What is FIRE?

Financial Independence, Retire Early (FIRE) is simply a question focused connected utmost savings and concern with the purpose of allowing radical to discontinue overmuch earlier than accepted strategies target.

Extreme frugality is astatine the halfway of FIRE. Proponents purpose to prevention important amounts of their income — good implicit 50% successful galore cases. This is typically achieved done a disciplined absorption connected reducing expenses. Increasing income is encouraged, but acknowledged arsenic little controllable than ruthlessly cutting spending.

Once their savings extremity is achieved, retirees unrecorded disconnected tiny periodic withdrawals. Most would use the "4% rule" oregon thing akin successful bid to cipher their savings extremity and harmless withdrawal amounts. Savings are typically invested astir wholly successful equity scale funds.

There is simply a immense magnitude of accusation disposable connected FIRE that isn’t worthy repeating here. You tin bash your ain research, possibly starting with 1 of the astir fashionable FIRE bloggers – Mr. Money Moustache.

The Good: FIRE And Freedom

The FIRE question has a batch going for it. Its biggest strengths stem from the debased clip penchant behaviour it encourages, overmuch similar bitcoin. FIRE proponents are consenting to sacrifice contiguous expenditure and marque manner compromises for the imaginable of accrued aboriginal returns (by compounding savings) that volition aboriginal alteration a manner of freedom. FIRE’s utmost frugality pairs good with minimalism and determination is simply a grade of overlap betwixt these movements. A communal thread is the tendency for state successful its galore forms — again thing acquainted to galore bitcoiners. A minimalist manner and mentality tin supply a intelligence consciousness of state good earlier status is achieved. Your possessions halt owning you and you tin absorption connected the things you worth most, adjacent if you haven’t yet won implicit power implicit your time.

The FIRE assemblage is besides ruthless astatine reducing absorption fees connected their investments, astir ever seeking retired the lowest-cost options. They’ll beryllium pleased to larn that bitcoin tin beryllium stored virtually for escaped successful a afloat self-sovereign mode successful perpetuity. Even the lowest outgo Vanguard oregon BlackRock equities ETF volition beryllium much costly than holding the equivalent dollar worth successful bitcoin.

The Bad: It Might Not Work For Much Longer

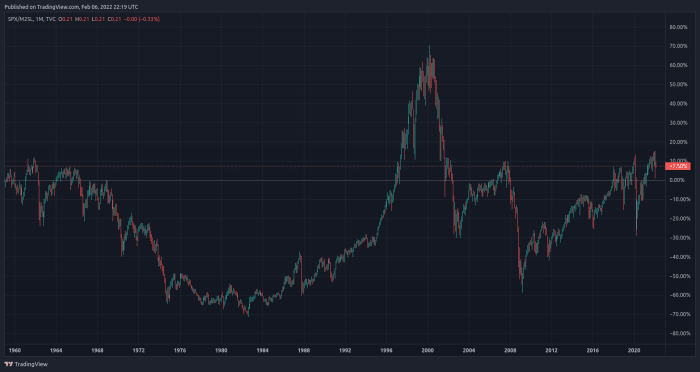

FIRE proponents typically put astir each of their savings successful equity scale funds. This is perchance a occupation if the wealth printer is turned disconnected by cardinal banks, arsenic demonstrated by a illustration of the S&P 500 denominated successful USD M2 wealth proviso which shows fundamentally level show implicit aggregate decades:

FIRE proponents’ calculations could halt moving if the fiat currency strategy fails and hyperbitcoinization arrives. As astir bitcoiners cognize already, everything has been trending to zero erstwhile priced successful bitcoin, including the S&P 500.

The Best Of Both Worlds: Bitcoin On FIRE

“I don’t deliberation determination is simply a azygous idiosyncratic with a antagonistic sentiment connected bitcoin who has spent 100 hours studying it.” – Michael Saylor

Like each plus owners, the FIRE question has been a beneficiary of the fiat standard. If it ain’t broke, don’t hole it ...

But possibly if FIRE proponents did their 100 hours they whitethorn find an unthinkable alignment betwixt bitcoin and their idiosyncratic values, arsenic good arsenic discovering concern fundamentals that are astir bulletproof and marque bitcoin the perfect savings vehicle.

Common critiques of bitcoin by the FIRE assemblage are nary antithetic from those dished up by accepted concern circles implicit the past decade: bitcoin has nary intrinsic value, it produces nary currency flows, it is excessively volatile. Even if you judge these arguments arsenic being deal-breakers to implementing a FIRE strategy (I don’t and I uncertainty astir volition aft their 100 hours), they are each blown retired of the h2o simply by bitcoin’s superior total returns.

It’s often said to beryllium sacrosanct to merchantability bitcoin and I mostly judge holding for arsenic agelong arsenic imaginable and supporting your manner done productive enactment is apt to beryllium the safest strategy for astir people. However, retiring aboriginal and drafting down connected your bitcoin holdings periodically into perpetuity volition beryllium mathematically imaginable for many, some sooner than they mightiness ideate and earlier hyperbitcoinization. It simply requires bitcoin’s maturation complaint to transcend that of your withdrawals and inflation. As Greg Foss says: “It’s conscionable math.”

I promote you to tally your ain numbers (everybody’s concern is antithetic and this is not fiscal advice). If you request assistance with a precise basal spreadsheet template delight scope retired via Twitter.

Bitcoin’s humanities full instrumentality show has been incredible. Its 10-year compound yearly maturation rate (CAGR) is 200%. However, its expanding maturity could yet effect successful longer cycles with little returns (fair to accidental the assemblage is inactive retired connected this!). Regardless, 200% provides a lot of wriggle country erstwhile you see the S&P 500’s 10 twelvemonth CAGR is ~13%. When moving your numbers it would beryllium prudent to physique successful your ain buffers (for example, presume little bitcoin returns successful the aboriginal and/or higher rates of ostentation into your expenses).

For those who are brave and spot successful math, you’ll find you necessitate a importantly little starting equilibrium erstwhile valued successful fiat compared to utilizing accepted FIRE techniques.

Bitcoin’s full instrumentality imaginable is besides the champion defence against volatility erstwhile retiring connected a bitcoin modular successful a fiat world. However, it whitethorn besides beryllium prudent to guarantee withdrawals are regular (for illustration play oregon monthly) arsenic you people wouldn’t privation lumpier income to coincide with periods of accrued downside volatility successful the bitcoin price. Psychologically this tin beryllium a hard process to manage. A disciplined and accordant attack to income - careless of short-term terms enactment - could assistance alleviate this tension. It’s fundamentally the other to buying bitcoin utilizing dollar-cost-averaging (DCA) strategies (without the assistance of automated services).

For retired Bitcoiners from the Michael Saylor schoolhouse who hold bitcoin volition summation successful worth “... everlastingly Laura” (my presumption too), delaying income arsenic overmuch arsenic imaginable volition apt execute amended implicit longer clip frames. It conscionable comes with much imaginable for anxiousness and quality error.

In conclusion, the emblematic FIRE template is not needfully broken, but I contend determination could beryllium a amended mode for that movement. Simply replacing equity scale funds with bitcoin (even successful part) has the imaginable to importantly accelerate their way to freedom.

For existing Bitcoiners, moving immoderate basal numbers connected status is ever worthy doing, adjacent if you ne'er mean to merchantability your bitcoin and would emotion to enactment forever. At the precise least, afterwards you mightiness consciousness similar you aren’t abbreviated bitcoin … for a time oregon two!

This is simply a impermanent station by John Tuld. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc oregon Bitcoin Magazine.

3 years ago

3 years ago

English (US)

English (US)