Globalization has occurred to people, products and corporations — but what astir our money?

Globalization + What Is Money = Bitcoin

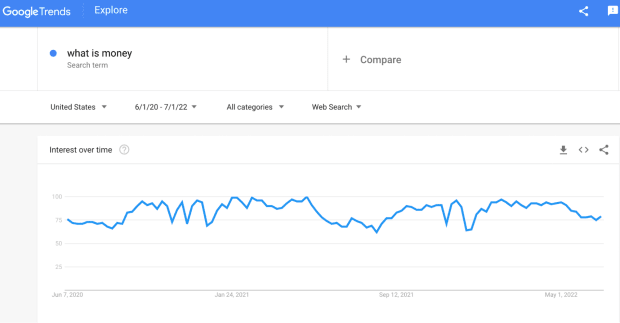

What is money? It's 1 of the much fashionable questions of the past fewer years. Especially successful 2020 and 2021, erstwhile the grand, caller U.S. medication decided to enactment arsenic if a drunken sailor had taken implicit the keys to the printing press.

“You get money, you get money, and you get …” CTRL+P … CTRL+P … CTRL+P …

So — what is money?

It’s a question I asked aboriginal successful my travel that started successful the depths of the Great Financial Crisis (GFC). I asked this question for years earlier and aft the infamous period of September 2008, erstwhile the planetary fiscal strategy crushed to a halt.

Bank Runs And Liquidity Crises

A historical day, September 16, 2008, the time of the breaking of the buck … The time erstwhile planetary wealth marketplace funds were nary longer worthy a dollar owed to a liquidity crunch manufactured by the world's astir salient banks, corporations, hedge funds, elites and planetary financiers — a crunch precipitated by professionals, not retail.

The systemic plumbing was frozen. Since May, the cryptocurrency ecosystem has been facing its ain liquidity crisis.

This caller integer plus people consists of galore caller and naive players, galore who’ve ne'er seen what happens erstwhile fiscal plumbing freezes. Pain has been felt and narratives person been shattered arsenic the meltdown and deleveraging moved crossed the intertwined system. The marketplace is taking nary prisoners, overmuch the aforesaid mode it ever does successful the accepted fiscal system. Leverage and greed are a double-edged sword. The 2 person nary mercy connected anyone successful their path. No subordinate goes unscathed. Neither did bitcoin oregon accepted markets arsenic the spillover from leverage and degen trading made its mode crossed the globe, 1 fiscal subordinate and plus astatine a time.

So, we beryllium here, facing our archetypal real and wide liquidity situation successful Bitcoin.

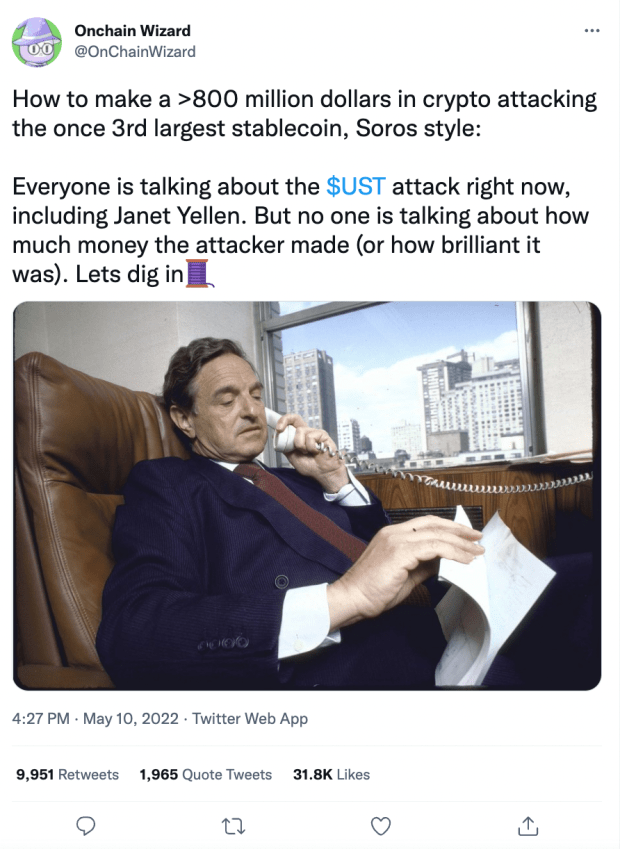

This is simply a situation precipitated by greed, exposed by Terra/LUNA’s algorithm which attempted to codify the behaviors and relation of the Federal Reserve Board. Through these mechanisms we learned they provided a installation for ex-Wall Street sharks to people as they swam amongst cryptocurrency liquidity pools, exchanges, and newly-formed cryptocurrency hedge funds.

Some things ne'er alteration … adjacent if wealth tries to.

Greed is hard to debar and hides successful plain show nether the names of yield, credit, lending and arbitrage.

We ticker headlines 1 aft different arsenic they announce the nonaccomplishment oregon merger of large “decentralized” cryptocurrency institutions. As they crumble we recognize galore of these “over-collateralized” lenders and loans whitethorn person conscionable been different alias for greed — the precise happening Bitcoin and its 21 cardinal impenetrable units are expected to assistance fix, but successful the extremity did not.

What we recovered is that the wealth mightiness beryllium different, but individuals and institutions are the same.

I conjecture determination truly are wolves successful sheep’s clothes?

What we recovered is that acquisition matters. An acquisition connected wealth is inactive sorely needed earlier Bitcoin and wealth are acceptable for globalization!

Monetary Crises Are Not New

The science and behaviour of these events are typically the same. Whether it’s 1873, 1893, 1907, 1929-1933, 2000, 2007, oregon 2020. It ever feels overmuch similar it does present — the hype, the hysteria, past the disbelief arsenic the dominoes fall.

Some person seen it earlier and immoderate are uncovering retired for the archetypal clip what it truly means to beryllium leveraged, experiencing the symptom of receiving a borderline call.

We are uncovering that contagion tin scope Bitcoin adjacent if it stems from the broader "cryptocurrency" ecosystem, arsenic galore believe. We're uncovering retired that boomers and their rocks whitethorn beryllium jaded, but whitethorn besides not beryllium wholly wrong. Every communicative is portion information and portion marketing. In challenging times, you find retired which is which.

Through symptom is learning. Through symptom determination is education. It comes with a grade from the schoolhouse of hard knocks.

Money made easily, goes easily.

Yield that sounds unreal, is unreal. It’s conscionable a substance of time.

That’s the archetypal people acquisition the assemblage learned. One collateral plus positive a borrowed collateral plus is not adjacent to to 20% risk-free yield. Some, unfortunately, volition repetition archetypal grade. Others volition determination on.

Preparing To Be Globalized Money

The full integer plus people is facing its archetypal existent trial arsenic it prepares to go planetary money. We globalized radical successful the aboriginal 1900s, we globalized corporations and products successful the 1980s and 90s, but we’ve inactive yet to globalize money. Until the globalization of wealth happens we can’t efficiently determination people, products and wealth passim the system.

What we larn from this event, from this carnivore marketplace successful bitcoin, volition assistance pb towards the globalization of money, completing the triangle of people, products and money.

The aforesaid tests were taken by corporations, manufacturers and the question manufacture arsenic they prepared to determination people, products and corporations astir the world. So, present it’s clip for wealth to basal up and instrumentality these tests arsenic well.

Bitcoin needs to beryllium it’s acceptable to beryllium a planetary money; to beryllium it’s acceptable for wide adoption.

This trial proved you can’t suffer show of the meaning of having a debased time-preference. This trial proved you can’t person 100:1 leverage, wherefore rehypothecation is atrocious and wherefore adjacent getting progressive successful an guiltless attraction to output tin get messy, truly quick.

Not your keys, not your coins conscionable became, “Hand implicit your keys, manus implicit your coins.”

Given the magnitude of leverage wiped out, we cognize determination were much wearing the not-your-keys t-shirts than determination were practicing what they preached. Today, and for the past period oregon two, individuals are nary longer asking, “What is money?” They are asking:

- Where is my money?

- What astir that output you promised?

- What is rehypothecation?

- Why, wherefore why?

The abbreviated reply is greed.

As the 21st period nears being already a 4th down us, it feels similar a bully clip to bespeak connected wherever we are, wherever we’ve been, and wherever we’re headed. To bash so, it requires reflecting connected globalization: what that means, what its interaction has been, and what it hasn’t achieved.

The Global Economy Is Integrated, But Money Is Not

This is the opportunity.

When referring to globalization, there’s nary clip similar the contiguous to punctuation our friends (below) astatine the World Economic Forum (WEF) connected the explanation of globalization.

Why? Shouldn’t we beryllium moving to the hills distant from this group?

Didn’t they origin the destruction?

Didn’t they lend to the wide psychosis of the past fewer years?

Aren’t they portion of the conspiracy the anons are against?

Frankly … who knows? I’ll fto you decide. They know. We don’t.

They’ll person to reply to the antheral upstairs astatine the pearly gates. Believers won’t person to reply for them.

All we tin bash is stitchery accusation that matters — to us, our families, our neighbors, our communities and the things that hap wrong the 4 walls of our ain households. What matters is that wealth is being globalized arsenic we speak. What matters is that the accidental astatine manus is to beryllium portion of the globalization of money, to bring it inline with the question of radical and firm products.

On the different broadside of this liquidity situation volition beryllium a satellite that operates for the archetypal clip successful a genuinely planetary nature. One wherever people, corporations, products and money flow seamlessly crossed the rails of the net arsenic needed and erstwhile needed.

So, according to the WEF, globalization is

“In elemental terms, globalization is the process by which people and goods determination easy crossed borders. Principally, it's an economical conception – the integration of markets, commercialized and investments with few barriers to dilatory the travel of products and services betwixt nations. There is besides a taste element, arsenic ideas and traditions are traded and assimilated.

Globalization has brought galore benefits to galore people. But not to everyone.”

Let’s rewrite this a little. In elemental terms, the accidental is to globalize wealth truthful that it tin determination arsenic easy crossed borders arsenic radical and goods, truthful that fewer barriers dilatory the travel of wealth betwixt nations, people, products and services. The accidental is to link ideas and integrate traditions truthful that wealth tin beryllium traded and assimilated successful manners that lucifer and are globalized successful a mode that brings payment to many, but much importantly, to everyone.

This is what the WEF, Bank of International Settlements (BIS), International Monetary Fund (IMF), World Bank and cardinal banks preach but DO NOT signifier with their siloed, self-serving non-globalized money. The accidental is to present change.

My thoughts were stirred by Lawrence Lepard’s (@LawrencLepard) comment connected a Twitter station by Otavio Costa (@TaviCosta).

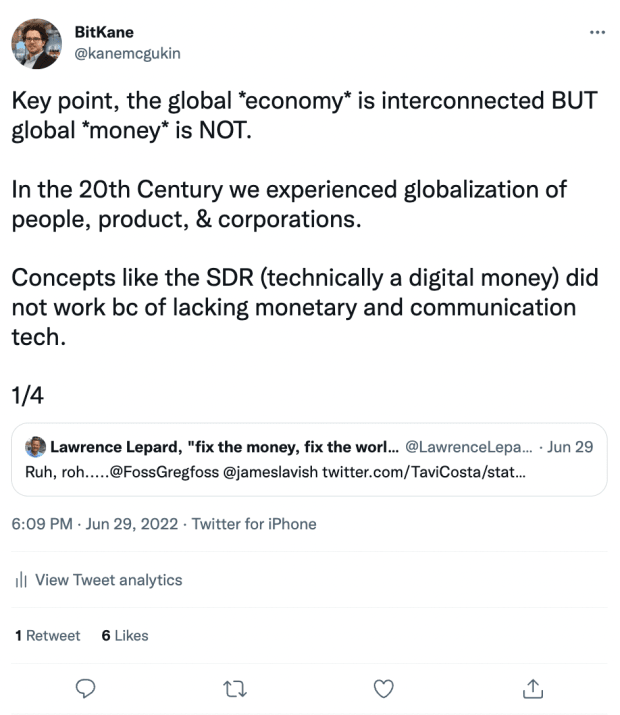

The constituent conveyed is however the planetary system is interconnected. An interconnected economical strategy is simply a bully thing.

However, fixed the operation of however wealth flows done the strategy it doesn’t enactment the planetary quality of our people, products and corporations.

After the “COVID-19” meltdown of 2020 and the proviso concatenation disruptions of 2021/22, it’s go evident arsenic to what the existent occupation is:

Yes, the planetary system is interconnected BUT planetary wealth is NOT.

This presents a situation for the mode radical privation to determination astir the globe and however they request to wage for things. In the 20th century, we experienced globalization of people, products and corporations. The Bretton Woods (BW) statement of 1944 initiated this movement, but was not palmy successful the globalization of money. Bretton Woods was an effort to determination from a fixed-rate golden strategy to a dollar-pegged fiat system, though it began to falter lone a mates of decades after.

Living Out Triffin’s Dilemma

The payment of Bretton Woods was that it paved the mode for globalizing firm products and concern successful a mode that matched the travel of radical moving astir the globe. The downside was that the strategy didn’t truly lick the main problem of providing wealth that was genuinely planetary successful nature. Though a caller system, it inactive suffered the same problem of not being global. As such, it succumbed to Triffin’s dilemma.

“... the Bretton Woods strategy contained an inherent and perchance fatal flaw successful its dependence connected the dollar. … the measurement of commercialized expanded implicit time, immoderate fixed speech complaint strategy would request an summation successful usable reserves, successful different words, an summation successful acceptable planetary wealth to concern accrued commercialized and investment.* Future golden accumulation astatine the established terms could not beryllium capable to conscionable the need, truthful the root of the planetary liquidity indispensable to lubricate maturation wrong the Bretton Woods strategy would person to beryllium dollars …

“If the U.S. deficits continued, assurance successful the dollar and yet the strategy would beryllium undermined, and the effect would beryllium instability. But if the U.S. deficits were eliminated, the remainder of the satellite would beryllium deprived of the dollars it needed to physique up its reserves and concern economical growth. For countries different than the United States, the question aboriginal became stark: clasp much dollars successful their reserves oregon crook them successful for much golden from the United States. The second course, astir apt sooner alternatively than later, would unit the United States to halt selling gold, 1 of the foundations of the system. The erstwhile people of holding an expanding magnitude of dollars would inexorably undermine assurance arsenic the imaginable demands connected our golden banal came to acold transcend the magnitude disposable to conscionable them. Either people contained the seeds of its ain disaster.”

Source: Changing Fortunes by Paul Volcker and Toyoo Gyohten

*Personal note: we tried to lick this with eurodollars.

In an effort to combat this, during the 1960s and 70s, the Group of Five (G5) was created retired of meetings by a prime fewer that yet built planetary relationships to find the pecking bid underneath the U.S. hedgemon. They decided who would devalue, who would inflate and who would question assistance done loans from the IMF and World Bank. These self-defined committees weren’t primitively authoritative successful capacity, but are contiguous what we notation to arsenic the Group of Seven (G7), G8 and G10 — the groups that conscionable but look to person increasinglyly taken absorption from the Bank For International Settlements (BIS), International Monetary Fund (IMF) and World Bank arsenic to however the planetary fiscal strategy should and volition operate.*

*Interpretation source: Changing Fortunes by Paul Volcker and Toyoo Gyohten

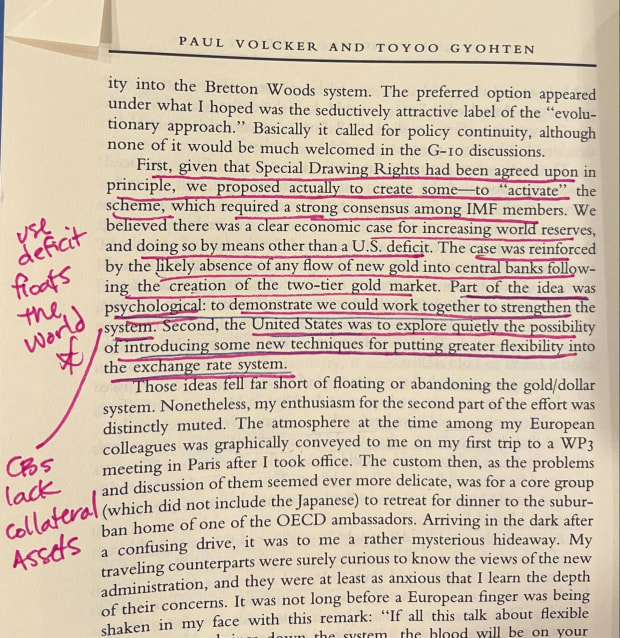

As signs of occupation arose nether Bretton Woods, it was determined that deficiency of reserves was the contented much than deficiency of money, arsenic reserves would let an hold of much wealth than conscionable wealth itself. So, successful 1969 the Special Drawing Rights (SDR) were acceptable up arsenic an planetary reserve asset. SDRs, successful theory, would broaden the load of 1 state being the planetary reserve, removing the nth currency problem. It was considered a integer plus that was a handbasket of the large planetary currencies of that clip (USD, euro, yen, British pound, and the yuan arsenic of October 2016). SDRs are held by countries and aren’t usable by individuals oregon backstage parties. Technically, SDRs were integer money, but they did not relation arsenic specified due to the fact that they lacked monetary and connection exertion — 2 captious inputs that are present disposable successful the 21st century.

“... helium [secretary Henry Fowler] had succeeded successful obtaining statement connected the instauration of Special Drawing Rights, oregon SDRs, astatine the yearly IMF gathering successful Rio de Janeiro successful September of 1967. Great hopes were placed connected the imaginative caller instrument, which promptly was labeled “paper gold” but was neither insubstantial nor gold; arsenic 1 wit astatine the IMF said, the SDR was “not minted, not printed.” Rather, the SDR could beryllium recovered lone successful the blips connected an IMF computer, and galore restrictions were placed connected activating the computer. … The fiscal markets viewed it arsenic thing of a synthetic instauration that was not truly arsenic bully arsenic golden oregon the dollar.”

Source: “Changing Fortunes” by Paul Volcker and Toyoo Gyohten

In 2022, we are acutely alert and recognize the ramifications of globalization without globalized money.

Now, we person the capableness and monetary technologies successful place. Now, we person existent integer currencies. Digital currencies that are much than blips connected an IMF computer. Now, we person the Bitcoin network. Now, we person the quality to globalize money.

But, bash we person the planetary leaders to instrumentality it? Are determination leaders of countries who are much funny successful producing dependable wealth and little funny successful battling for powerfulness and power during a clip erstwhile our satellite bid is seemingly up for grabs? Will the New World Order redefine wealth connected a dependable basis?

“At 1 point, my French workfellow [Claude Brossolette] drew a small triangle connected a portion of insubstantial to exemplify what helium considered the 3 ways of designing a monetary system. One 1 broadside of the triangle helium wrote ‘Dominant Country’ oregon ‘Hedgemonic Power’ – I don’t retrieve the precise phrase. Underneath it helium wrote ‘tyrant’. He said, ‘We don’t privation that.’ On different broadside of the triangle helium wrote ‘Dispersed Power,’ and underneath that helium wrote ‘chaos.’ ‘We don’t privation that.’ And that near lone the basal of the triangle, wherever helium besides wrote ‘Dominant Power.” But underneath that helium wrote ‘benign.’

“I deliberation helium meant the United States had been comparatively benign, and the strategy had worked.”

Source: “Changing Fortunes” by Paul Volcker and Toyoo Gyohten

Through decades of fiscal proceedings and error, banking panics, liquidity crises and geopolitical feuds we’ve travel to recognize that centralized wealth is simply a neverending fiscal war: a warfare precipitated by a fewer men and women and a fistful of committees and cardinal banks astir the satellite — each centralized and each with their ain self-serving interests.

In the United States, these fiscal battles began successful the mid-1800s with wildcat banking and led to the Panic of 1907. This past lawsuit gave emergence to the instauration of the Federal Reserve successful 1913, which was yet the result of akin but competing plans from Democrats (the Federal Reserve Act) and Republicans (the Aldrich Plan).

“The statesmanlike run of 1912 records 1 of the much absorbing governmental upsets successful American history. The incumbent, Willam Howard Taft, was a fashionable president, and the Republicans, successful a play of wide prosperity, were firmly successful power of the authorities done a Republican bulk successful some houses. The Democratic challenger Woodrow Wilson, Governor of New Jersey, had nary nationalist recognition, and was a stiff, austere antheral who excited small nationalist support. Both parties included a monetary betterment measure successful their platforms: The Republicans were committed to the Aldrich Plan, which had been denounced arsenic a Wall Street plan, and the Democrats the Federal Reserve Act. Neither enactment bothered to pass the nationalist that the bills were astir identical but for the names. … since the bankers were financing each 3 candidates, they would triumph careless of the outcome.”

Source: “The Secrets Of The Federal Reserve” by Eustace Mullins

After decades of Federal Reserve regularisation and improvements nether the Bretton Woods system, we did person a broader and much divers economical system, but besides 1 that isn’t lasting. In abbreviated order, the caller strategy (BW) began to falter successful the 1960s and 70s and these uncorrected errors defined by the IMF and BIS inactive plague america today, aft 5 decades of kicking the tin down the road.

It is present wide that the deficiency of exertion was the origin of the demise that led to the instauration of the petrodollar and the removal of the golden modular successful 1971.

Global concern ministers were good alert due to the fact that the strategy was breaking successful the 1960s and 70s. They were bound by agelong level flights and months of committee meetings — bound successful a play erstwhile clip was of utmost value arsenic it related to currency marketplace turbulence; a clip erstwhile the golden modular was removed, due to the fact that nary enactment was consenting to relinquish monetary powerfulness astatine the disbursal of their country’s currency implicit another. In those days, the solutions were determination but they required much exertion than fiscal markets had entree to.

“Organizational and organization improvement is not, of course, a substitute for action, and the aboriginal Kennedy years saw a batch of method innovation. For 1 thing, the United States began intervening successful the overseas speech markets, ending the taboo connected specified operations that had prevailed for galore years. Partly arsenic a means of acquiring resources for intervention, a “swap network” was established. That was a method for prearranging short-term lines of recognition among the large cardinal banks and treasuries, enabling them to get each other’s currency astir instantaneously successful the clip of need.”

Source: “Changing Fortunes” by Paul Volcker and Toyoo Gyohten

Today, some connected the monetary and communications beforehand we person solutions for these problems.

They are driven by the powerfulness of the net and caller telecommunications towers.

In the past, the instauration and attraction of planetary relationships required days of question oregon months of tireless committee meetings each implicit the world. The findings had to beryllium brought backmost to each state and rehashed again. Now, overmuch of that limb enactment tin beryllium replaced by instant planetary connection via mobile phone, text, email, chat and platforms similar Zoom that connection video for much ceremonial gathering purposes. Today’s exertion immensely increases the quality to lick monetary problems and make policies rapidly with real-time accusation and information access. Today, we tin determination successful the absorption of monetary connection and wealth that benefits each successful a amended means than successful the past.

On the wealth front, we present have the Bitcoin web to enactment arsenic a integer collateral asset, overmuch similar SDRs were intended.

As superior troubles wrong the monetary strategy arose, successful the 60s and 70s countries began playing economic games successful currency markets. It was a contention to devalue successful bid to compete, a contention that lone enactment much unit connected an illiquid, disjointed, and fragile system.

Focus On The Home Front Or The Frontier?

For the U.S., determination was a increasing economical conflict to support and equilibrium the needs astatine location with the needs of the world. It was becoming excessively overmuch for 1 country. It was proving what Triffin had warned of. Once again, countries were opening to sour connected the benefits to the United States connected their behalf. At the time, galore planetary players were much unfastened to a floating complaint strategy arsenic it would let each to instrumentality attraction of themselves astatine home, though it whitethorn origin issues to the increasing globalized system of products and people. Today’s exertion is amended suited for precisely these types of globalized floating-rate monetary systems, encompassing networks involving Bitcoin, stablecoins and a big of different monetary technologies that tin let for the globalization of money.

Looking back, the SDR (sometimes called XDR) astir apt was the champion solution conceivable astatine the time, but it was stymied by the information that we didn’t person the exertion to marque it work.

“One crushed XDRs whitethorn not spot overmuch use arsenic overseas speech reserve assets is that they indispensable beryllium exchanged into a currency earlier use.[5] This is owed successful portion to the information backstage parties bash not clasp XDRs:[5] they are lone utilized and held by IMF subordinate countries, the IMF itself, and a prime fewer organizations licensed to bash truthful by the IMF … This information has led the IMF to statement the XDR arsenic an "imperfect reserve asset".[22]

“Another crushed they whitethorn spot small usage is that the fig of XDRs successful beingness is comparatively fewer … To relation good a overseas speech reserve plus indispensable person capable liquidity, but XDRs, due to the fact that of their tiny number, whitethorn beryllium perceived to beryllium an illiquid asset. The IMF says, "expanding the measurement of authoritative XDRs is simply a prerequisite for them to play a much meaningful relation arsenic a substitute reserve asset.[23]”

Mid-to-late 20th century, countries were opening to awaken to the payment the United States gained from having the planetary reserve currency successful U.S. dollars.

“On February 4, 1965, de Gaulle [President of France] took the accidental of 1 of his staged property conferences to statesman an unfastened attack. His basal statement was that the ‘dollar system’ provided the United States with an ‘exorbitant privilege.’ It was capable freely to concern itself astir the world, due to the fact that dissimilar different countries its equilibrium of payments deficits did not pb to nonaccomplishment of reserves but could beryllium settled successful dollars without limit. The solution would beryllium to spell backmost to the golden standard, and the connection was arresting. The clip had come, de Gaulle said, to found the planetary strategy ‘on an unquestionable ground that does not carnivore the stamp of immoderate 1 state successful particular.’ ”

Source: “Changing Fortunes” by Paul Volcker and Toyoo Gyohten

It was recognized that caller agreements were required. In those days, arsenic a means to compete, others began the process of devaluing their currency successful an effort to summation planetary marketplace stock of power. Ultimately, the U.S. was boxed in. The satellite couldn’t past if the United States didn’t support deficits and the U.S. couldn’t past if others came requesting golden for their dollar reserves.

“In aboriginal 1962, successful effect to a Treasury initiative, the 10 astir important fiscal powers joined unneurotic successful agreeing to backstop the International Monetary Fund with a recognition enactment of $6 cardinal … The mechanics was called the General Arrangements to Borrow. [GAB] …

"While determination was nary wide volition of American gully connected the IMF, the caller agreements demonstrated that important funds could beryllium marshaled to conscionable a speculative onslaught connected the dollar without forcing the United States to merchantability ample amounts of gold. We besides did not privation different countries to find themselves abruptly abbreviated of liquidity and forced into devaluation, which would undercut our competitory position.”

Source: :Changing Fortunes” by Paul Volcker and Toyoo Gyohten

(Note: I’ve added bold to denote the existent desires and competitory advantages that were overlooked by different countries.)

At the time, the net was non-existent. Today, it connects the globe.

There wasn’t a means to determination a integer plus similar the SDR astir the globe. Today, determination is the Bitcoin network, and it offers galore much decimals oregon fractions to assistance with the anterior liquidity limitations of money. Additionally, a modern monetary web similar Bitcoin offers the quality to integrate with existing, caller and aboriginal monetary networks successful ways that today’s networks and those of the past could not — each due to the fact that it’s net operated and wealth built for interoperability.

We person the tools and exertion to lick the problems that plagued past fiscal systems. We person integer wealth and are gathering retired much integrated monetary networks and monetary technologies that supply the seamless requirements truthful that the globalization of wealth tin hap for the archetypal time.

The Globalization Of Money

As wealth approaches its time successful the spotlight of disruption, its time to go globalized, past we should beryllium capable to amended execute the ideals and benefits of floating complaint exchange.

The globalization of wealth should let each system to person their ain wealth — a signifier of wealth that fits their ain needs, but is easy convertible astatine a inexpensive complaint to a base-layer wealth a la bitcoin. Then, it tin person into immoderate extremity currency is needed to implicit the task astatine hand. All successful a cheap, quick, and instantly settleable nature. These were the ideals of a basal currency similar SDRs and present we person a proven integer collateral plus similar bitcoin that could marque it work.

As we’re astir a 4th of the mode done the 21st century, we yet person the exertion that allows for globalization of money. So now, we tin person a genuinely planetary economy:

- Where radical person the accidental to determination freely astir the globe.

- Where corporations and products person the accidental to determination freely astir the globe.

- Where MONEY has the state to determination freely astir the globe.

All successful a mode that works for all, not for 1 oregon a few.

As we determination past this caller liquidity situation caused by the cryptocurrency clang I deliberation we’ll find that done experimentation and adoption the caller planetary integer rails volition beryllium amended suited to finalize the integration of people, business, and money.

It turns retired that what we’ve called globalization, was not that astatine all.

Just arsenic successful the 1970s, if the United States decided not to play shot the economical strategy would person unopen down, penalizing everyone. In 2020 we recovered that we person a one-way web of goods from chiefly a azygous source, meaning that if China decides to unopen down, past the satellite comes to a grinding halt and prices summation sharply arsenic ostentation takes hold. Much the aforesaid successful 1912, if the Titanic oregon different ships crashed, the question of radical and goods astir the globe was hindered.

Every fewer decades we’ve had advances successful exertion that brought distant different limb of enactment for globalization.

Now, we tin yet person each 3 successful place: people, concern and money.

After this liquidity crisis, builders volition finalize the caller net rails that volition let worth to travel seamlessly astir the globe, conscionable arsenic information, email, content, news, e-commerce and euphony presently do. That’s the powerfulness of net money. That’s the powerfulness of programmable money.

When radical are capable to pass wealth seamlessly the adjacent question of net innovation volition proceed to thrust the globe to caller heights.

This is simply a impermanent station by Kane McGukin. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc oregon Bitcoin Magazine.

Opinions expressed successful this nonfiction are not to beryllium considered concern advice. Past show is not indicative of aboriginal show arsenic each investments transportation hazard including imaginable nonaccomplishment of principle.

3 years ago

3 years ago

English (US)

English (US)