Bitcoin (BTC) witnessed a notable terms surge successful the past week, climbing good supra the antecedently coveted $30,000 mark. The crisp summation affected each marketplace participants, particularly the short-term holders. These are entities oregon individuals who’ve held onto their Bitcoin for little than 155 days. Their behavior, peculiarly during marketplace rallies, offers invaluable insights into marketplace sentiment and imaginable aboriginal movements.

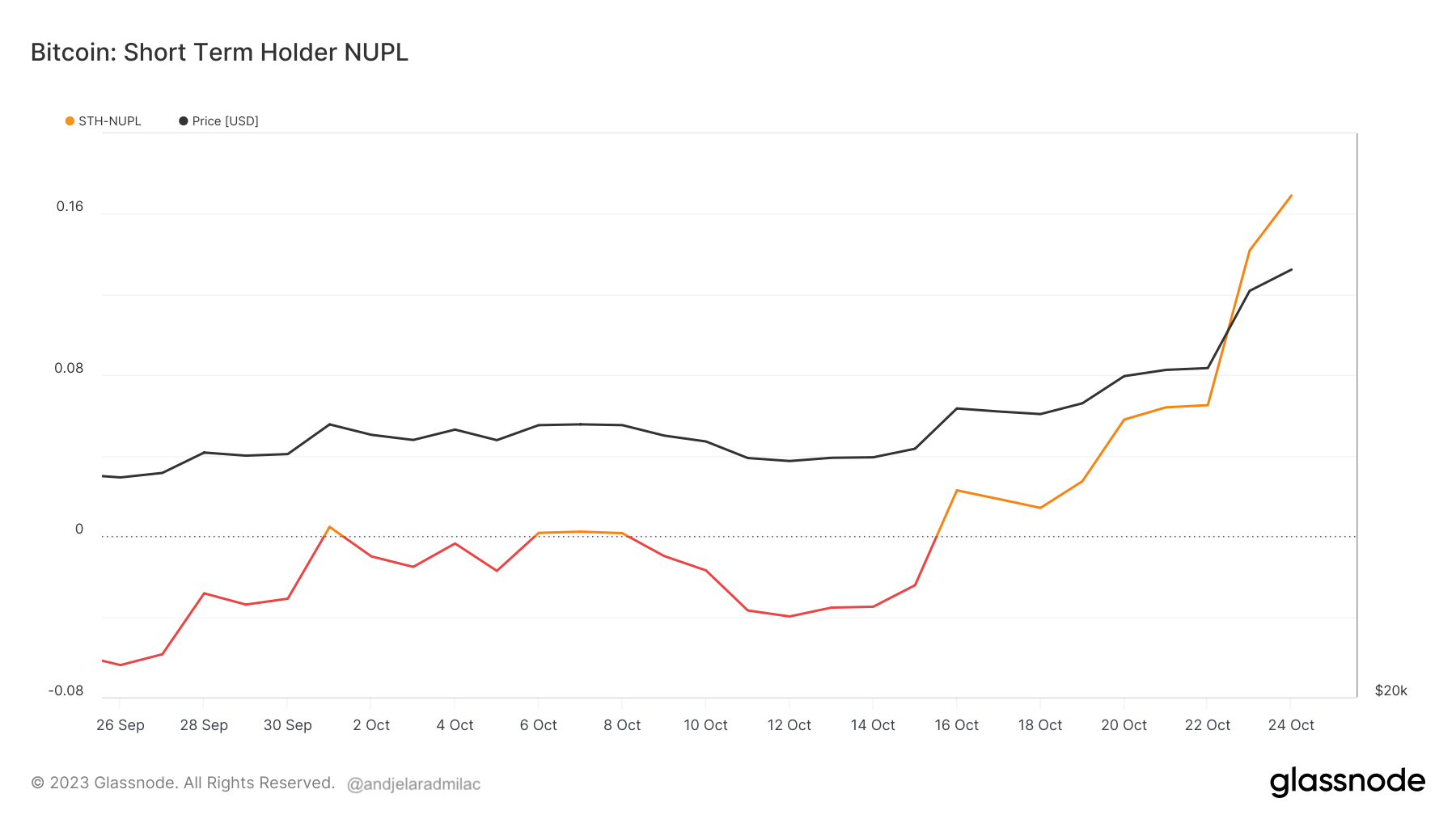

Short-Term Holder NUPL (STH-NUPL), oregon Net Unrealized Profit/Loss, is simply a specialized metric that zeroes successful connected unspent transaction outputs (UTXOs) younger than 155 days, serving arsenic a barometer to gauge the sentiment of these newer marketplace participants. When STH-NUPL is positive, it signals that, connected average, these holders are sitting connected nett unrealized gains, indicating their acquisition terms is little than the existent marketplace price.

As Bitcoin’s terms began its upward trajectory, the STH-NUPL mirrored this optimism. On Oct. 16, the STH-NUPL shifted from a somewhat bearish -0.02 to a neutral 0.02 successful conscionable 24 hours. This swift alteration was not conscionable a fleeting moment; by Oct. 24, arsenic Bitcoin continued its bullish run, the STH-NUPL climbed further to 0.169, showcasing the increasing assurance among the newer entrants successful the market.

Graph showing the nett unrealized profit/loss for short-term holders from Sep. 26 to Oct. 24, 2023 (Source: Glassnode)

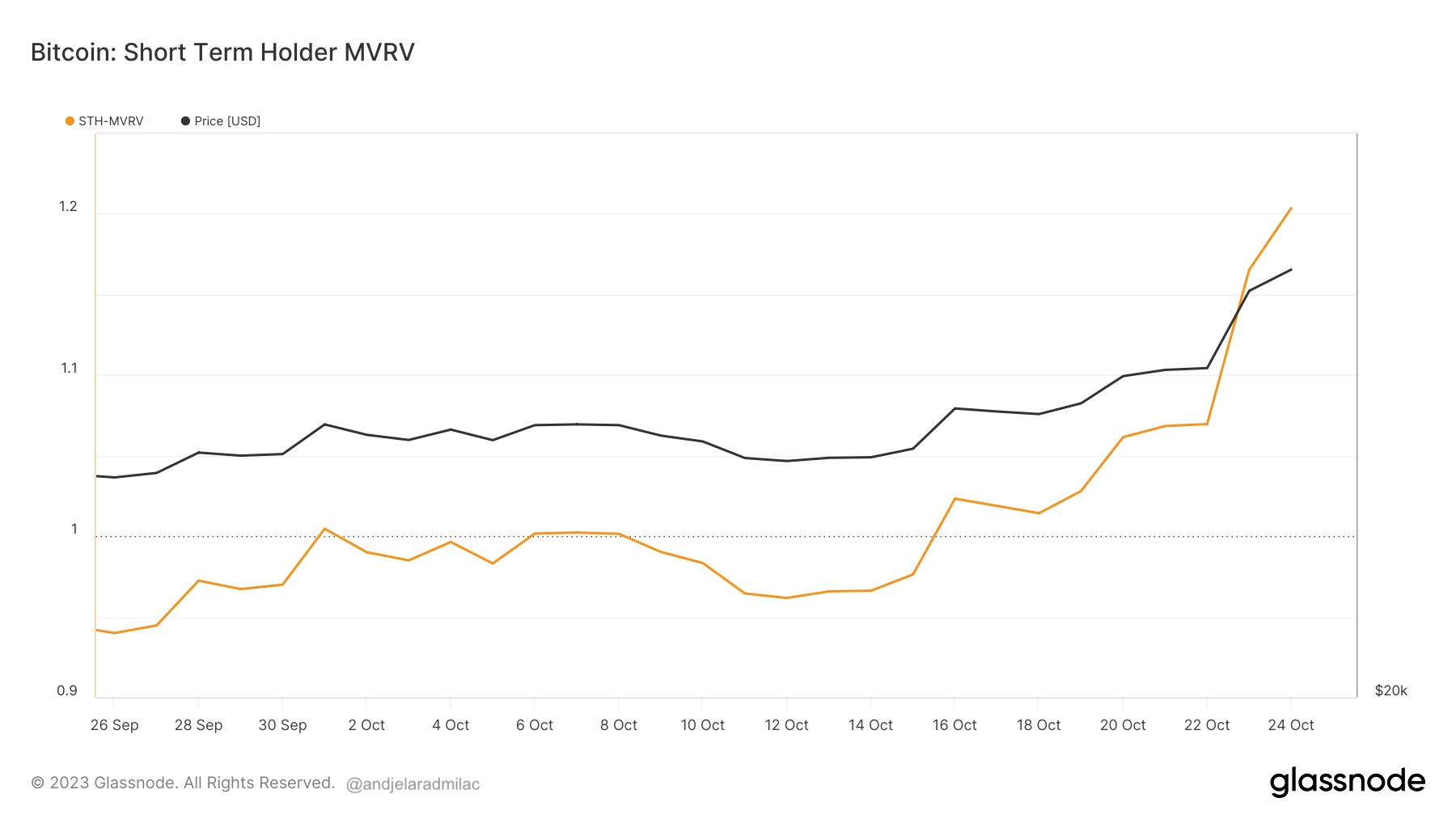

Graph showing the nett unrealized profit/loss for short-term holders from Sep. 26 to Oct. 24, 2023 (Source: Glassnode)Another pivotal metric successful this discourse is the Short-Term Holder Market Value to Realized Value (STH-MVRV) ratio. While some metrics supply insights into the sentiment and behaviour of short-term holders, STH-NUPL offers a nonstop measurement of their unrealized nett oregon loss. In contrast, STH-MVRV compares the existent marketplace worth to the realized worth for these holders.

On Oct. 16, the STH-MVRV ascended supra the 1 mark, and by Oct. 24, it stood astatine 1.21, confirming that, connected average, short-term holders were successful a important unrealized profit.

Graph showing the marketplace worth to realized worth ratio for short-term holders from Sep. 26 to Oct. 24, 2023 (Source: Glassnode)

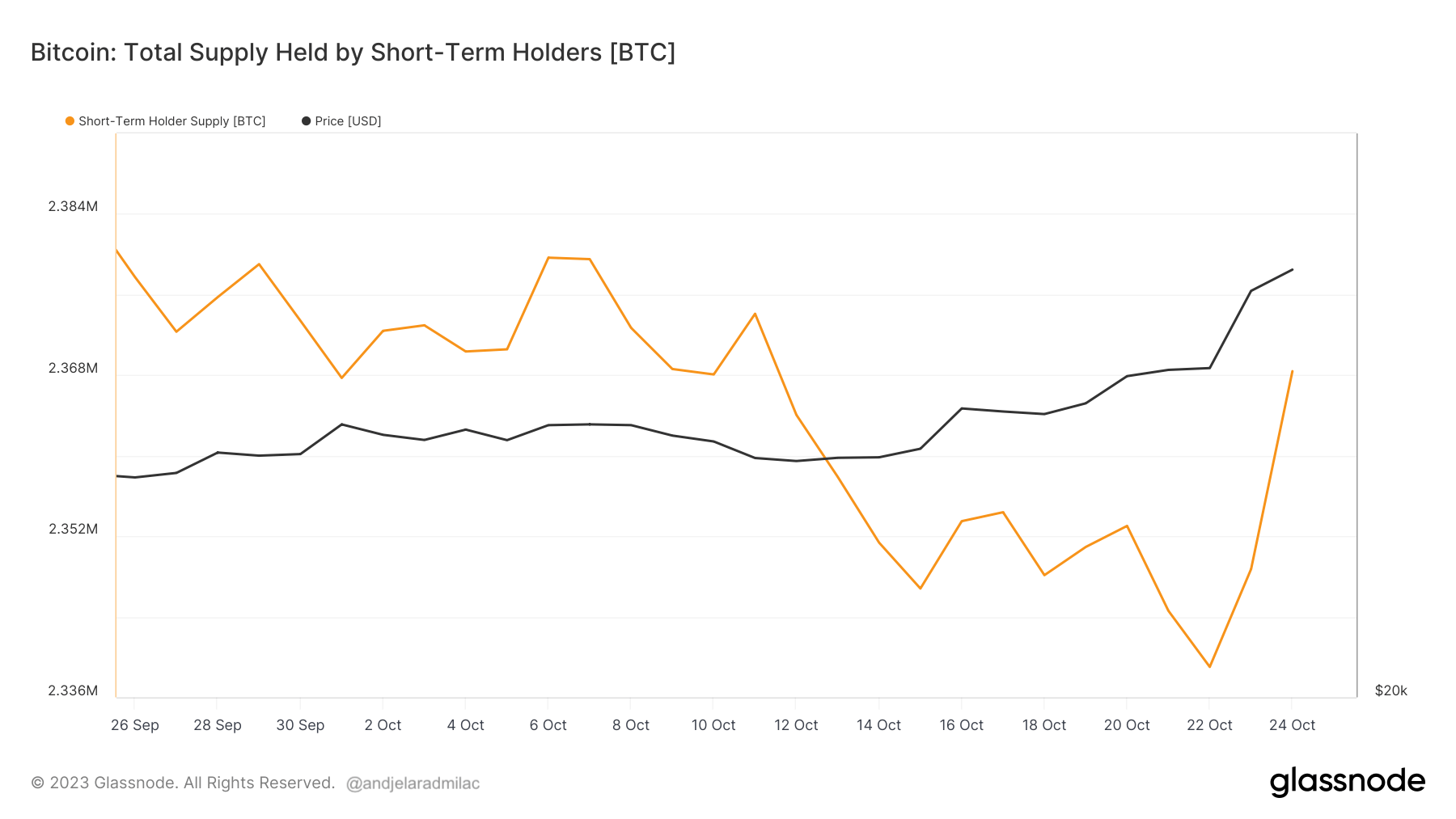

Graph showing the marketplace worth to realized worth ratio for short-term holders from Sep. 26 to Oct. 24, 2023 (Source: Glassnode)However, the behaviour of short-term holders wasn’t solely characterized by optimism. The short-term holder supply, which reflects the magnitude of Bitcoin held by this group, began to diminution rapidly arsenic Bitcoin’s terms started its upward trajectory. From 2.354 cardinal BTC connected Oct. 17, it decreased to 2.339 cardinal BTC by Oct. 22. This inclination mirrors the summation successful speech deposits from short-term holders, arsenic highlighted successful a caller CryptoSlate analysis, suggesting that galore were capitalizing connected the terms surge to recognize their profits. Yet, the communicative took different twist arsenic the short-term holder proviso rebounded, reaching 2.368 cardinal BTC by Oct. 24.

Graph showing the proviso of Bitcoin held by short-term holders from Sep. 26 to Oct. 24, 2023 (Source: Glassnode)

Graph showing the proviso of Bitcoin held by short-term holders from Sep. 26 to Oct. 24, 2023 (Source: Glassnode)When analyzed collectively, these metrics overgarment a multifaceted representation of the market. The affirmative STH-NUPL and STH-MVRV values bespeak bullish sentiment among short-term holders. However, the fluctuating short-term holder proviso suggests a premix of profit-taking and renewed interest. The archetypal driblet successful supply, coupled with accrued speech deposits, points to a important information of this radical cashing successful connected their gains. However, the consequent emergence suggests either a instrumentality of erstwhile holders oregon an influx of caller ones, perchance driven by FOMO oregon assurance successful Bitcoin’s continued upward trajectory.

The station Bitcoin is soaring, and short-term holders are present for the ride appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)