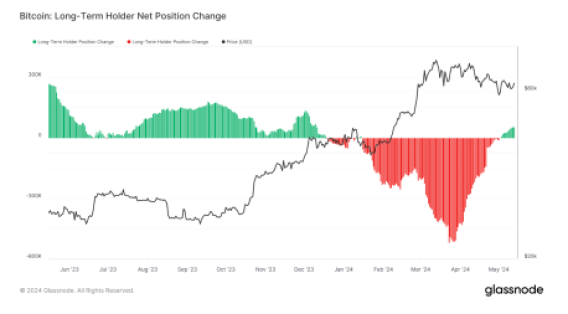

Glassnode data has revealed that Bitcoin semipermanent holders are taking vantage of the cryptocurrency’s little terms to importantly summation their holdings. This accumulation further strengthens the content that this radical of Bitcoin investors expect a potential upside for Bitcoin contempt its caller volatility.

Long-Term Holders Pay $4.3 Billion For 70,000 BTC

According to Glassnode, semipermanent Bitcoin holders who had antecedently sold 1 cardinal BTC successful the second portion of 2023 are accumulating erstwhile again. This buying enactment could beryllium interpreted arsenic a imaginable bullish awesome for Bitcoin.

Traditionally, Bitcoin semipermanent holders sell their holdings during highest prices and bargain caller tokens during periods of correction oregon important declines. When these seasoned investors bargain cryptocurrencies during marketplace lows, it usually indicates their expectations of a imaginable rebound, leading to profits.

On the different hand, short-term holders are known to bargain cryptocurrencies during sporadic terms surges, often signaling that a cryptocurrency is nearing its peak.

With Bitcoin presently stabilizing supra $61,000, semipermanent Bitcoin holders astir apt spot the cryptocurrency’s worth arsenic a prime buying opportunity. They person precocious added a staggering 70,000 BTC valued astatine implicit $4.3 cardinal to their holdings.

Source: Glassnode

Source: GlassnodeThis sentiment for Bitcoin’s imaginable rally is besides shared by a fewer crypto analysts who person predicted that the cryptocurrency would surge to caller all-time highs during the approaching bull market. Earlier successful March, earlier Bitcoin’s halving event, the cryptocurrency skyrocketed supra $73,000, marking a caller historical all-time high.

With the bull marketplace inactive connected the way, Bitcoin could see further upsides arsenic marketplace conditions amended and capitalist request rises. This could perchance pb to profits for agelong word holders who had purchased the cryptocurrency earlier.

Moreover, the upcoming United States ostentation report, acceptable for merchandise connected May 15, could besides beryllium different superior origin driving semipermanent investors’ important BTC accumulation. With the US Consumer Price Index (CPI) remaining historically high, and the Federal Reserve (FED) unchanged rates, Bitcoin is seen arsenic a imaginable hedge against inflationary pressures, protecting investors’ wealthiness against decline.

Bitcoin Whales Display Opposite Trend

Reports from blockchain analytics level Santiment uncover that Bitcoin whales are showing an other inclination from semipermanent holders.

The analytics level noted that Bitcoin whales look to beryllium taking a interruption from accumulating BTC, arsenic the fig of large-scale transactions has been decreasing significantly.

This inclination coincides with the cryptocurrency’s reduced on-chain activities and its declining value implicit the past fewer weeks.

Crypto expert Ali Martinez has besides shared a akin report, emphasizing that Bitcoin’s accumulation inclination people is presently displaying a worth person to zero, indicating that larger investors were distributing their holdings alternatively than buying.

Despite the downtrend, Martinez has disclosed that Bitcoin’s existent TD sequential is signaling a buying opportunity and the cryptocurrency was poised for a rebound soon. At the clip of writing, the cryptocurrency’s terms is trading beneath $62,000, receiving a alteration of astir 6.38% successful the past month, according to CoinMarketCap.

Featured representation from StormGain, illustration from Tradingview.com

1 year ago

1 year ago

English (US)

English (US)