Recent information connected Bitcoin liquidations and leverage levels indicates unsocial terms find enactment arsenic longs and shorts person been swept from the market. Much of the leveraged positions were shaken retired past week arsenic Bitcoin saw volatile terms actions astir the US marketplace open.

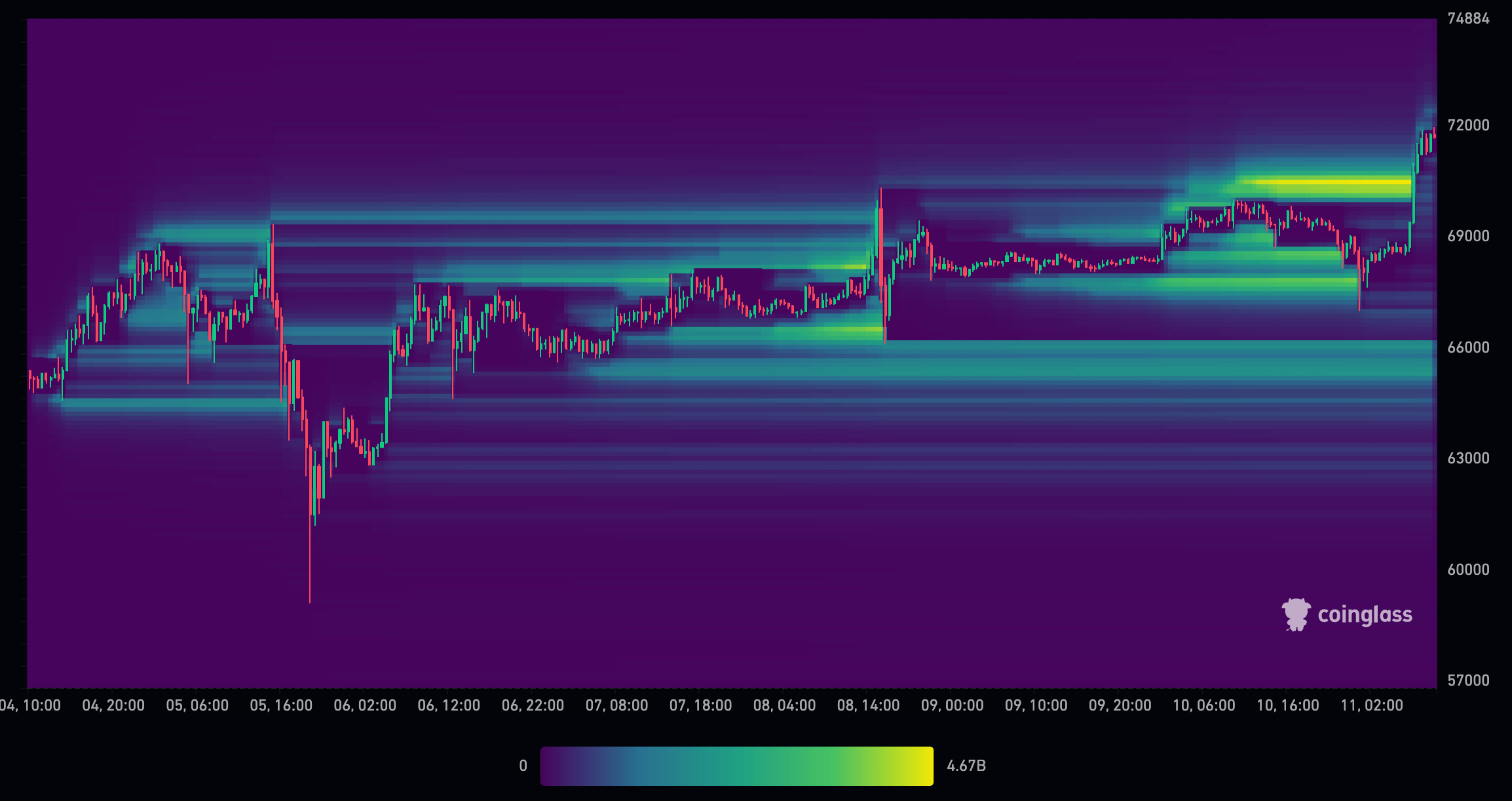

The liquidation illustration from CoinGlass beneath highlights however trading enactment connected March 5 and 8 astir 2.30 p.m. GMT (US marketplace open) led to dense liquidations of some agelong and abbreviated positions. A astir 2% summation was followed by a alteration of implicit 10% connected March 5, which swept the bid books and flushed retired each leverage down to $60,000.

The consequent accelerated V-shaped betterment saw further leverage positions created astir $70,000 and $66,000. The marketplace unfastened connected March 8 shook these out, leaving small to nary leverage supra $66,000.

Bitcoin liquidations 3 days (Source: CoinGlass)

Bitcoin liquidations 3 days (Source: CoinGlass)As of March 11, the driblet to $67,000, followed by a surge to caller highs astir $71,500, has again removed astir leveraged positions supra $66,000, clearing mounting a coagulated floor. The effect of specified movements is that Bitcoin present has escaped reign for earthy terms find supra $66,000.

Unlike the bull marketplace of 2021, which was heavily influenced by highly leveraged positions, the existent rhythm appears to beryllium shaking retired leverage earlier it has the accidental to origin important volatility. Further, cardinal organization players and marketplace makers whitethorn person a manus successful clearing the way for Bitcoin’s terms find done large-scale trading activities.

The relation of marketplace makers successful terms discovery

Market makers and, much recently, ETF-authorized participants heavily influence financial markets, conducting the travel of buy and merchantability orders with precision, and are liable for providing liquidity, which is the lifeblood of immoderate asset’s market. By quoting continuous bid and inquire prices, they purpose to nett from the spread, but their relation extends acold beyond mere nett generation.

During periods of precocious volatility, marketplace makers prosecute successful a strategical maneuver known arsenic “sweeping” the bid book. This involves placing galore orders astatine varying terms levels to probe the market’s extent and ascertain the existent equilibrium of proviso and demand. This sweeping enactment is simply a probe into the market’s contiguous authorities and a catalyst for terms discovery, revealing the levels astatine which marketplace participants are consenting to transact successful important volumes.

The caller expanse of leverage from the Bitcoin marketplace has profoundly impacted terms conditions. With the removal of leveraged merchantability orders, the marketplace has witnessed a simplification successful downward pressure, allowing for a much integrated terms find process. This is characterized by a marketplace little influenced by the amplified bets of leveraged traders and much by its participant’s genuine sentiment and valuations.

Moreover, the liquidation of leverage has cleared the way for upward terms movement. As the marketplace adjusts to the caller equilibrium escaped from the value of leveraged positions, the terms of Bitcoin is much apt to bespeak its existent marketplace value. This is not to accidental that the way volition beryllium linear oregon devoid of volatility; the crypto marketplace is known for its accelerated terms swings. However, the existent scenery suggests the conditions are ripe for a much sustained upward trend.

Leverage simplification and bid publication sweeping since December

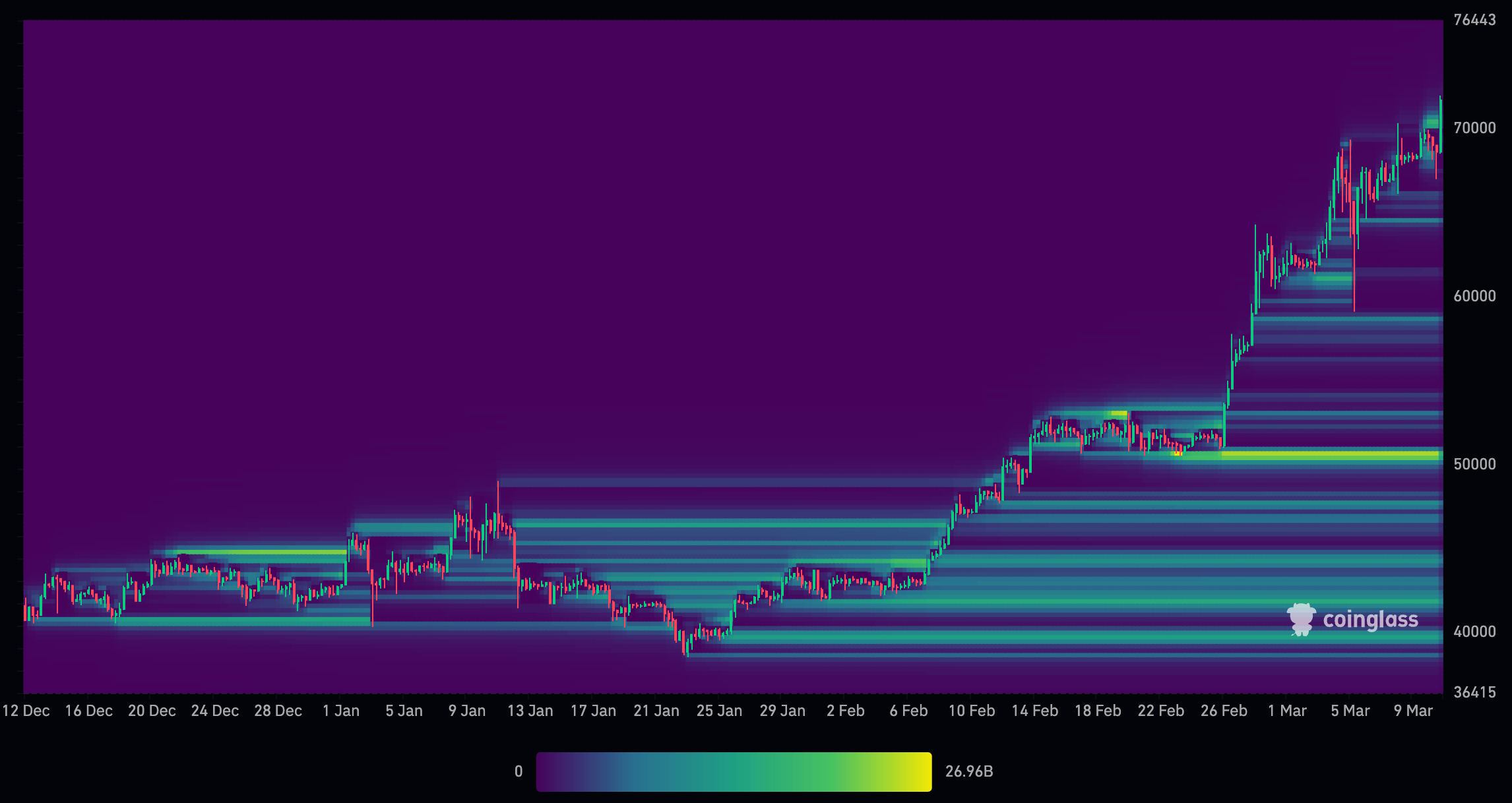

A person look astatine the marketplace forces from December 2022 to March 2023 reveals a wide way for further terms discovery.

In December, the marketplace witnessed important liquidations of leveraged positions, with galore longs liquidated conscionable supra the $41,000 level and shorts liquidated astir $45,000. As Bitcoin approached the ETF support connected January 11, galore shorts were opened astir the $45,000 level, which persisted arsenic the terms dropped to astir $40,000. Interestingly, determination were not galore longs astatine this level, suggesting that the terms was supported by holders and wide terms find alternatively than leveraged positions.

Bitcoin liquidation levels (Source: CoinGlass)

Bitcoin liquidation levels (Source: CoinGlass)As Bitcoin rebounded from $40,000 and climbed toward $45,000 by aboriginal February, respective shorts were liquidated on the way. As Bitcoin continued its upward trajectory, longs were positioned from $40,000 to $50,000. By the clip Bitcoin reached $50,000, determination were important leveraged positions, amounting to astir $27 billion. However, arsenic the terms increased, the magnitude of leveraged positions supra $50,000 diminished considerably.

The terms enactment astatine the opening of March saw Bitcoin surge to $70,000 and past plummet to $59,000 wrong a azygous candlestick, efficaciously wiping retired astir each leveraged positions successful the market. Although determination was immoderate leverage astir $70,000, the bulk of leveraged positions are present concentrated beneath $50,000.

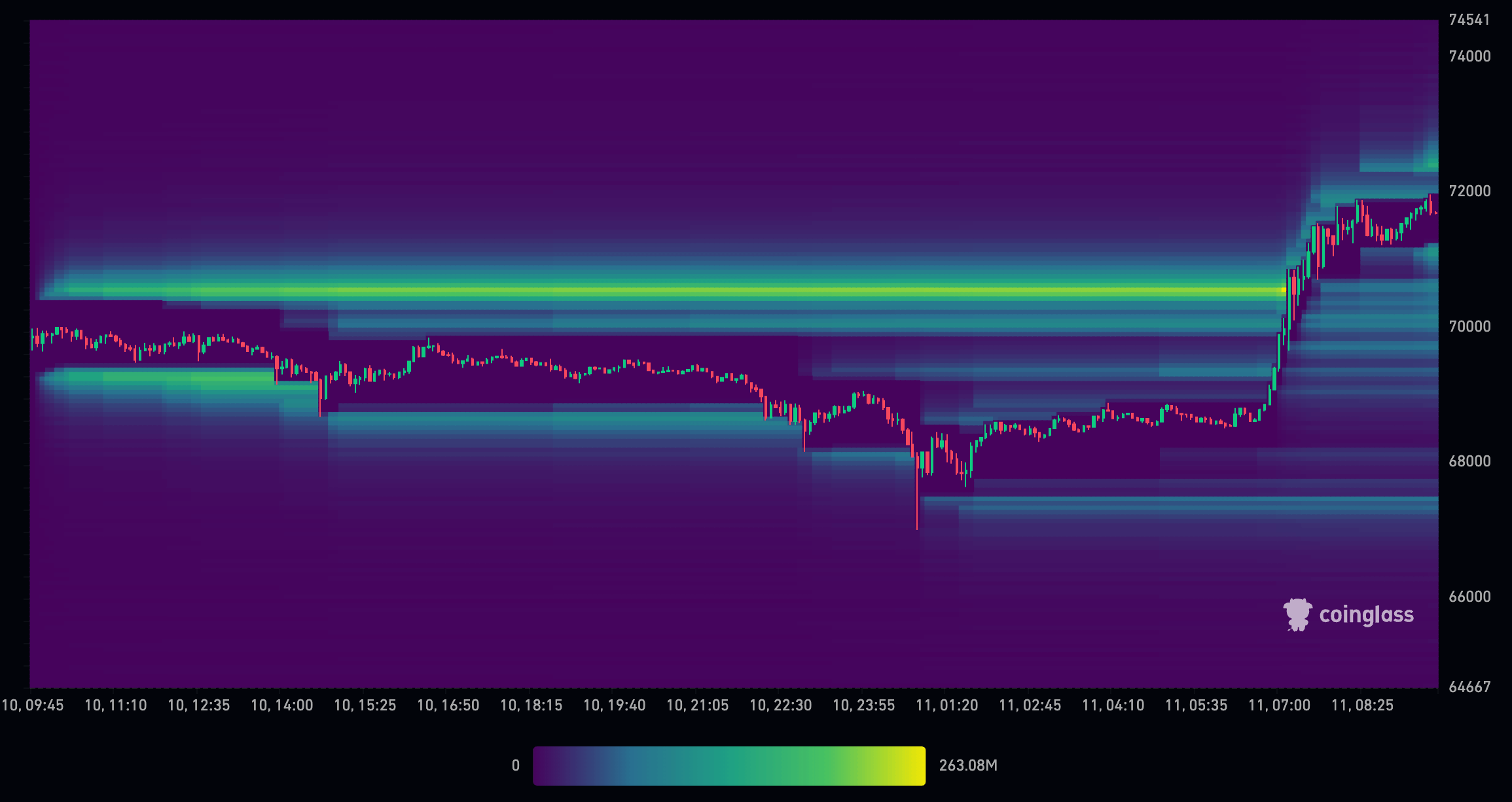

Bitcoin liquidation levels in March (Source: CoinGlass)

Bitcoin liquidation levels in March (Source: CoinGlass)The liquidation of leveraged positions has led to a much transparent marketplace structure, with a much balanced organisation of longs and shorts. This improvement could pave the mode for a much integrated terms find process driven by genuine marketplace request alternatively than leveraged speculation.

The caller liquidations and simplification of leveraged positions successful the Bitcoin marketplace suggest a imaginable displacement towards a much fundamentally driven market. With the bulk of leveraged positions present concentrated astatine little terms levels, determination is country for the marketplace to acquisition upward unit arsenic genuine request and adoption thrust prices higher.

Clearing retired excessive leverage has acceptable the signifier for a healthier marketplace dynamic, wherever terms find is guided by cardinal factors specified arsenic expanding mainstream acceptance, regulatory clarity, and technological advancements successful the blockchain space.

The caller liquidations and leverage information supply a compelling lawsuit for a potential upward inclination driven by integrated terms discovery.

The station Bitcoin leverage supra $66k wiped retired creating caller level for higher terms discovery appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)