Bitcoin’s correction from its January highest is simply a emblematic rhythm pullback and is not retired of the ordinary, with a terms apical inactive connected the horizon, crypto analysts and executives archer Cointelegraph.

“I don’t deliberation the bull tally is over; I deliberation the highest of the rhythm has been pushed backmost owed to macro conditions, and planetary liquidity isn’t pretty, which isn’t helping crypto,” Collective Shift CEO Ben Simpson told Cointelegraph.

Bitcoin experiencing expected retracement

“It is lone the 3rd oregon 4th correction we’ve had implicit 25% we’ve had successful Bitcoin this rhythm compared to 12 past cycle,” Simpson said.

Bitcoin (BTC) is down 24% from its all-time precocious of $109,000 connected Jan. 20 amid uncertainty astir US President Donald Trump’s tariffs and the aboriginal of US involvement rates, but Simpson called it “a mean correction.”

“Things got overheated, and they needed to chill down, and the marketplace needed to find a caller foundation, and present we’re waiting for the adjacent caller narrative,” helium said.

Bitcoin is down 13.58% implicit the past month. Source: CoinMarketCap

Derive laminitis Nick Forster shared a akin view, telling Cointelegraph that Bitcoin “is apt successful a mean correction phase, with the rhythm highest inactive to come.”

“Historically, Bitcoin experiences these types of corrections during semipermanent rallies, and there’s nary crushed to judge this clip is different,” helium said.

After Trump’s predetermination successful November, Bitcoin surged astir 36% implicit a month, hitting $100,000 for the archetypal clip successful December. At the clip of publication, Bitcoin is trading astatine $82,824, according to CoinMarketCap.

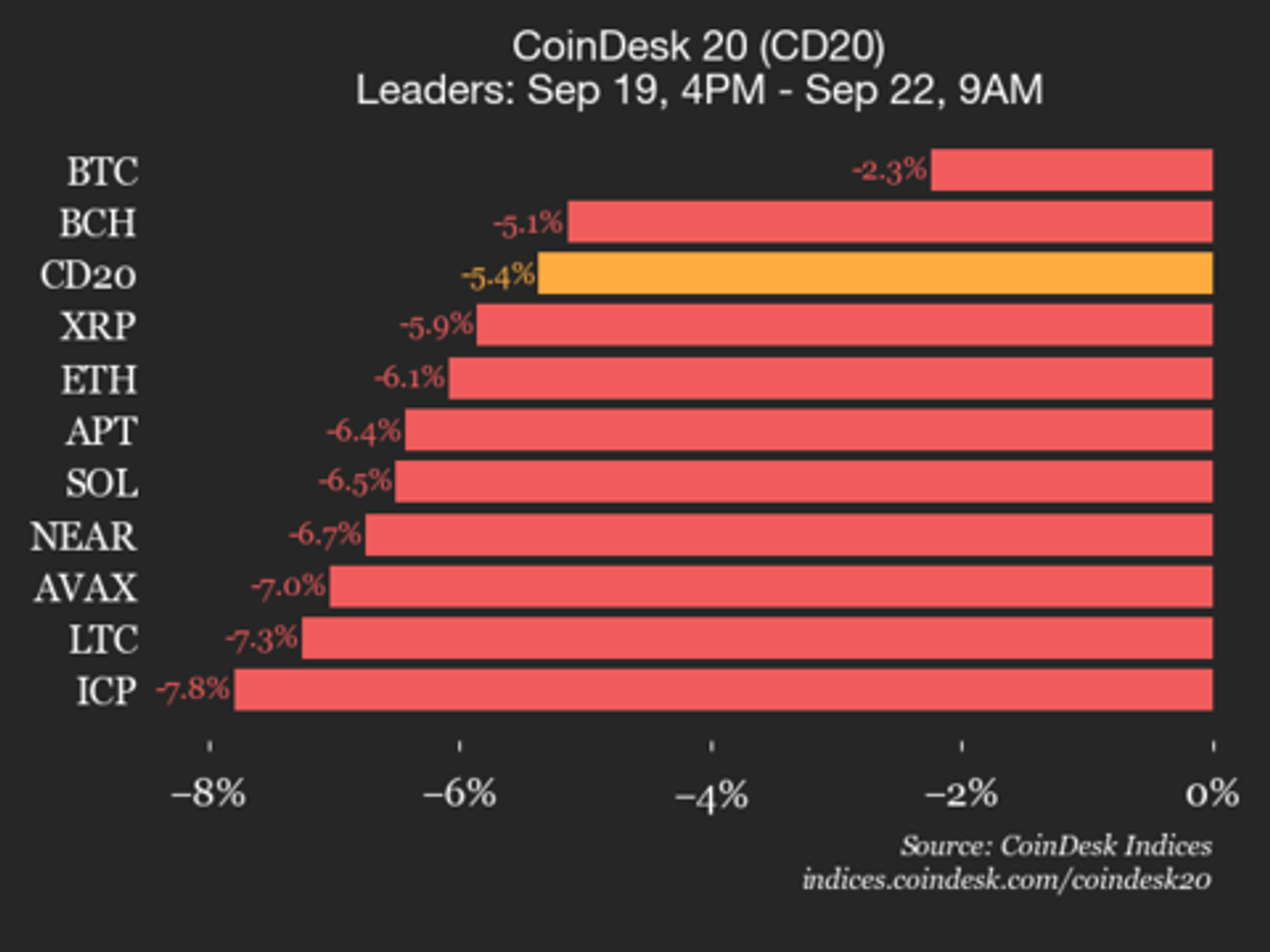

However, Forster added that the six-month destiny of Bitcoin seems progressively tied to accepted markets. Similarly, Independent Reserve CEO Adrian Przelozny told Cointelegraph that it isn’t conscionable Bitcoin being impacted by the macroeconomic conditions.

“This is pervading each plus classes and whitethorn pb to a spike successful planetary ostentation and a contraction successful planetary growth,” Przelozny said.

Source: Charles Edwards

Forster said Bitcoin’s existent terms inclination aligns with past behaviour earlier a terms rally, adjacent though it appears “tumultuous” astatine the moment.

Bitcoin’s existent inclination whitethorn “change quickly”

Collective Shift’s Simpson said the adjacent communicative volition apt revolve astir US complaint cuts, easing quantitative tightening, and expanding planetary liquidity.

However, Capriole Investments laminitis Charles Edwards said helium isn’t truthful definite if the Bitcoin bull tally is implicit oregon not.

The likelihood are “50:50, successful my opinion,” Edwards told Cointelegraph.

Related: Bitcoin beats planetary assets post-Trump election, contempt BTC correction

“Yes, from an onchain position astatine present, but that could alteration rapidly if the Fed starts easing successful the 2nd fractional of the year, stops equilibrium expanse reduction, and dollar liquidity grows arsenic a result, which I deliberation has decent likelihood of happening,” Edwards explained.

The comments travel a time aft CryptoQuant founder and CEO Ki Young Ju declared that the “Bitcoin bull rhythm is over.”

“Expecting 6-12 months of bearish oregon sideways terms action,” Ju said.

Magazine: Crypto fans are obsessed with longevity and biohacking: Here’s why

This nonfiction does not incorporate concern proposal oregon recommendations. Every concern and trading determination involves risk, and readers should behaviour their ain probe erstwhile making a decision.

6 months ago

6 months ago

English (US)

English (US)