On-chain information shows the Bitcoin leverage ratio has surged up to a caller all-time high, suggesting the marketplace could beryllium heading towards precocious volatility.

Bitcoin All Exchanges Estimated Leverage Ratio Sets New ATH

As pointed retired by a CryptoQuant post, the backing complaint has remained neutral portion the leverage has accrued successful the market.

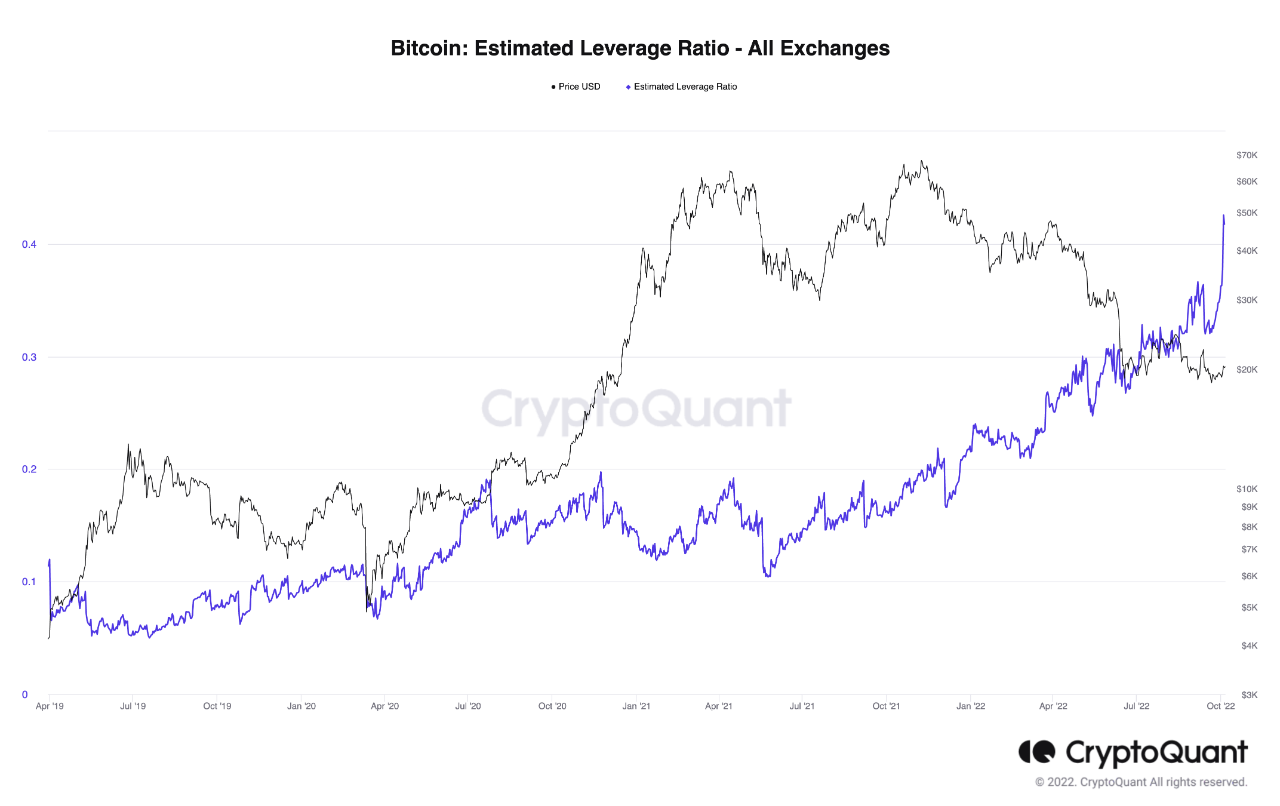

The “all exchanges estimated leverage ratio” is an indicator that measures the ratio betwixt the Bitcoin unfastened involvement and the derivative speech reserve.

What this metric tells america is the mean magnitude of leverage presently being utilized by investors successful the BTC futures market.

When the worth of this indicator is high, it means users are taking a batch of leverage close now. Historically, specified values person led to higher volatility successful the terms of the crypto.

On the different hand, the worth of the metric being debased suggests investors aren’t taking precocious hazard astatine the moment, arsenic they haven’t utilized overmuch leverage.

Now, present is simply a illustration that shows the inclination successful the Bitcoin leverage ratio implicit the past fewer years:

As you tin spot successful the supra graph, the Bitcoin estimated leverage ratio has changeable up precocious and has attained a caller ATH. This means that investors are taking a precocious magnitude of leverage connected average.

The crushed overleveraged markets person usually turned highly volatile successful the past lies successful the information that specified conditions pb to wide liquidations becoming much probable.

Any abrupt swings successful the terms during periods of precocious leverage tin pb to a batch of contracts getting liquidated astatine once. But it doesn’t extremity there; these liquidations further amplify the terms determination that created them, and hence origin adjacent much liquidations.

Liquidations cascading unneurotic successful specified a mode is called a “squeeze.” Such events tin impact either longs oregon shorts.

The Bitcoin backing rates (the periodic interest exchanged betwixt agelong and abbreviated traders) tin springiness america an thought astir which absorption a imaginable compression whitethorn spell in.

CryptoQuant notes that this metric has a neutral worth currently, implying the marketplace is arsenic divided betwixt shorts and longs. As such, it’s hard to accidental thing astir the absorption a imaginable compression successful the adjacent aboriginal mightiness thin towards.

The Bitcoin volatility has successful information been precise debased successful caller weeks, but with specified precocious accumulation of leverage, it whitethorn beryllium a substance of clip earlier a volatile terms takes over.

BTC Price

At the clip of writing, Bitcoin’s terms floats astir $19.6k, up 2% successful the past week.

3 years ago

3 years ago

English (US)

English (US)