On-chain information suggests Bitcoin semipermanent holders person started to capitulate precocious arsenic the crisp terms driblet causes panic successful the market.

Bitcoin CDD Inflow Indicator Jumps Up, Showing Long-Term Holders Have Been Selling

As pointed retired by a CryptoQuant post, the caller terms driblet has pushed semipermanent holders towards selling their BTC.

“Coin days” are the fig of days a Bitcoin has remained dormant for. An example: if 1 BTC doesn’t determination for 5 days, it accumulates 5 coin days.

When specified a coin would beryllium transferred oregon moved, its coin days would beryllium “destroyed” arsenic the fig volition reset backmost to zero.

Related Reading | Bitcoin Slips Below $33k As Exchange Inflows Reach Highest Value Since July 2021

The “coin days destroyed” (CDD) metric people measures however galore of these coin days are being destroyed successful the full marketplace astatine immoderate fixed time.

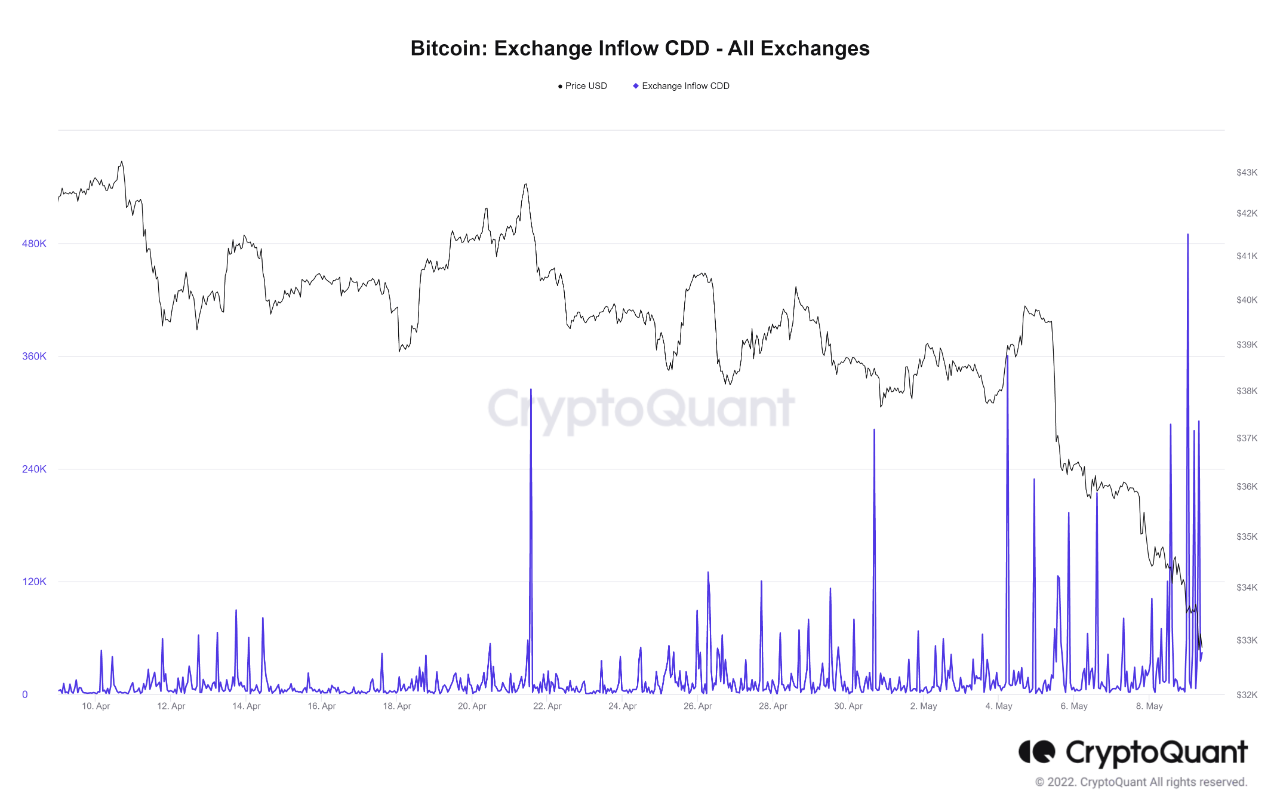

A modification of this indicator, called the “Bitcoin exchange inflow CDD,” tells america astir lone those coin days that were destroyed by a transportation to exchanges.

A precocious worth of the inflow CDD mostly suggests that long-term holders (who accumulate a ample fig of coin days) are moving their coins to exchanges.

Investors usually transportation their Bitcoin to exchanges for selling purposes, truthful LTHs transferring a ample fig of their coins tin beryllium bearish for the terms of the crypto.

Now, present is simply a illustration that shows the inclination successful the BTC inflow CDD implicit the past month:

As you tin spot successful the supra graph, the Bitcoin speech inflow CDD has observed immoderate precocious values implicit the past fewer days.

This shows that semipermanent holders person been selling amid the caller panic successful the marketplace owed to the terms driblet from $38k to beneath $30k.

Related Reading | Terra Beats Tesla As Second-Largest Corporate Bitcoin Holder After $1.5B Purchase

The particularly ample spikes successful the past 2 days suggest LTHs whitethorn person started to spell done a signifier of capitulation.

Since LTHs usually marque up the Bitcoin cohort that is the slightest apt to sell, capitulation from them is simply a antagonistic motion for the terms of the coin.

BTC Price

At the clip of writing, Bitcoin’s price floats astir $31.6k, down 18% successful the past 7 days. Over the past month, the crypto has mislaid 26% successful value.

The beneath illustration shows the inclination successful the terms of the coin implicit the past 5 days.

Bitcoin’s driblet has continued contiguous arsenic the crypto concisely touched beneath $30k for the archetypal clip since July of past year, earlier rebounding backmost to the existent level.

Featured representation from Unsplash.com, charts from TradingView.com, CryptoQuant.com

3 years ago

3 years ago

English (US)

English (US)