The assorted interior workings of the fiat strategy lend to an accrued “surface area” for misuse, misallocation and misunderstanding.

This is an sentiment editorial by Dan, cohost of the Blue Collar Bitcoin Podcast.

A Preliminary Note To The Reader: This was primitively written arsenic 1 effort that has since been divided into 3 parts. Each conception covers distinctive concepts, but the overarching thesis relies connected the 3 sections successful totality. Part 1 worked to item wherefore the existent fiat strategy produces economical imbalance; Part 2 and Part 3 enactment to show however Bitcoin whitethorn service arsenic a solution.

Series Contents

Part 1: Fiat Plumbing

Introduction

Busted Pipes

The Reserve Currency Complication

The Cantillon Conundrum

Part 2: The Purchasing Power Preserver

Part 3: Monetary Decomplexification

The Financial Simplifier

The Debt Disincentivizer

A “Crypto” Caution

Conclusion

The Financial Simplifier

Our existent fiscal strategy is extraordinarily complicated, and this complication inhibits the information and occurrence of those who are little financially literate. Preparing for the fiscal aboriginal is overwhelming for galore (if not most) mundane folks. One mightiness inquire wherefore our existent strategy is truthful complex, and portion of the reply harkens backmost to thing covered successful Part 1 and Part 2 of this essay. We’ve established that a centralized monetary strategy with fiat arsenic its basal invariably leads to accrued monetary manipulation. A salient signifier of monetary manipulation is influencing involvement rates. Short-term involvement rates acceptable by cardinal banks are 1 of the astir important inputs successful some home and planetary markets (the astir influential of which is the federal funds rate acceptable by the U.S. cardinal bank, the Federal Reserve Board). These centrally controlled rates dictate the outgo for superior astatine the basal of the system, which yet seeps upward and impacts virtually each plus class, including treasury and recognition markets, mortgages, existent property and yet equities (stocks). I’ll erstwhile again defer to Lyn Alden to sum up the reasoning behind, and interaction of, short-term involvement complaint manipulation:

“This complaint [the national funds rate] trickles up to each different indebtedness classes, powerfully affecting them, but indirectly. So, arsenic the Federal Reserve raises oregon lowers this cardinal rate, it yet affects treasury bonds, mortgages, firm bonds, car loans, borderline debt, pupil debt, and adjacent galore overseas bonds. There are different factors that impact involvement yields connected assorted debt, but the Federal Funds Rate is 1 of the astir important impacts. The Federal Reserve reduces this complaint erstwhile it wants to nutrient ‘easy money’ to stimulate the economy. A debased involvement complaint for each types of indebtedness encourages consumers and businesses to get wealth and usage it to devour oregon expand, which benefits the system successful the abbreviated term.”1

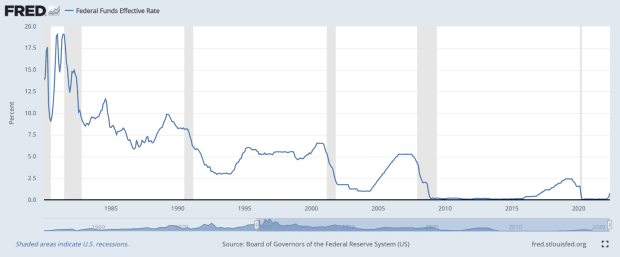

In an effort to boost economical enactment and/or mitigate short-term economical discomfort, cardinal banks astir the satellite person demonstrated a humanities susceptibility to little involvement rates good beyond wherever they would person settled naturally. Today, we are staring down the tube of a 40-year diminution successful short-term rates to nothing. Below is simply a illustration displaying the question of the national funds complaint implicit the past 40 years:

Chart Source: St. Louis Fed

Chart Source: St. Louis FedIn galore parts of the world, rates person adjacent gone beneath zero into antagonistic territory, i.e., negative involvement rates. My conjecture is that if you had told a enslaved trader 30 years agone that determination would 1 time beryllium trillions of dollars worthy of antagonistic nominal-yielding indebtedness instruments, they would person laughed you retired of the country — yet present we are. And though causes are multifaceted, it’s hard to contradict that prevalent monetary policy, successful the signifier of involvement complaint manipulation and enabled by fiat fundamentals, is astatine slightest partially to blame.

Image/Article Source: The Motley Fool

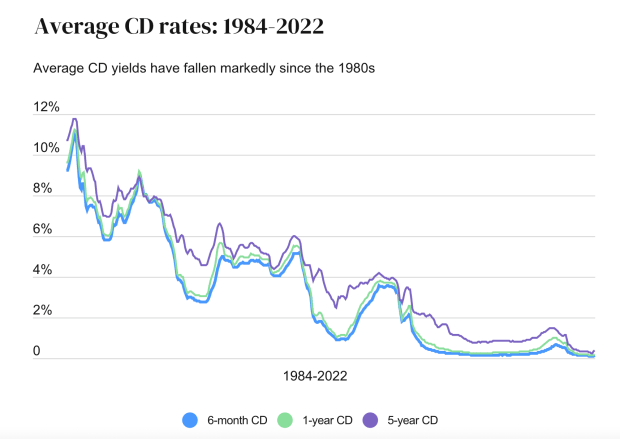

Image/Article Source: The Motley FoolBecause the short-term cardinal slope involvement rates (“risk-free rates”) are artificially suppressed, risk-free returns (or yields) are besides suppressed. Consequently, savers and investors looking to turn their superior indispensable get much originative and nimble arsenic good arsenic instrumentality connected much risk. In 1989 a idiosyncratic could fastener wealth successful a certificate of deposit (CD) astatine their section slope and get a precocious nominal (and serviceable real) yield. But arsenic the illustration beneath demonstrates, times person changed — immensely.

Chart Source: Bankrate.com

Chart Source: Bankrate.comWhen we see today’s monolithic indebtedness levels and correlated risks of debasement, and past harvester the information that low-risk returns connected superior are historically diminished, we uncover an issue: low-risk investments really go risky implicit clip arsenic purchasing powerfulness gets depleted. Savers need returns to simply support up with inflation; they indispensable instrumentality connected much hazard to support up. The constituent present is that an inherently and progressively inflationary wealth proviso demands that radical look to flight the wealth they are paid in. They indispensable spell elsewhere to support and turn wealthiness — currency is trash and existent yields connected assets that were erstwhile profitable are present persistently negative. With low-risk output opportunities diminished, those who privation to sphere and turn the buying powerfulness of their superior are confronted with 3 main options:

- Be progressively agile successful managing their ain portfolio. They indispensable larn to talk fluent “financialeze” if you will.

- Rely connected a nonrecreational to grip the analyzable fiscal scenery for them.

- Utilize passive concern vehicles (for illustration index funds), which exposure them to broad, systemic risks. (I americium surely not against passive investing and indexing — I bash overmuch of it myself — but the occupation is these strategies person mostly go synonymous with saving.)

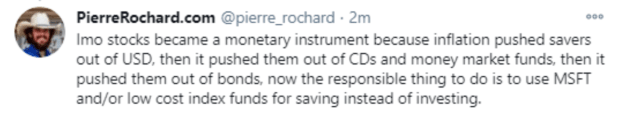

An aged tweet by Pierre Rochard highlights this well:

Image/Tweet Source: “Bitcoin Is The Great Definancialization” by Parker Lewis

Image/Tweet Source: “Bitcoin Is The Great Definancialization” by Parker LewisThese aforementioned dynamics person led to an engorged fiscal assemblage filled with endless planners, managers, brokers, regulators, taxation professionals and intermediaries. The concern and security assemblage has grown from astir 4% of GDP successful 1970 to adjacent to 8% of GDP today.2 An tremendous magnitude of slop has been tossed into the pig pen, and the hogs are feeding. Can you blasted them? Don’t misunderstand me; I americium not against the fiscal assemblage successful totality, and I bash judge that adjacent if Bitcoin is the monetary modular of the future, fiscal services volition stay prevalent and important (although their relation volition change, they volition look overmuch different, and I judge much consumers volition request transparency and auditability similar proof of reserves3). But what does look intelligibly imbalanced is the sheer size of today’s fiscal sector. In his nonfiction “The Great De-Financialization”, Parker Lewis wonderfully summarizes the impetus down this dynamic:

“Financialization has turned status savers into perpetual risk-takers and the effect is that fiscal investing has go a 2nd full-time occupation for many, if not most. Financialization has been truthful errantly normalized that the lines betwixt redeeming (not taking risk) and investing (taking risk) person go blurred to the grade that astir radical deliberation of the 2 activities arsenic being 1 successful the same. Believing that fiscal engineering is simply a indispensable way to a blessed status mightiness deficiency communal sense, but it is accepted wisdom.”

Imagine if determination was a spot wherever radical were simply capable to store, sphere and turn their hard-earned superior without hazard oregon request of expertise? This sounds startlingly elemental and immoderate would accidental far-fetched — successful fact, galore wealth managers would shudder astatine specified a prospect, since a analyzable concern scenery is simply a cardinal operator of their usefulness. Gold erstwhile served this purpose, and successful definite times and places of the past a blacksmith oregon husbandman could reliably support purchasing powerfulness successful a precious metal. But arsenic the centuries wore connected and economies of standard grew larger and much global, the velocity of money grew exponentially and the weaknesses of traditionally hard monies similar golden became a hindrance — namely the weaknesses of portability and divisibility.4 This dynamic necessitated nascent monetary technologies and gave emergence to insubstantial currencies backed by gold, past yet backed by nation-state promises — fiat arsenic we cognize it today.

An probe of Bitcoin invariably thrusts the learner into an exploration of the characteristics of wealth itself. For many, this travel leads to the designation that Bitcoin harnesses and improves connected gold’s timeless store of worth strength: scarcity, portion besides rectifying (and galore would reason perfecting) gold’s shortcomings of portability and divisibility. Bitcoin mitigates the inherent limitations of traditionally dependable stores of worth portion besides harboring the imaginable to conscionable today’s monetary velocity needs arsenic a mean of exchange. For this crushed it has entered the modern fiscal whirlwind arsenic a large decomplexifier. It introduces a natively integer token with contiguous currency finality, portion simultaneously assuring holders of a fixed proviso by mode of a decentralized ledger.

BTC is besides the archetypal ever integer bearer asset, and it tin beryllium self-custodied with nary counterparty risk. This is simply a tremendously underappreciated feature, particularly successful high-debt environments wherever the fiscal stack is based connected progressively susceptible promises.5 Architecturally, Bitcoin whitethorn beryllium the champion wealth our taxon has ever had, and dissimilar gold, it’s built for the 21st century. If you ain Bitcoin, you are mathematically, cryptographically and verifiably guaranteed to support a definite size involvement successful the web — your portion of the pastry is acceptable successful stone. This azygous integer plus is equipped to bargain gum astatine the market store portion simultaneously resting astatine the precise basal of the fiscal strategy successful sovereign wealthiness funds, successful some cases with nary intermediary oregon counterparty risk. Bitcoin is simply a signifier of wealth that tin bash it all.6

As a result, Bitcoin simplifies the concern scenery for the mean individual. Instead of perpetual disorder regarding due concern strategies, mean wage earners tin allot astatine slightest a information of their superior to the champion savings exertion ever discovered — a web specifically designed to antagonistic the assured debasement of existing fiat units and the risks of vulnerability to investments similar equity, fixed income and existent property (if that hazard is unwanted by savers).7 Some laughter erstwhile Bitcoin is described arsenic a “safe haven asset,” but it is important to retrieve that volatility and hazard are not the aforesaid thing.8 BTC has been incredibly volatile portion besides generating much alpha than astir immoderate plus connected the satellite implicit the past decade.

At this day and time, Bitcoin is mostly a “risk-on” asset, coupled to the NASDAQ and broader banal market, but I hold with hedge money manager Jeff Ross erstwhile helium states:

“At immoderate constituent successful the future, Bitcoin volition beryllium seen arsenic the eventual ‘risk-off’ asset.”9

As liquidity successful the Bitcoin web continues increasing exponentially, I judge we volition spot much and much superior flood into BTC alternatively than cash, treasuries and golden during periods of economical uncertainty and distress. The crippled mentation suggests that the satellite volition aftermath up to the champion and hardest signifier of wealth available, and truthful economical participants volition progressively denominate goods and services successful it. As that inclination continues, Bitcoin is apt to go an all-weather plus with the quality to execute successful a assortment of economical environments. This is the quality of an inherently deflationary10 store of worth that tin besides relation arsenic a portion of relationship and mean of exchange. Bitcoin could go a one-stop store for the mundane wage earner — thing they whitethorn 1 time get paid with, bargain goods and services with, and store wealthiness successful without fearfulness of purchasing powerfulness depletion. The Bitcoin web is processing into the eventual fiscal simplifier, depriving centralized policymakers the quality to siphon superior retired of the hands of those who don’t cognize however to play the fiscal game. Bitcoin is monetizing successful a parabolic manner earlier our eyes, and for those motivated and privileged capable to admit the fundamentals driving it, this protocol represents an unparalleled wealthiness preservation mechanics — a nonstop foil to the fiat Ponzi. As a result, mediate and little people basement dwellers, knee-deep successful leakage, who elite to support themselves with Bitcoin volition precise apt find themselves supra people successful the agelong run.

The Debt Disincentivizer

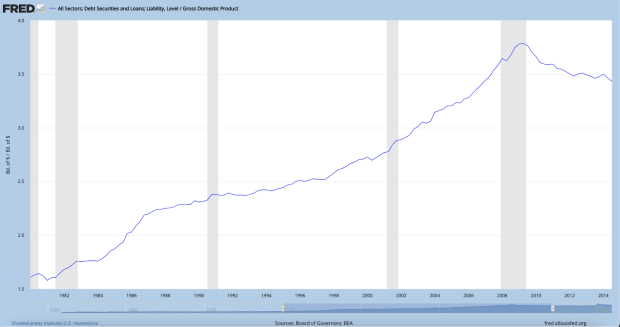

In Part 2 we established that the system arsenic a full is heavy indebted, but let’s instrumentality different look astatine indebtedness arsenic compared to gross home merchandise (debt/GDP). The illustration beneath trends each types of U.S. indebtedness (total debt) arsenic a aggregate of GDP:

Chart Source: St. Louis Fed

Chart Source: St. Louis FedTotal U.S. indebtedness is presently 3.5 times that of GDP (or 350%). In comparison, indebtedness was conscionable implicit 1.5 times that of GDP successful 1980, and anterior to the Global Financial Crisis, full indebtedness was 3.7 times that of GDP (just somewhat higher than wherever it is today). The strategy tried to reset and delever successful 2008, but cardinal banks and governments didn’t afloat let it and indebtedness remains preposterously high. Why? Because fiscal policymakers person relied connected overused expansionary monetary policies to debar a deflationary situation and depressions (policies specified arsenic nonstop involvement complaint manipulation, quantitative easing, and chopper money).<FN11> To support indebtedness from unwinding, caller wealth and/or recognition is required. Think astir this successful presumption of the individual: without expanding their income, determination is lone 1 mode idiosyncratic tin work debts they can’t spend without going bankrupt — instrumentality retired caller indebtedness to wage the old. At a macroeconomic level, unsound wealth enables this crippled of “debt balloon” to spell connected for immoderate time, since the fiat wealth printer repeatedly assists successful mitigating systemic insolvency and contagion. If aerial is consistently blown into a balloon and ne'er allowed to exit, it simply keeps getting bigger … until it pops. Here’s Lyn Alden summarizing the precariousness of a fiscal strategy progressively built connected indebtedness and credit:

“The credit-based planetary fiscal strategy we person constructed and participated successful implicit the past period has to continually turn oregon die. It’s similar a crippled of philharmonic chairs that we person to support adding radical and chairs to successful bid for it to ne'er stop. This is due to the fact that cumulative debts are acold larger than the full currency supply, meaning determination are much claims for currency than determination is currency. As such, excessively galore of those claims tin ne'er beryllium allowed to beryllium called successful astatine once; the enactment indispensable ever spell on. When indebtedness is excessively large comparative to currency and starts to get called in, caller currency is created, since it costs thing different than immoderate keystrokes to produce.”12

Society has go progressively accustomed to monetary stimulation. These monetary and fiscal tactics person surely pulled immoderate maturation forward, but overmuch of that enlargement is contrived and insubstantial. A dependable dose of monetary amphetamine has contributed to a societal addiction to bloated indebtedness and inexpensive wealth access. Due to accordant and anticipated backstopping astatine the monetary foundation, each participants — from nation-states to the backstage assemblage to the idiosyncratic — person been structurally enabled to instrumentality connected much indebtedness and bargain much with the recognition created portion avoiding immoderate of the consequences of mediocre superior allocation. As a result, malinvestment abounds.

Debt comes successful vastly antithetic qualities. Some forms are productive and others are unproductive. Unfortunately, the mediate and little classes thin to beryllium engrossed successful overmuch of the latter.13 I often thrust astir looking astatine homes and cars successful driveways wondering, “How successful the bluish blazes does everyone spend each this crap?” The older I’ve gotten, the much I’ve recognized that the reply is simple: they can’t. A immense percent of radical are levered up to their eyeballs arsenic a effect of buying each kinds of unnecessary worldly they can’t afford. We unrecorded successful an incessant user civilization wherever middle-class folks often deem it mean to unrecorded an upper-class lifestyle; ergo, they extremity up with minimal escaped currency travel to prevention oregon put for the future, oregon worse, buried beneath mounds of suffocating debt. In his effort “Bitcoin Is Venice,” Allen Farrington states:

“Those who bash not ain hard assets are progressively tending to drown successful indebtedness from which they volition realistically ne'er escape, incapable to prevention but by speculation, and incapable to spend the ostentation successful the indispensable costs of surviving that does not officially exist.”14

Individuals who find themselves successful indebtedness up to their eyeballs are surely astatine fault, but it’s besides important to origin successful that indebtedness is artificially inexpensive and wealth artificially abundant. Seemingly infinite pupil loans and debased single-digit mortgages are, astatine slightest partially, the downstream effect of exorbitant fiscal and monetary incautiousness. Moving distant from a strategy built connected indebtedness means determination volition be, good … little debt. Ready oregon not, Bitcoin whitethorn thrust the 21st period system into withdrawal, and though the headaches and tremors whitethorn beryllium uncomfortable, I judge sobriety from inordinate recognition volition beryllium a nett affirmative for humanity successful the agelong run. Prominent entrepreneur and tech capitalist Jeff Booth has described the innovation of Bitcoin arsenic such:

“The exertion of Bitcoin allows you to physique a system, adjacent to peer, that doesn’t necessitate indebtedness for velocity of money. And what I conscionable said is astir apt the astir important happening astir Bitcoin.”15

I hazard being misunderstood here, truthful let maine to clarify thing earlier I determination on. I americium NOT saying indebtedness is inherently bad. Even successful a perfectly architected fiscal system, leverage would, and should, exist. One of my lifelong champion friends who is simply a nonrecreational enslaved trader enactment this good successful 1 of our idiosyncratic correspondences:

“Debt has been transformative for the maturation of technologies and the betterment of the mediate class. Debt allows radical with bully ideas the quality to make those technologies now, arsenic opposed to waiting for them to person each the wealth saved up. That connects those that person excess currency with those that request it, truthful some win.”

What’s said determination is successful galore ways accurate, and the availability of indebtedness and recognition has furthered the wide system and/or led to adjuvant advancements being pulled forward. Even so, my proposition is that this has been overdone. An unsound monetary basal furniture has allowed leverage to grow for excessively long, successful excessively ample a quantity and successful a worrisome variety. (The assortment of leverage I’m referring to present was discussed astatine magnitude successful Part 1, namely a important magnitude of recognition hazard has transferred from the fiscal strategy to the equilibrium sheets of nation-states, with the mistake word successful the indebtedness equation being the fiat currency itself.16)

If Bitcoin becomes a reserve plus and underpins adjacent a information of the planetary system (the mode golden erstwhile did), its decentralized mint and immutable fixed proviso could telephone the bluff connected an artificially inexpensive outgo of capital, making borrowing importantly much expensive. It’s important to admit that Bitcoin is built to beryllium the cardinal bank. Rather than marketplace participants waiting with baited enactment to spot what colour fume emerges from meetings of appointed Federal Reserve officials, this protocol is constructed to beryllium the arbiter of monetary determination making — monetary physics if you will. Satoshi Nakamoto begged an absorbing question for humanity: Do we privation a acceptable of monetary rules that a fewer tin change and everyone other has to play by? Or bash we privation a acceptable of rules everyone has to play by? In a hyperbitcoinized (and importantly little centralized) monetary future, the levers impacting the outgo and quantity of wealth would beryllium removed (or astatine slightest importantly shortened) — the terms of wealth could beryllium restored.

Within a perchance harder integer monetary environment, behaviour would beryllium dramatically altered. Inexpensive wealth changes fiscal conduct. Artificially suppressed risk-free rates trickle done the full lending landscape, and inexpensive wealth enables excess borrowing. To supply a tangible example, see that a owe involvement complaint of 6% alternatively than 3% increases monthly payments connected a location by 42%. If the outgo of superior is accurately priced higher, uproductive leverage volition beryllium little prevalent and the detriments of dumb indebtedness volition beryllium much visible. People simply won’t beryllium incentivized to “afford” truthful overmuch stupidity.

Additionally, Bitcoin could (and already is) magnifying the consequences of indebtedness default. When a idiosyncratic takes retired a loan, superior is pledged by the borrower to support the interests of the lender; this is called collateral. The collateral pledged to lenders successful today’s fiscal strategy is often acold from their possession — things similar borrower income statements, concern relationship totals, homes, cars, adjacent currency successful the bank. When idiosyncratic is incapable to marque payments connected a owe oregon loan, it tin instrumentality months oregon years earlier the lender gets restitution, and the borrower tin often play “get retired of jailhouse escaped cards” specified arsenic foreclosure and bankruptcy. Compare this to Bitcoin, which allows for 24/7 by 365 liquidity successful a digital, instantly currency final, planetary money. When idiosyncratic takes retired a indebtedness and pledges Bitcoin arsenic collateral — meaning the creditor holds the private keys — they tin beryllium instantly borderline called oregon liquidated if their extremity of the bargain isn’t upheld. Responsible creditors successful the already existent and exponentially increasing Bitcoin borrowing and lending scenery often picture Bitcoin arsenic “pristine collateral,” immoderate reporting adjacent to 0% indebtedness losses.17 It seems inevitable that much and much lenders volition admit the protections an plus similar Bitcoin provides arsenic collateral, and arsenic they do, borrowers volition beryllium held to greater account. When indebtedness payments aren’t made oregon loan-to-value ratios aren’t upheld, restitution tin beryllium immediate.

Why is this a bully happening idiosyncratic mightiness ask? I presumption this arsenic a net-positive due to the fact that it whitethorn assistance disincentivize unproductive debt. Bitcoin is the eventual accountability plus — a leverage destroyer and a stupidity eliminator. Financial occurrence is rooted successful dependable behavior, and borrower habits are bound to amended successful a Bitcoin satellite wherever incentives are restructured and mediocre decisions amusement existent and contiguous consequences. This volition assistance steer mundane folks distant from unproductive indebtedness and lengthen fiscal clip preferences.

From nation-states to corporations to the individual, flimsy fiat fiscal and monetary argumentation has enabled atrocious habits — bailouts, stimulus, manufactured liquidity, contrived stableness and injudicious superior allocation proliferate without capable fiscal accountability. An applicable analogy commonly utilized successful the Bitcoin abstraction is that of wood fires. When towns and lodging developments unwisely outpouring up implicit susceptible landscapes, wood fires are extinguished instantly and important burns aren’t permitted. This is akin to today’s economical situation wherever recessions and lockdowns are rapidly drenched with the fiat monetary occurrence hose. We indispensable heed the warnings of parent quality — uncontrolled fires inactive inevitably materialize successful these susceptible areas, but present the occurrence load has built up significantly. Instead of regular burns decently restoring and resetting ecosystems, these rampant infernos get truthful blistery that the topsoil is destroyed and the situation is dramatically harmed. This dynamic echoes what’s occurring successful today’s markets arsenic a effect of artificial intervention. When fiscal fires commencement successful the 21st century, the magnitude of these events, the efforts needed to thwart them, and their harmful aftermath person each been magnified. If Bitcoin serves arsenic the arbiter of planetary monetary accountability (as I judge it 1 time may), our taxon volition larn to amended debar unsafe economical landscapes altogether.

Bitcoin is simply a caller monetary sheriff successful town, and though its inflexible rules whitethorn beryllium distressing for some, I judge it volition lend to cleaner economical streets and yet pb to greater prosperity and egalitarianism. The quality to bail retired the individual, the instauration oregon the strategy arsenic a full whitethorn diminish, but this symptom is good worthy the summation arsenic the restitution of dependable wealth successful the integer property volition drastically amended terms signals and make a cleaner playing field. This is destined to payment the mediate and little classes, arsenic mostly speaking, they deficiency the consciousness and/or quality to alteration the rules of the existing fiscal crippled successful their favor.

A “Crypto” Caution

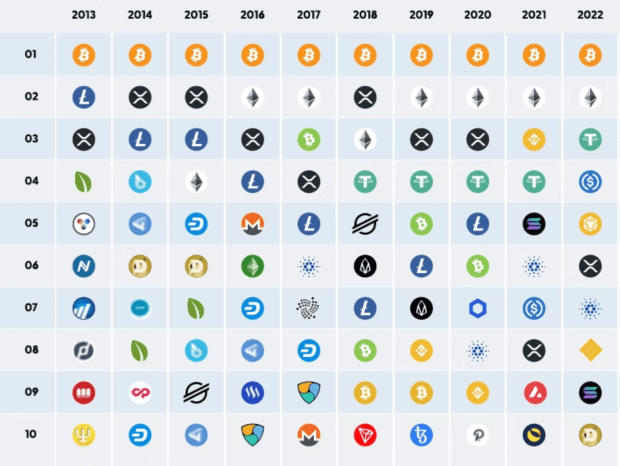

21st period fiscal plumbing is surely dysfunctional, but erstwhile we spell to regenerate the leaky pipes, we indispensable guarantee we are doing truthful with well-built, watertight and durable hardware. Unfortunately, not each the parts successful the “cryptocurrency hardware store” are created equal. The scenery of cryptocurrencies has grown astir endlessly divers with thousands of protocols successful existence. Despite a relentless cohort of task superior funds, Redditors and retail investors salivating implicit the newest altcoins, bitcoin has proven repeatedly it stands successful a league of its own.

Image Source: “Bitcoin Versus Digital Penny Stocks” by Sam Callahan

Image Source: “Bitcoin Versus Digital Penny Stocks” by Sam CallahanBitcoin’s simplistic and sturdy design, unreplicable origin, profound and expanding decentralization, and distinctive crippled mentation person each contributed to an exponentially increasing web effect. It seems progressively improbable Bitcoin volition look substantive contention arsenic a integer reserve plus oregon store of value. Altcoins travel successful endless varieties — astatine their worst they are outright scams; astatine their champion they are attempts to fulfill imaginable marketplace needs of a much decentralized fiscal future. In each cases they are FAR much risky and unproven than bitcoin. When 1 makes a determination to bargain different cryptocurrency too BTC, they indispensable travel to presumption with the information that they are passing connected a protocol that is presently filling an tremendous spread successful planetary markets, with what is arguably the largest addressable marketplace successful quality history.

An exploration of altcoins could beryllium an effort of its own, but successful my humble sentiment the opportunities I’ve outlined supra regarding bitcoin use to it specifically, not cryptocurrency generally. At the precise least, I promote caller participants to question to recognize Bitcoin’s plan and usage lawsuit archetypal anterior to branching disconnected into altcoins. The pursuing excerpt from the portion “Bitcoin First” by Fidelity Digital Assets sums this up nicely.

“Bitcoin’s archetypal technological breakthrough was not arsenic a superior outgo exertion but arsenic a superior signifier of money. As a monetary good, bitcoin is unique. Therefore, not lone bash we judge investors should see bitcoin archetypal successful bid to recognize integer assets, but that bitcoin should beryllium considered archetypal and abstracted from each different integer assets that person travel aft it.”18

Conclusion

If this effort accomplishes thing else, I anticipation it motivates the scholar to learn. Knowledge is power, but it doesn’t travel without work. I implore each readers to bash idiosyncratic investigation. Don’t spot me, verify connected your own. I americium thing much than 1 precise constricted and evolving perspective. I bash judge Bitcoin is simply a singular tool, but it isn’t simple. It tin instrumentality hundreds of hours of probe earlier its implications click, and thousands earlier existent knowing is reached (a travel I americium inactive precise overmuch on). Don’t tally earlier you locomotion — erstwhile it comes to redeeming and investing, one’s allocation size and knowing should ideally reflector each other.

With the disclaimers complete, I consciousness each marketplace participants (the mediate and little classes successful particular) should see allocating a information of their hard-earned superior to this protocol. In my view, determination is 1 intelligibly unwise allocation size erstwhile it comes to Bitcoin: zero. Bitcoin is simply a monetary beast, driven by attributes and crippled mentation that marque it improbable to vanish and its accomplishment coincides with an situation that intelligibly illuminates its usage case. It appears the fiat experimentation that began successful earnest successful 1971 is decaying. A tectonic displacement is happening successful money, and positioning yourself connected the close continent whitethorn person melodramatic implications. Today’s progressively brittle fiscal strategy requires much and much involution to stay intact. These manipulations person a inclination to payment incumbent institutions, affluent individuals, almighty participants and already severely indebted nation-states, portion disenfranchising the mundane antheral and woman.

Leaking and corroded pipes are being continuously repaired and jerry-rigged successful the economical residence of the mediate and little classes, flooding an already bedewed basement. Meanwhile, a marque caller location with pristine, durable and watertight plumbing is being architected adjacent door. The doorway to this caller location is open, and each individuals, peculiarly mean wage earners, should see moving a information of their belongings there.

Acknowledgements: Beyond the plethora of radical quoted oregon referenced successful this essay, appreciation and recognition spell to galore others for editing and improving this piece: my podcast cohost (and chap firefighter) Josh, who sharpens my ideas each week and has walked earlier maine each measurement of the mode successful my Bitcoin acquisition journey; besides Ryan Deedy, Joe Carlasare, DazBea, Seb Bunny, my person Kyle, my anonymous enslaved trading buddy, my woman (a spelling and grammar guru), arsenic good arsenic Dave, Ryan, and Jim from the firehouse.

End Notes

1. From Lyn Alden’s nonfiction “Why Investors Should Care About Interest Rates and the Yield Curve”

2. Source is Parker Lewis’ “Bitcoin Is The Great Definancialization”

3. For much connected impervious of reserves, spot Nic Carter’s Proof of Reserves page

4. Robert Breedlove does a fantastic occupation explaining the characteristics of wealth and however they pertain to golden and Bitcoin successful the podcast occurrence “BTC001: Bitcoin Common Misconceptions w/ Robert Breedlove”

5. For much connected this theme, cheque retired “Why Gold And Bitcon Are Popular (An Overview Of Bearer Assets)” by Lyn Alden

6. If this seems far-fetched, retrieve Bitcoin is unfastened root and programmable similar the net protocol stack itself. Without compromising its halfway statement rules, applications and technologies tin beryllium built connected apical of it to conscionable aboriginal monetary and fiscal needs. This is being done presently connected 2nd layers similar the Lightning Network.

7. These aforementioned plus classes are not inherently bad. Investment and lending are cardinal drivers of productivity and growth. However, due to the fact that today’s wealth is decaying, redeeming and investing are becoming synonymous, and adjacent those who privation to debar hazard are often forced to instrumentality it on.

8. Jim Crider is the archetypal idiosyncratic I heard picture this favoritism wrong the pursuing podcast episode: “BCB029_Jim Crider: The Black Sheep of Financial Planning.”

9. From podcast occurrence “BCB046_Dr. Jeff Ross: Treating Septic Markets”

10. The connection “deflation” is controversial, complex, and multifaceted. When I usage it here, I americium not speaking to a transient oregon momentary economical lawsuit oregon period; rather, I americium utilizing it to picture the imaginable for inflexible monetary proviso successful which buying powerfulness inherently grows implicit decades and centuries (think golden and different hard assets). I hold with Jeff Booth that “the escaped marketplace is deflationary” and that exertion inherently allows america to bash much with less. In my view, we request a currency that amended allows for this. Jeff Booth explores this thought successful item wrong his publication “The Price of Tomorrow.”

11. From “Principles for Navigating a Big Debt Crisis” by Ray Dalio

12. From “The European Central Bank Is Trapped. Here’s Why.” by Lyn Alden

13. Extreme indebtedness is not unsocial to the mediate people — each of nine is over-leveled from the apical to the bottom; however, owed to deficiency of knowledge, education, and access, it’s my contention that the little classes person a propensity to usage indebtedness little advantageously.

14. Allen Farrington present has a publication by the aforesaid title: “Bitcoin is Venice.”

15. From Jeff Booth comments astatine Bitcoin 2022 Conference during a macroeconomics panel.

16. Credit goes to Greg Foss for this concept. He explores this successful item wrong his effort “Why Every Fixed Income Investor Needs To Consider Bitcoin As Portfolio Insurance” (specifically connected leafage 23).

17. See podcast occurrence “BCB049_Mauricio & Mario (LEDN): The Future of Financial Services”

18. From “Bitcoin First” by Chris Kuiper and Jack Neureuter

This is simply a impermanent station by Dan. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc oregon Bitcoin Magazine.

3 years ago

3 years ago

English (US)

English (US)