Publish date:

Dec 29, 2021

Despite the accepted banal marketplace presumption connected 200-day moving averages, a dip beneath it could mean a merchantability lawsuit for Bitcoin.

Despite the accepted banal marketplace presumption connected 200-day moving averages, a dip beneath it could mean a merchantability lawsuit for Bitcoin.

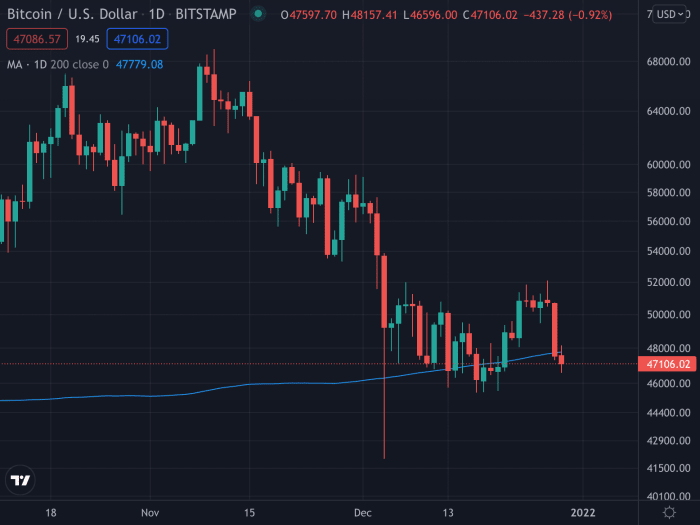

Bitcoin has been trading astatine sideways terms enactment for astir of December, struggling to enactment supra the 200-day moving average.

After a beardown October and an aboriginal November of caller all-time highs, Bitcoin has encountered a blocking roadworthy successful December, having mislaid 13.60% since the opening of the month. This world stands successful stark opposition to a wide content that Bitcoin’s terms would deed $100,000 by the extremity of the year.

At the clip of writing, Bitcoin is trading astatine astir $47,500 aft having closed beneath its 200-day moving mean connected Tuesday. The 200-day MA is often utilized to gauge an asset’s semipermanent inclination successful accepted superior markets. An plus is mostly considered to beryllium successful an wide uptrend for arsenic agelong arsenic it holds supra its 200-day MA.

In March 2020, Bitcoin violently broke beneath its 200-day MA arsenic the pandemic outbreak dispersed fearfulness passim the world, including superior markets. It took BTC astir 2 months to get backmost supra the moving average, triggering a stellar bull marketplace that would widen past the extremity of the year. Bitcoin held supra its 200-day MA for implicit a twelvemonth until China banned bitcoin mining, erstwhile again spreading fearfulness to those unaware of Bitcoin’s existent functioning mechanics and triggering a abbreviated wintertime for terms implicit the summertime months.

Bitcoin roseate from $8,000 to $60,000 successful little than 1 twelvemonth earlier correcting beneath its 200-day MA astatine astir $40,000 successful May 2021. Source: TradingView.

Despite the accepted banal marketplace presumption that an plus beneath its 200-day MA could beryllium successful a carnivore market, for Bitcoin, it could correspond a merchantability event. Given the peer-to-peer (P2P) currency’s strong, unsocial fundamentals and its past of crushing each different assets implicit the past 10 years, a dip beneath a method indicator tin service arsenic a discount indication, particularly fixed Bitcoin’s volatility, which makes it plunge and soar much rapidly than accepted assets.

4 years ago

4 years ago

English (US)

English (US)