinal to propulsion disconnected the onslaught you indispensable beryllium a large subordinate — oregon astatine slightest person idiosyncratic with large pockets to backmost you up. It volition beryllium astir intolerable to larn wherever the wealth came from.

Until the existent fiat-based strategy — which grants to the fewer adjacent capable to the spigots of “fake” wealth the “great privilege” to combat wars, colonize and enslave others astatine nary outgo — collapses, past the monolithic magnitude of fiat-based indebtedness created ex nihilo volition beryllium ever utilized by the privileged fewer to expropriate existent assets similar golden oregon bitcoin. This is the main crushed wherefore 1 should support nonstop custody of his/her bitcoin and not play the corrupted fiat crippled with DeFi and shitcoins.

Bitcoiners Should Stay Away From Altcoins And DeFi

Alternative cryptocurrencies and DeFi successful the extremity are thing but the latest casino playground for Wall Street. The problems are well-known: excessive leverage, derivatives, derivatives of derivatives successful an endless concatenation of liabilities, contagion and spiraling insolvencies erstwhile things crook sour. There’s 1 large quality though: successful cryptocurrency and DeFi determination is nary Fed to bail risk-takers out. Unfortunately bitcoin is the lone coagulated cryptocurrency plus with nary counterparty hazard which tin beryllium utilized arsenic collateral successful the sector. Therefore bitcoin volition ever beryllium taxable to utmost volatility successful lawsuit of insolvencies successful the sector. This is not the archetypal clip nor the past it volition happen.

Ultimately, DeFi’s artificial output crippled volition play against one’s bitcoin stash. Every bitcoin which is near successful third-party custody oregon alternatively pledged arsenic collateral, volition beryllium utilized against its eventual owner. It volition beryllium lent retired oregon collateralized successful a spiraling crippled of leverage with shitcoins and un-stablecoins. When prices spell down this triggers borderline calls and the liquidation of the lone existent plus pledged arsenic collateral successful a cascading effect of ever-increasing borderline calls and liquidations to screen the losses. In the extremity 1 volition suffer some the speculative altcoin presumption and the collateralized bitcoins. By utilizing the structural weaknesses of fragile protocols similar Terra/LUNA, astute players tin trigger borderline calls and liquidations thereby gaining some from shorting the shitcoin, betting safely against bitcoin connected the futures marketplace (they are causing the terms driblet truthful it is simply a harmless bet) and past closing the positions by buying the suckers’ bitcoin connected the cheap. They tin further treble the stake by going agelong connected the futures marketplace arsenic well. An casual and harmless stake fixed capable “firepower.” And accepted concern has plentifulness of firepower acknowledgment to the leveraged debt-based fiat system. Unless of course, Bitcoiners yet aftermath up and halt playing successful DeFi’s casino and halt collateralizing their bitcoin.

Reality Check: Bitcoin Is Stronger Than Ever

Truth is, similar astir of bitcoin’s pullbacks before, this 1 excessively has precise small to bash with Bitcoin itself.

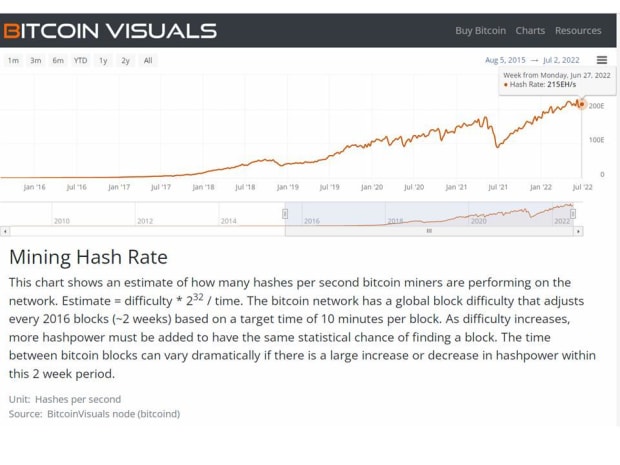

The protocol is stronger than ever. The pursuing charts volition springiness you an thought of the exponential maturation of the network.

Figure 1 — Hash Rate

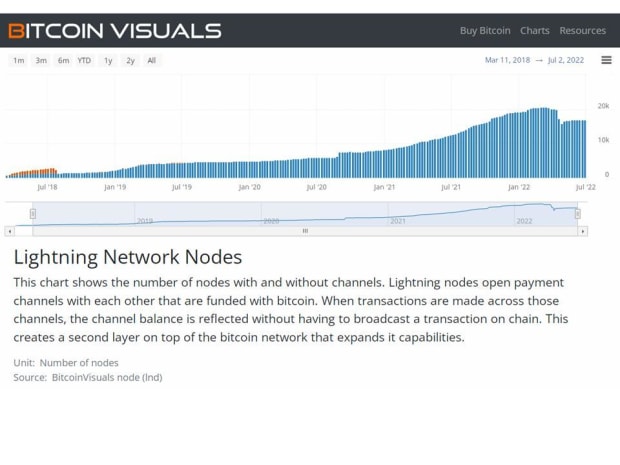

Figure 1 — Hash RateThe maturation of the Lightning Network — which is simply a existent proxy for Bitcoin’s adoption chiefly successful the East and planetary South — has been impressive. Here is the chart:

Figure 2 — Lightning

Figure 2 — LightningLightning tin grip 1 cardinal transactions per second, portion Visa handles 24,000 per second. The web has been expanding its capableness and is presently handling astir 4,000 BTC connected nationalist channels.

Kraken, a large cryptocurrency exchange, has present added Lightning to its modular outgo options and it has released an intelligence report showing precise absorbing information connected Lightning maturation and adoption.

According to the Kraken Report "Lightning usage has been connected a steep upwards trajectory since precocious 2020, increasing parabolically successful September 2021 corresponding with the instauration of BTC arsenic ineligible tender successful El Salvador. Still, nationalist metrics bash not picture the afloat grade of Lightning adoption due to the fact that of the fig of users successful the Lightning ecosystem utilizing backstage channels."

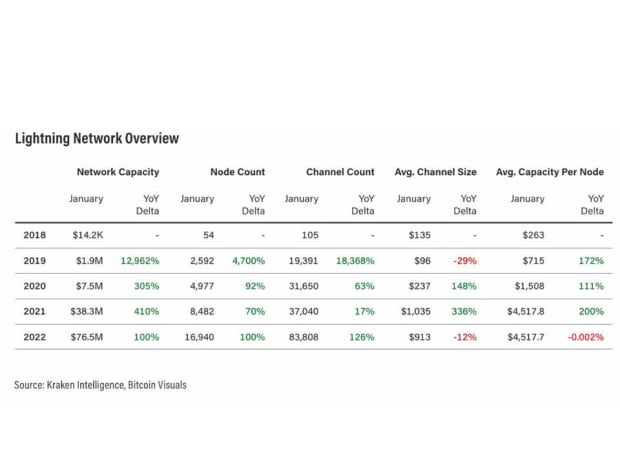

Figure 3 — Lightning Nodes

Figure 3 — Lightning NodesRegarding the Lightning nodes´growth (Figure 2), Kraken states "Furthermore, the maturation successful the sheer fig of Lightning nodes indicates that the web is opening to spot galore caller participants. Nodes saw continuous maturation from 2018 to precocious August 2020, rising from 54 to 6,134. However, node maturation has since gone parabolic, rising implicit 176% to 16,940 nodes astatine the clip of writing. Lightning node maturation has proliferated truthful accelerated that determination are present astir 1,000 much Lightning nodes than Bitcoin nodes. Should adoption proceed to turn astatine this rate, the Lightning web could recognize BTC’s imaginable arsenic a mean of speech plus — an indispensable diagnostic for planetary wealth that was antecedently a bottleneck for BTC going mainstream."

Among processing countries El Salvador has been starring the way towards Bitcoin adoption. While I person been and stay captious of the risky strategy adopted by the country, I assistance that President Bukele has taken a “revolutionary” step, and a humanities 1 for a nation-state. Therefore, El Salvador’s occurrence remains fundamental for Bitcoin’s aboriginal adoption among processing countries. So acold El Salvador´s results are encouraging.

In this interrogation President Bukele states that a ample information of the antecedently unbanked colonisation whitethorn present financially transact with bitcoin. President Bukele stated, “If it works, wherefore would immoderate different state not privation to bash the aforesaid thing? Imagine a state similar El Salvador, which had 75% of radical unbanked. Imagine successful a twelvemonth from now, that's down to 10%. We person been trying for, I don't know, 30 years to slope our people, and it has been impossible, due to the fact that they don't spot the banks, due to the fact that the banks don't privation to springiness work to them, due to the fact that the services are excessively expensive, whatever.”

More importantly though, Salvadoran citizens volition save implicit $400 million per twelvemonth successful fees from nonstop remittances from expatriates abroad. This is implicit 2.5% of the country’s gross home merchandise (GDP). This was a large origin successful making the determination to follow Bitcoin. And this fig tin lone summation since the outgo of remittances done intermediaries — which presently stands betwixt 5% to implicit 20% — volition spell down to practically zero. So if you are a Salvadoran expatriate and you presently effort to bounds remittances, you excavation them successful the largest imaginable transactions to trim the interaction of the fees. If you present person substantially zero fees utilizing bitcoin via the Lightning transmission past you could remit adjacent a tiny magnitude whenever you person the chance.

No uncertainty galore processing countries are looking astatine El Salvador’s acquisition and are preparing to travel successful its steps.

Bitcoin Is The Best Form Of Money Ever Invented So Far

Sound wealth has ruled quality monetary past portion an unconstrained fiat wealth modular has been the peculiar lawsuit of lone the past 50 years. While the taxable of dependable wealth and fiat wealth successful monetary past is not the intent of this article, I inactive request to marque an important point.

Money has been chiefly a technological issue. Technology has ever dictated the modulation from a little technological signifier of wealth to a superior one. Think astir the modulation from primitive forms of wealth to golden and metallic acknowledgment to the invention of coinage and the standardization of value successful past Greece (for a bully past of wealth work Dr. Saifedean Ammous’ "The Bitcoin Standard"). The cardinal crushed wherefore golden was abandoned arsenic wealth was due to the fact that it could not beryllium moved done abstraction and clip astatine the aforesaid velocity of accusation and commerce arsenic caller technologies appeared. Historically, the banking assemblage was calved to arbitrage the accidental created by technological developments by initially substituting gold´s cumbersome circulation with convenient to usage insubstantial “IOUs” afloat backed by golden reserves held astatine the bank. The adjacent measurement was to determination to a fractional reserve strategy partially backed by golden and, erstwhile capable spot was built into the fractional fiat system, the fractional reserve plus was wholly abandoned to conveniently instal an unbacked fiat currency strategy based solely connected insubstantial claims, which talented the “elites” with the riches and privileges granted by the Cantillon effect: a five=decade sleight of manus which is coming, 1 mode oregon another, to an end.

So it was technological advancement and the laws of physics which rendered golden obsolete and impractical arsenic a bearer plus for financial/business transactions successful modern times. Gold could lone service arsenic a reserve asset. This was the existent crushed for its demise arsenic a bearer colony plus archetypal and for its afloat demonetization later.

Bitcoin´s revolutionary exertion wholly changes that paradigm.

Nowadays determination is nary accidental to arbitrage clip and abstraction successful fiscal transactions by offering soft/unsound wealth solely due to the fact that it moves faster than hard money. Bitcoin fills that gap.

Not lone tin nowadays bitcoin question faster than fiat money, but it besides has the further advantages — arsenic a bearer colony plus — to person cash-like contiguous finality, much security, full immutability and implicit scarcity

Bingo.

Therefore, arsenic acold arsenic exertion is concerned, Bitcoin is simply a superior signifier of wealth compared to thing humanity has ever experienced truthful far. 12 years aft its instauration inactive thing compares to Bitcoin, afloat stop.

While it remains intolerable to forecast what the people of its adoption and its monetization process volition beryllium successful the aboriginal — due to the fact that that volition beryllium connected excessively galore variables — Bitcoin is determination for everyone to use, to experimentation with and there's nary mode to enactment the genie backmost successful the bottle.

The Energy Transition And A Highly Inflationary Macroeconomic Background Will Favor Bitcoin

All the FUD thrown astatine Bitcoin has been wholly debunked successful its 12 twelvemonth history. However determination is ever thing caller coming up. Regardless of the reasons down it, this is aft each a worthwhile workout since it enables the assemblage to absorption connected captious aspects, analyse them and suggest solutions. If the critics are reasonably motivated the effect tin lone beryllium positive. The latest summation to the FUD communicative has been Bitcoin’s vigor use. The taxable is not caller and it has been precise efficaciously and rationally discussed connected galore occasions. The Bitcoin Mining Council, successful particular, has done a large occupation successful responding to the U.S. Environmental Protection Agency’s “misperceptions” astir Bitcoin mining. Here you tin find the Council’s effect missive to the EPA.

In addition, a fig of competent authors person done a large occupation successful analyzing the existent aspects of Bitcoin’s vigor usage and its complexities. Among them Nic Carter is surely 1 of the astir prolific and competent. Here you tin find each his absorbing articles connected the topic. The critics, adjacent if mostly instrumental successful the demonization of Bitcoin, had the affirmative effect of fostering a alteration successful mining operations towards the usage of residual vigor sources — which would beryllium mislaid successful immoderate lawsuit oregon would negatively interaction the situation like state flaring/venting successful lipid fields oregon using landfill methane — and the stabilization of vigor grids successful captious instances. Very important developments which the MSM has wholly disregarded, obviously.

Therefore, going guardant — contempt the debunking and the accelerated advancement of Bitcoin’s “alternative” mining — 1 should lone expect that the unit applied utilizing the vigor depletion FUD communicative volition proceed to summation successful the future.

The crushed is that clime alteration has been erected by the World Economic Forum’s Davos 2022 league arsenic their foundational communicative to warrant each sorts of restrictions connected quality activity. From praising the virtues of the destructive — for some the economies and the wellness of quality beings — COVID-19 lockdowns to the U.N. praising the virtues of famine, to the banning of Bitcoin mining oregon “unhosted” wallets. Therefore the combat against this caller benignant of FUD volition beryllium overmuch much difficult. Simply debunking their arguments with existent data, statistic and antagonistic arguments volition person small interaction against the monolithic firepower astatine their disposal successful presumption of wealth and the enactment this wealth buys from the corrupted mainstream media.

But successful the medium-long word the greenish vigor modulation communicative forced by Davos 2022 volition yet play successful favour of Bitcoin.

Energy markets adept Dr. Anas F. Alhajji points retired successful this interesting “MacroVoices” interview that “a large planetary vigor situation is inevitable. That situation is fundamentally created by our governmental leaders’ policy, which is forcing distant cardinal investments successful the lipid and state assemblage earlier the alternate replacement had realistically been phased in.”

Simply put, lone an insane idiosyncratic volition halt investing successful a cardinal assets which keeps the full system and societal beingness moving until a reliable replacement has been found. Unless of people the consequent monolithic vigor situation and the double-digit ostentation which volition beryllium arising from that “insane” argumentation is precisely what they privation and what they need. Indeed, successful summation to benefiting from directing hundreds of billions of freshly printed fiat currencies into the pockets of their ain ESG (environmental, societal and firm governance) players, "what they privation and what they need" is to fulfill a analyzable docket whose eventual and existent nonsubjective is NOT the "green transition" but the modulation to a caller monetary strategy to prevention their aged privileges: a monetary reset.

That is simply a cardinal constituent to beryllium noted.

What is going connected does not hap by chance. Nor it is simply the effect of the politicians’ incompetence. My content is that it is simply a deliberate argumentation choice, and the docket includes (i) inflating the excessive indebtedness away, (ii) the unavoidable (high) ostentation of the nationalist currencies volition beryllium utilized arsenic the excuse to modulation into a caller monetary strategy based connected CBDCs. Western populations - portion impoverished and annihilated by monetary ostentation - volition beryllium easy made babelike connected governmental subsidies, and they volition easy judge escaped integer currencies successful their wallets to past astatine the disbursal of their freedoms; and (iii) this volition consequently execute the last nonsubjective of installing a planetary government, a planetary wealth and the planetary enslavement of populations.

Adding to this point, macroeconomic advisor Luke Gromen, points retired successful this MacroVoices interview: “The ECB tin ne'er rise rates precocious capable to trim vigor input ostentation without blowing up the debt, erstwhile they're cutting backmost their vigor inputs from the Russians. And so, what's the effect you get? Well, you spot it successful the U.K., we're gonna commencement handing retired 400 pounds to everybody due to the fact that vigor costs person gone up, are you insane? They are virtually mounting up an vigor hyperinflation decease spiral with their currencies, which, if I'm looking astatine it from a precise Machiavellian constituent of view, there's I deliberation astir apt definite interests successful Washington that would emotion to spot that happen. Watch the Eurozone implode and get those German surpluses recycled backmost into buying Treasurys alternatively of financing, you know, Southern European deficits.”

As I write, the euro is down to parity against the dollar and is breaking beneath parity against the Swiss franc — levels not seen since precisely 20 years agone successful 2002.

So if it is ostentation that they privation connected 1 broadside of the ocean, Luke Gromen adds that it is not antithetic connected the different broadside of it: “The equilibrium expanse of the United States is our starring indicator, and it tells you that we are going to get ostentation for a agelong clip to come. And conscionable by mode of context, the 8% CPI ostentation we saw successful 2021. It took our shortage from 129% of GDP to 122% of GDP. You person to person ostentation tally higher than your involvement coupon for an extended play of time. So we request double-digit ostentation for astir apt 5 years.”

Summing up, an artificially created planetary vigor situation is successful the making and double-digit ostentation is precise apt to persist for a precise agelong clip due to the fact that — successful the extremity — this is what Western governments request to destruct their excessive debt.

To further marque the constituent determination is besides a concurrent artificially created planetary nutrient situation successful the making which — despite the West blaming of Russia — intelligibly has thing to bash with the war. This nutrient situation has been acceptable up by a fewer planetary players who person cornered the nutrient commodities market. Again, those fewer players are besides portion of the Davos elite and owned by the accustomed suspects who nett from their oligopolistic marketplace position. A fistful of planetary funds which fundamentally ain each the planetary companies: Blackrock, State Street, Vanguard, Bill Gates Foundations, George Soros, etc.

Regardless of the causes though, the highly inflationary macroeconomic inheritance which is shaping up volition beryllium nett affirmative for Bitcoin for 2 reasons:

(i) portion Davos-sponsored ESG and greenish vigor modulation projects volition neglect miserably — simply due to the fact that determination is presently not yet a viable timely alternate to fossil fuels and this volition soon unit governments to either spell backmost to much polluting alternatives similar ember (already happening successful the “green” EU) oregon simply illness — Bitcoin miners are highly flexible to respond to marketplace signs and incentives. If lipid and state prices spell done the extortion past they volition power to untapped renewable sources, since you tin excavation bitcoin successful the mediate of the godforsaken with star panels good distant from vigor grids.

(ii) The effect by governments to the vigor situation volition beryllium to people much wealth to manus retired subsidies to the impoverished citizens. This creates a highly inflationary situation which is bullish for Bitcoin, the eventual scarce asset.

The Geopolitical Background Has Never Been More Bullish For Bitcoin

The Western indiscriminate sanctions connected Russia — with the unlawful and arbitrary expropriation of Russian assets, some backstage and state-owned — unneurotic with the weaponization of the dollar and its outgo rails (SWIFT), person shown to the planetary South and the East of the satellite that the Western “democracies” are a gag and their monetary strategy is terminally ill. They whitethorn beryllium looking for alternatives to transact concern without utilizing the dollar and its outgo rails. The full satellite has learned from Russia’s hard acquisition what each Bitcoiner learns archetypal — the equivalent of “not your keys not your bitcoin.” U.S. Treasurys are not a harmless plus to ain if you bash not conform to the issuer’s diktats. Nor is it harmless to clasp “reserves” successful the dollar oregon euro currencies oregon entrust golden reserves with a Western cardinal bank. All tin beryllium seized and expropriated connected a whim. This is the acquisition that each the autarkic (or consenting to be) countries successful the satellite person learned from caller events. And the lessons won’t beryllium forgotten anytime soon.

So, portion the West has committed economical and monetary suicide, the rational stake tin lone beryllium bullish bitcoin, careless of its short-term volatility caused by the deleveraging successful the cryptocurrency space.

Why the West collectively commits economical termination though is simply a overmuch much analyzable question to answer. While this is commonly blamed connected the Western politicians’ incompetence (which is besides a factor), the truthful mentation lies with the relation that the Davos globalist elite plays successful directing those politicians who person been co-opted wrong their almighty network. The Davos elite are the puppeteers and the Western politicians are their puppets.

For anyone acquainted with however the lobbying strategy and the “revolving doors” enactment successful advancing one’s involvement and agendas astatine governmental level, it should not instrumentality a batch of imaginativeness to fig retired what Davos-supported politicians would bash to beforehand the docket of their sponsors.

Among their ranks it is not lone the Davos WEF which plays a cardinal influential relation successful nurturing and shaping the young planetary leaders of the future, but besides parallel, analyzable and interlocking networks similar the Bilderberg Meetings, the Trilateral Commission, the Atlantic Council, the Fabian Society oregon the Soros Open Society.

Image source

Image sourceMake nary mistake, those sponsored politicians are not idiots (well immoderate are …). They are precise good paid actors and they are fulfilling their relation splendidly. They are executors and they person to instrumentality an agenda. The puppeteers and their puppets cognize what they are doing.

By expropriating Russia’s assets and by weaponizing the dollar they person killed the dollar, the U.S. Treasurys and the euro arsenic reserve currencies and harmless assets. This suicidal determination of the U.S. administration cannot beryllium explained if not with the prevalence wrong the U.S. authorities of non-American interest. Indeed, alternatively than American interest, the latest moves are beneficial to a planetary authorities and planetary wealth astatine the disbursal of the reserve presumption of the U.S. dollar.

Basically, some the U.S. medication and the EU, bash not correspond their citizens anymore — rather, they correspond the pack of Davos. Independent geopolitical expert Tom Luongo shares the aforesaid view: “… that the American president, ‘as a proxy for the oligarchs successful Davos, is acting connected their behalf to yet weaken the U.S.’”

All this, aims to create the situation needed to modulation to a caller monetary system based connected a supranational/global wealth which could good beryllium the peculiar drafting rights (SDR) reserve plus of the International Monetary Fund. Under that planetary wealth a caller acceptable of nationalist integer currencies (in the signifier of CBDCs) could beryllium utilized to warrant their globalist puppet governments the precise aforesaid aged privileges which they enjoyed truthful acold successful an unconstrained fiat system: unlimited powerfulness to make integer fiat wealth and power however this is spent. Their vassals would proceed to nett from the Cantillon effect astatine the disbursal of nine and proceed to expropriate existent invaluable assets successful speech for fiat integer worthless currencies. Wealth inequality volition proceed to increase.

Global enslavement could ensue for the ignorant masses globally.

Everything changes and thing changes.

With immoderate luck though, their program present has 2 fierce adversaries. The archetypal 1 they person themselves created and it is the unexpected and unwelcome effect of their geopolitical brainsick games. The different 1 has been determination since 2009 but lone much precocious came into their crosshairs.

Russia and China, unneurotic with the remainder of the planetary South and the East, person been forced successful an inextricable confederation for endurance and independency from the West. They person had capable and person stopped playing a crippled made by idiosyncratic other with idiosyncratic else´s rules. The short-lived American unipolar planetary bid — calved successful 1989 aft the autumn of communism — ends now, and a caller multipolar bid is born. Again, this caller multipolar bid and the consequent deglobalization, should beryllium a thriving situation for Bitcoin, the embodiment of decentralization. Since golden and bitcoin are the lone existing assets with nary counterparty hazard they mightiness adjacent play a relation successful the coming monetary reset. They mightiness beryllium portion of the handbasket of currencies and/or commodities chosen to backmost up the SDR oregon immoderate other is chosen. In this nonfiction I person postulated the reasons wherefore a monetary reset mightiness mean $18,000 golden and $650,000 bitcoin.

“More apt though governments volition not usage bitcoin but lone golden successful a monetary reset. After each this is the existent plus that the biggest cardinal banks own. Bitcoin past volition go the preferred reserve plus for each non-sovereign institutions and besides tiny processing nations which person small golden reserves. In this scenario, the Bitcoin modular volition beryllium apt adopted by the bequest fiscal sector, commercialized banks (which tin usage bitcoin arsenic a reserve plus to connection a caller question of commercialized escaped banking services), corporations and individuals. Basically, the satellite mightiness beryllium utilizing 2 monetary systems mutually integrated: an precocious tier - for governments and cardinal banks - moving with SDR arsenic the planetary satellite currency fractionally backed up by golden reserves; and a little tier for tiny sovereigns, banks and individuals moving connected nationalist fiat currencies and bitcoin arsenic a reserve asset, frictionless moving betwixt fiat currencies for expenditures and bitcoin for savings. This would beryllium the perfect solution."

At slightest this is what I hope. Anything abbreviated of that volition mean a acheronian aboriginal for humanity.

Conclusions

Despite the caller terms pullback, Bitcoin’s fundamentals and its concern lawsuit are stronger than ever. Never earlier has the protocol been much secure. It continues to turn and adoption is connected the emergence particularly successful processing countries, wherever Bitcoin represents a lifesaver for millions of people. As we person seen, adjacent the astir caller geopolitical events overgarment a bullish lawsuit for Bitcoin. That inheritance though is fluid, analyzable and with truthful galore variables, it is intolerable to forecast what the outcomes volition be.

The warfare successful the bosom of Europe, the precocious hazard of an escalation extracurricular of Ukraine’s borders, the precocious ostentation and a planetary situation gathering up successful the energy, commodities and nutrient sectors and the Western currencies inflating aft years of monetary madness to money consumerism and plus bubbles alternatively than productive investment: All this should successful my sentiment compellingly nonstop investors towards the ONLY plus which acts arsenic extortion against specified analyzable and worrisome inheritance acknowledgment to its unsocial features. Bitcoin achieves implicit scarcity, existent decentralization, censorship resistance, immutability, the highest protocol security, unlimited portability, comparative anonymity and unsocial cash-like finality to settee peer-to-peer transactions successful a parallel fiscal system. But this is the archetypal clip successful past that we are astatine specified a analyzable juncture with Bitcoin truthful we volition person to spot what happens next.

Then we person the Davos variable.

The almighty fiscal elite and the caller tech oligarchs ain besides the largest mainstream media channels and publications and fundamentally each the starring planetary corporations successful an intricate web of money, powerfulness and vested involvement which is unprecedented successful caller modern history. For years they person besides funded, formed, nurtured, sponsored and shaped the minds of their vocation bureaucrats and governmental puppets and person installed them successful cardinal posts to instrumentality attraction of their interests. As they are pulling the strings to combat those non-aligned governments - which thrive for independency and bash not privation to bow to their caller planetary bid successful the geopolitical arena - you should besides expect that they volition combat Bitcoin bony and nail, since Bitcoin is THE instrumentality which enables existent independence, self-sovereignty and decentralization.

It is simply a combat betwixt 2 almighty forces. The 1 pushes towards an authoritarian globalist authorities based connected the cardinal banks’ power of caller integer money, the maltreatment of surveillance tech and the power of large data. The different is simply a afloat decentralized asymmetrical exertion which empowers the bulk of the radical implicit elitist cardinal entities acknowledgment to the unsocial operation of cryptography, encryption, trouble accommodation and POW (proof-of-work - this is wherefore POW is needed and the full statement astir POW and proof-of-stake for Bitcoin is preposterous).

It is simply a conflict betwixt a top-down authoritarian powerfulness and a bottom-up tech market-based gyration which tin bring astir the precise overmuch needed separation of State and money.

One is the acheronian Middle Ages, the different is the aboriginal American imagination and the Western frontier escaped spirit.

Someone said that being decentralized does not mean being disorganized. I agree. It is astir apt precocious clip for Bitcoiners to travel unneurotic successful an enactment akin to the Bitcoin Mining Council, astatine slightest to survey the scenarios and the inheritance that I person mentioned successful this nonfiction and someway elaborate immoderate countertactics. At slightest debating implicit specified topics volition besides bring ideas.

Count maine in.

As for the rest, Bitcoin remains “the wrench thrown successful the evil globalist engine.” It volition nary uncertainty proceed to bash its enactment against evil and for the escaped satellite provided we fto it bash what it has been programmed to do.

Being a Bitcoiner means ever holding your keys, having a debased clip penchant and

investing for the aboriginal to beryllium a escaped man.

This is simply a impermanent station by Andrea Bianconi. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc. oregon Bitcoin Magazine.

3 years ago

3 years ago

English (US)

English (US)