The past clip Bitfinex BTCUSD Longs spiked bitcoin ran up to a caller all-time precocious wrong 4 months. Could this beryllium an indicator of a section bottom?

Cover art/illustration via CryptoSlate

Long positions connected Bitcoin person deed an all-time precocious connected Bitfinex arsenic they spike implicit 60% successful a day. The spike is 1 of the astir assertive moves up that has ever been seen connected the exchange. The erstwhile all-time precocious was deed successful July 2021 with the BTCUSD Longs merchandise being archetypal introduced successful August 2017.

Source: TradingView

Source: TradingViewThe past of agelong positions connected Bitfinex tin possibly springiness immoderate penetration into the authorities of the marketplace and wherever we could beryllium headed next. Some analysts are looking for the past clip that longs peaked to suggest that determination whitethorn beryllium a respite successful the downward question of the marketplace ahead.

Source: Twitter

Source: TwitterA reappraisal of the BTCUSD Shorts merchandise besides makes absorbing reading. On the play chart, determination is simply a agelong wick up towards 7500 earlier a play adjacent of 3111. This indicates that the abbreviated positions took vantage of the volatility successful the marketplace crossed the past week but person present closed retired positions. When this is paired with the 60% summation successful agelong positions it indicates bullish sentiment for the marketplace overall.

Source: TradingView

Source: TradingViewBitfinex CTO, Paolo Ardoino called the lawsuit “accumulation” suggesting that helium agrees Whales are acquiring Bitcoin astatine a discounted price. He went connected to say,

“Some whales are expanding their existing longs a lot. Keep successful caput that helium whitethorn hedge himself determination else, truthful not needfully bullish (although I americium by nature)” (from Italian via Google Translate)

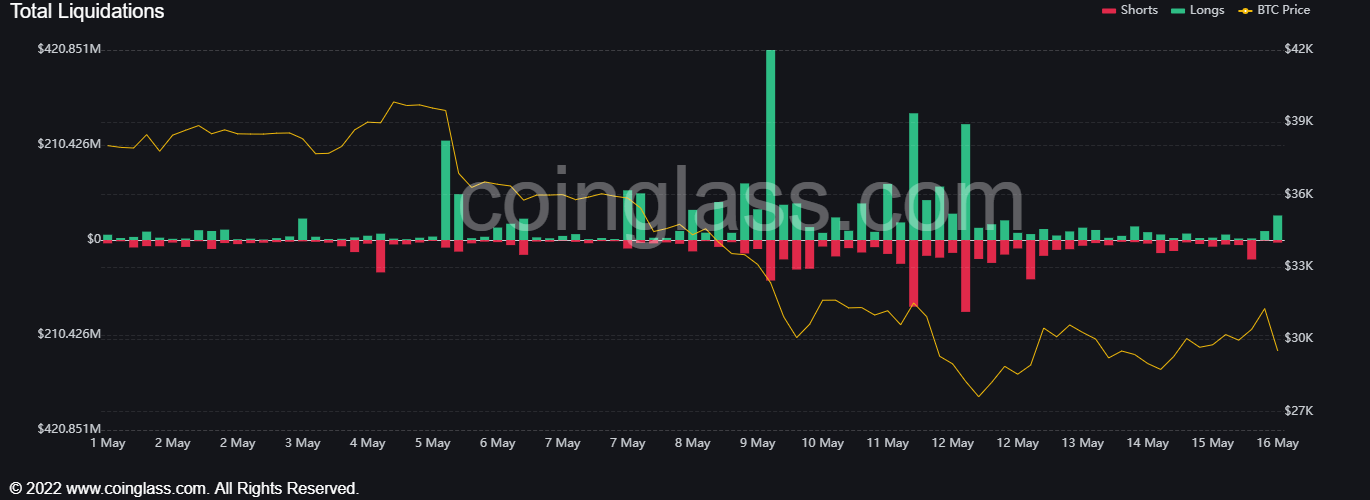

This remark is important to enactment arsenic Ardoino highlights that agelong positions successful futures markets are often offset by selling Bitcoin (shorting) connected the spot market. This strategy tin springiness you a hedge against further marketplace volatility depending connected however you acceptable your bounds orders successful the futures contract. A tiny miss-step successful this strategy tin pb to oversized losses, particularly for those utilizing borderline oregon leverage. Over $500 cardinal successful Bitcoin agelong positions person been liquidated since May 9 and implicit $2 cardinal crossed the full crypto market. The beneath graph from Coinglass shows some agelong and abbreviated liquidations since May 1.

Source: Coinglass

Source: Coinglass

3 years ago

3 years ago

English (US)

English (US)