Despite its caller resurgence to regain the 200-week moving mean (WMA), Bitcoin’s terms has remained wrong a choky trading scope for the past week.

BlackRock’s announcement of integrating Bitcoin into their ETF portfolios and Bitwise’s refiling for a Bitcoin spot ETF are important quality that could perchance determination Bitcoin’s price. Furthermore, whispers of a “seismic” move by Fidelity successful crypto are adding to the anticipation.

However, investigation of assorted on-chain metrics, including Bitcoin’s liveliness, suggests a deficiency of volatility successful the market.

Liveliness is simply a time-weighted measurement of Bitcoin UTXOs (unspent transaction outputs), indicating the proportionality of Bitcoin that’s been dormant for a definite period. As such, it serves arsenic a invaluable barometer of marketplace enactment and provides penetration into the behaviour of Bitcoin hodlers.

The liveliness metric uses “coin days,” meaning the fig of days since each coin was past moved. A higher liveliness people and uptrends suggest that hodlers are progressive and moving their coins around. Conversely, a little liveliness people and downtrends bespeak a deficiency of enactment among hodlers and coin dormancy.

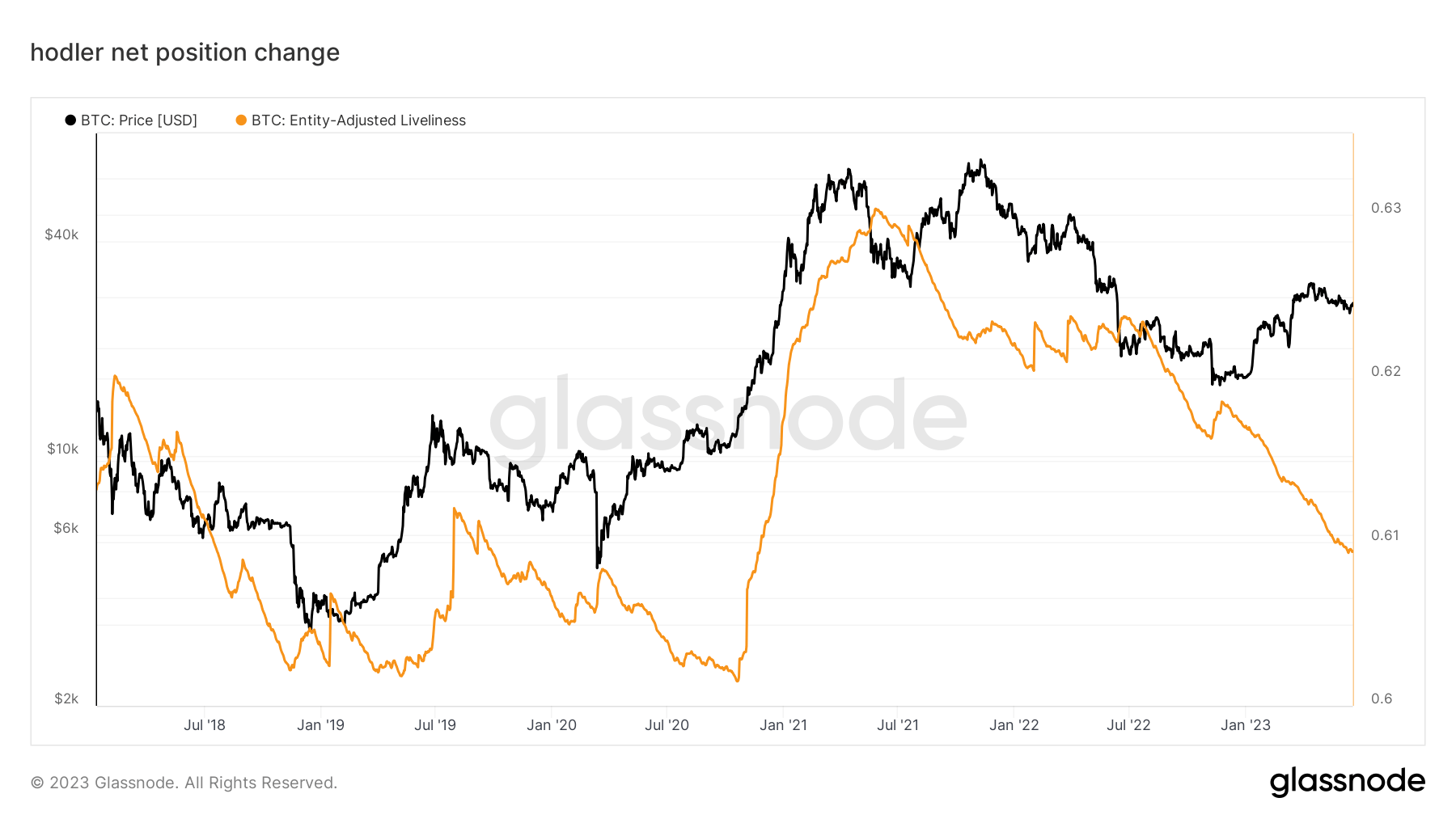

Graph showing Bitcoin Liveliness from January 2018 to June 2023 (Source: Glassnode)

Graph showing Bitcoin Liveliness from January 2018 to June 2023 (Source: Glassnode)Bitcoin’s liveliness has been connected a downward trajectory since peaking successful May 2021, correlating with the onset of the ongoing carnivore market.

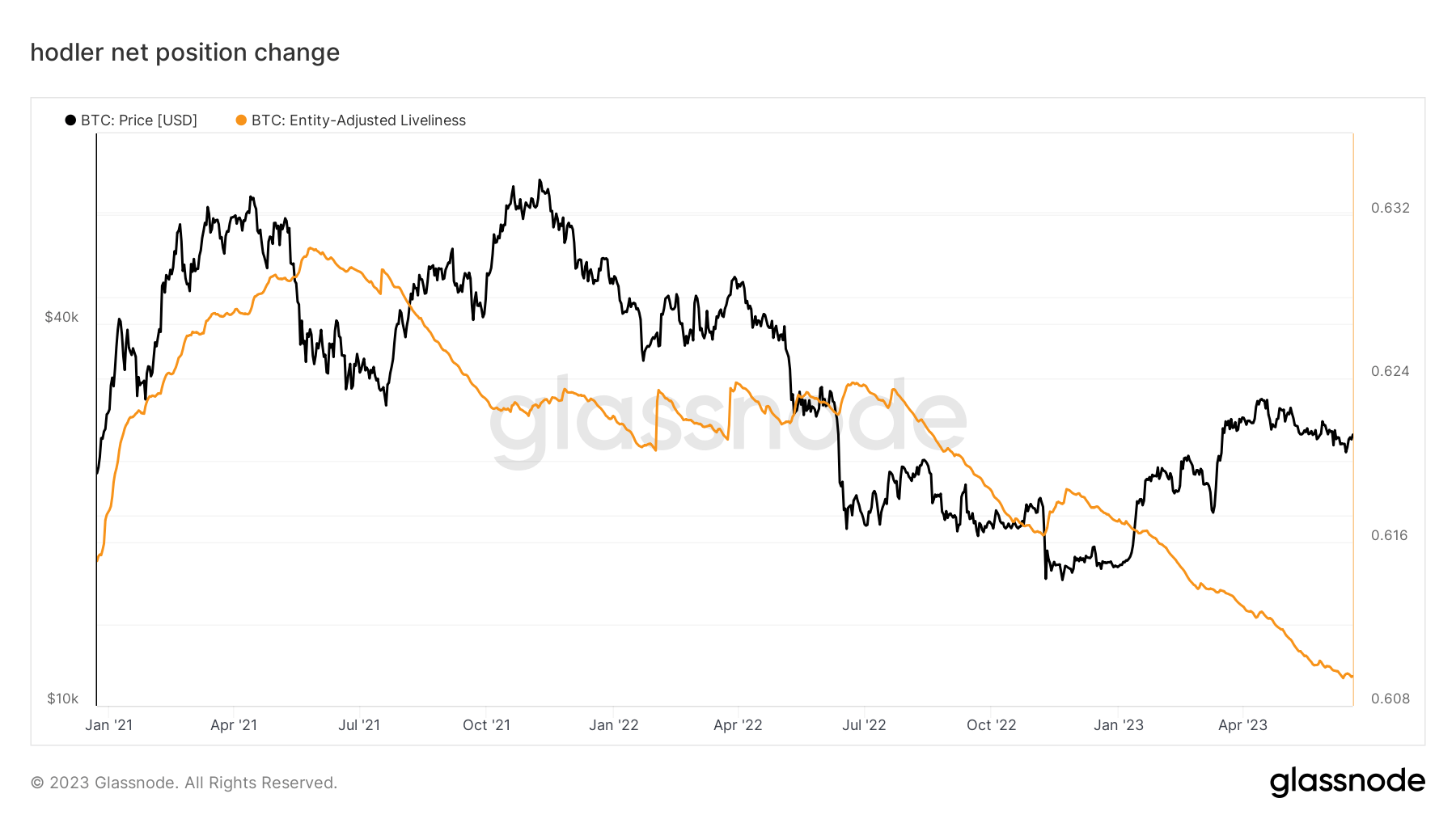

Graph showing Bitcoin Liveliness from January 2021 to June 2023 (Source: Glassnode)

Graph showing Bitcoin Liveliness from January 2021 to June 2023 (Source: Glassnode)A decreasing inclination successful liveliness often signifies that hodlers are moving their Bitcoins to acold storage, taking them retired of circulation. This behaviour leads to an summation successful the illiquid proviso of Bitcoin, which contributes to the existent stableness we are witnessing successful the market.

This humanities downtrend suggests that much hodlers are moving their coins to acold storage, perchance positioning for a semipermanent concern strategy.

The station Bitcoin liveliness indicates “hodler” behaviour during extended terms stability appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)