- Ark Invest published its monthly Bitcoin report, detailing respective bullish signs for the plus and the wide market.

- It notes that Bitcoin is successful oversold condition, and the plus mightiness person reached a beardown bottom, pointing to Bitcoin’s short-term-holder outgo ground crossing beneath the long-term-holder equivalent for the archetypal clip since precocious 2018.

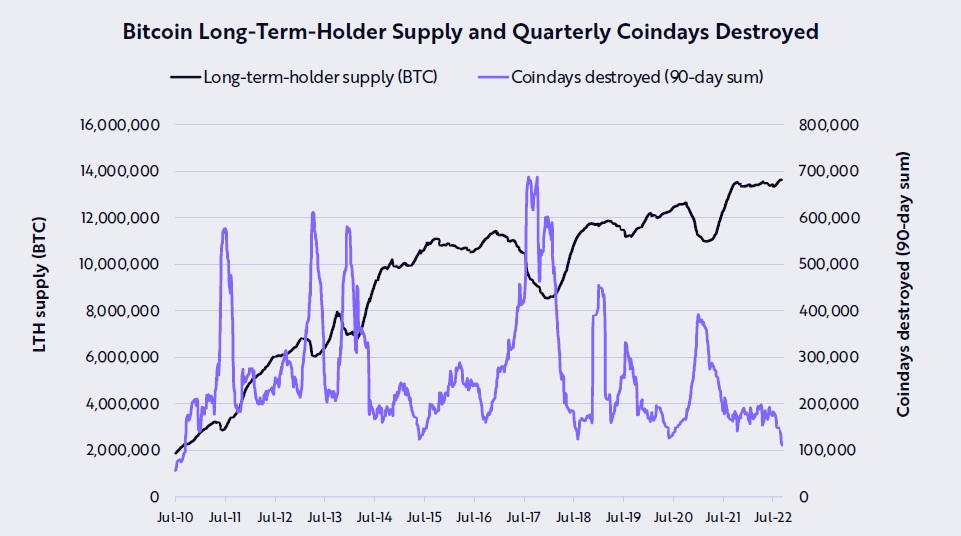

- Bitcoin’s semipermanent holder proviso reached an all-time precocious of 13.7 cardinal BTC, accounting for 71.5% of the outstanding supply.

Ark Invest has released its monthly Bitcoin report, and immoderate of the statistic successful the study bespeak a bullish aboriginal for the asset. While Bitcoin did find absorption astatine its 200-week moving mean of $23,500, determination are signs that the cryptocurrency has recovered its bottom.

To enactment the mentation that Bitcoin has reached a beardown marketplace bottom, Ark Invest says that the integer asset’s short-term-holder outgo ground crossed beneath its long-term-holder outgo ground for the archetypal clip since precocious 2018.

But possibly astir interestingly, Bitcoin’s semipermanent holder proviso reached an all-time high of 13.7 cardinal BTC, which accounts for 71.5% of the outstanding supply. The steadfast defines semipermanent holders arsenic those who person held Bitcoin successful their wallets for implicit 155 days. Year-over-year, this fig has accrued by 2.19%.

BTC Long-Term Holder Supply: Ark Invest

BTC Long-Term Holder Supply: Ark InvestArk Invest besides points to the locked proviso arsenic different bullish sign. This statistic is presently astatine 14.18 cardinal BTC, which is simply a 5.39% summation implicit the past year.

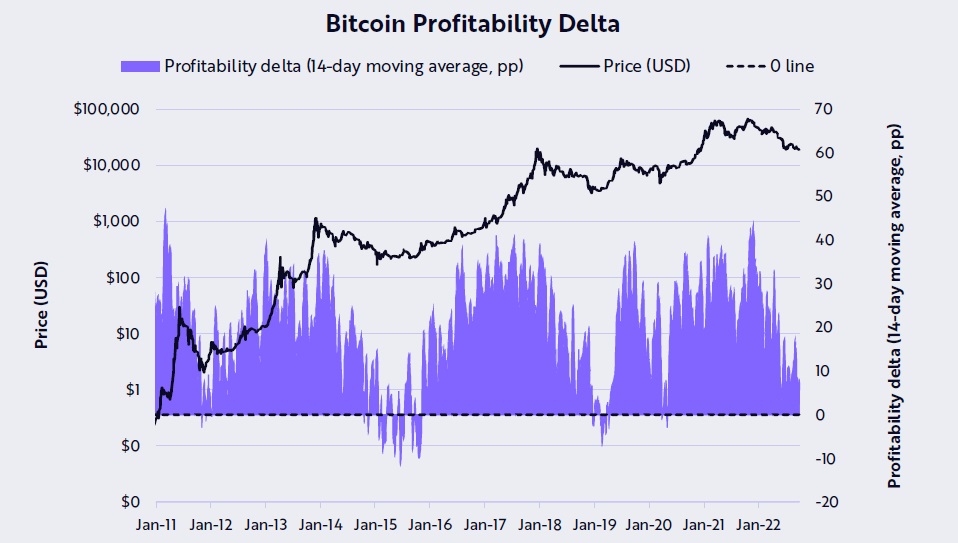

The steadfast besides firmly believes that Bitcoin is oversold, pointing to the profitability delta being adjacent 0. This suggests that astir trading enactment is seller-exhausted.

BTC Profitability Delta Nears 0: Ark Invest

BTC Profitability Delta Nears 0: Ark InvestThe takeaway from these on-chain indicators, according to Ark Invest, is that Bitcoin’s terms does not bespeak its positivity. However, it does spot respective macroeconomic factors arsenic being bearish influences connected the market. In caller years, the crypto marketplace has go much closely connected to different markets, and antagonistic macroeconomic forces would undoubtedly person an effect connected the plus class.

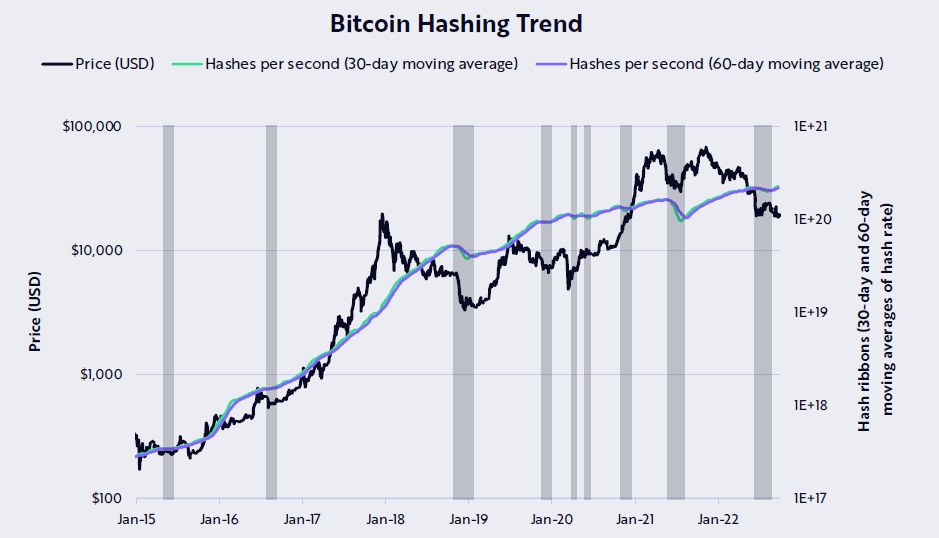

Mining Statistics Also Indicate Bullish Future

Ark Invest reports respective different affirmative indicators that the marketplace is doing well. One of these is the information that miners are “no longer successful capitulation mode,” pointing to caller all-time highs of the hash rate. Bitcoin’s hash complaint is presently 272.81 cardinal TH/s. Another origin it shows arsenic being a bullish motion is the nett realized nett and loss, which suggests a capitulation proportional to anterior rhythm bottoms.

The marketplace whitethorn beryllium successful the mediate of a rut, but on-chain factors and wide sentiment hint that it mightiness not past for long. Investors volition beryllium keen to spot a question upwards, and Bitcoin and the crypto marketplace person proven to beryllium beardown towards the extremity of the twelvemonth connected aggregate occasions. Ark Invest and Cathie Wood person felt that way for immoderate time.

3 years ago

3 years ago

English (US)

English (US)